Equity Pledge Debt Fund 858

Type: Debt

Target: $8,000,000

Annual Return: 8.15 - 8.40%

Min-invest Amount: $10,000

Duration: 6 – 36 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $8,000,000 |

| Estimated Return | 8.15 – 8.40% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | August 2025 |

| Investment Timeline | 6 – 36 Months*2 |

| Dividend Schedule | Prepaid per 6 Month*3 |

*1 8.15% Annualized Return for Investment of 1-19 Units; 8.40% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 5 extension options, and investors will receive dividends accordingly at the same dividend rate.

- The project is in the heart of Downtown Brooklyn, a prime area known for excellent transportation and a thriving commercial district. Recent new development have attracted a growing population of young professionals and middle-income residents, making it a desirable neighborhood for living and working.

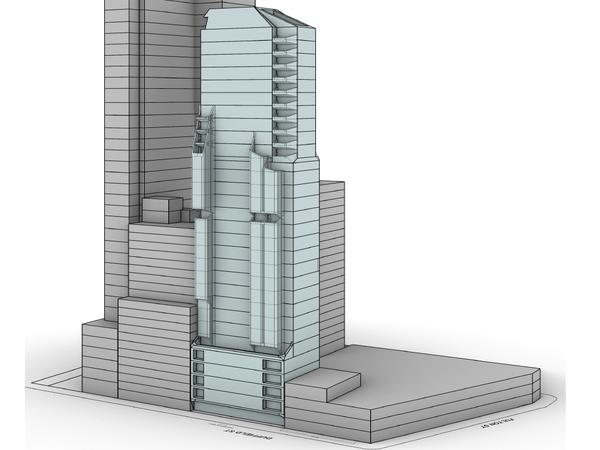

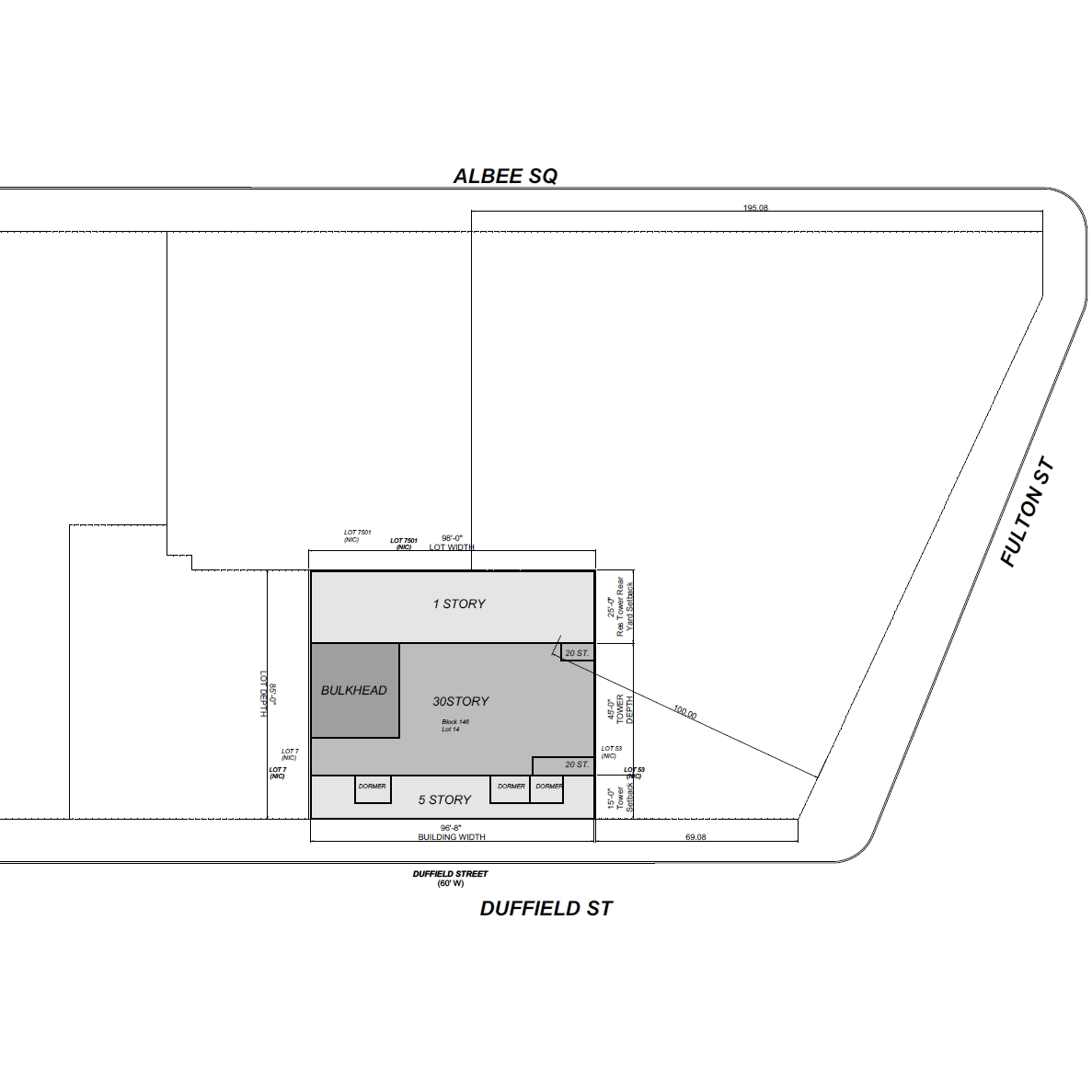

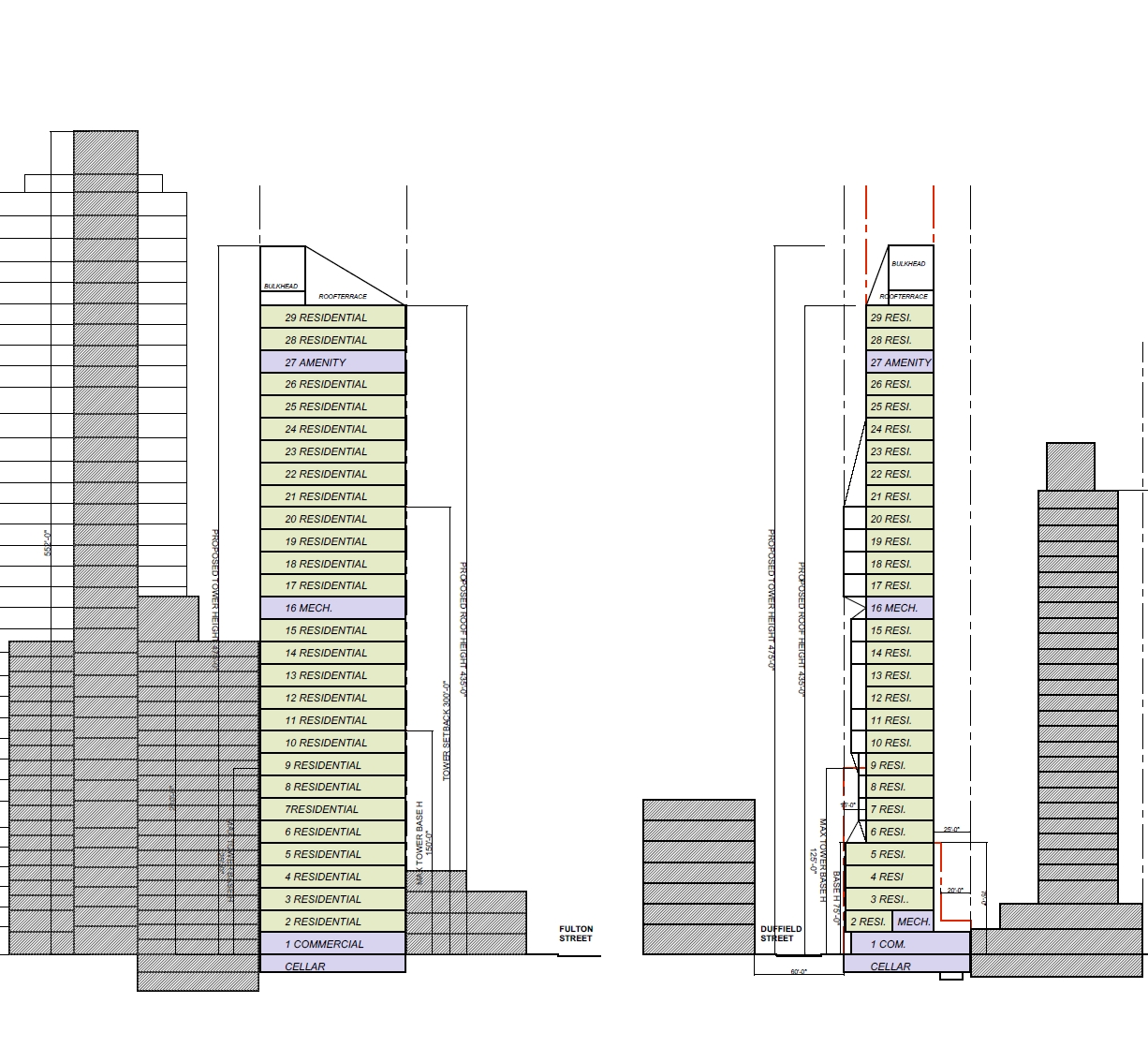

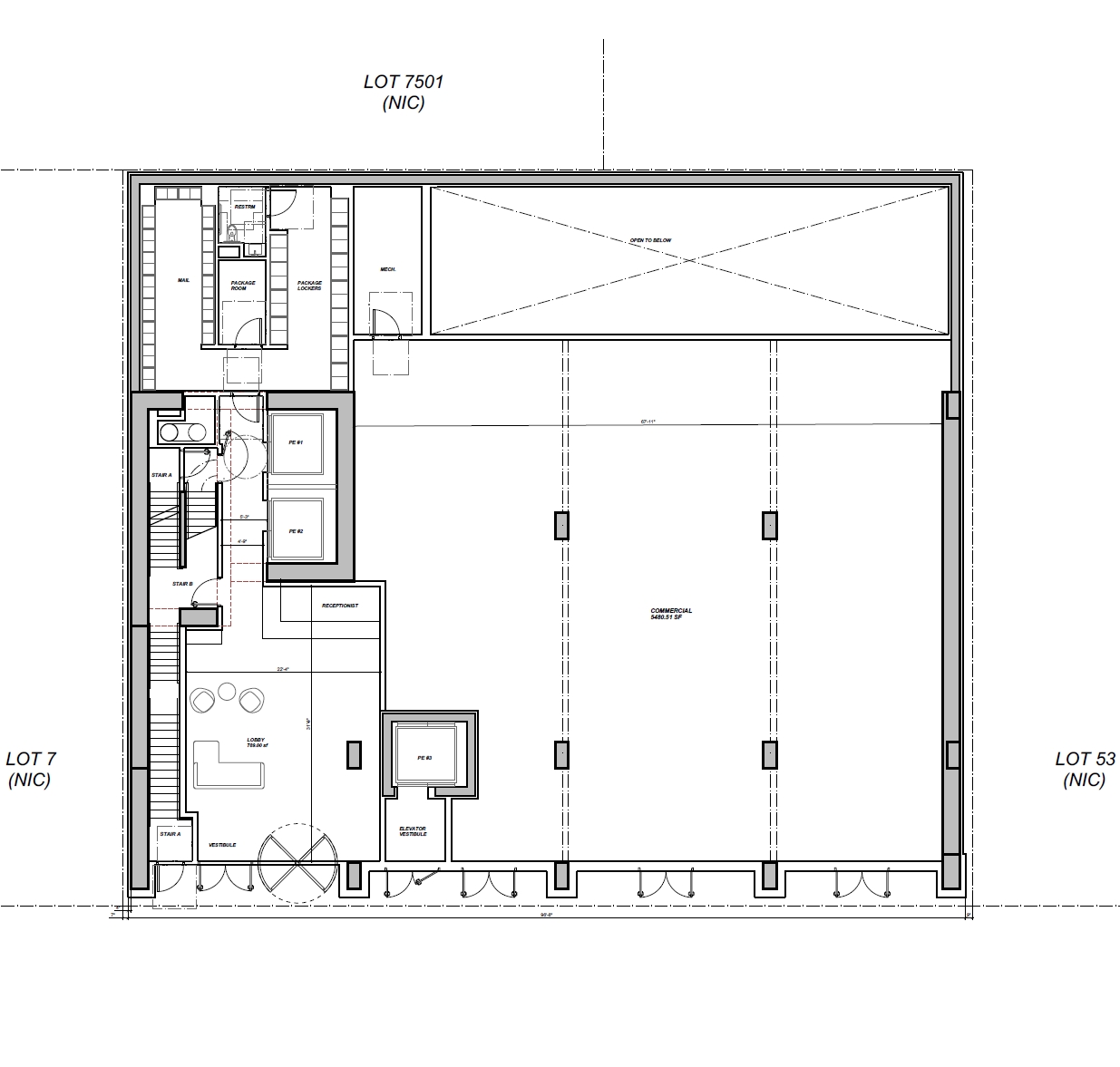

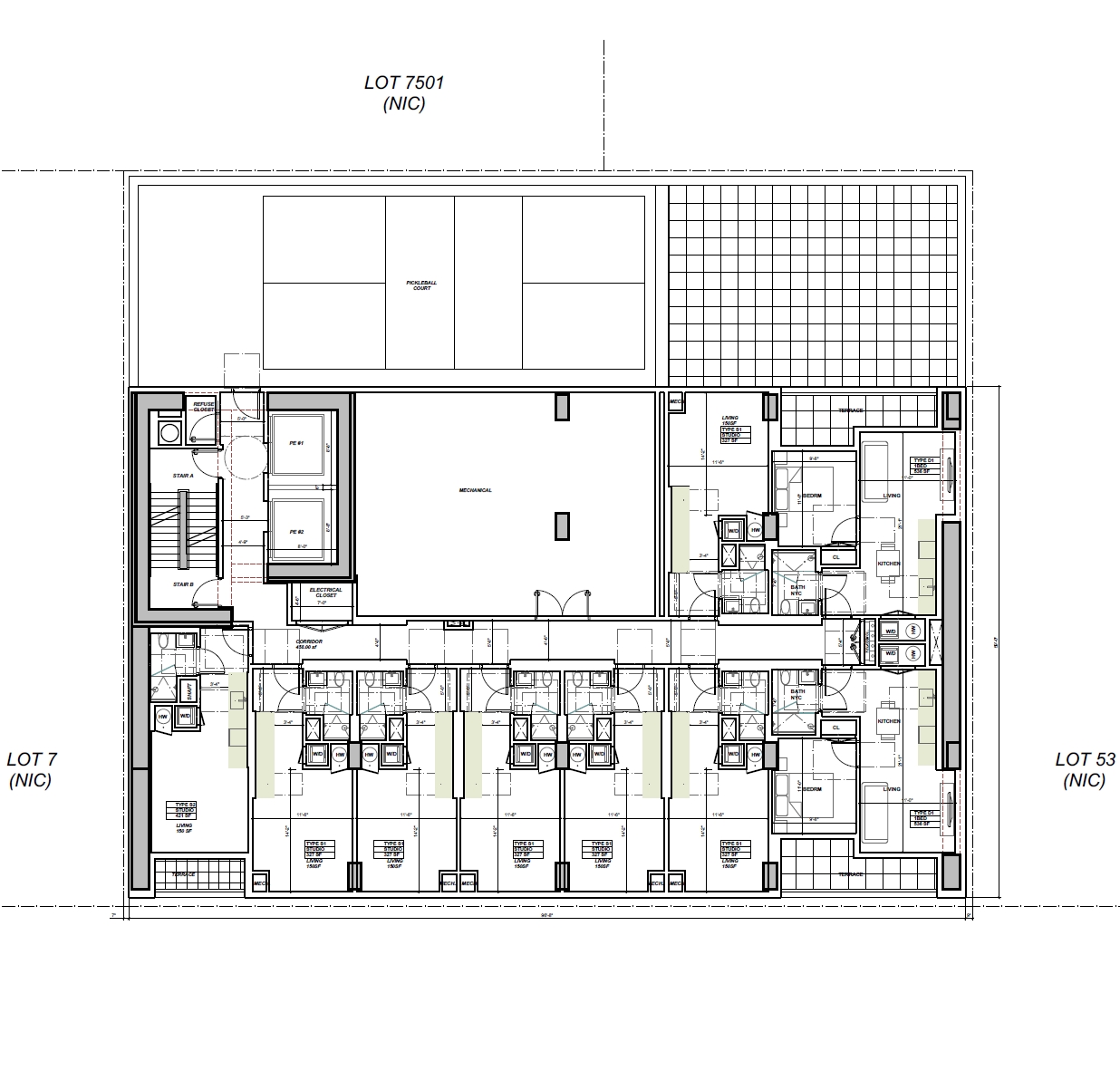

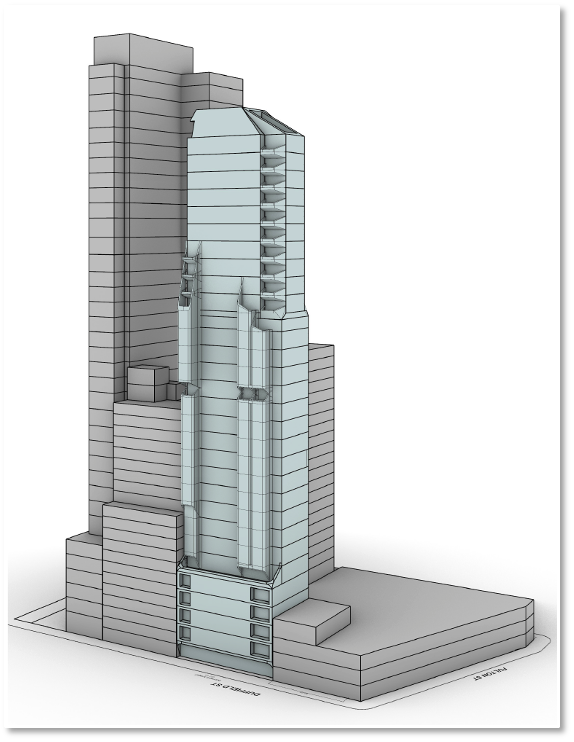

- The proposed property is a mixed-use building with 2 cellars and 28 stories in a total Gross Floor Area of 99,960 square feet. According to the proposed planning, the first cellar to the third floor above ground will be used as commercial space for rent after completion; the second cellar is proposed to be storage space for residents, bicycle parking, and other amenities for residents. The 4th to 25th floors and 27th to 28th floors of the building will be used to construct residential condominiums for sale; the 26th floor is also planned to be amenities for residents. The proposed residential condominiums are mainly one-bedroom units and supplemented by studios, focusing on affordable but boutique residential units.

