Hotel Equity Bridge Loan

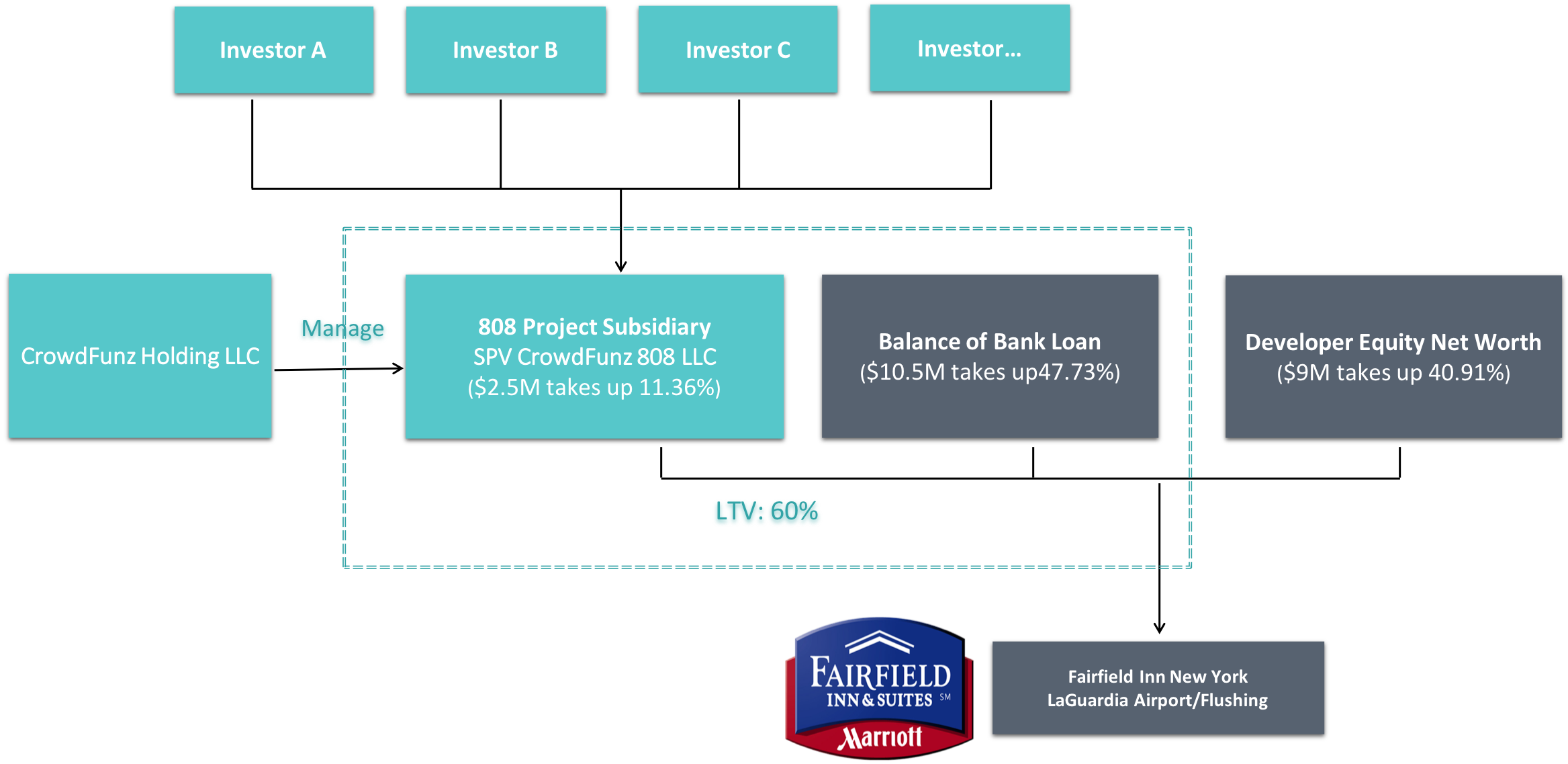

Type: Preferred Equity

Target: $2,500,000

Annual Return: 8.0 - 8.5%

Min-invest Amount: $10,000

Duration: 12 - 18 months

Total Investment: $2,500,000(Maximum) *

Expected Annualized Return: 8.0% - 8.5% *

* First round raising up to $1500,000, expected Closing Date: Aug 15th, 2019 or After Fundraising Mission Accomplished.

* Second round raising up to $1000,000, expected Closing Date: Sep 15th, 2019 or After Fundraising Mission Accomplished.

