community facility development preferred equity

Type: Preferred Equity

Target: $1,500,000

Annual Return: 8.0 - 8.5%

Min-invest Amount: $10,000

Duration: 12 - 18 months

Total Investment: $1,500,000(Maximum) *

Expected Annualized Return: 8.0% - 8.5% *

Investment Type: Preferred Equity *

Minimum Investment: $10,000 per Membership Unit

Investment Duration: 12 - 18 Months

Payment Period: Semi-annual Payment in advance

* Expected Closing Date: June 30th, 2019 or After Fundraising Mission Accomplished

* Subscribers will enjoy 8.5%/year expected annual return for investment on & above $500,000, plus 2.5% discount off for purchasing office condo. Final price will be base on approved condo book provided by developer. Crowdfunz reserve the right of final explanations.

* Preferred Equity 807 will take 100% of developer’s equity as collateral when proceed to closing.

Location: 133-20/22 41st Rd, Flushing, NY 11355

Neighborhood & Borough: Flushing, Queens, NY

Lot Size: 5,000 sqft (50 ft * 100 ft)

Zoning: R6

Building Size: 23,618 sqft

Purchase Price: $6 million

Construction Loan: Approved, waiting for closing

- Located in downtown flushing, the developer bought the lot with 6 million USD in 2017. The buildable price, $254/SF, is strongly competitive compared with new medical offices in flushing neighborhood. The demolition has been done.

- The project contains 10-story all-new-designed, well-decorated modern medical offices & 30 parking lots. There are tens of medical offices in south flushing with limited services and outdated conditions. This project offers opportunities for bring medical services to new level.

