Condo Development Preferred Equity 806

Type: Preferred Equity

Target: $6,000,000

Annual Return: 8.0%

Min-invest Amount: $50,000

Duration: 12 - 18 months

Gross Financing: $6,000,000(Max)

* (Phase I. Investment:$3,000,000,the expected closing date is March 15th, 2019 or after fundraising accomplished)

* (Phase II. Financing:$3,000,000,the expected closing date is May 15th, 2019 or after fundraising accomplished)

Expected Return: 8.0%

Investment Type: Preferred Equity + condo book price discount

Minimum Investment: $500,000 per Membership Unit

Investment Duration: 12 - 18 Months

Payment Period: Semi-annual Payment in advance

* Per Construction loan appraisal, the total finish value of the project is over $250 Million, bank provided $68 Million construction loan which is been approved and used partially.

* Subscribers will gain 8.0%/year expected return plus the discount of 5% base on the condo book price provided by developer.

Address: Elmhurst, NY, 11373

Region: Queens, New York

Lot Size: 46,768 sqft(298 ft *183 ft)

Zoning:C4-2

Building Size: 327,844 sqft

Purchase Price: $26.5 million

Construction Loan: has been approved, will be paid in full*

- This building is located in Elmhurst, Queens. The developer & its partners bought this piece of land on Oct. 2014 with $26.5 million dollars. Compared to nearby development site, competitive purchase price is only $81/sf. Superstructure has been finished. The construction team is working on the interior of this building.

- The mixed-use 17 floor building contains 184 condos (from 1b1b to 3b2b), 150 of which are under contact. Besides, 145k SF commercial spaces spread from 1st floor to 4th floor. A huge parking lot with 252 spaces is attached. Target buyers are those who work in Manhattan, LIC and those who are looking forward to upgrade their living space in Elmhurst.

- 3 mins walking distances to M/R train, adjacent to Queens Center & Queens Place. 20 mins to LIC/ 30 mins to Manhattan with train ride.

* Based on the filling record from First Commercial Bank in 2014, the total amount of the construction package is $67.5 million, the loan is being paid to developer in batches.

| Expected Schedule of Interest Payment | ||||||

|---|---|---|---|---|---|---|

| Payment | Round of Investor | Payment Date *1 | Interest-bearing Date | Interest Due Date | Interest Period | Notes |

| First Time | First Round Investors | 4.05, 2019 | 3.15, 2019 | 10.01, 2019 | 6.5 Months | Distributed on 4.05, 2019 *2 |

| Second Round Investors | 05.01, 2019 | 05.01, 2019 | 10.01, 2019 | 4.5 Months | Distributed | |

| Second Time | All Investors | 10.02, 2019 | 10.02, 2019 | 04.01, 2020 | 6 Months | Distributed |

| Third Time | All Investors | 04.02, 2020 | 04.02, 2020 | 10.01, 2020 | 6 Months | Distributed |

| Fourth Time | Investors | 10.02, 2020 | 10.01, 2020 | 12.31, 2020 | 3 Months | Distributed |

| Fifth Time | Investors | 01.02, 2021 | 01.01, 2021 | 03.31, 2021 | 3 Months | Distributed |

*1 If the Payment date falls on holidays or not working day, the payment will be processed by the next business day.

*2Updated on 2019-04-05

Solid Fund Structure

Developer successfully closed $ 67.5 million construction loan, most of which has been used in this project. All equity from developer ($40 million) were deployed already. The 6 million preferred equity raised by CrowdFunz will fill in the gap between construction loan and developer’s equity, making sure the project can be finished on time.

Fund Security Measurement

The developer’s equity is 6.7 times of preferred equity. Market price of this building is more than $250 million, which is 3 times of construction loan + preferred equity. The value of this building strongly support its safety of preferred equity.

Stable Returns with discount offer

This project only open to internal selected investors. Minimum investment starts from $500,000. Interest rate is 8%. Plus, all clients will also enjoy 5% discount when buying remaining condos.