Investment Type: Bridge Loan (Equity Pledged) *

Minimum Investment: $10,000 per Membership Unit

Investment Duration: 12 - 18 Months

Payment Period: Semi-annual Payment in advance

* According to Appraisal report by CBRE, the hotel’s value was estimated $17.1M in 2016, expected today’s value is over $22M.

* Subscribers will enjoy 8.5%/year expected annual return for investment on & above $300,000. Crowdfunz reserve the right of final explanations.

* Bridge Loan 808 will take 100% of developer’s equity as collateral when proceed to closing.

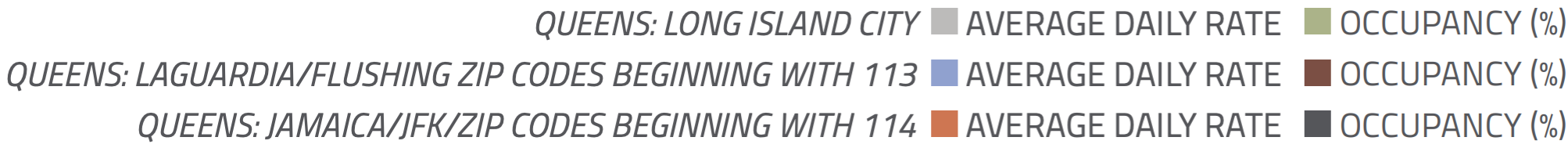

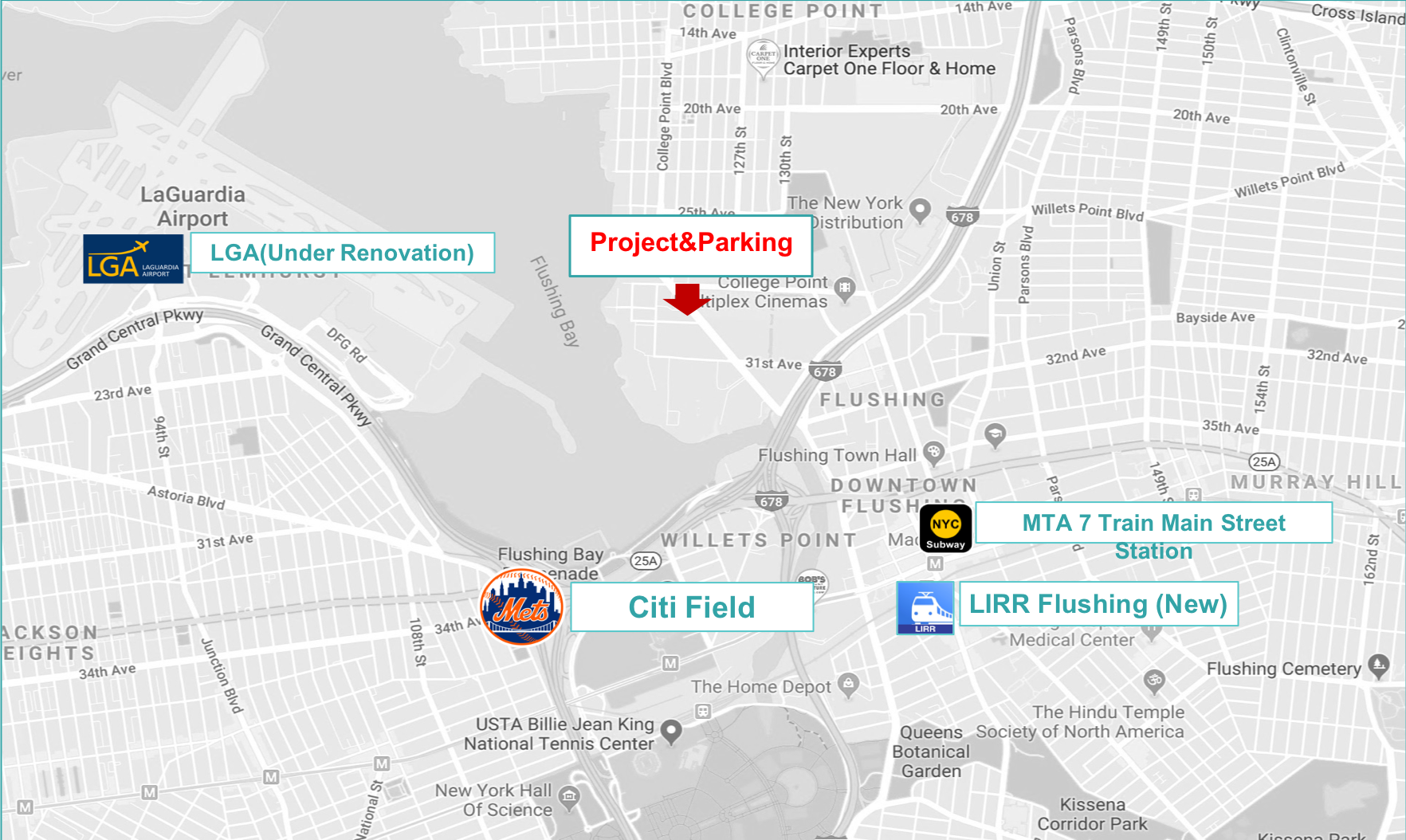

Address: 28-66 College Point Blvd NY 11354

Area: Flushing, Queens, NY

Land Size: 23,600 SFT(216*141 FT)

