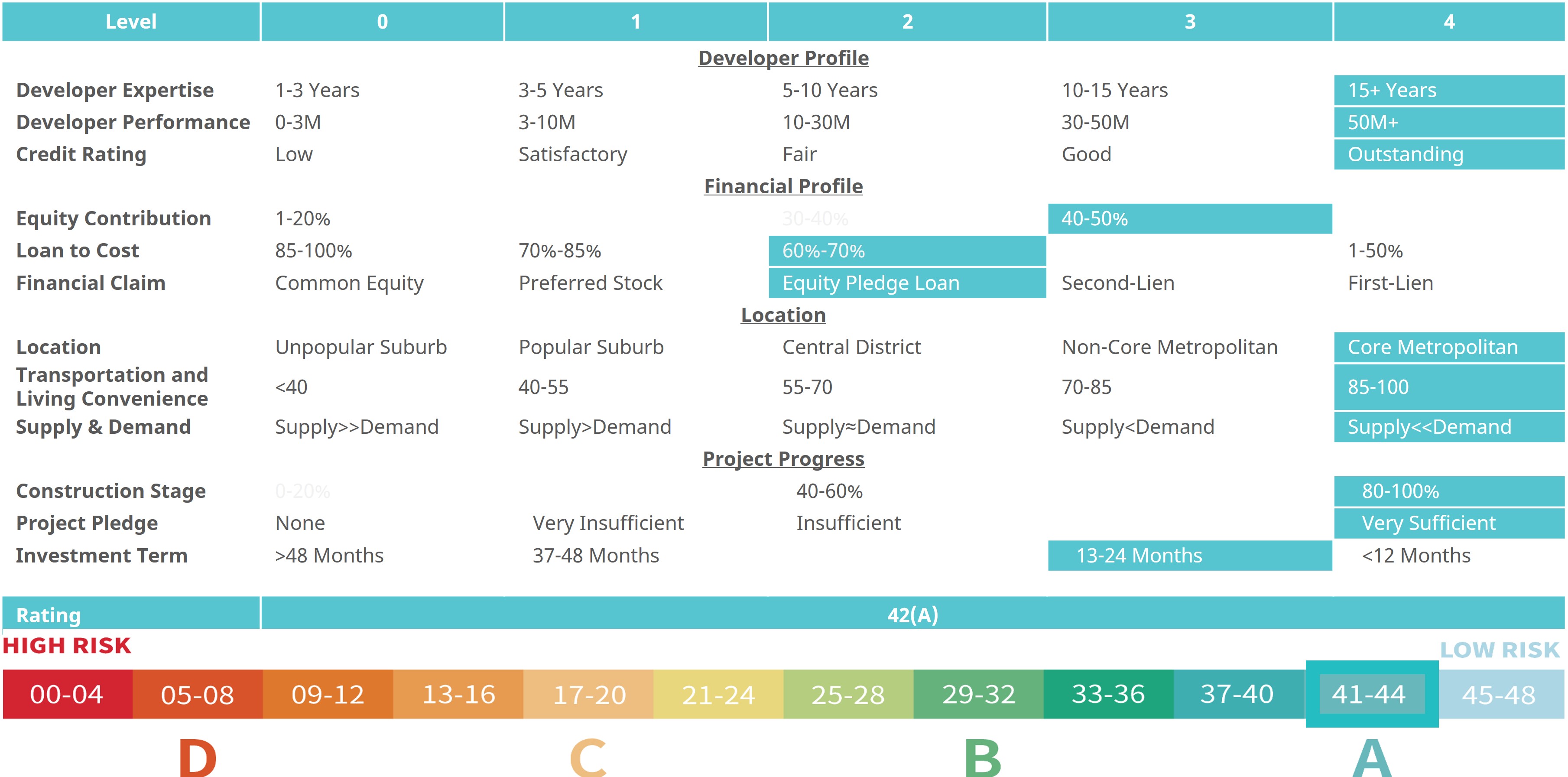

Equity Pledge Debt Fund 835

Type: Debt

Target: $3,500,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 6 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $3,500,000 |

| Estimated Return | 8.5 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | June 2023 |

| Investment Timeline | 6 – 18 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.5% Annualized Return for Investment of 1-19 Units; % Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend. After 12 months, dividends will be calculated in terms of days, till principal is repaid.

*3 Investors will receive prepaid dividend before every period of 6 months.

- Property is in Kips Bay, Manhattan, a quiet yet bustling neighborhood. Area has well-developed public transit and infrastructures and has multiple top-tier hospitals and medical facilities. Residents have education and medical backgrounds and earn above-average income. Paired with limited housing supply, the area is deemed one of the most underrated communities and full of growth potential.