| Address | 245 Duffield St, Brooklyn, NY 11201 |

| Area | Downtown Brooklyn, Brooklyn, New York |

| Lot Area | 8,330 Sqft |

| Building Area | 99,960 Sqft |

| Proposed Design | 25 Floors of Condominium Units, Commercial Spaces in the first cellar and the first 3 Floors |

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Phase *1 | Amount | Dividend Date *2 | Counting Date | Ending Date | Dividend Period | Notes |

| First | First | $4,000,000 | No Later Than 8/25/2025 | 8/10/2025 | 2/9/2026 | 184 Days | Prepaid Dividend*2 |

| Second | $4,000,000 | No Later Than 9/25/2025 | 9/10/2025 | 2/9/2026 | 153 Days | Prepaid Dividend | |

| Second | - | - | No Later Than 2/25/2026 | 2/10/2026 | 8/9/2026 | 181 Days | Extension Option Owned by Developer *3 |

| Third | - | - | No Later Than 8/25/2026 | 8/10/2026 | 2/9/2027 | 184 Days | Extension Option Owned by Developer |

| Fourth | - | - | No Later Than 2/25/2027 | 2/10/2027 | 8/9/2027 | 181 Days | Extension Option Owned by Developer |

| Fifth | - | - | No Later Than 8/25/2027 | 8/10/2027 | 2/9/2028 | 184 Days | Extension Option Owned by Developer |

| Sixth | - | - | No Later Than 2/25/2028 | 2/10/2028 | 8/9/2028 | 182 Days | Extension Option Owned by Developer |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan;

*3 After the first dividend period, Borrower owns 5 extension options, and investors will receive dividends accordingly at the same dividend rate.

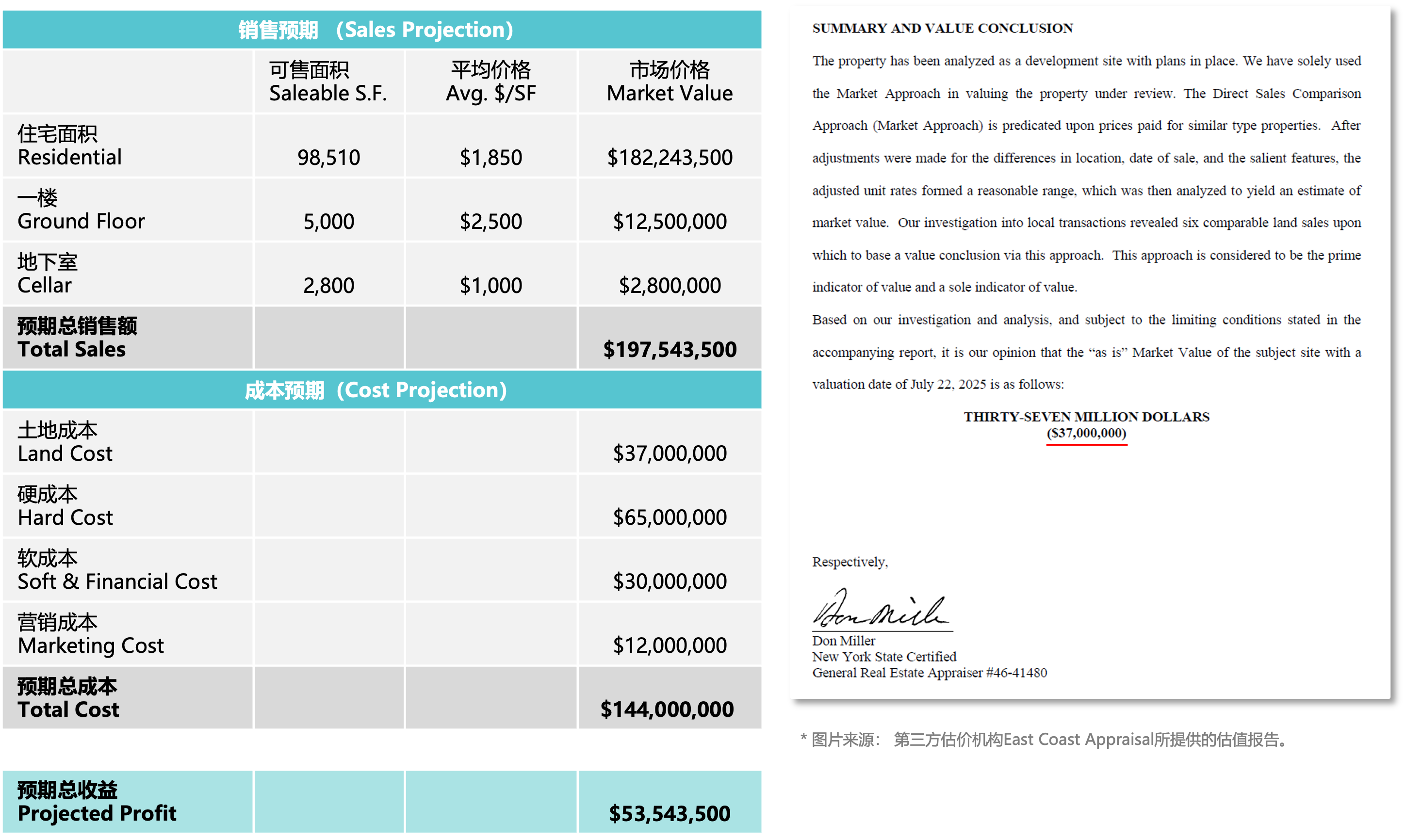

- According to the third-party appraisal provided by East Coast Appraisal, the land of the project is valued at $37,000,000. Based on the borrower’s budget, total development costs upon completion are estimated around $144,000,000, with a projected market value of $197,543,500. The borrower has signed a Purchase and Sale Agreement with the current landlord with the closing date on September 15th, 2025.

