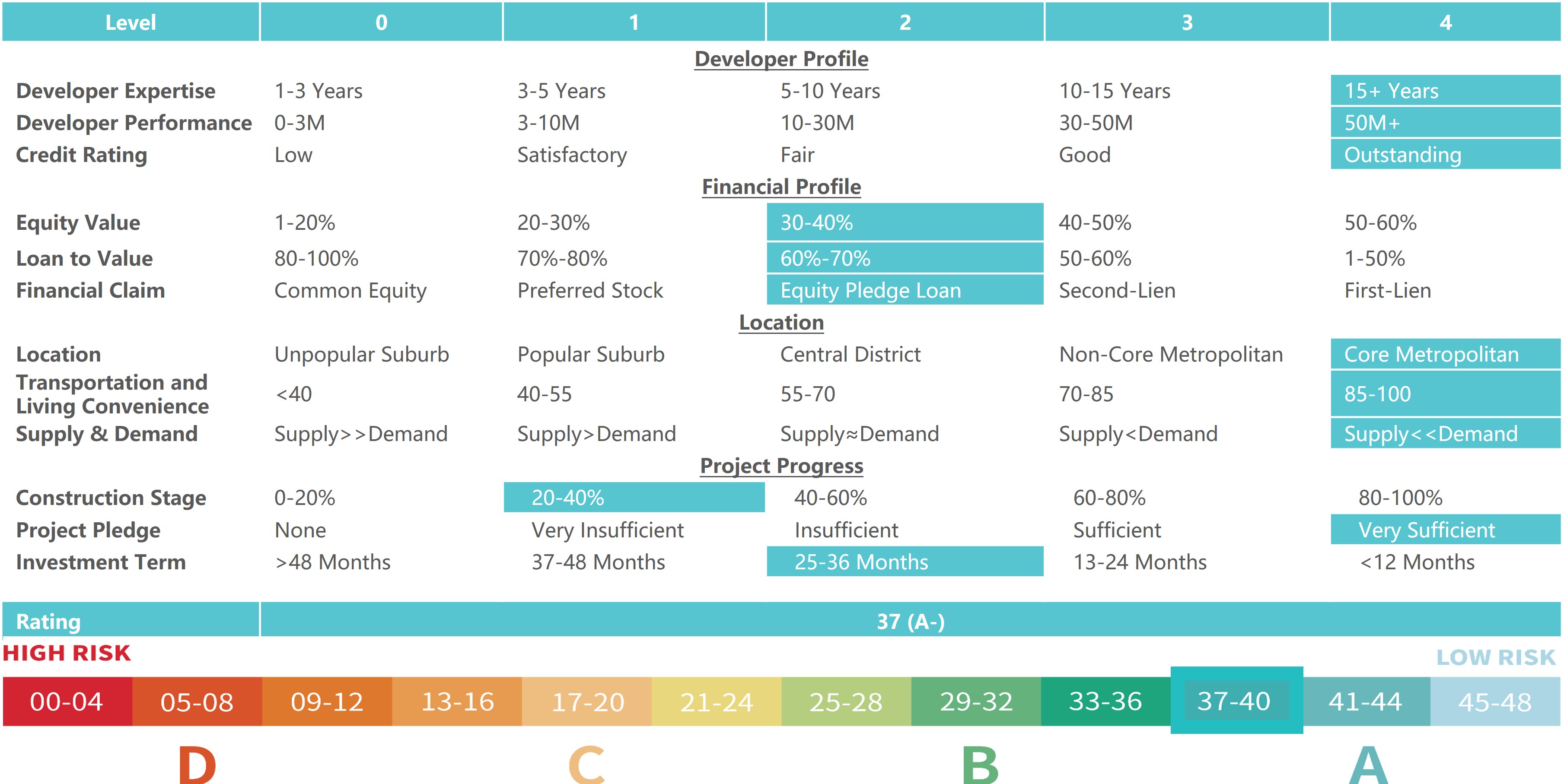

Equity Pledge Debt Fund 854

Type: Debt

Target: $5,000,000

Annual Return: 8.25% - 8.50%

Min-invest Amount: $10,000

Duration: 12 – 30 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $5,000,000 |

| Estimated Return | 8.25 – 8.50% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | May 2025 |

| Investment Timeline | 12 – 30 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.25% Annualized Return for Investment of 1-19 Units; 8.50% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the second dividend period, Borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate.