Zoning: M2-1

Building Size: 29,175 SFT

Construction time: Land acquired in 2001, starting operating since 2005.

LTV: 60% *

- The project is located in Flushing, Queens, New York City. The developer purchased the land in 2001 and the hotel was completed and operational in 2005. The land acquisition time is early, and the land appreciation trend is good. After the completion of the hotel, the famous chain hotel has been operating smoothly for many years, and the annual operating income is growing.

- The project is a 5-story comprehensive 3 star hotel with a total of 88 rooms currently operated by Marriott Hotel Group. The average room price is $150-$190 per night. It is located in Flushing, close to LGA and JFK airport. It is equipped with a multi-functional lobby that combines entertainment, entertainment and leisure. It provides valet parking service.

- 10 minutes drive to the LGA and Flushing Center, transfer to 7 Train to Manhattan and LIRR to Long Island, and 30 mins drive to JFK.

* According to ICBC's loan records, the total commercial loan for the project in 2016 was US$11.3 million, and the current unpaid loan amount is $10.5 million.

According to CBRE's 2016 Appraisal report, the hotel was valued at $17.1 million at the time, and the hotel is currently estimated at more than $22 million.

| Expected Schedule of Interest Payment * | |||||||

|---|---|---|---|---|---|---|---|

| Payment | Round of Investors | Funding Deadline | Payment Date *1 | Interest-bearing Date | Interest Due Date | Interest Period | Notes |

| 1st Batch | First Round Investors | 2019-8-15 | No later than 2019-8-31 | No later than 2019-8-31 | No later than 2020-2-29 | Pre-paid Interest | |

| Second Round Investors | 2019-9-15 | No later than 2019-9-31 | No later than 2019-9-31 | No later than 2020-2-29 | 5 months | Pre-paid Interest | |

| 2nd Batch | All Investors | No later than 2020-3-1 | No later than 2020-3-1 | No later than 2020-8-31 | 6 Months | Pre-paid Interest | |

| 3rd Batch *2 | All Investors | No later than 2020-9-1 | No later than 2020-9-1 | No later than 2021-2-28 | 6 Months | Pre-paid Interest | |

* Timetable will be updated periodically, please find latest version on our website

*1 If the Payment date falls into holidays or weekends, distributions will be processed by the next business day

*2 The 3rd Batch payment will be determined by developer’s deferred option

Premium Location

Hotel is equipped with valet parking and minibus. There is 10 mins drive to LGA and 30 mins drive to JFK. There is also convenient transit system to commute from Flushing to Manhattan.

Industry-Leading Developer

The developer is a family-run business. It has completed more than 100 development projects in the past 20 years. It has strong strength and rich experiences in those similar projects.

Solid Fund Structure

This bridge loan will be used for the renovation and upgrading of the hotel infrastructure. It will replace old facilities without affecting normal operations. It will further improve the quality of the room service.

Fund Security Measurement

The $2.5 million bridge loan will be secured by a net worth of more than $9 million project shares + more than $100 million personal assets guarantee; the average annual EBITDA of the hotel in the past three years is about $1.5 million / year, the revenue is increasing year by year, and the cash flow is stable and sufficient.

Clear Exit Strategy

The developers entered the sales phase at two major projects, LIC and Elmhurst. Three hotels in the Jamaica area are operating, and capital withdrawals or refinancing of existing projects will generate sufficient cash flow to return the investor's principal. If the loan is defaulted, Crowdfunz will sell out developer’s equity share or forfeit personal properties for repayment purpose.

* The delay of the principle payment from borrower(Developer) will trigger double interest penalty which the investor shall receive double interest (16-17%/year) on any unpaid principle from the due date to the date of receiving payment in full which subject to the payment of the borrower.