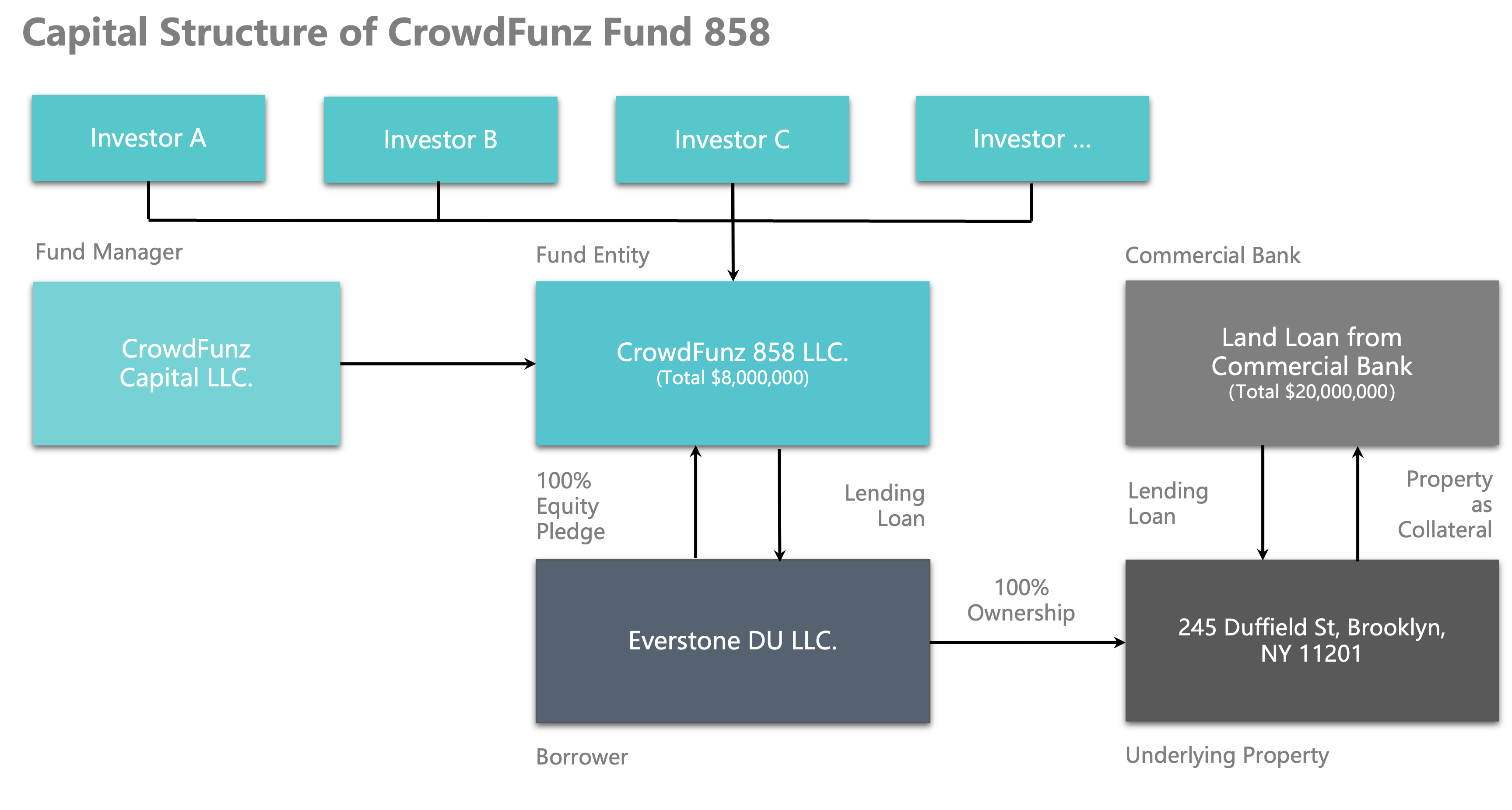

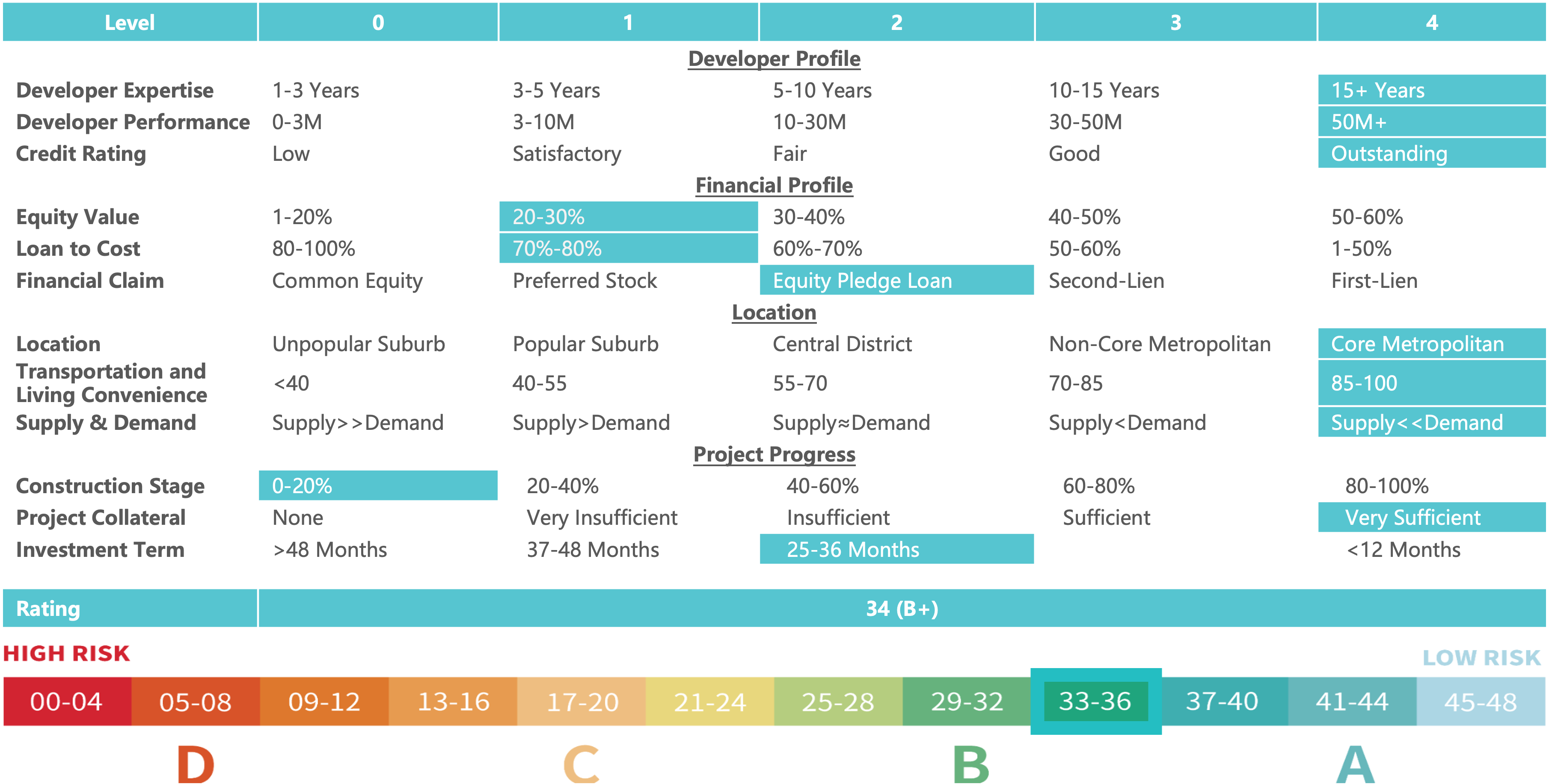

- CrowdFunz Fund 858 is providing a mid-term loan secured by 100% equity interest in the property-owning entity, which currently has equity contribution approximately $9,000,000. In addition, the borrower’s key person has provided an unlimited personal guarantee for the repayment of the loan.

- The borrower has over 15 years of real estate investment experience in New York, along with a strong development track record in China. In recent years, the borrower has actively expanded in the New York market, having completed five local projects and currently managing four more under development.

- CrowdFunz Fund 858 marks the sixth collaboration between CrowdFunz and the borrower, following Fund 830, 834, 837, 845, and 851. Both parties aim to deliver investment opportunities through this partnership, allowing Fund 858 investors to earn the potential returns from local real estate market.

- CrowdFunz Fund 858 will originate the loan in two phases, each providing $4,000,000 in financing, for a total of $8,000,000. The loan will be disbursed into an escrow account in stages according to the land purchase schedule. The borrower intends to use the proceeds from the borrowing for land acquisition and pre-construction expenses.

- Repayment of the loan is expected to come from a future construction loan from a commercial bank, proceeds from the sales of condominium units, or cash flows from other properties held by the borrower.

- The site is on the west side of Duffield Street, bordered by Willoughby Street to the north and Fulton Street to the south. Just two blocks west is Flatbush Avenue, a major traffic artery connecting to the Manhattan Bridge. The property is within a 5-minute walking distance of multiple subway stations, including the 2/3/4/5, A/C/G at Hoyt Street, and B/D/N/Q/R/W at DeKalb Avenue, offering exceptional access to public transportation.