- Developer purchased the lot for $14,800,000 in August 2021. Demolition of previous 3-floor building was finished, and developer plans to build a 12-floor apartment building with 59 Condo units. Foundation, excavation, and construction are expected to begin in Q2 2023, and the project is proposed to be completed in January 2025.

| Property Address | 112-15 Northern Boulevard, Queens, NY 11368 |

| Site Area | Corona, Queens, New York |

| Lot Area | 20,909 Sqft |

| Building Area | 128,389 Sqft |

| Intended Use | 173 Hotel Units, Conference Center, Indoor Parking Structure, and 2 Retail Units. |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 7/6/2023 | 6/22/2023 | 12/21/2023 | 183 days | Prepaid Dividend *2 | |

| Second | No Later than 1/5/2024 | 12/22/2023 | 6/21/2024 | 183 days | Extension Option Owned by Developer *3< | |

| Third | No Later than 7/6/2024 | 6/22/2024 | 12/21/2024 | 183 days | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 183 days of dividends. After 6 months, dividends will be calculated in terms of days till Developer repays the loan.

*3 After the second dividend period, Developer owns two extension options, and investors will receive dividends accordingly at the same dividend rate.

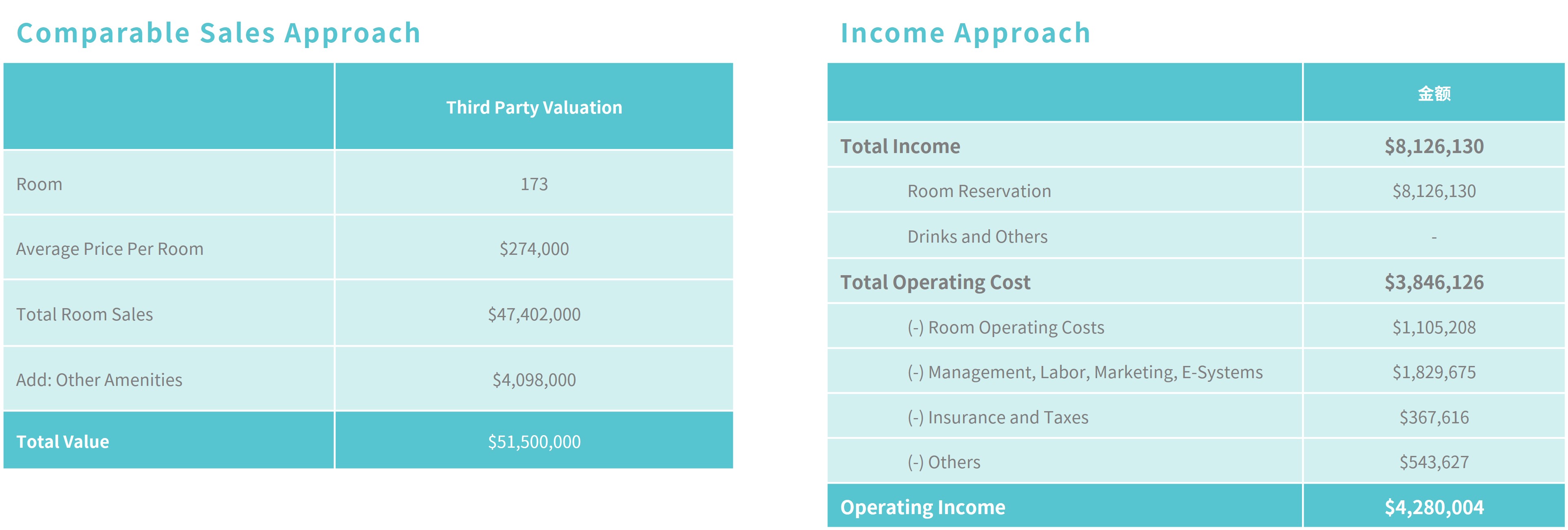

- According to Appraisal Report provided by LWHA, the hotel is valued at $51,500,000.

- The loan provided by CrowdFunz Fund 835 is pledged with 100% equity of the operating hotel, which is valued at $20,700,000 as of now. In addition, Developer will provide Unlimited Personal Guarantee, which is estimated to be 30 times the loan amount.