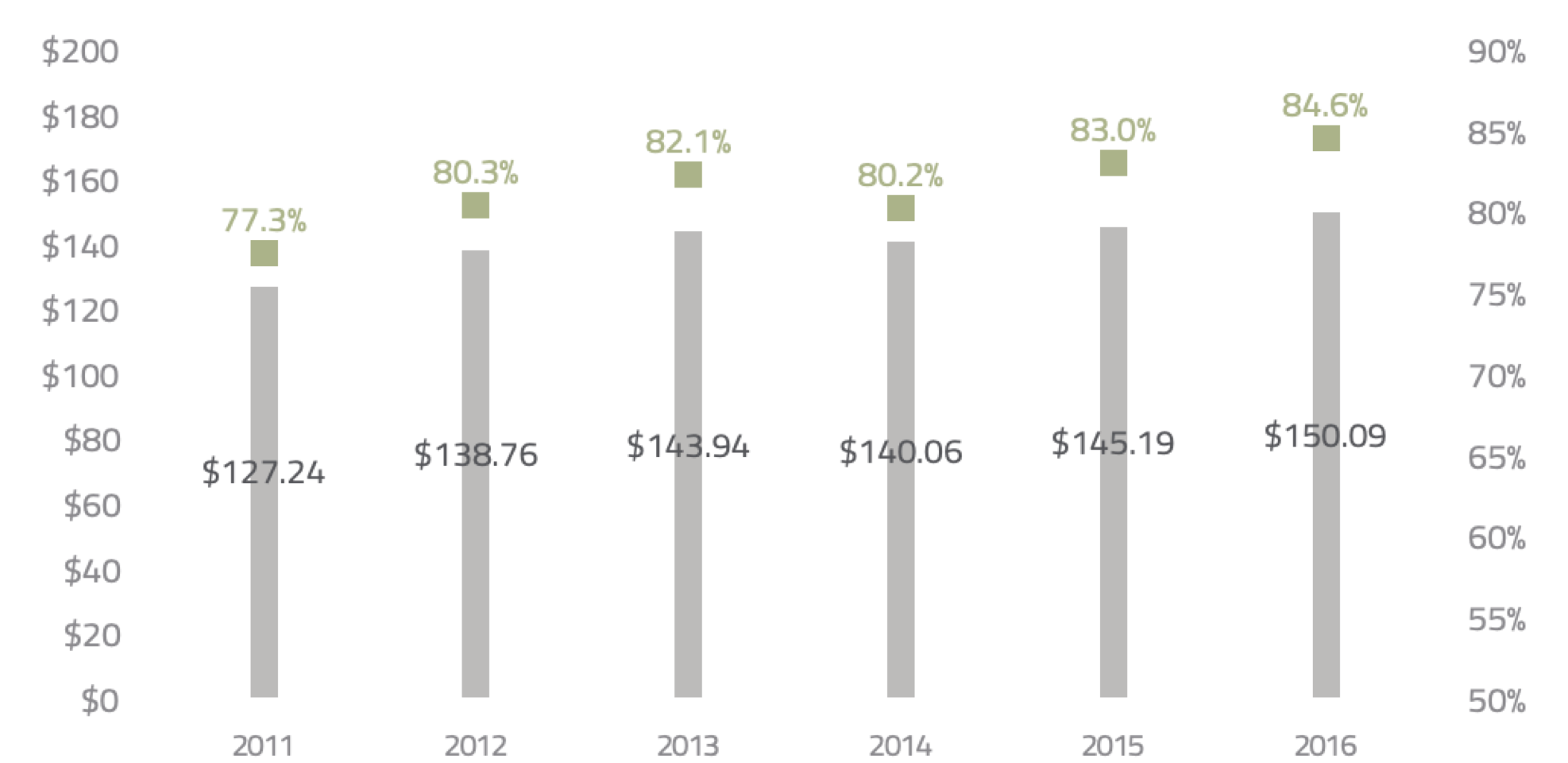

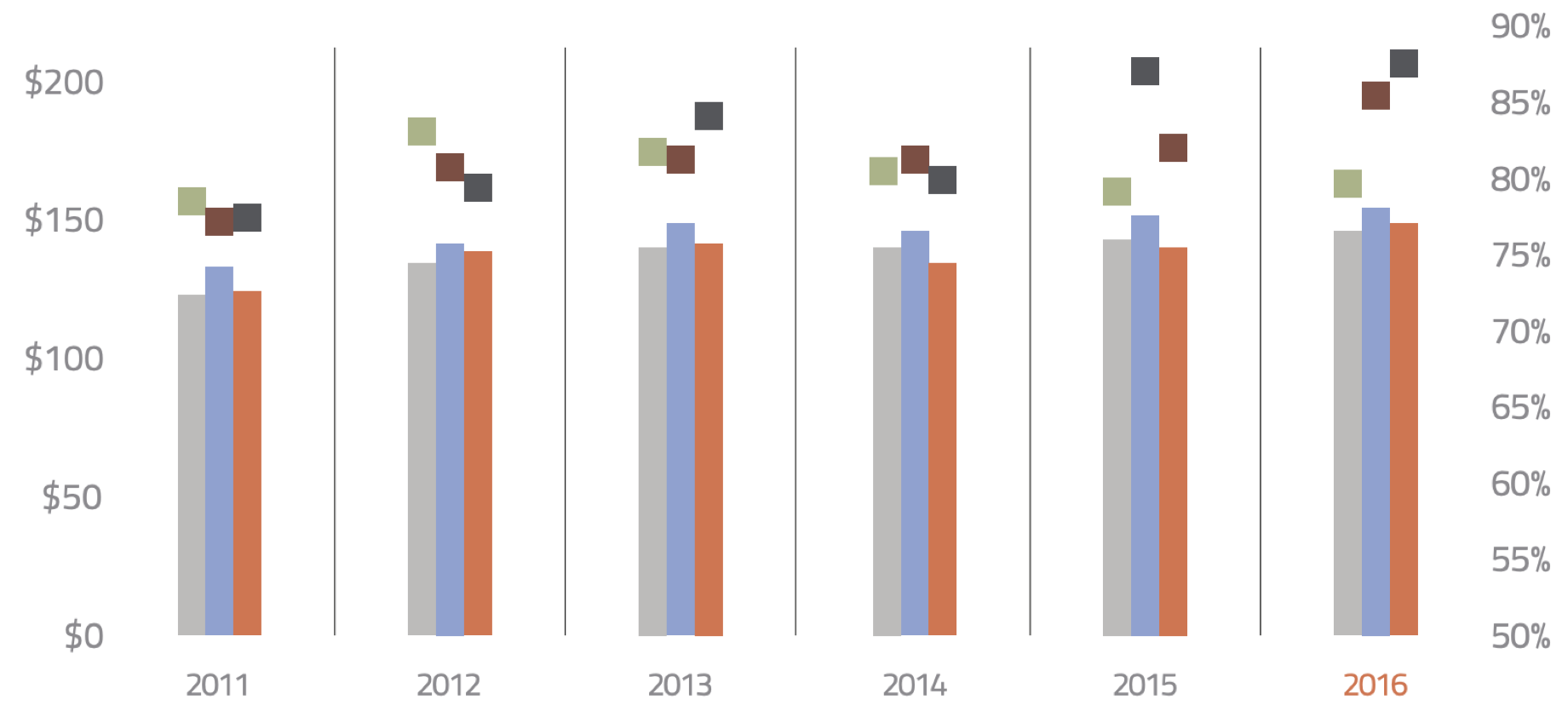

* Data Source:New York City Department of City Planning | NYC Hotel Market Analysis

