Condo Development Preferred Equity 810

Type: Preferred Equity

Target: $4,000,000

Annual Return: 8.0 - 8.5%

Min-invest Amount: $10,000

Duration: 8 - 14 months

Total Investment: $4,000,000 *

* First Round: Funding Amount: $1,000,000, Funding Deadline: 12/18/2019

* Second Round: Funding Amount: $1,000,000, Funding Deadline: 01/18/2020

* Third Round: Funding Amount: $1,000,000, Funding Deadline: 02/18/2020

* Fourth Round: Funding Amount: $1,000,000, Funding Deadline: 03/18/2020

Expected Annualized Return: 8.0% - 8.5% 1

Investment Type: Preferred Equity 2

Minimum Investment: $10,000

Investment Duration: 8 - 14 Months 3

Payment Period: Prepaid All Interest Before Deferral

1 Subscribers will enjoy 8.%/year expected annual return, Subscribers will enjoy 8.5%/year expected annual return for investment on & above $300,000. Crowdfunz reserve the right of final explanations.

2 This project is preferred equity investment. Project 810 will take majority of developer’s equity which is valued as $8M as collateral when proceed to closing. And the developer provides his unlimited personal guarantee to ensure investors’ safety (According to third party appraisal in June 2018 that the project is estimated $32.6M when finished and the bank has provided $14.95M land and construction loan).

3 The developer can choose extend another 6 months at the first 8 months Crowdfunz reserves the right of final explanations.

Address: 148-31/35/37 90th Ave, Jamaica, NY 11435

Area: Jamaica, Queens, NY

Land Size: 15,225 SF

Zoning:R7-A

Building Size: 70,000 SF

Transaction Time: March, 2017

- The developer bought the land with $5.7M in March 2017. By far, more than $8M has been invested by developer and the bank has provided $14.95M land and construction loan. According to the third-party appraisal in June 2018, this project is estimated $32.6M after completion. The value will be the 1.72 times more than loans and preferred equity total amount.