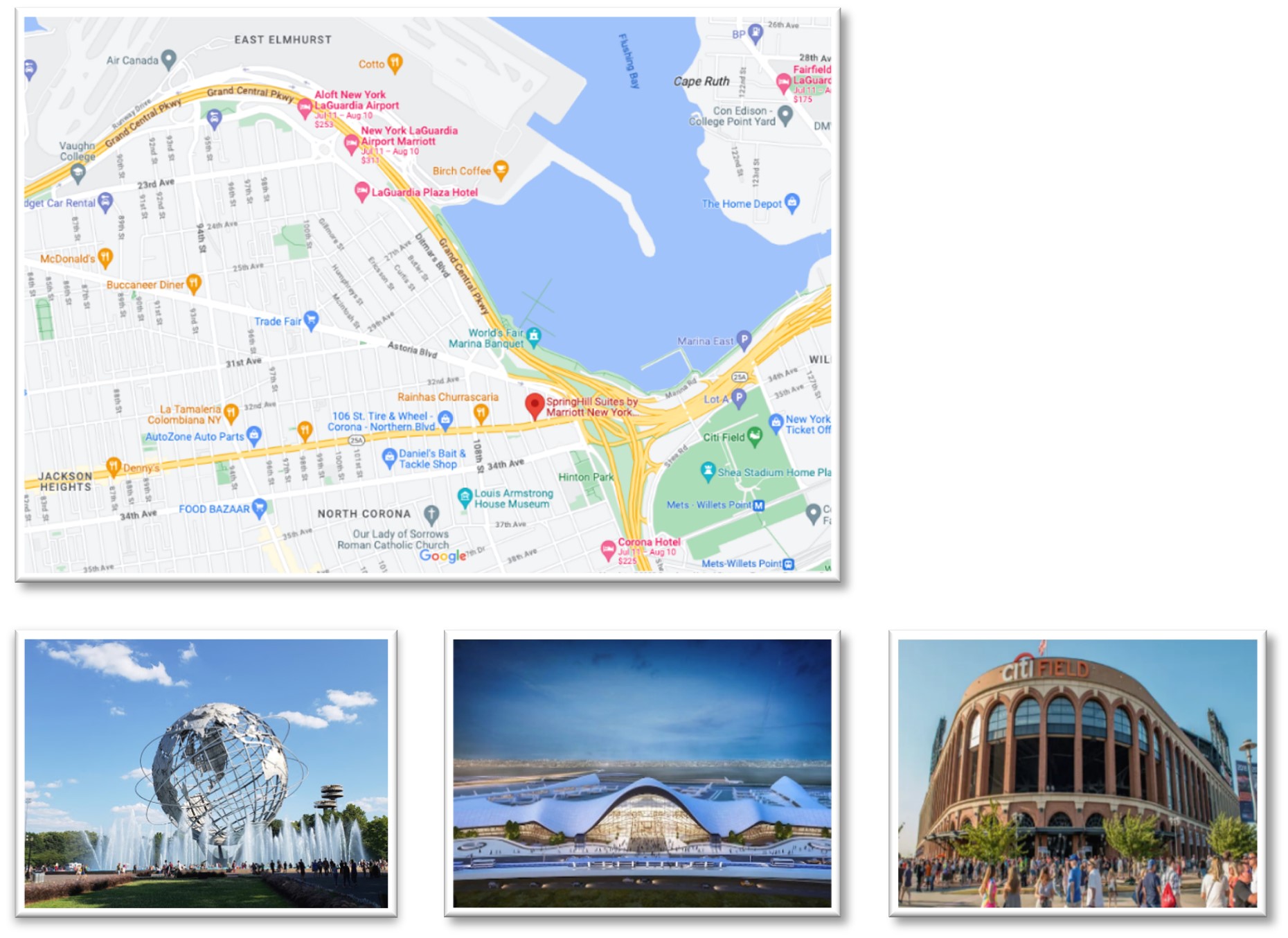

- Collateralized hotel is in core area of Corona and is minutes away from LGA Airport.

- Hotel is next to Citi Field of New York Mets and is one of the first choices for flight crews and sports fans.

- Hotel had signed long-term contract with New York City to lower vacancy rate.

- Developer will use the loan provided by CrowdFunz Fund 835 to cover construction costs of a newly purchased project in Rego Park.

- CrowdFunz chose an operating and profitable hotel of Developer as collateral to mitigate investment risk.

- Developer expects to apply new loans or to use other sources of income to repay the loan provided by CrowdFunz Fund 835.

- Developer is one of the most well-known Chinese developers in New York, with 2 decades of experience in real estate development. Successful projects spread across Queens, including hotels, mixed-use, and multi-family properties.

- Developer and CrowdFunz had cooperated in CrowdFunz Fund 806, 808, and 816. Two parties look forward to extending strong alliance with CrowdFunz Fund 835.