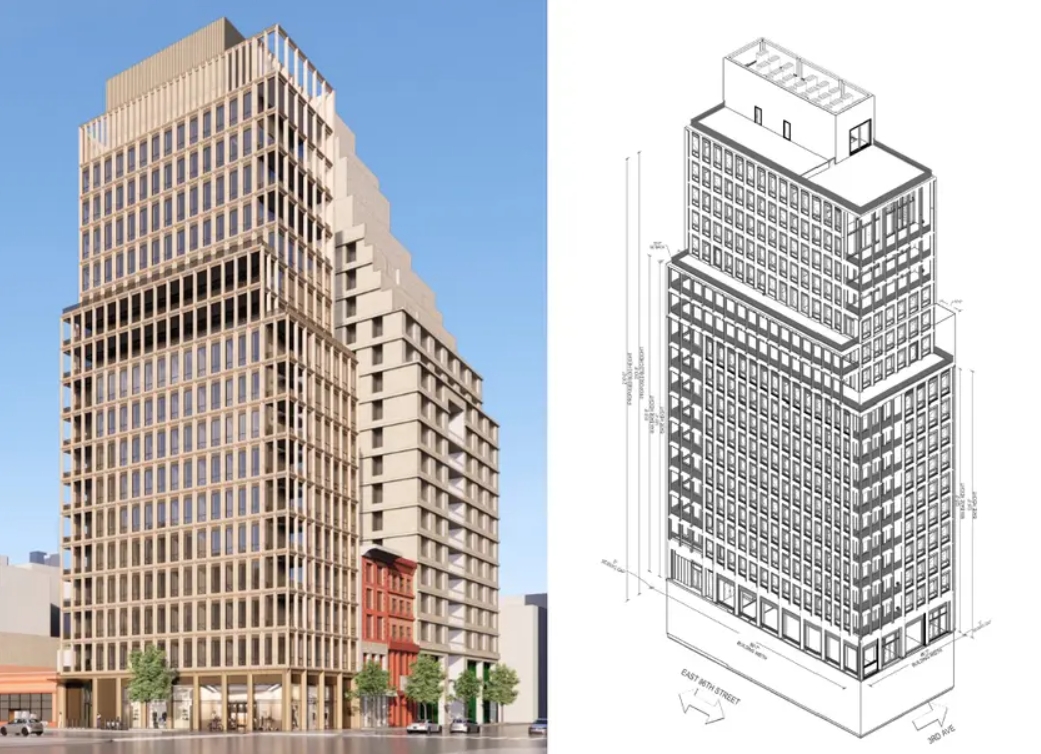

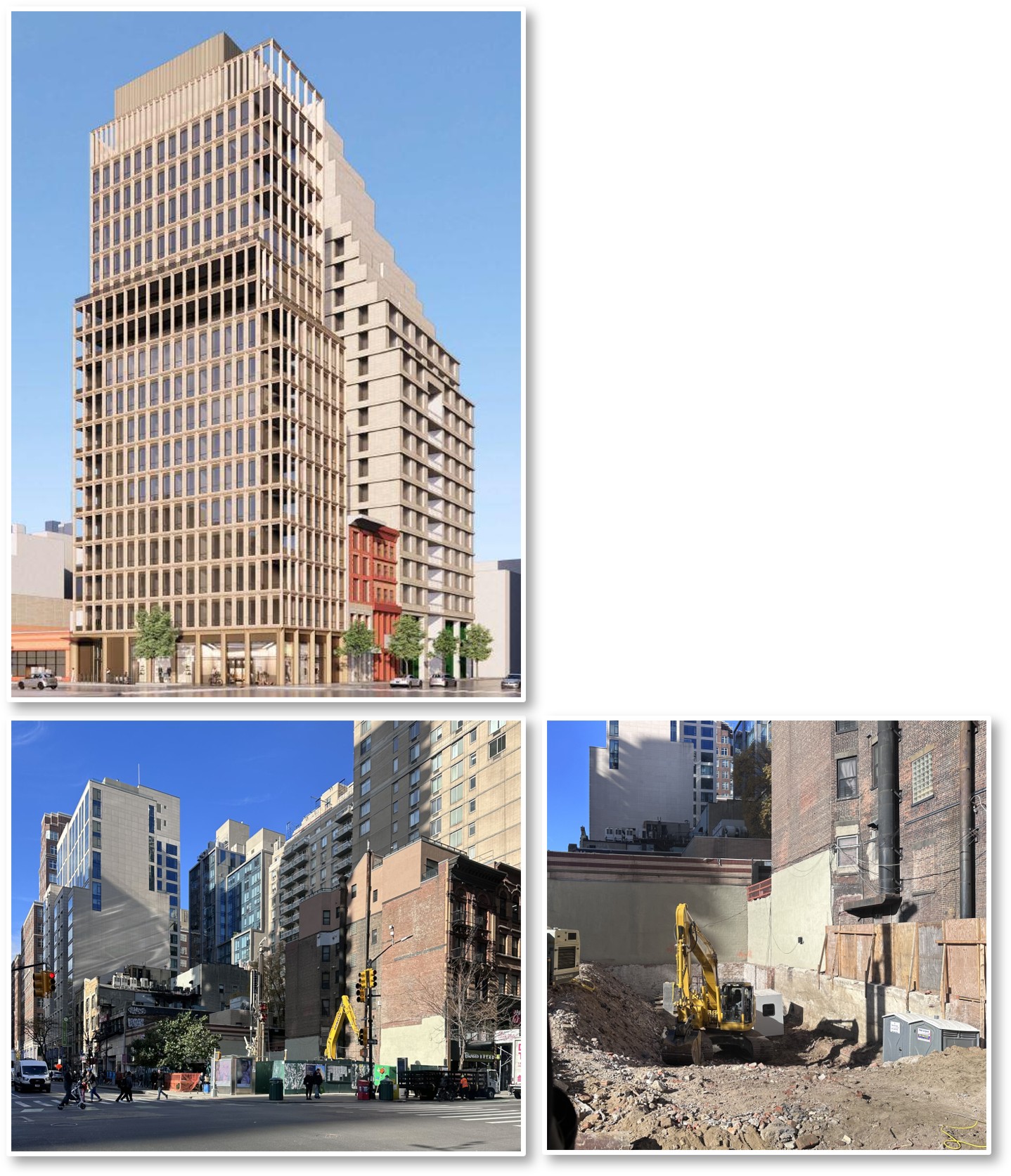

- The project is in Manhattan Upper East Side on East 86th Street, just a 3-minute walking from the 4, 5, 6 subway line station and close to Central Park. This prestigious neighborhood is known for luxury residences, upscale retail, and cultural institutions like the Met, Guggenheim, and Sotheby’s.

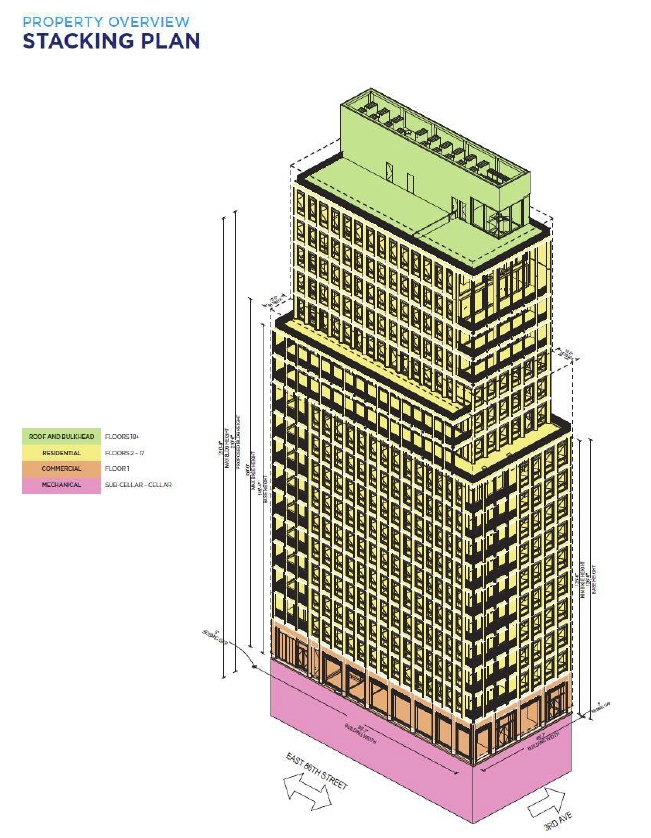

- The developer acquired the land in October 2023 for $24.5 million and plans to build a 17-story luxury condominium building with 24 residential units and a retail corridor. The demolition is completed, and the foundation is under construction. The project expects to obtain the Temporary Certificate of Occupancy by September 2026 and full completion by February 2027. The building will be total approximately 70,844 sq. ft., including 5,738 sq. ft. of retail space, and feature high-end amenities such as a gym, cinema, lounge, game room, and co-working space.

| Address | 171 East 86th Street, New York, NY 10028 |

| Area | Upper East Side, Manhattan, New York |

| Lot Area | 5,000 Sqft |

| Building Area | 70,844 Sqft |

| Intended Use | 24 Condo Units, 1 Retail Unit |