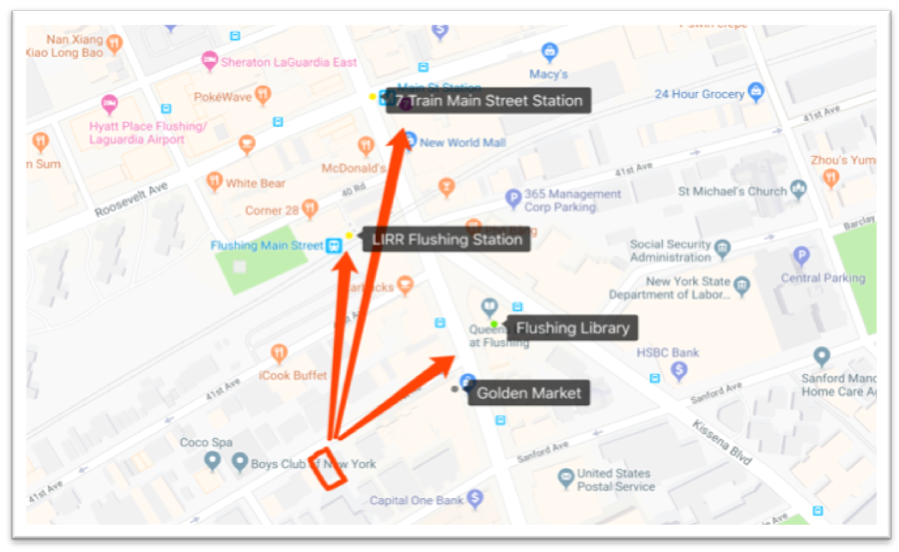

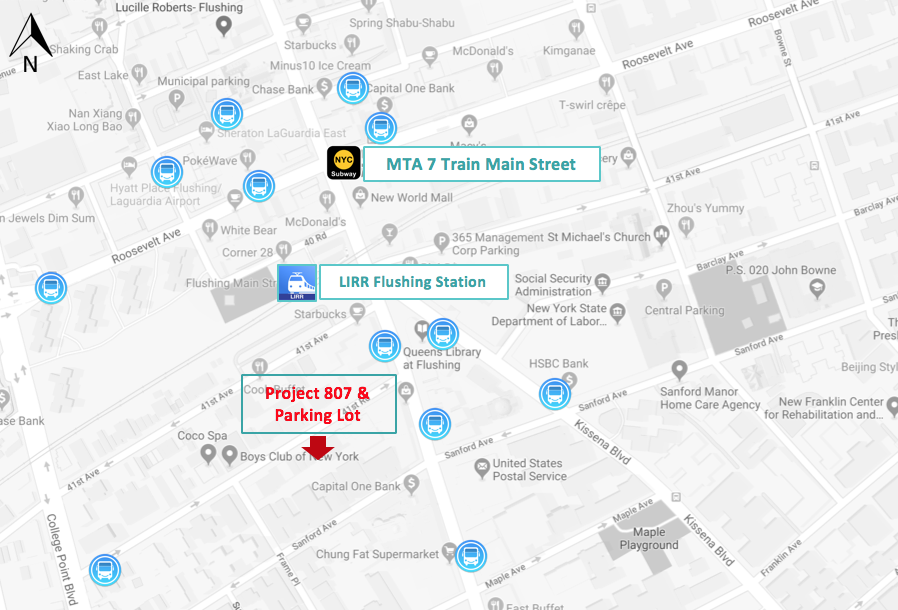

- Right beside Flushing Library & Golden Shopping Mall, this property is only 5 mins walk to 7 train & LIRR main street station and surrounding bus stops. This all-new medical office could cover over 85,000 people living in south flushing, 70% of which are Asian.

| 807 Financing & Interest Payment Timetable * | |||||||

|---|---|---|---|---|---|---|---|

| Payments | Round of Investors | Funding Deadline | Payment Date *1 | Bearing Date | Due Date | Interest Period | Notes |

| 1st Batch | All Investors | 2019-6-15 | No Later Than 2019-6-30 |

No Later Than 2019-6-30 | No Later Than 2019-12-31 | 6 Months | Pre-paid Interest |

| 2nd Batch | All Investors | No Later Than 2020-1-1 | No Later Than 2020-1-1 |

No Later Than 2020-6-30 | 6 Months | Pre-paid Interest | |

| 3rd Batch *2 | All Investors | No Later Than 2020-7-1 | No Later Than 2020-7-1 |

No Later Than 2020-12-31 | 6 Months | Pre-paid Interest | |

| 4th Batch | Partial Investors | 2020-12-23 | 2020-12-16 | 2021-6-16 | 7 Months | Pre-paid Interest | |

* Timetable will be updated periodically, please find latest version on our website

*1If the Payment date falls into holidays or weekends, distributions will be processed by the next business day

*2The 3rd Batch payment will be determined by developer’s deferred option

Premium Location

Only 2 mins walk to Golden Shopping Mall & Flushing Library, Tenfu Medical Center lies across the street; The property located in south downtown Flushing. Arising developments in this area will bring up its potential value.

Industry-Leading Developer

Native Chinese developer, equipped with vast construction experience and well-established connections, has been rooted in NYC real estate development for over 20 years; Familiar with flushing neighbor with highly spoken reputation.

Solid Fund Structure

Demolition was done, new blueprint and construction loan have been approved. 1 million USD preferred equity will cover mostly on construction insurance, legal contracts, government processing fees and other soft costs.

Fund Security Measurement

1.5 million USD preferred equity investment will be guaranteed by 4.54 million USD common equity + over 10 million USD personal guarantee. The market value of the completely project is 21 million USD, which is 1.68 times of sum of construction loan and preferred equity.

Clear Exit Strategy

Investment period will be over once the developer receiving funds from finished projects. If the loan is defaulted, Crowdfunz will sell out developer’s equity share or forfeit personal properties for repayment purpose.

* The delay of the principle payment from borrower (Developer) will trigger double interest penalty which the investor shall receive double interest (16-17%/year) on any unpaid principle from the due date to the date of receiving payment in full which subject to the payment of the borrower.

