—— Demand in the U.S. job market slowed in June; Citigroup hopes to expand by 500 people; Uber’s first quarterly free cash flow; Mysterious Chinese ADR surged 520%; AmericanDream defaulted on interest; Airbnb revenue rose 25%; Robinhood laid off another 23%.

1. U.S. job demands slowed in June

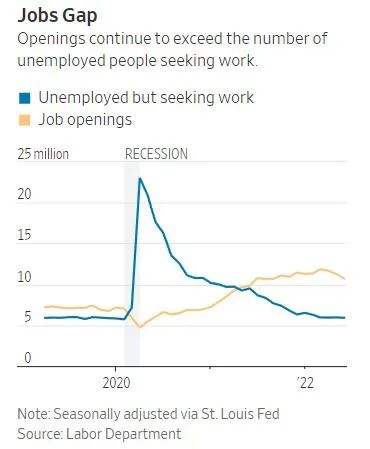

The number of job vacancies in the U.S. fell to 10.7 million in June from 11.3 million in May and hit the lowest level since September last year, according to the latest data released today by the U.S. Department of Labor.

Resignations fell from 4.3 million in May to 4.2 million; dismissals fell from 1.4 million to 1.3 million, and hiring fell from 6.5 million to 6.4 million.

Nick Bunker, an economist at job search site Indeed, said while demand in the job market had fallen, job seekers still had many options. The number of job vacancies remains much higher than the number of unemployed people still seeking work.

Although demand in the U.S. job market has slowed, there are still more job openings than jobseekers

______

2. Citigroup looks to expand hiring

Last year, Citigroup launched Weather at Work, a high-net-worth client asset management unit, and hired Naz Vahid, a prominent industry private-banking executive, to oversee its development.

Recently, Citigroup announced that the department will recruit 500 employees from private equity, consulting, and accounting backgrounds in the next three years.

Citigroup’s current CEO Jane Fraser’s goal after taking office is to help Citigroup develop into an asset management giant.

In the first six months of the year, revenue from Citi’s private-asset management unit rose 3 percent from a year earlier to $353 million.

The strategic direction of Citi Group is to hope that the company will improve the competitiveness and scale of the asset management department

Source: Bloomberg – Citigroup Is Planning a Hiring Spree to Add 500 People to Its New Wealth Unit

______

3. Uber got its first quarterly free cash flow

U.S. ride-hailing giant Uber’s quarterly report today showed its revenue soared 105% to $8.07 billion, with adjusted revenue also hitting an all-time high of $364 million. Both figures beat Wall Street expectations.

Uber CEO Dara Khosrowshahi said more than 70 percent of drivers cited inflation as a factor in their choice to drive.

The company explained that the rise in revenue was due to higher prices for rides due to a shortage of drivers.

In addition, Uber earned $382 million in free cash flow, the company’s first free cash flow quarter. Shares of Uber jumped more than 10% after the opening bell today

Uber has been burning cash fast, and this quarter has given investors a lot of relief

Source: WSJ – Uber Revenue Doubles, Sending Shares Surging

______

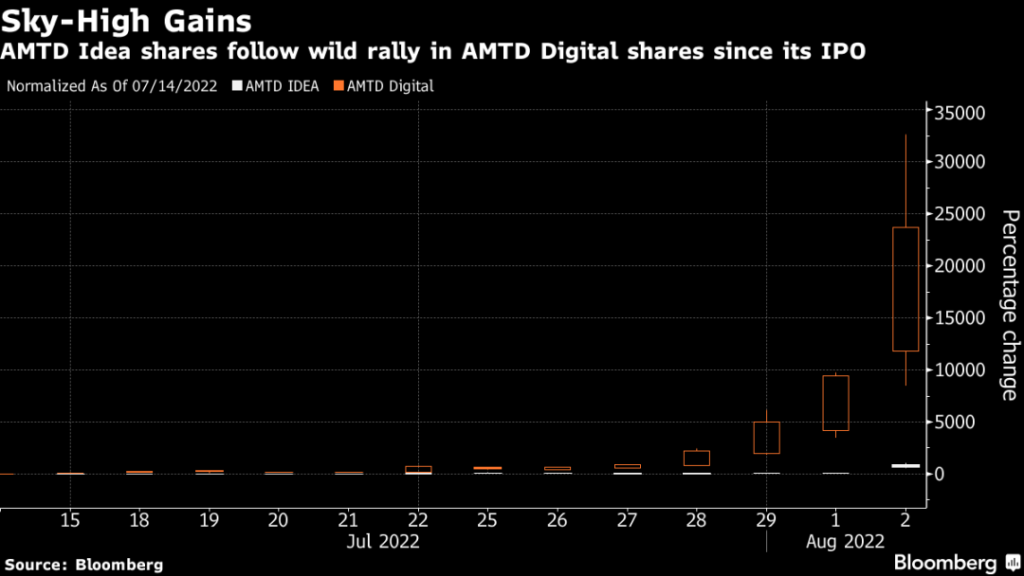

4. Mysterious Chinese ADR soared 520%

U.S. ride-hailing giant Uber’s quarterly report today showed its revenue soared 105% to $8.07 billion, with adjusted revenue also hitting an all-time high of $364 million. Both figures beat Wall Street expectations.

Uber CEO Dara Khosrowshahi said more than 70 percent of drivers cited inflation as a factor in their choice to drive.

The company explained that the rise in revenue was due to higher prices for rides due to a shortage of drivers.

In addition, Uber earned $382 million in free cash flow, the company’s first free cash flow quarter. Shares of Uber jumped more than 10% after the opening bell today

Retail investors participate in the trading of meme stocks mainly for speculation, and the risk is very high

______

5. AmericanDream defaults on interest

American Dream, a more than 3 million-square-foot shopping mall in New Jersey, missed $8.8 million in interest payments on Monday.

Although American Dream will not be able to repay the interest on time, it will not result in a default on the $287 million bond issued by the Public Finance Authority, according to regulatory filings.

In 2021, the American Dream mall will lose nearly $60 million. Notable amenities at the mall include the DreamWorks water park and indoor ski slopes.

AmericanDream unfortunately catches up with the retail winter, and there are problems with capital flow

______

6. Airbnb revenue soars by 25%

Airbnb reported $2.1 billion in revenue today, 25% more than a year earlier and in line with Wall Street expectations.

The average nightly housing rent was $163.74, down from the previous quarter, but still 40% higher than pre-pandemic levels.

In the second quarter, Airbnb generated $795 million in free cash flow and a net income of $379 million, well above the $68 million loss a year earlier.

The company expects to generate $2.99 billion in revenue for the current quarter, is on track to set an all-time record, and has confidently announced a $2 billion share repurchase program.

Years later, in the sharing economy orbit, Airbnb is one of the few profitable companies

Source: Financial Times – Airbnb benefits from high booking prices and predicts ‘strong’ summer

______

7. Robinhood lays off another 23%

Stock trading platform Robinhood announced today in a blog post that the company will lay off about 780 employees, or 23% of its workforce.

Vlad Tenev, the co-founder of Robinhood, said in a statement that the company unfortunately needs to say goodbye to many talented people. Recently, the volume of transactions has continued to decline, and the deteriorating macroeconomic environment has also brought huge challenges to the company.

Robinhood revealed that affected employees have the option to work until October 1.

Robinhood’s welfare during the epidemic has run out, and a large number of retail investors have left the stock market after losing money

______

The content of this article comes from various financial news media such as The Wall Street Journal, Financial Times, and Bloomberg.