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Phase*1 | Amount | Dividend Date *2 | Counting Date | Ending Date | Dividend Period | Notes |

| First | First | $1,000,000 | No Later Than 5/23/2025 | 5/8/2025 | 11/7/2025 | 184 days | Prepaid Dividend*3 |

| Second | $1,000,000 | No Later Than 7/8/2025 | 6/23/2025 | 11/7/2025 | 138 days | Prepaid Dividend | |

| Third | $1,000,000 | No Later Than 8/23/2025 | 8/8/2025 | 11/7/2025 | 92 days | Prepaid Dividend | |

| Fourth | $1,000,000 | No Later Than 10/8/2025 | 9/23/2025 | 11/7/2025 | 46 days | Prepaid Dividend | |

| Second | Fifth | $1,000,000 | No Later Than 11/23/2025 | 11/8/2025 | 5/7/2026 | 181 days | Prepaid Dividend |

| Third | - | - | No Later Than 5/23/2026 | 5/8/2026 | 11/7/2026 | 184 days | Extension Option Owned by Developer*4 |

| Fourth | - | - | No Later Than 11/23/2026 | 11/8/2026 | 5/7/2027 | 181 days | Extension Option Owned by Developer |

| Fifth | - | - | No Later Than 5/23/2027 | 5/8/2027 | 11/7/2027 | 184 days | Extension Option Owned by Developer |

*1 Funding amount of different investment phases could be varied based on construction progress.

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*1 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*1 After the second dividend period, Borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate.