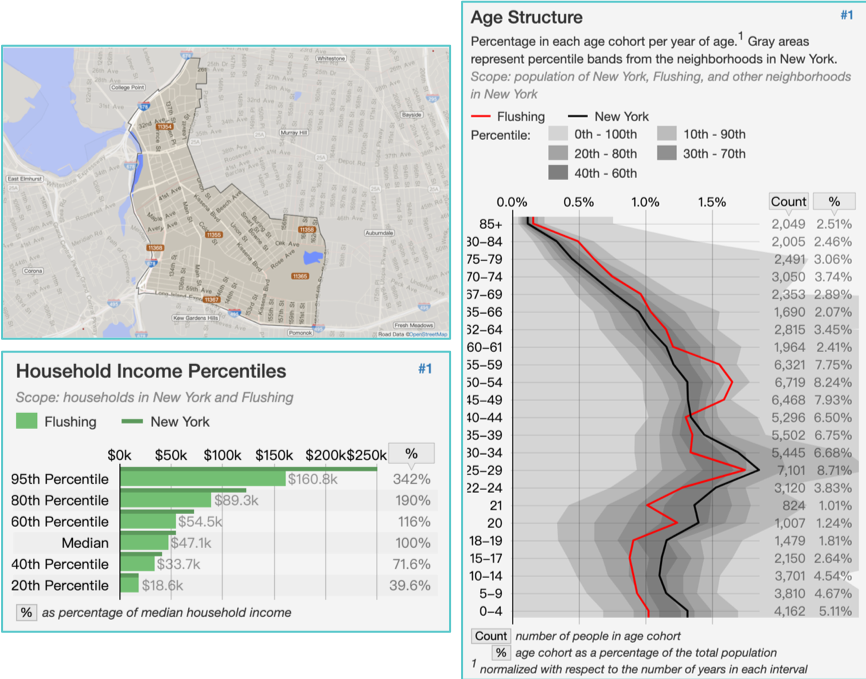

Demographics within the Zip Code:

| Zip Code: 11354-11368 | |

|---|---|

| Total Population | 81,947 |

| Average Age | 43.1 |

| High School or Higher Education | 71.4% |

| Races | Asian, Hispanic, White, African |

| Median Family Income | $47,960 |

| Unemployment Rate | 4% |

| Family with Children | 37% |

| Average Family Member | 2.9 |

| Self-occupation Rate | 34.9% |

* Data Source: Statistical Atlas, Property Shark, Areavibes, February 2019

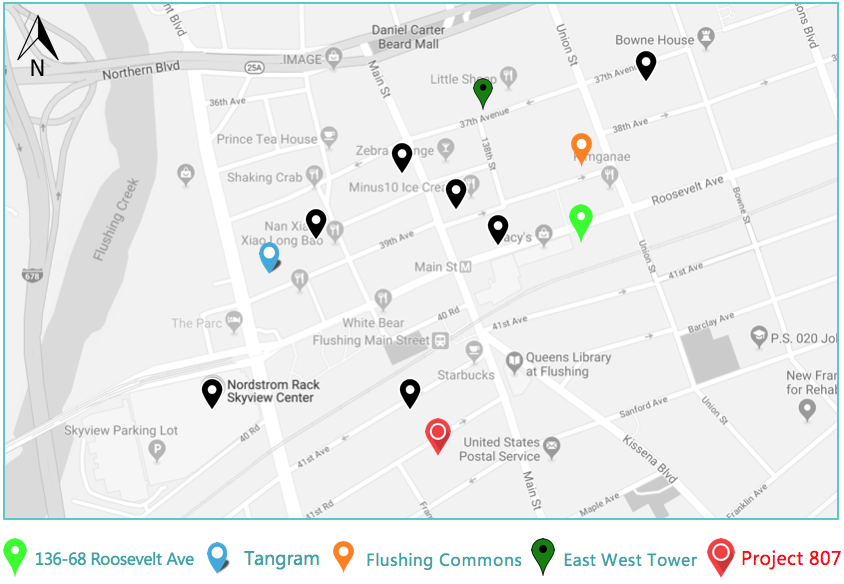

Office Condo Comparable:

Downtown Flushing Office Condo Sale & Rent Market Overview:

- Property Involved: 11

- Unit Sold: 62

- Average Sale Price: $1,264/ft2

- Price Range: $1,061,673~$5,388,156

- Average Sold Unit SF: 1,828 ft2

- Average Rent Price: $56.4/ft2/Year

* Sold & Rented Properties in past 12 months within 0.5 Miles of 7 Train Main Street Station