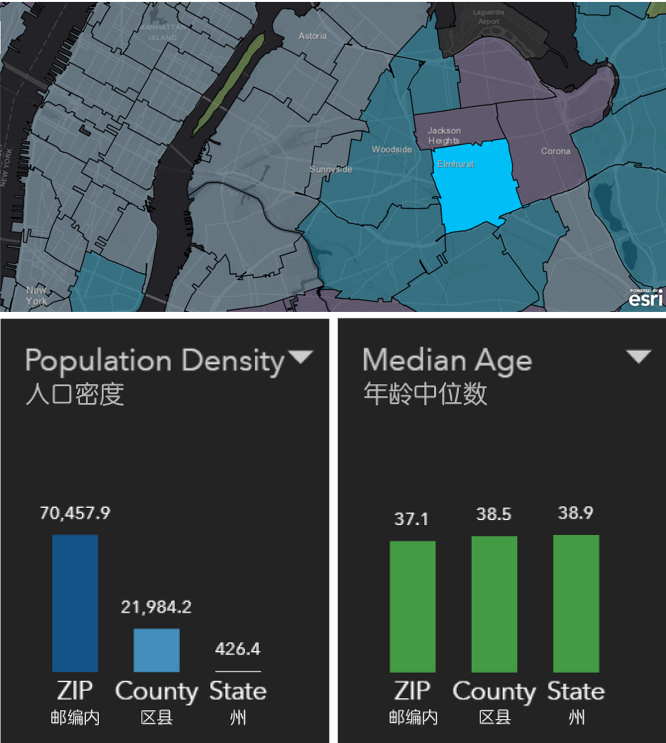

Prime Location in Elmhurst

This building is located in the hottest area of Elmhurst: highly density population with well developed commercial facility, most convenient spot in Queens no matter where you heading. Nearby new construction site won’t be on the market for sale.

Industry-leading developers

Developers is a real estate development, construction, and acquisition firm based in New York City that’s driven by an unmatched commitment to quality and innovation. In his pass 20 years, finished over 100 projects located in NYC.