- According to the third-party appraisal report provided by CBRE, the land is valued at approximately $30.3 million dollars, with a projected total development cost of $111.8 million dollars and an estimated market value of $151.29 million dollars upon completion.

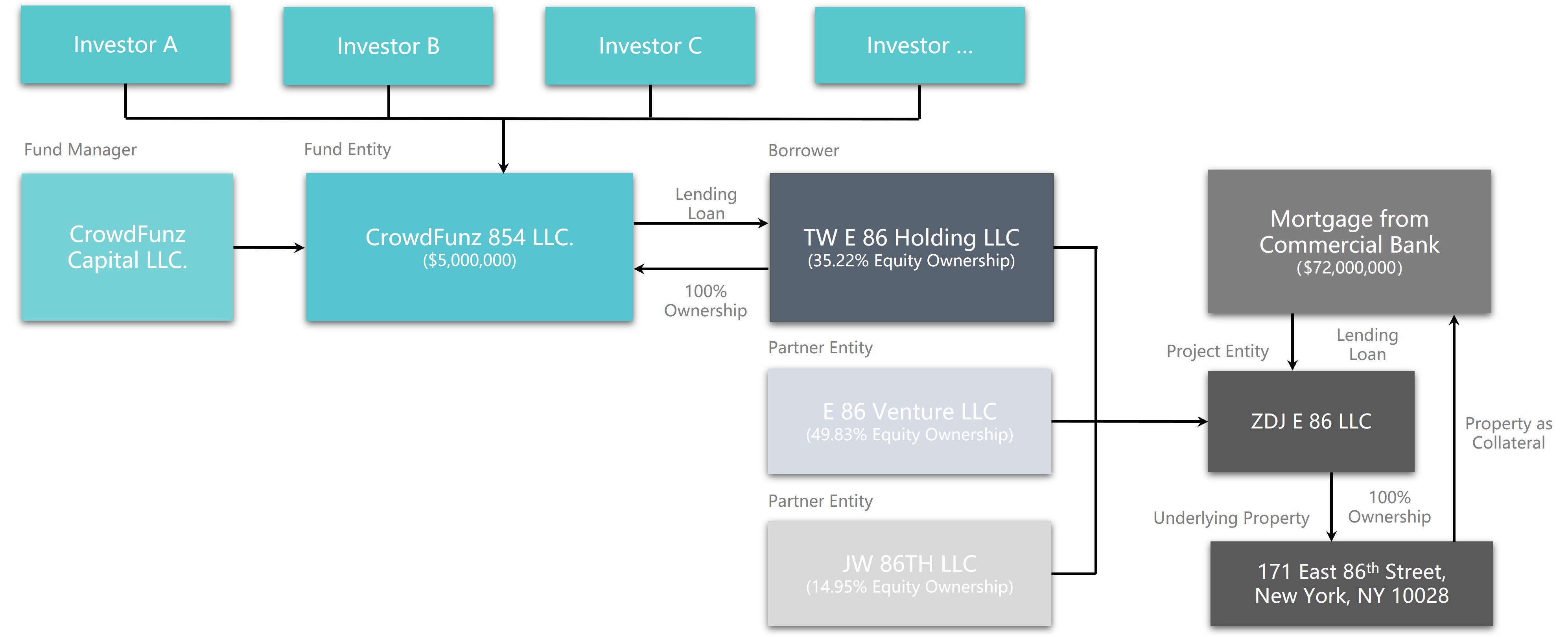

- The mid-term loan issued by CrowdFunz Fund 854 is secured by 100% equity in one of the project partner companies, with the borrower committing $12.26 million equity contribution. In addition, the borrower’s key individual will provide an unlimited personal guarantee.

- The subject property is in the core area of Manhattan Upper East Side, on the north side of East 86th Street, just a 3-minute walking to the 86th Street subway station serving the 4, 5, and 6 lines. Residents can reach Central Park in a 3-block walk west. From the site, most areas of Manhattan and Queens are accessible within 30 minutes by taking subway, and most of Brooklyn within 45 minutes. Driving time is approximately 20 minutes to LaGuardia Airport and 45 minutes to JFK.

- The Upper East Side is one of New York City’s most prestigious residential neighborhoods, known for its prime location, dense population, and high-rise luxury buildings. It is a preferred area for high-net-worth individuals globally, with steadily appreciating property values and limited new residential development, making newly built properties especially valuable.

- The borrower plans to use the loan provided by Fund 854 for the construction costs incurred during the development phase, ensuring the project is completed on schedule and ready for sales shortly after completion.

- Repayment of the loan is expected to come from the proceeds of condominium sales or cash flows from the borrower’s other real estate assets.

- The borrower of this project is a veteran Chinese-American real estate developer with over 30 years of residential development experience in the New York market. Their completed and successfully exited projects span multiple areas of Queens and include retail complexes, large-scale residential buildings, and mixed-use developments.

- The borrower first partnered with CrowdFunz in 2017 through Fund 606. Since then, they have successfully collaborated on several other funds, including 606, 806, 810, 813, 817 Phase I & II, 824, 829, and 839. All of the borrowings have repaid on time with interest, demonstrating strong creditworthiness.