Capital Structure of CrowdFunz Fund 858

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| Commercial Bank Land Loan | $20,000,000 | 54.05% | |

| CrowdFunz Fund 858 Equity Pledge Loan | $8,000,000 | 21.62% | |

| Equity Contribution | $9,000,000 | 24.32% | |

| Valuation – Cost Basis | $37,000,000 | 100.00% | |

- According to the third-party appraisal provided by East Coast Appraisal, the land of this project is valued at approximately $37,000,000. The borrower has already signed a Purchase and Sale Agreement with the seller and paid a deposit, with the closing date on September 15th, 2025.

- Upon disbursement, the land loan provided by a Commercial Bank is in total of $20,000,000, counted 54.05% of capital contribution; the borrower’s equity contribution is in total of $9,000,000, counted 24.32% of capital contribution. The loan originated by Fund 858 is in total of $8,000,000, counted 21.62% of total capital contribution. The loan-to-cost ratio is about 75.68%, slightly leveraged but within industry range.

- In addition, the key person from the borrowing entity will provide an unlimited personal guarantee to ensure timely repayment of principal and interest. In the event of default, CrowdFunz may pursue legal remedies against the guarantor’s personal assets.

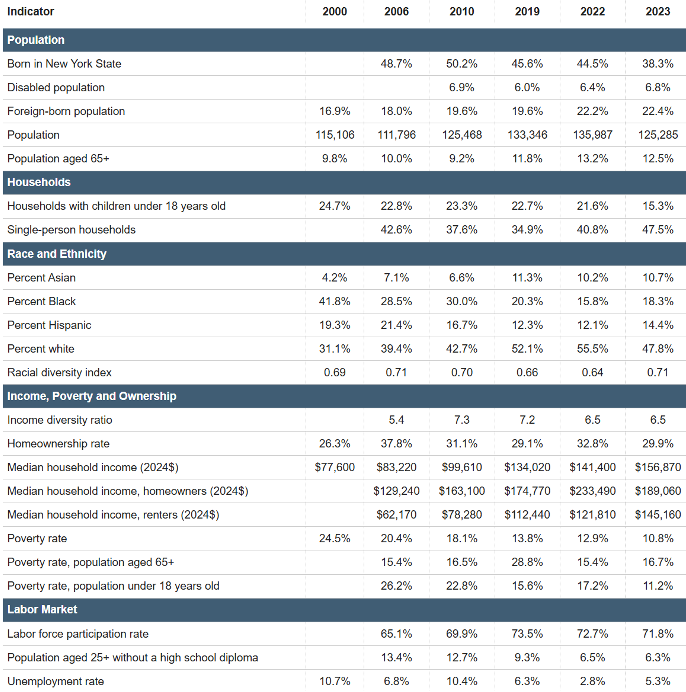

Demographics in Zip Code Area

| Flushing/Whitestone | |

|---|---|

| Population | 125,285 |

| Born in | New York (38.30%) / Foreign (22.40%) |

| Race | Caucasian (47.80%) / African American (18.30%) / Latino (14.40%) / Asian (10.70%) |

| Child-bearing (Under 18) | 11.20% |

| Unemployment Rate | 5.30% |

According to data from the U.S. Census as used by NYU Furman Center, the Fort Greene/Brooklyn area, where Downtown Brooklyn is located, is characterized by a diverse population. Caucasian residents make up the largest group at 47.80%, followed by African American residents at 18.30%, Hispanic residents at 14.40%, and Asian residents at 10.70%.