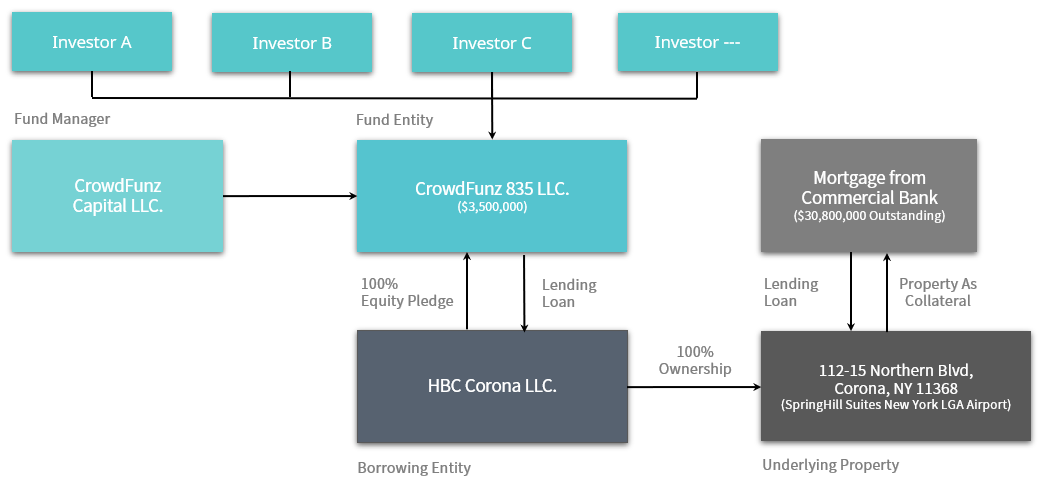

Investment Structure of CrowdFunz 835 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Mortgage from Commercial Bank | $30,800,000 | 59.8% |

| CrowdFunz Fund 835 Equity Pledge Loan | $3,500,000 | 6.8% |

| Developer Equity Value | $20,700,000 | 40.2% |

| Total | $51,500,000 | 100.00% |

- Loan provided by CrowdFunz Fund 835 is collateralized by SpringHill Suites by Marriot LGA Airport. The hotel has signed long-term contract with city government and has stable cash flows.

- According to Appraisal Report, underlying hotel is valued at $51,500,000, with $30,800,000 of remaining mortgage balance.

- After deducting mortgage, Developer equity value is around $20,700,000, more than 6 times the loan amount provided by CrowdFunz Fund 835.

- Developer will provide unlimited Personal Guarantee to ensure timely repayments and mitigate investment risks.

Demographic in Zip Code Area

| Zip Code 11368 | |

|---|---|

| Population | 109,931 |

| Median Age | 31 |

| College Degree or Above | 64% |

| Racial Makeup | Asian(10)%/Caucasian(32)%/African American(6.8%) |

| Average Family Income | $62.254 |

| Child-bearing Family | 49% |

| Average Family Size | 3.9 |

Corona has been one of the fastest growing communities in the past 10 years, for its convenient transportation and proximity to LGA Airport and sport stadiums, in New York.

Residents are from diverse background, and most are Caucasian.

Residents are on-average 31 years old, and most families have stable incomes. Child-bearing family is accounted for around 49%.

Due to proximity to Flushing, floods of Asian residents had migrated to Corona in recent years, in turn driving up property prices and draining inventory.

* Source: United States Zip Codes. Org. & Wikipedia, as of June 2023。

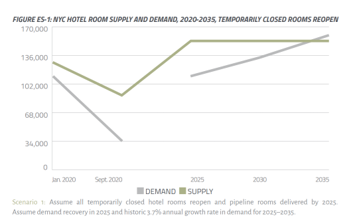

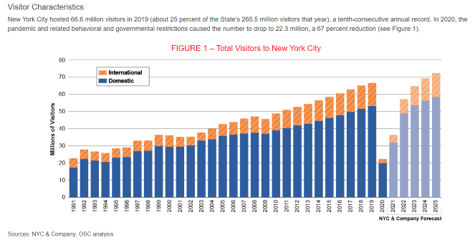

New York Hotel Market Trend

According to CBRE Report in 2022, hotels in New York had a strong recovery after the pandemic. CBRE expects the occupancy rate will recover to 77.2% and 82% in 2023 and 2024. In 2022, the average daily rate increased by 29.7%.

According to Crain’s New York Business Report, during the pandemic, total value of hotel properties in New York decreased from $32.7B to $26.3B. According to an analysis by The Real Deal, small-to-mid sized hotels are operated well as tourism recovers, but large-scale hotels are still facing challenges.