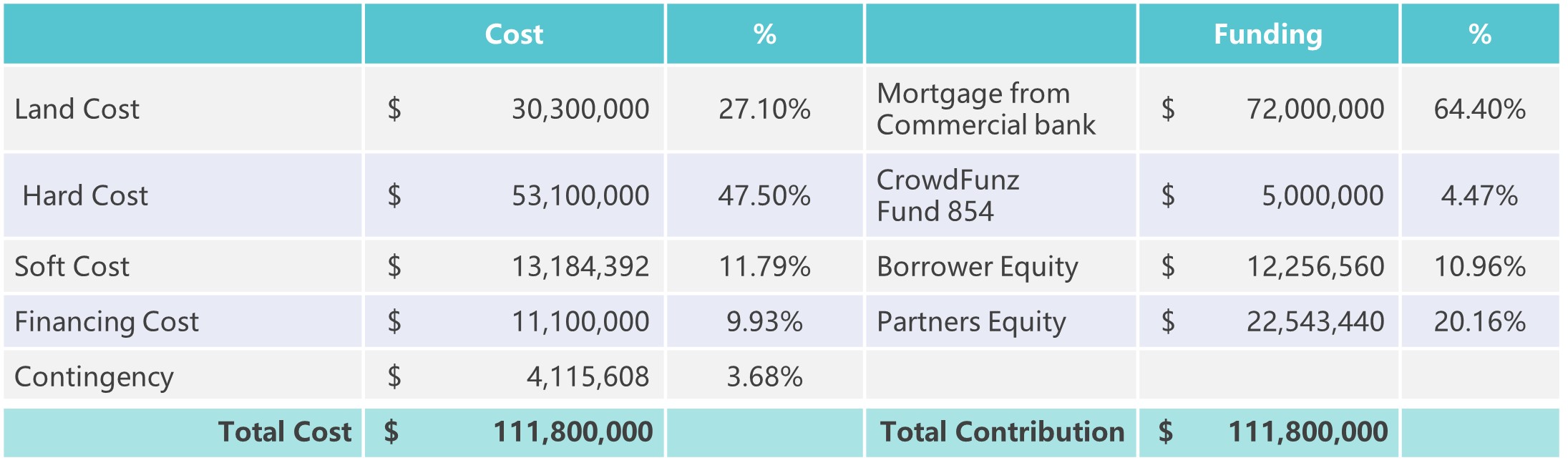

Capital Structure of CrowdFunz Fund 854

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| Commercial Bank Mortgage | $72,000,000 | 64.40% | |

| CrowdFunz Fund 854 Equity Pledge Loan | $5,000,000 | 4.47% | |

| Equity value | $12,256,560 | 10.96% | |

| Partners’ Equity Contribution | $22,543,440 | 20.16% | |

| Total Capital | $111,800,000 | 100.00% | |

- According to the third-party appraisal report provided by CBRE, the subject land is valued at approximately $30,300,000. The estimated total development cost is $111,800,000, with a projected market value upon completion of $151,290,000.

- The mid-term loan issued by Fund 854 is secured by 100% equity in one of the project partner companies, with the borrower contributing $12,256,560 equity, which is more than twice the loan amount provided by Fund 854, accounting for 20.16% of the capital stack.

- The construction loan issued by a commercial bank in total of $72,000,000 is accounted for 64.40% of the capital stack. The $5,000,000 loan from Fund 854 accounts for 4.47% of the capital stack. Based on the current financing plan, the loan-to-cost (LTC) ratio of the underlying project stands at 68.87%, which is acceptable based on industry standards.

- Additionally, the key peerson from the borrower will provide an unlimited personal guarantee, ensuring the repayments of principal and interest. In case of default, CrowdFunz Fund 854 has the right to pursue the guarantor’s personal assets through legal action.

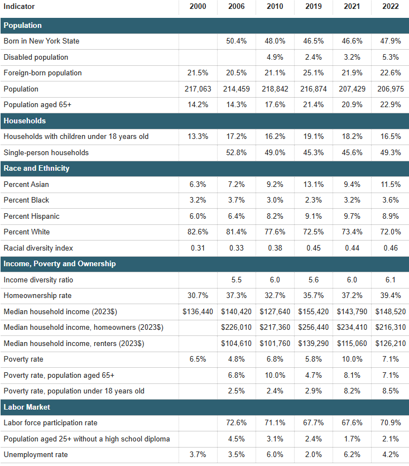

Demographics in Zip Code Area

| Upper East Side | |

|---|---|

| Population | 206,975 |

| Median Age | 42 |

| Born in | New York (47.90%)/ Out of the U.S (22.60%) |

| Race | Caucasian (72.00%)/ Latino(8.90%)/ Asian(11.50%)/ African American(3.60%) |

| Median Family Income | $148,520 |

| Child-bearing (Under 18) | 16.50% |

| Unemployment Rate | 4.20% |

Upper East Side is one of the wealthiest areas in New York City and a hub for museums and luxury retail spaces. Its convenient transportation and high quality of life make it a preferred residential choice for high-net-worth individuals worldwide.