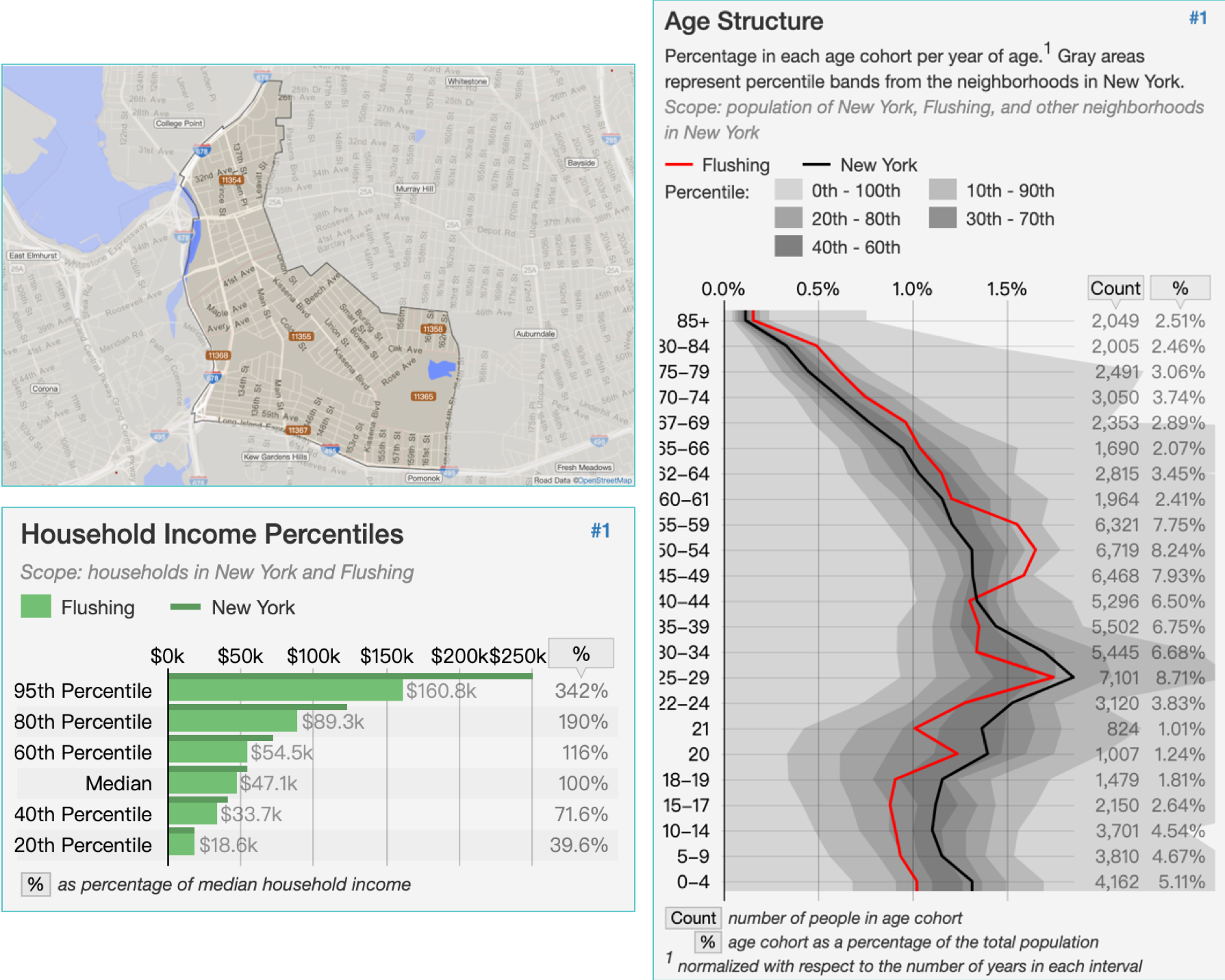

Demographics within the Zip Code:

| Zip Code: 11354-11368 | |

|---|---|

| Total Population | 81,947 |

| Average Age | 43.1 |

| High School or Higher Education | 71.4% |

| Races | Asian, Hispanic, White, African |

| Median Family Income | $47,960 |

| Unemployment Rate | 4% |

| Family with Children | 37% |

| Average Family Member | 2.9 |

| Self-occupation Rate | 34.9% |

* Data Source: Statistical Atlas, Property Shark, Areavibes, February 2019.

Sampling Analysis of Hotel Rooms Around LGA Airport

Excluding Airbnb rooms, the layout of the star-rated hotels around Flushing and LGA Airport is shown on the right:

It is not difficult to find that star-rated hotels are concentrated in the high-speed line connecting the airport and the core area of Flushing; convenient highway and the relative closer location with Flushing are two important considerations for hotel location in the region.

- Number of Hotels: 50-60

- Number of standard rooms: 500-600 units

- Average price of standard room/night: $170

- Star range of hotels: 2-3 stars

- Range of room price: $118~$439

* The above is from Google's comprehensive search, including the single night price of the double standard room on July 26th near LGA Airport.

| Hotel Room Prices Near Flushing(July, 2019) * | |||

|---|---|---|---|

| Hotel Name | Ave Room Price/night | Address | Hotel Stars |

| Hyatt Place Flushing | $439 | 133-42 39th Ave, Flushing, NY 11354 | 3-star hotel |

| John Hotel | $179 | 133-12 37th Avenue, Flushing, NY 11354 | NO Rating |

| Asiatic Hotel | $119 | 135-21 37th Avenue, Flushing, NY 11354 | 2-star hotel |

| Sheraton LaGuardia East Hotel | $269 | 135-20 39th Ave, Flushing, NY 11354 | 4-star hotel |

| 808Project: Fairfield Inn by Marriott | $189 | 28-66 College Point Blvd, Flushing, NY 11354 | 3-star hotel |

| Grandview Hotel New York | $145 | 31-6 Linden Pl, Flushing, NY 11354 | 2-star hotel |

| Flushing Central hotel | $118 | 135-33 38th Ave, Flushing, NY 11354 | 2-star hotel |

| Best Western Queens Court Hotel | $175 | 13351 39th Ave, Flushing, NY 11354 | 2-star hotel |

| The One Boutique Hotel | $125 | 137-72 Northern Blvd, Flushing, NY 11354 | 3-star hotel |

| Ramada by Wyndham Flushing Queens | $166 | 3627 Prince St, Flushing, NY 11354 | 2-star hotel |

| SuperLake Hotel | $140 | 36-31 Prince St, Flushing, NY 11354 | 2-star hotel |

* Source: Google Travel,July 2019, Real-time statistics, organized and compared by Crowdfunz.