Most residents are native New Yorkers, with 38.30% born in New York State and 22.40% born outside the U.S. The median age in the area is approximately 40 years old, with most residents being middle-income working professionals. Households with children under 18 comprise 11.20% of the population. In recent years, many newcomers to the area have been young, white-collar professionals who primarily rent their homes.

* Source: NYU Furman Center, and U.S. Census Bureau,in April 2025.

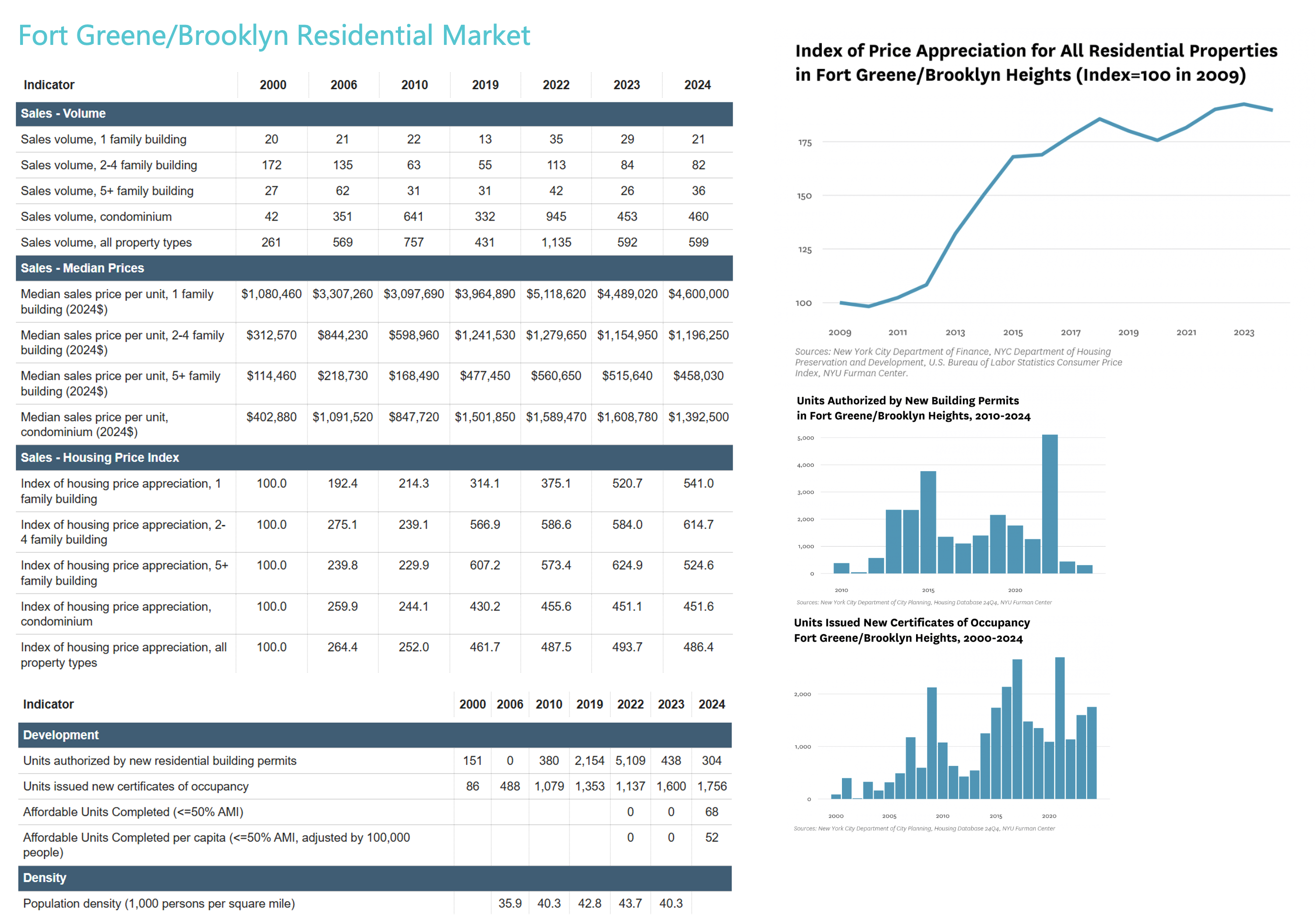

Residential Market in Project Area

According to U.S. Census data used by NYU Furman Center, as of the end of 2024, the Fort Greene/Brooklyn district had a homeownership rate of 29.9%, with the residential market primarily composed of rental apartments. There were 70,986 registered housing units in the area, and the rental vacancy rate was 4.00%. The area experienced waves of new housing development in 2019 and 2022, with new building permits reaching 2,154 and 5,109, respectively. Certificates of occupancy for newly built units reached 1,353 in 2022, 1,137 in 2023, and 1,756 in 2024.

Since 2019, most residential transactions in the area have been for condominiums. In 2024, there were 460 condominium sales, compared to 139 transactions for other residential property types.

As of the end of 2024, the median sale price for single-family houses in the area was $4,600,000, while the median price for condominium units was $1,392,500. Overall, residential real estate prices have increased approximately 190% compared to it in 2009.

* Source: Appraisal Report provided by NYU Furman Center and U.S. Census Bureau.