The neighborhood is predominantly Caucasian (72%), followed by Asian (12%), Hispanic (9%), and Black (4%) populations. Most residents are middle- to upper-income, middle-aged local families, with an average age of 42 and a median household income of $148,520. The area has a low unemployment rate of just 4% and the lowest poverty rate in all of NYC areas at 7.1%.

As a traditional residential district, Upper East Side has historically leaned toward rental housing. By the end of 2022, only 39% of the population were owner-occupants.

* Source: NYU Furman Center, and U.S. Census Bureau, in April 2025.

Residential Market Trend in Upper East Side

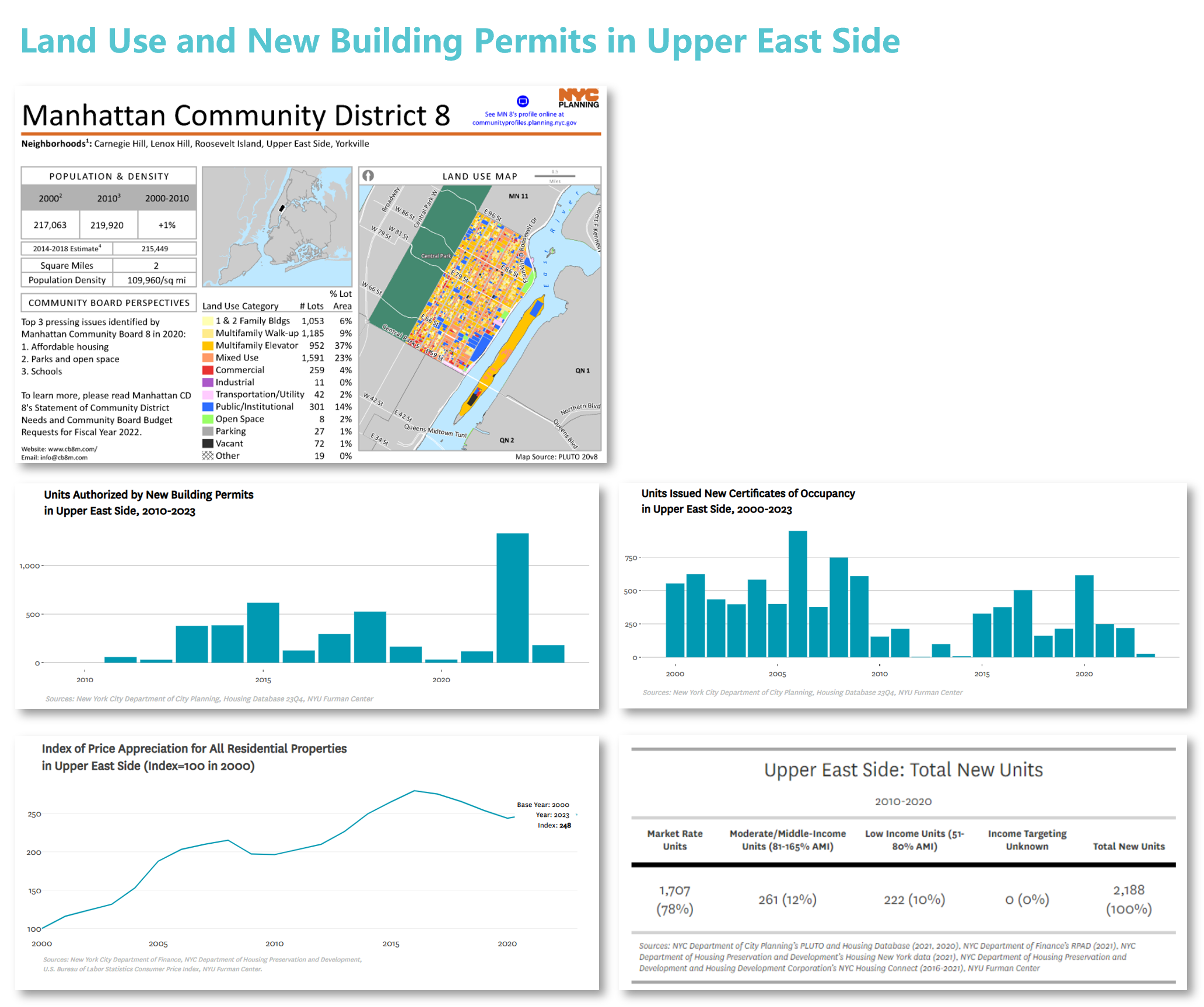

According to the NYC Department of City Planning, 46% of land use in Upper East Side is designated for multifamily residential buildings, followed by 23% for mixed-use residential-commercial properties. Single-family and two-family homes make up just 6%. The housing stock primarily consists of mid- and low-rise apartment buildings, most of which are over 50 years old, with limited new development.