* Data Source: CUSHMAN & WAKEFIELD, organized by CrowdFunz

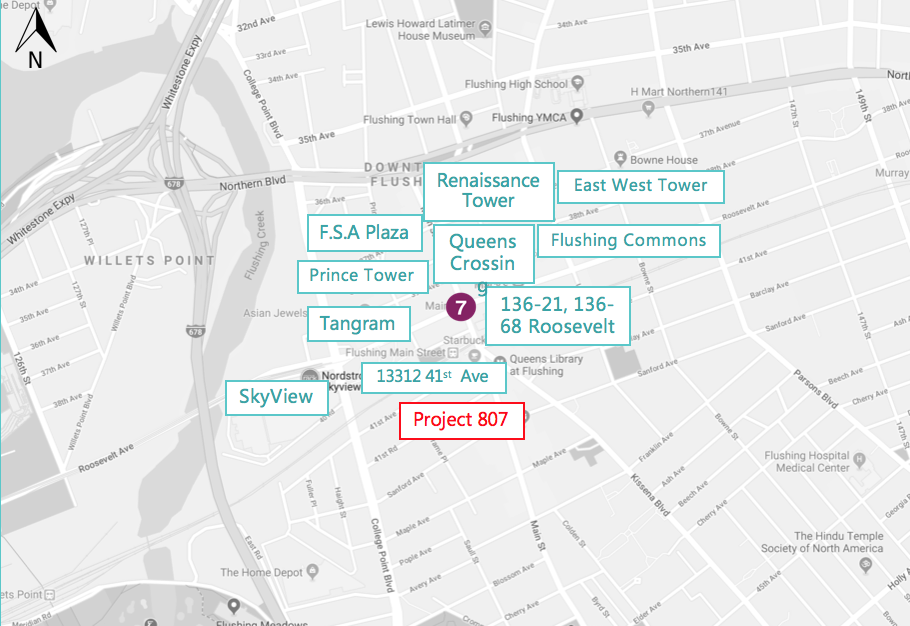

Surrounding Properties (New-built/Under-Construction)

Similar new-built/under-construction projects in Flushing downtown are showed besides, in all highlighted properties including 807, three of which are on going ones, the remaining are new construction.

The Phase 1 Tangram South component also involves two recently commenced condominium buildings: a 192-unit residential condominium building and an 85,000 square-foot office condo project with 48 planned units. The overall project is also planned for a 200-room hotel and will include a parking garage with 1,100+ spaces.

The five-acre Flushing Commons’ mixed-use development site on a five-acre site at 39th Avenue and Union Streets planned for a total of 1.8 million square feet, with the two-building Phase 1 being recently completed with three components.

| Core Flushing Condo Office Market* | ||||||||

|---|---|---|---|---|---|---|---|---|

| Project Name | Sold/Under Contract Units | Lowest Price(/sf) | Highest Price(/sf) | Average Price(/sf)* | ||||

| Flushing Commons | 12 | $1,022 | $1,811 | $1,364 | ||||

| Renaissance Tower | 6 | $1,150 | $1,696 | $1,546 | ||||

| Skyview Tower | 7 | $1,099 | $1,210 | $1,149 | ||||

| 136-68 Roosevelt Ave | 13 | $1,048 | $1,968 | $1,393 | ||||

| Queens Crossing | 6 | $1,026 | $1,201 | $1,134 | ||||

| East West Tower | 9 | $730 | $1,332 | $966 | ||||

| Tangram Tower | 2 | $1,099 | $1,130 | $1,115 | ||||

* Data Source:CUSHMAN & WAKEFIELD Market Report April, 2017-April, 2019

| Core Flushing Office Leasing Market* | ||||||||

|---|---|---|---|---|---|---|---|---|

| Property Name | Built Year | NRA(ft2) | Story | Tenant Name | Lease Area(ft2) | Start Date | Lease Price | Lease Term |

| 133-12 41st Ave | 2016 | 40,795 | 10 | - | 2,200 | 4/19 | $55.00 | 5.0 |

| 136-21 Roosevelt Ave. | 2006 | 71,505 | 12 | Bluedata Int'l | 4,350 | 7/17 | $55.17 | 10.0 |

| F.S.A PLAZA | 2007 | 72,000 | 9 | Demidchick Law Firm | 4,380 | 12/16 | $52.41 | 5.0 |

| F.S.A PLAZA | 2007 | 72,000 | 9 | Prudential | 3,883 | 5/16 | $64.97 | 5.0 |

| Prince Tower | 2008 | 175,000 | 15 | Bona Fieds Advisory Group | 2,011 | 4/15 | $56.62 | 5.0 |

| Prince Tower | 2008 | 175,000 | 15 | Global Bank | 2,490 | 12/14 | $55.20 | 5.0 |

| Prince Tower | 2008 | 175,000 | 15 | Lisma Queens ESL Ctr. | 5,196 | 12/14 | $55.41 | 5.0 |

* Data Source:CUSHMAN & WAKEFIELD Market Report April, 2017-April, 2019

Geographic Location:

Flushing, the most famous China Town in NYC, now becoming the core business circle for all Chinese immigrations in Tri-borough Area. Compared with South Flushing, North Flushing downtown are arising rapidly in recent years. Huge growth potential can be uncovered coming with community upgrading in south Flushing.