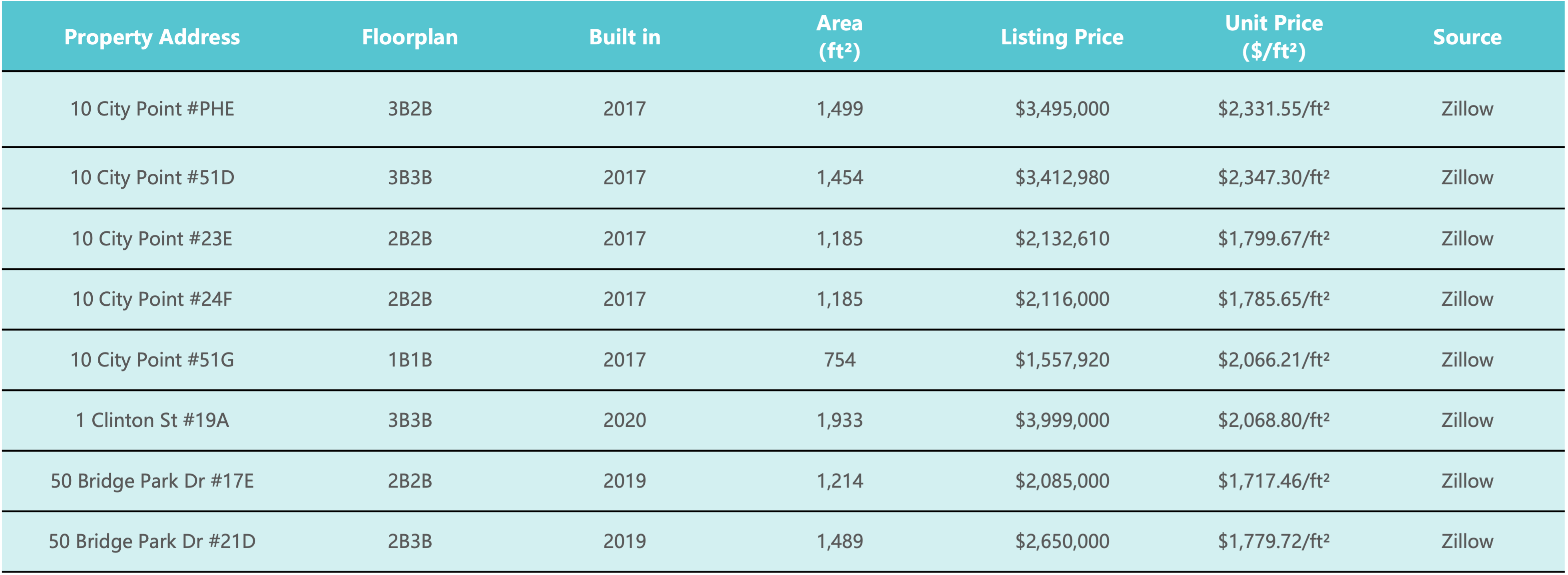

Valuation Analysis of the Property

The borrower has successfully signed a Purchase and Sale Agreement with the land seller and paid a deposit. The land transaction is expected to close on September 15th, 2025. The appraised land value is $37,000,000.

Based on the current project status, CrowdFund believes that the project’s valuation should be consistent with the land value prior to construction, estimated at $37,000,000.

According to the borrower’s projected costs, the total development cost is approximately $144,000,000, and the estimated market value upon completion is approximately $197,543,500. Detailed projections are shown in the adjacent table.

* * Source: Data provided by Borrower.

Location

The project site is in the heart of Downtown Brooklyn, within walking distance (approximately 5 minutes) to multiple major subway stations, including the 2/3/4/5 and A/C/G trains at Hoyt Street Station, as well as the B/D/N/Q/R/W lines at DeKalb Avenue Station. From this location, travel time by taking metros is approximately 15 minutes to Lower Manhattan and 25 minutes to Midtown Manhattan. By driving a car, it is about 25 minutes to LaGuardia Airport and 45 minutes to JFK International Airport.

Transportation

- Subway: 2/3/4, A/C/G, B/D/N/Q/R/W

- To Midtown: 25-minute train

- To JFK: 45-minute driving

- To LGA: 25-minute driving

School

The project site is in New York City’s District #15, Kings County, a well-established school district with approximately 52 public schools. Several schools in the area have received high GreatSchools ratings, including elementary schools like P.S. 29 John M. Harrigan, P.S. 172 Beacon School of Excellence, and P.S. 321 William Penn (all rated 9), as well as middle schools such as MS 442 Carroll Gardens School for Innovation and New Voices School of Academic and Creative Arts (also rated 9). Millennium Brooklyn High School, a local high school, holds a rating of 8.

Living Facilities

The neighborhood is predominantly composed of single households under the age of 40, featuring a diverse population with strong spending power. The local commercial area offers a wide range of international cuisines, while supermarkets and retail stores needed for daily living are readily available throughout the community.

Entertainment

The project site is surrounded by ample recreational amenities, including nearby parks such as Commodore Barry Park, Fort Greene Park, and Cadman Plaza Park. The area also features a wide range of gyms and public sports facilities. In addition to local conveniences, residents enjoy easy access to various areas of Manhattan, making it ideal for urban living.

Borrower: FBL Development

Website: www.fbldevelopment.com

Past Cooperative Projects: CrowdFunz Fund 830 / 834 / 837 / 845 / 851

- The developer of the underlying project is jointly managed by two next-generation Chinese-American developers based in New York. With over 15 years of experience in commercial real estate development, the team has completed five projects in Queens and is actively expanding into more competitive neighborhoods.

- In the past 15 years, they have established a comprehensive development and cost management system, steadily growing their presence in the local market.

- CrowdFunz Fund 858 provides a mid-term loan to the borrower, who has signed a Purchase and Sale Agreement for the land acquisition on September 15th, 2025. The loan is expected to be repaid through a part of the construction loan, sales proceeds from condominium units, or cash flows from other real estate held by the borrower.

- The project site is in the heart of Downtown Brooklyn, New York’s third-largest central business district, a neighborhood experiencing renewed growth and strong transit connectivity to Manhattan.

- The borrower has over 15 years of experience in real estate investment across New York and China and has cooperated CrowdFunz in prior debt financing with track record of on-time repayments.

- Given the borrower’s track record and legal structure of the loan, CrowdFunz believes that Fund 858 offers investment opportunities with relatively low default risk suitable for fixed-income investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)