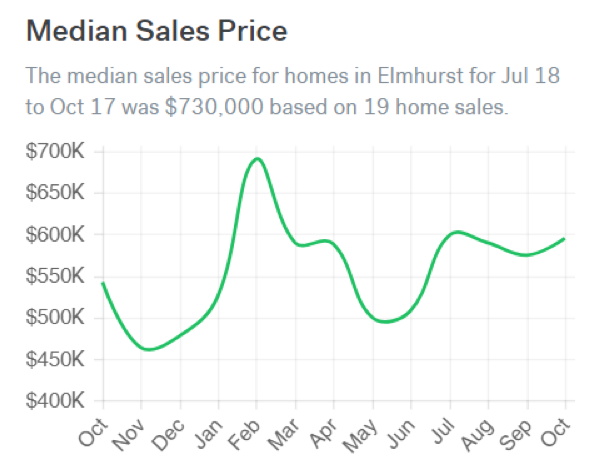

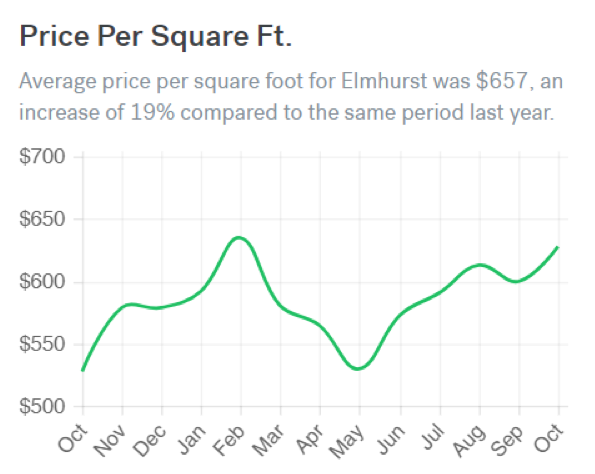

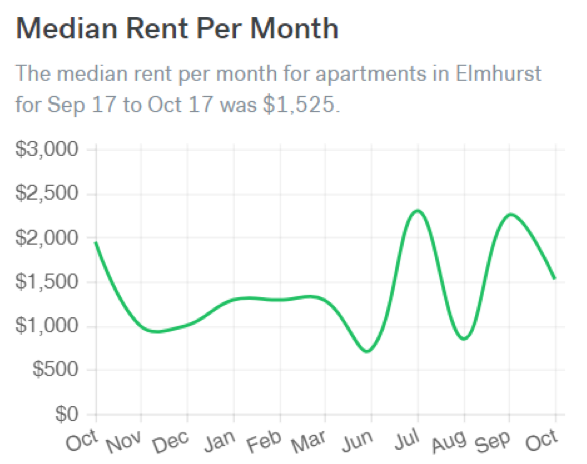

Elmhurst Market Overview:

* Data Source:Trulia, Oct 2017 to Oct 2018; Average Rental per SF per Year is calculated by the properties listed on Streeteasy, Oct 2018.

Demographics within the Zip code:

| Zip Code: 11373 | |

|---|---|

| Total Population | 100,713 |

| Average Age | 36 |

| High School or Higher Education | 69.5% |

| Races | Chinese, White, Southeast Asian, African |

| Average Household Income | $65,470 |

| White Collar/Blue Collar | 77.4%/22.6% |

| Family with Child | 34% |

| Average Family Member | 3.16 |

| Principle Residence | 27.5% |

* Data Source: ArcGIS Esri Database, and Property Shark, Oct 2018

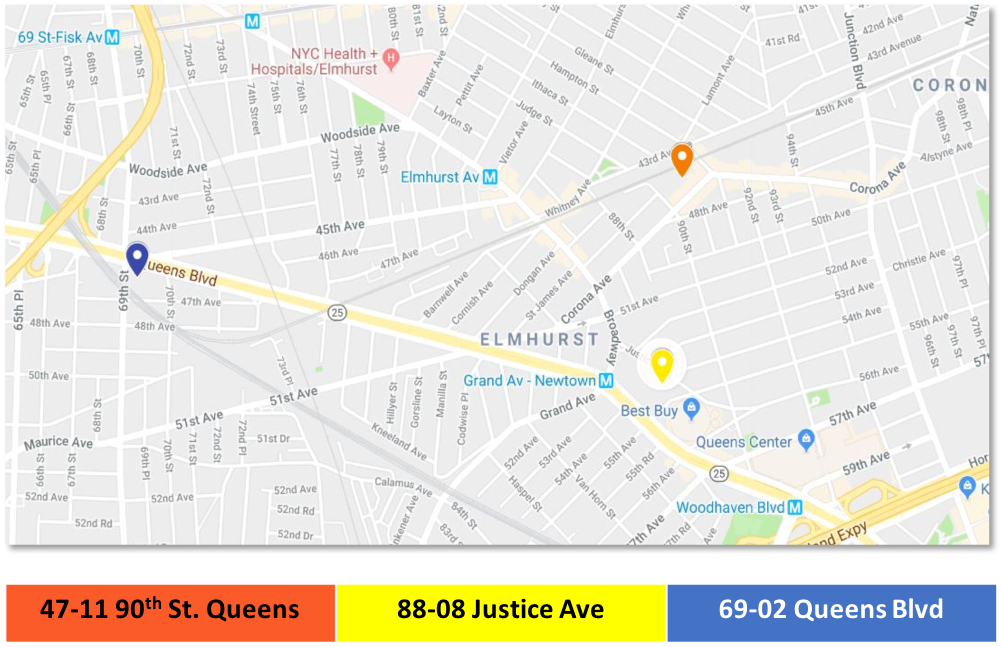

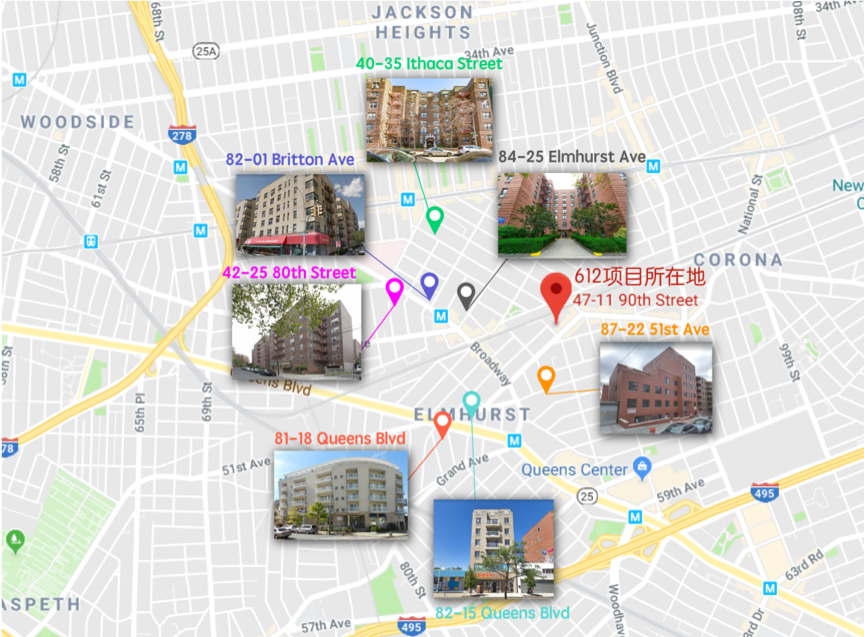

Surrounding Property Construction:

- In the radius of 5 miles, There were 25 similar projects under developing during the last year. 17 projects were waiting for plan approval; 6 projects were under construction, and 2 projects had been completed and listed on the market.

- The project located at 88-08 Justice Ave is the largest development among the surrounding similar cases; the completed property will contain 183 residential units and a mixed-use community center. As of October 2018, the project was closing to its completion.

- The second largest development in the surrounding area is the project located at 69-02 Queens Blvd. The final property will have 17 stories and 561 units. As of October 2018, the project was waiting for final approval of the plan.

- In the total 25 similar projects, 13 projects have property value between 1 million to 5 million; 4 projects have property value between 5 million to 10 million; 6 projects have property value exceeded 10 million. There are 19 projects designed as condominium or rental apartment.

Comparative Analysis of Surrounding Peers:

Market Summary of Similar Surrounding Condominiums: (October, 2017 to October, 2018)

- Property Involved: 20

- Unit Sold: 73

- Median Sales Price per SF: $630

- Unit Median Sales Price: $470,000

- Price Range: $415,210~$845,148

- Median Sold Unit SF: 724 ft²

| Detailed Information of 7 Peer Properties (Oct. 2017 - Oct. 2018) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Location | Built Year | Square Foot | Story | Total Unit | Average Unit Square Foot | Average Sales Price per SF | Median Sales Price | Number of Unit Sold in 1 Year |

| 84-25 Elmhurst Avenue | 1954 | 117,518 | 6 | 144 | 759 | $503.33 | $455,000 | 3 |

| 40-35 Ithaca Street | 1937 | 51,890 | 6 | 65 | 851 | $576.80 | $495,000 | 6 |

| 82-01 Britton Ave | 1939 | 82,867 | 6 | 82 | 686 | $554.83 | $490,400 | 6 |

| 42-25 80th Street | 1960 | 118,319 | 6 | 147 | 840 | $527.20 | $444,600 | 4 |

| 81-18 Queens Blvd | 2004 | 29,141 | 6 | 30 | 830 | $645.70 | $525,000 | 6 |

| 82-15 Queens Blvd | 2006 | 13,692 | 7 | 8 | 912 | $663.12 | $525,000 | 2 |

| 87-22 51st Ave | 2016 | 37,214 | 8 | 44 | 675 | $873.28 | $532,036 | 24 |

* Data Source:Property Shark,Oct. 2017 to Oct. 2018; data was summarized, calculated, and compared by CrowdFunz Holding LLC.