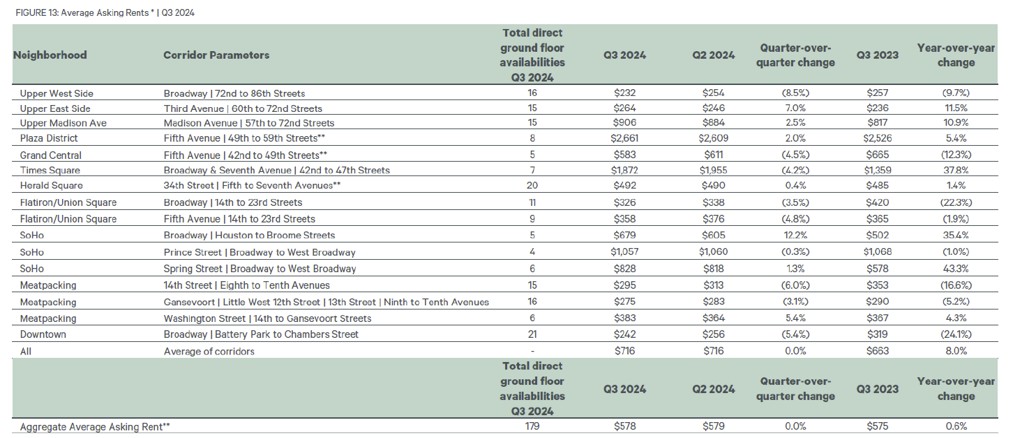

As reported by CBRE, as of Q4 2024, Upper East Side had 57,198 rental units with an occupancy rate of 98.1% and an average monthly rent of $4,301, indicating a strong and stable rental market.

Data from NYU Furman Center shows that by the end of 2023, home prices in the Upper East Side had increased by 248% since 2000, with the average property price now at approximately $1,214,721. Unlike many emerging neighborhoods in NYC, new residential development in the area remains limited. Between 2010 and 2020, only 1,707 market-rate condos, 261 affordable condos, and 222 low-income condos were built.

Since 2010, the area has seen just three peaks in new residential unit approvals: 616 units in 2015, 525 units in 2018, and 1,329 units in 2022.

* From: NYC Planning, and NYU Furman Center, in April 2025.