This property is located in downtown flushing, only 5 mins walk to 7 Train and LIRR Station; 3 mins walk to all bus stops around flushing library. Highly density population area with various transportation methods.

Transportation:

Rail Transit:7, Long Island Rail Road

Bus:Q13, Q16, Q17, Q25, Q27, Q28, Q34, Q58, Q65, Q20A, Q20B, Q44-SBS

Parking: 30 parking spaces are available for patients and doctors in this Medical Center

Developer: GS Main Street Realty

Founded Time: 1999

Project Location: Flushing and Nearby Area, Elmhurst, Rego Park, LIC, Brooklyn

Project Type: Residential Houses, Condominiums, Community Facility, Mixed-use Retail/Office Buildings, Hotel and Commercial Buildings

Project Display:

Started from 1999, GS Main Street Realty conduct construction business in Manhattan, Queens, Bronx. Especially in Elmhurst, Queens, GS accumulated vast experiences in multifamily & condo development projects. Lead by Dennis Zhao, GS step into real estate development business with full speed, which has built and hold over 200K commercial + residential properties. GS is now a pioneer of upraising developers among Chinese real estate developers.

Based on the tracking record of joyful cooperation between GS and different Crowdfunding platforms in NYC, GS has built strong connections between investors and its high-quality products. The successful story will be continued.

1. Since the second quarter of 2018, the U.S. real estate market has been in adjusting period. The price growth rate fell from the pick at the end of 2017, and the sales prices moderately declined. Looking forward to the trends in the next 2 years, the real estate industry will face higher costs of borrowing due to incremental interest rates, and the overall market might turn back to a more rational position which is based on affordability and supply and demand. In such market trends, CrowdFunz will mainly focus on debt investment opportunities as the core of strategy, adopting conservative loan agreements to build partnerships with real estate developers, and reduce uncertainty from fluctuant market adjustment which may lower the profitability of CrowdFunz’s investors.

2. The mission of CrowdFunz is to offering fixed income products that have controllable value-at-risk, conforming to the demands of investors who would like to minimize their risk profiles. CrowdFunz also insists on selecting real estate projects with low loan-to-value ratio and high collateral as a part of core criteria of debt investment.

3. Compared to other regional real estate markets in the U.S., the market environment of New York city generally has relatively lower volatility and downward interval; the real estate market at New York city has strong local economic support and steady residential and commercial demands. By regional market familiarity and professional understanding of real estate development, CrowdFunz carefully selects those fundraising projects of which the underlying assets or development plans possess great business fundamentals and potentials.

4. As a result of our conservative strategy, CrowdFunz 807 project was successfully passed our risk filtering processes and due diligence. CrowdFunz securitized the borrowing to private equity investment opportunities and introduces it to all CrowdFunz’s clients and potential investors. We believe that the strong market fundamentals in Elmhurst real estate market, the developer’s reliable track of record, and dependable feasibility of the operational planning of the development may support the success of investment for investors who are looing for moderate risk-return trade-off.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-2 yrs | 3-5 yrs | 6-10 yrs | 10+ yrs | |

| Tracking Record | 0-3M | 3-10M | 10-50M | 50M+ | |

| Credit Score | Accept | Fair | Good | Excellent | |

| Property as Collateral | No | Yes | |||

| Financials | |||||

| Investor Equity% | 50%-60% | 40%-50% | 30%-40% | 20%-30% | <20% |

| Loan Senior Crowdfunz | 70%-79% | 60%-69% | 50%-59% | 1%-49% | 0% |

| Location | |||||

| Location | Rural | Suburban | Core Urban | ||

| Walk Score | 0-49 | 50-69 | 70-89 | 90-100 | |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Type | |||||

| Development Phase | Ground Up | Value-added | Stablized | ||

| Occupancy | Low | Moderate | High | Very High | |

| Investment Term | 60+ Mths | 25-60 Mths | 13-24 Mths | < 12 Mths | |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)