Geographic Location:

Located in center Elmhurst, 3 mins walking to M\R train station,30 mins drive to Manhattan, right next to Queens Blvd & Long Island Expy, this place lead in all directions. Reachable to all kinds of Public Facility, with 4-story, over 120k Commercial space attached, this project brings in huge convenience to all residents. Besides, Costco, Queens Plaza & Elmhurst Hospital are all close to this property.

Transportation:

METRO:M、R

BUS:Q29、Q53、Q58、Q59、Q60

Distance to JFK:8 Miles (15 min)

Distance to LGA:4.5 Miles (11 min)

| Public Facilities | |

|---|---|

| School | Elm Tree Elementary School |

| Jewish Institute Of Queens | |

| NYC School Construction Authority | |

| Park | Veterans Grove |

| Hoffman Park | |

| Museum | New York Hall Of Science |

| Louis Armstrong House Museum | |

1. Since the second quarter of 2018, the U.S. real estate market has been in adjusting period. The price growth rate fell from the pick at the end of 2017, and the sales prices moderately declined. Looking forward to the trends in the next 2 years, the real estate industry will face higher costs of borrowing due to incremental interest rates, and the overall market might turn back to a more rational position which is based on affordability and supply and demand. In such market trends, CrowdFunz will mainly focus on debt investment opportunities as the core of strategy, adopting conservative loan agreements to build partnerships with real estate developers, and reduce uncertainty from fluctuant market adjustment which may lower the profitability of CrowdFunz’s investors.

2. The mission of CrowdFunz is to offering fixed income products that have controllable value-at-risk, conforming to the demands of investors who would like to minimize their risk profiles. CrowdFunz also insists on selecting real estate projects with low loan-to-value ratio and high collateral as a part of core criteria of debt investment.

3. Compared to other regional real estate markets in the U.S., the market environment of New York city generally has relatively lower volatility and downward interval; the real estate market at New York city has strong local economic support and steady residential and commercial demands. By regional market familiarity and professional understanding of real estate development, CrowdFunz carefully selects those fundraising projects of which the underlying assets or development plans possess great business fundamentals and potentials.

4. As a result of our conservative strategy, CrowdFunz 806 project was successfully passed our risk filtering processes and due diligence. CrowdFunz securitized the borrowing to private equity investment opportunities and introduces it to all CrowdFunz’s clients and potential investors. We believe that the strong market fundamentals in Elmhurst real estate market, the developer’s reliable track of record, and dependable feasibility of the operational planning of the development may support the success of investment for investors who are looing for moderate risk-return trade-off.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-2 yrs | 3-5 yrs | 6-10 yrs | 10+ yrs | |

| Tracking Record | 0-3M | 3-10M | 10-50M | 50M+ | |

| Credit Score | Accept | Fair | Good | Excellent | |

| Property as Collateral | No | Yes | |||

| Financials | |||||

| Investor Equity% | 50%-60% | 40%-50% | 30%-40% | 20%-30% | <20% |

| Loan Senior Crowdfunz | 70%-79% | 60%-69% | 50%-59% | 1%-49% | 0% |

| Location | |||||

| Location | Rural | Suburban | Core Urban | ||

| Walk Score | 0-49 | 50-69 | 70-89 | 90-100 | |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Type | |||||

| Development Phase | Ground Up | Value-added | Stablized | ||

| Occupancy | Low | Moderate | High | Very High | |

| Investment Term | 60+ Mths | 25-60 Mths | 13-24 Mths | < 12 Mths | |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)