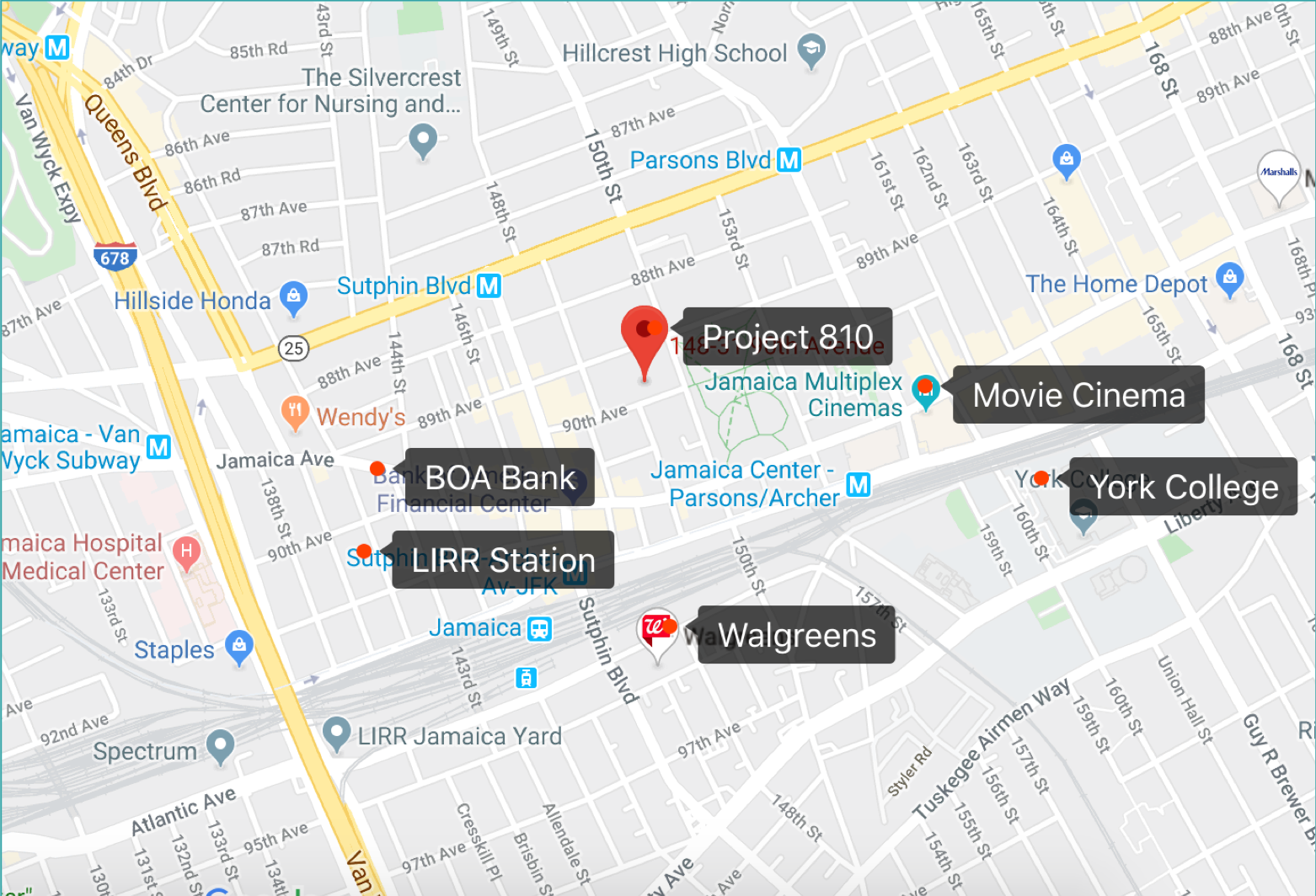

- The project is located on the core business area of Jamaica, NY and adjacent to courts, SSN center and all the living facilities. The infrastructure of the building was finished. Now they move onto interior construction & condo book application. Construction risk has been reduced to minimum. The building is anticipated to completed by March 2020.

- Only 3 mins walk to Subway $ LIRR station; 20mins train ride to Manhattan; 10 mins Air train to JFK.

* Based on third-party appraisal on June 2018, the building worth 32.6 million USD after complication.

* The development has secured $14.95 million construction & land loan package from bank, CrowdFunz will lend another $4 million as preferred equity.

| Interest Payment Timetable * | |||||||

|---|---|---|---|---|---|---|---|

| Payments | Round of Investors | Funding Deadline | Payment Date | Bearing Date *1 | Due Date | Interest Period | Notes |

| 1st Batch | First round investors | 2019-12-18 | 2019-12-18 | 2019-12-18 | 2020-8-18 | 8 months | Pre-paid Interest |

| Second round investors | 2020-1-18 | 2020-1-18 | 2020-1-18 | 2020-8-18 | 7 months | Pre-paid Interest | |

| Third round investors | 2020-2-18 | 2020-2-18 | 2020-2-18 | 2020-8-18 | 6 months | Pre-paid Interest | |

| Fourth round investors | 2020-3-18 | 2020-3-18 | 2020-3-18 | 2020-8-18 | 5 months | Pre-paid Interest | |

| 2nd Batch *2 | All Investors | 2020-8-18 | 2020-8-18 | 2021-2-18 | 6 months | If Extension Needed | |

| 3rd Batch | Partial Investors | 2021-2-18 | 2021-2-18 | 2021-3-18 | 1 month | Pre-paid Interest | |

* Timetable will be updated periodically, please find latest version on our website

*1 If the Payment date falls into holidays or weekends, distributions will be processed by the next business day

*2 The 2nd Batch payment will be determined by developer’s deferred option

Project Location

The project is surrounded by government departments, supermarkets, restaurants and banks, full access to all kinds of life supports. Right next to I678 & Queens Blvd, only few minutes to subway, 20 mins train ride to Manhattan.

Developer Background

Family real estate development firm built and hold over 100K SF commercial & residential properties in NYC, mostly in Queens. Total value of his portfolio is over $650 million.