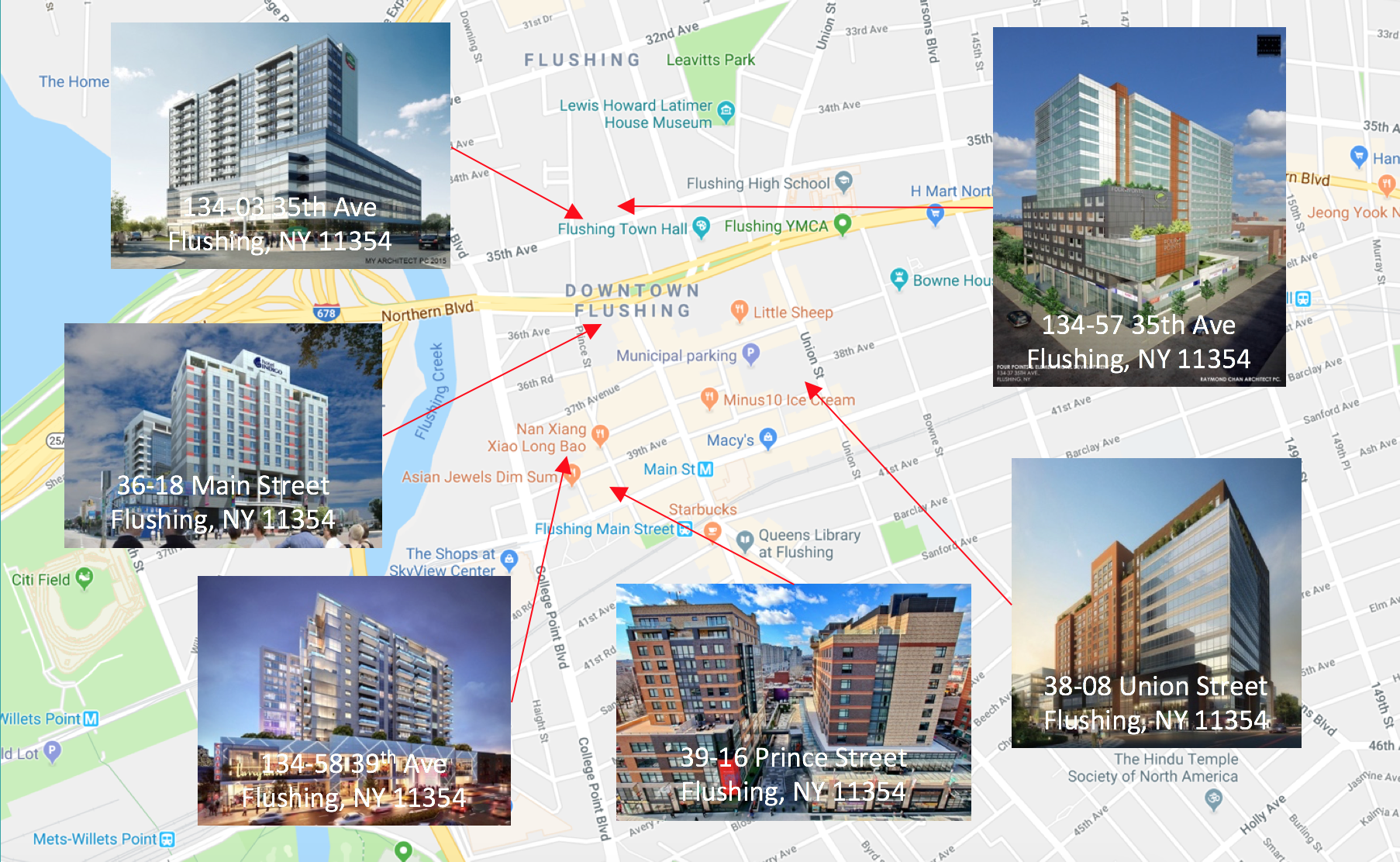

Surrounding Market Analysis

The passenger flow around Flushing is currently divided into two major parts, one is the demand for occupancy by the Chinese community, and the other is the passenger flow brought by LGA Airport. Although the LGA passenger-driven hotel business has remained stable for a long time, the LGA airport expansion will stimulate the development of the entire Flushing hotel industry in 2-3 years. At present, the larger projects under construction are concentrated in the north of Roosevelt Avenue, with medium and high-end hotel projects as the mainstay. However, low-end affordable hotels will still be an important part of the Flushing hotel segment. At the same time, the development and traffic improvement of the Flushing community will bring more and more tourists to visit this new Chinatown, and the future hotel industry in Flushing will have a great development.