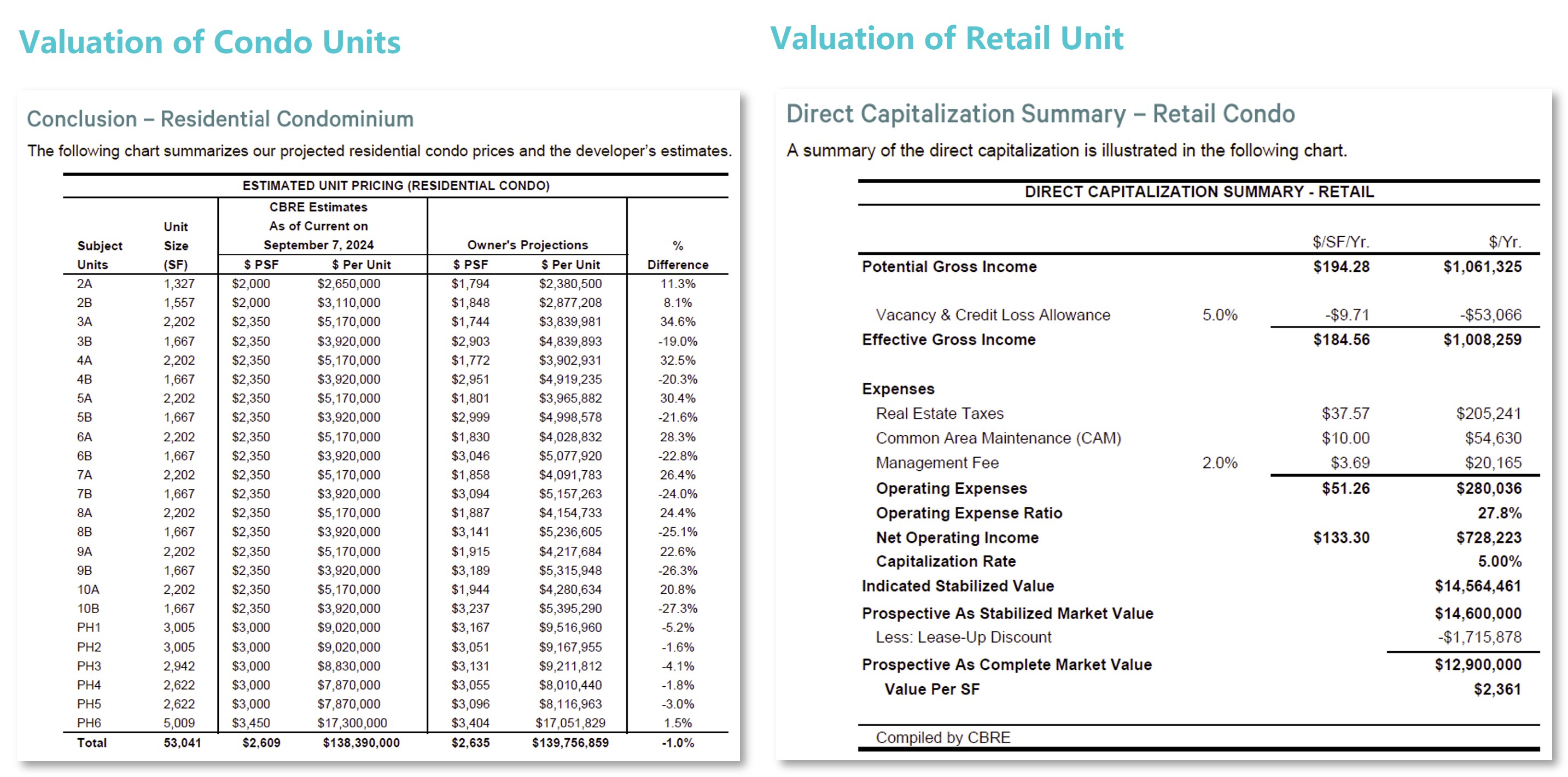

Valuation Post-completion

According to the third-party appraisal report provided by CBRE, the projected market value of the subject property upon completion is approximately $151,290,000. This includes an estimated $138,390,000 for the 24 condominium units and $12,900,000 for the commercial retail space, as detailed in the accompanying chart.

* Source: Appraisal report from CBRE.

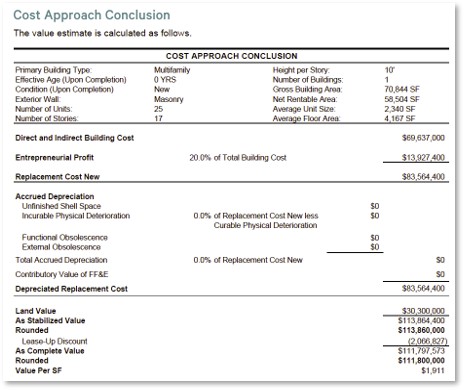

Cost Approach

According to the third-party appraisal report provided by CBRE, the land value of the subject property is approximately $30,300,000, with a projected total development cost of around $111,800,000.

CrowdFunz believes the $111,800,000 cost estimate provided by CBRE accurately reflects the current project valuation and meets the underwriting standards required for Fund 854’s loan issuance. A detailed breakdown of the cost budget is shown in the chart below.

* Source: Cost breakdown provided by borrower, data compiled and calculated by CrowdFunz.

Location

The property is extremely well-connected, with multiple transit options nearby. It is just a 3-minute walking to the 4, 5, 6 subway lines and a 5-minute walking to the N, Q, R lines. Central Park is only three blocks west of the site. From the property, most areas of Manhattan and Queens are reachable within 30 minutes by taking subway, and most of Brooklyn within 45 minutes. Driving time is approximately 20 minutes to LaGuardia Airport and 45 minutes to JFK International Airport.

Transportation

- Subway: 4 / 5 / 6 (3-min Walking) / N / Q / R(5-min Walking)

- To Midtown: 10-min Subway

- To JFK: 45-min Driving

- To LGA: 20-min Driving

School

The property is in Manhattan Upper East Side, one of New York City’s top school districts. The area is home to dozens of highly ranked private schools, as well as five top-rated public schools: PS 77 Lower Lab School, Eleanor Roosevelt High School, PS 6 Lillie D. Blake, PS 267 East Side Elementary, and PS 290 Manhattan New School. Several higher education institutions are also nearby, including Rockefeller University and Hunter College, both within one mile of the property.

Living Facilities

As a traditional upscale residential area in Manhattan, the neighborhood boasts a thriving commercial scene. Centered around Madison Avenue, it offers a wide range of luxury retail stores, major shopping centers, international restaurants, and hotels, supporting for residents’ daily dining, shopping, and lifestyle needs.

Entertainment

The project is surrounded by abundant museums, gyms, and entertainment venues, offering residents full access to the vibrant lifestyle of Manhattan. Central Park, the city’s largest urban green space, is just 3 blocks away, ideal for family recreation. Nearby cultural landmarks include the Metropolitan Museum of Art, Guggenheim Museum, Frick Collection, Sotheby’s, as well as numerous galleries and antique shops.

Developer Company: ZD Jasper Realty.

Developer Website: https://www.zdjasper.com/

Prior Cooperation: CrowdFunz Fund 606 / 806 / 810 / 813 / 817-1 / 817-2 / 824 / 829 / 839

- CrowdFunz Fund 854 provides a mid-term mezzanine loan to the borrower, which will be used for the construction costs during the development stage. The loan will be repaid through proceeds from condominium sales or cash flow from the borrower’s other real estate holdings.

- The project’s loan-to-cost (LTC) ratio is 68.87%, within standard industrial levels, and the borrower is contributing $12,256,560 equity, more than twice the loan amount originated by Fund 854, demonstrating strong equity support.

- The project is well-positioned in a prime residential market with strong demand for new condominiums in Manhattan Upper East Side.

- Given the conservative leverage and strong location, Fund 854 is viewed as a lower-risk, fixed-income investment opportunity for retail investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)