* Source: NYS Comptroller, The Tourism Industry in New York City Reigniting the Return。

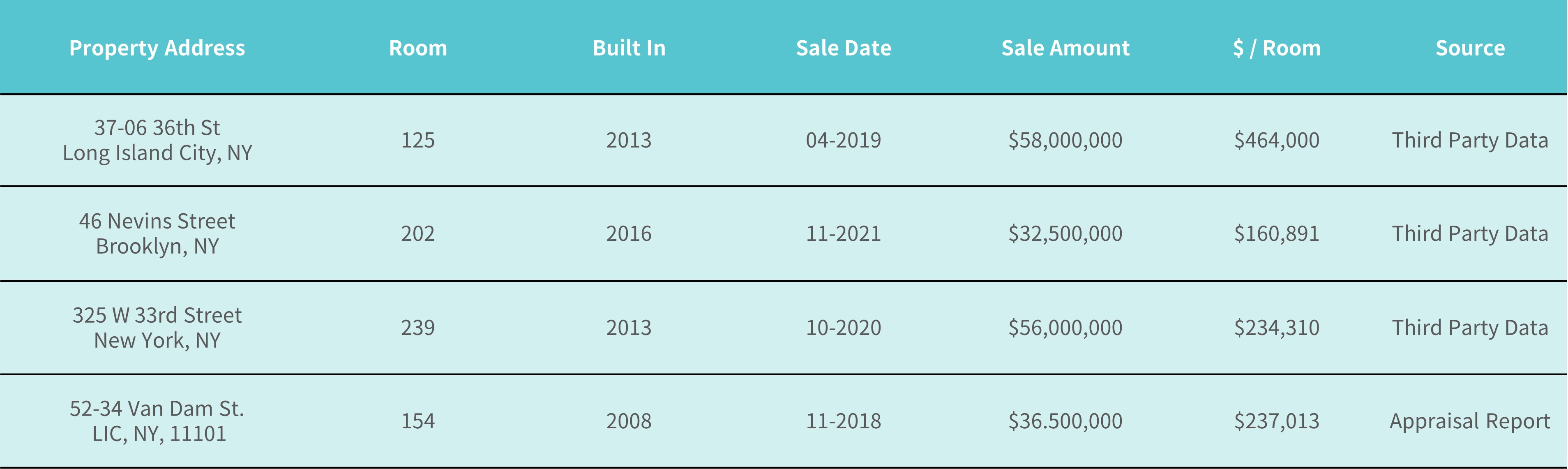

Comparable Sales Approach

* Source: Third party Appraisal Report, compiled and calculated by CrowdFunz.

Location

Hotel is 5 minutes away from 7 Train stations, and 20-min subway away from Midtown Manhattan; driving to LGA Airport takes 5 minutes.

Transportation

- Subway:7 Train

- To Midtown Manhattan: 20-minute Train

- To JFK Airport:5-minute Drive

- To LGA Airport:18-minute Drive

Nearby Schools

Hotel is in central area of Corona, which has copious options of elementary schools, middle schools, and high schools, to meet education needs.

Living Facilities

Corona is adjacent to Chinese communities in Flushing, which offers comprehensive restaurant, supermarkets, and businesses to meet daily needs.

Entertainment

Local family-friendly entertainment venues include art and science museums, and US Open Tennis stadiums.

Developer Company: United Construction & Development Group.

Developer Website: https://unitedgroupny.com/

Prior Cooperation: CrowdFunz Fund 806 / CrowdFunz Fund 808 /CrowdFunz Fund 816

United Construction & Development Group was founded in early 1990. Under the leadership of Mr. Chris Xu, the company has had over 20 years of experience in development and earned reputation among the industry.

Company manages over 2 million squarefeet of retail, residential, industrial, and commercial properties. The Skyline Tower in LIC is one of Developer’s most well-known projects.

Given Developer’s reputable track record, expertise, and creditworthiness, CrowdFunz believes that the new cooperation would create value for all parties.

- The loan provided by CrowdFunz Fund 835 is a short-to-mid term loan. CrowdFunz chose an already operating property of Developer’s as collateral to mitigate investment risks. Developer will apply for new loans with commercial bank or use other incomes to repay the loan provided by CrowdFunz Fund 835.

- The loan provided by CrowdFunz Fund 835 has an LTV of under 70%. Collateralized hotel has stable and profitable operations without concerns of construction and other risks.

- Collateralized hotel has stable occupancy rate and profitability. Sitting in central area of Corona, the hotel is in proximity of LGA Airport and Citi Field, making it popular among travelers and sports fans. The hotel had signed long-term contract with city government to secure its profitability.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)