Among large-scale development cases, the largest development case is Tangram jointly developed by F&T Group and Shanghai Construction Engineering. The project is a shopping mall with 289 residential units, an office, a 4D cinema, a hotel, and a 3-storey underground parking lot. The comprehensive development building, the main body of the project building has been basically completed.

The second largest project under construction is THE FARRINGTON, located

at 134-57 35th Ave. The project is expected to build a 15-storey complex with 100 units of residential buildings and 210 hotel rooms. The project is currently under interior renovation.

Geographic Location:

The project is located in the center of Flushing, 5 minutes drive from 7 Train and LIRR, and 30 mins drive to Manhattan. Adjacent to Queens and Long Island Traffic Aorta Grand Central Pkwy & I- 678; half an hour to LGA & JFK Airport. Adjacent to the core area of Flushing, the living facilities are available: dining and entertainment are within easy reach, hospitals, police stations, banks and other convenience services are available, making it easy for tourists and business people to travel. The hotel itself is equipped with a multi-purpose lobby, valet parking and airport minibus transfers at an affordable price.

Transportation:

Subway: 7 Train

Train: LIRR

JFK Airport: 10 Miles (about 25 mins drive)

LGA Airport: 4.5 Miles (about 10 mins drive)

Developer: United Construction & Development Group

Founded Time: 1990

Project Location: Flushing and nearby area, Jamaica and nearby are, Manhattan Chinatown

Project Type: Residential Houses, Condominiums, Community Facility, Mixed-use Retail/Office Buildings, Hotel and Commercial Buildings

Project Display:

Founded in early 1990, United Construction & Development Group has more than 20 years of development experience in New York. Led by founder Chris Xu, the company has become a leader in the real estate development industry in New York City. The developer has developed, operated and managed more than two million square feet of commercial, residential, industrial and retail properties, with Queens‘ highest residential project, LIC Skyline Tower, being the masterpiece of the developer.

Developers' successful development records, extensive experience in different project developments, and good credit in commercial lending have helped partners and investors get rich returns.

1. Since the second quarter of 2018, the U.S. real estate market has been in adjusting period. The price growth rate fell from the pick at the end of 2017, and the sales prices moderately declined. Looking forward to the trends in the next 2 years, the real estate industry will face higher costs of borrowing due to incremental interest rates, and the overall market might turn back to a more rational position which is based on affordability and supply and demand. In such market trends, CrowdFunz will mainly focus on debt investment opportunities as the core of strategy, adopting conservative loan agreements to build partnerships with real estate developers, and reduce uncertainty from fluctuant market adjustment which may lower the profitability of CrowdFunz’s investors.

2. The mission of CrowdFunz is to offering fixed income products that have controllable value-at-risk, conforming to the demands of investors who would like to minimize their risk profiles. CrowdFunz also insists on selecting real estate projects with low loan-to-value ratio and high collateral as a part of core criteria of debt investment.

3. Compared to other regional real estate markets in the U.S., the market environment of New York city generally has relatively lower volatility and downward interval; the real estate market at New York city has strong local economic support and steady residential and commercial demands. By regional market familiarity and professional understanding of real estate development, CrowdFunz carefully selects those fundraising projects of which the underlying assets or development plans possess great business fundamentals and potentials.

4. As a result of our conservative strategy, CrowdFunz 807 project was successfully passed our risk filtering processes and due diligence. CrowdFunz securitized the borrowing to private equity investment opportunities and introduces it to all CrowdFunz’s clients and potential investors. We believe that the strong market fundamentals in Elmhurst real estate market, the developer’s reliable track of record, and dependable feasibility of the operational planning of the development may support the success of investment for investors who are looking for moderate risk-return trade-off.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-2 yrs | 3-5 yrs | 6-10 yrs | 10+ yrs | |

| Tracking Record | 0-3M | 3-10M | 10-50M | 50M+ | |

| Credit Score | Accept | Fair | Good | Excellent | |

| Property as Collateral | No | Yes | |||

| Financials | |||||

| Investor Equity% | <20% | 20%-30% | 30%-40% | 40%-50% | 50%-60% |

| Loan Senior Crowdfunz | 70%-79% | 60%-69% | 50%-59% | 1%-49% | 0% |

| Location | |||||

| Location | Rural | Suburban | Core Urban | ||

| Walk Score | 0-49 | 50-69 | 70-89 | 90-100 | |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Type | |||||

| Development Phase | Ground Up | Value-added | Stablized | ||

| Occupancy | Low | Moderate | High | Very High | |

| Investment Term | 60+ Mths | 25-60 Mths | 13-24 Mths | < 12 Mths | |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)