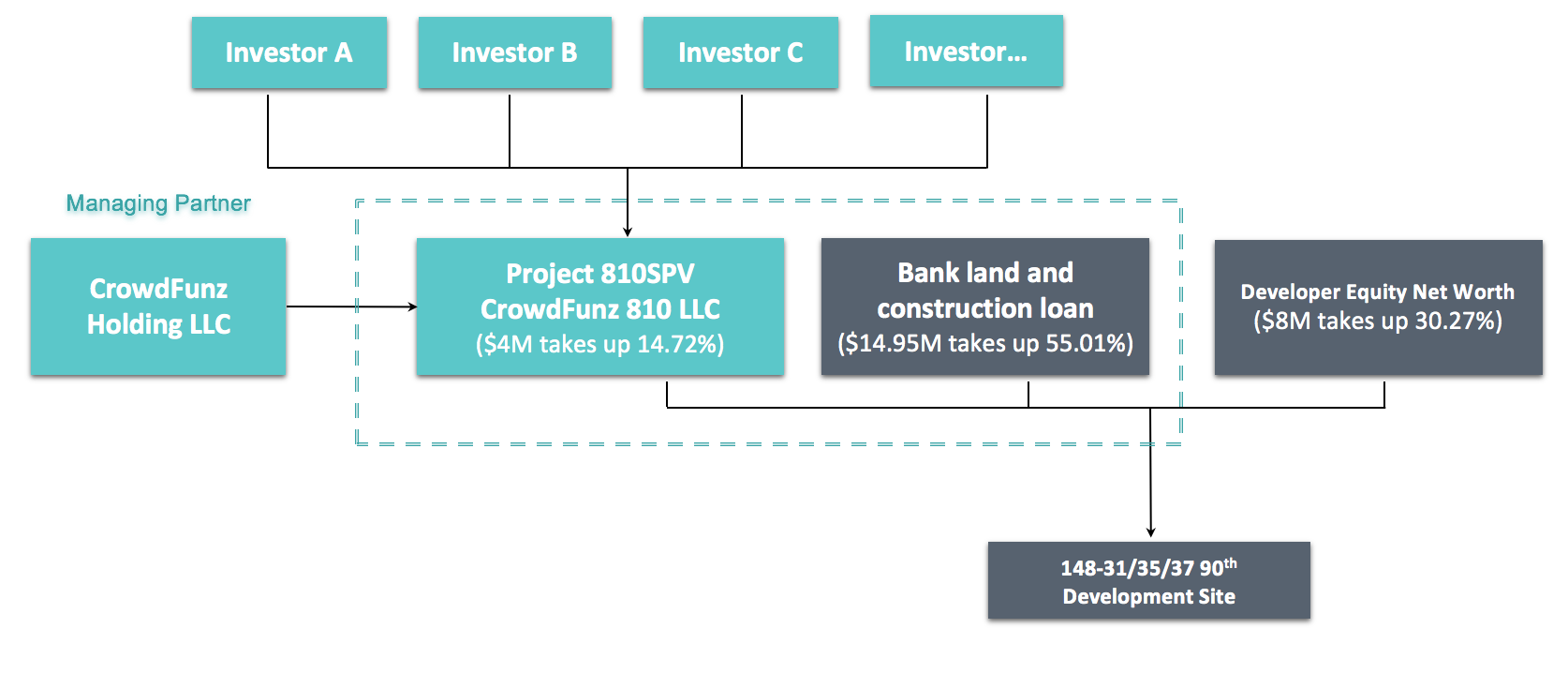

Fund Structure

4 million Preferred equity will cover interior construction coast of this building, The infrastructure of the building was finished. Construction risk has been reduced to minimum. The building is anticipated to completed by March 2020.

Fund Security Measurement

CrowdFunz 810 is preferred equity investment, investors of 810 enjoy second priority after the bank, all other equity partners are not allowed to exit until 810 ends. Unlimited personal guarantee from developer will also protect all 810 investors.

Exit Strategy

The building is anticipated to completed by March 2020. Units will be rented out by Sep 2020. Investors expect to get payed by secure new refinance package from the lender right after it landed. *

* The delay of the principle payment from borrower (Developer) will trigger double interest penalty which the investor shall receive double interest (16%/year) on any unpaid principle from the due date to the date of receiving payment in full which subject to the payment of the borrower on daily bases.

| Fund Sources | |||

|---|---|---|---|

| Fund Structure | Ratio | Status | |

| Bank Loan | $14,950,000 | 55.01% | Ready |

| Preferred Equity | $4,000,000 | 14.72% | Processing |

| Developer Equity | $8,224,704 | 30.27% | Spent |

| Total | $27,174,704 | 100.00% | |

| Fund Usage | |||

|---|---|---|---|

| Fund Usage | Amount | Ratio | Status |

| Total Acquisition Costs | $5,871,000 | 21.60% | Spent |

| Total Hard Costs | $18,927,637 | 69.65% | Partially Spent |

| Total Soft Costs | $2,376,067 | 8.75% | Partially Spent |

| Total | $27,174,704 | 100% | |

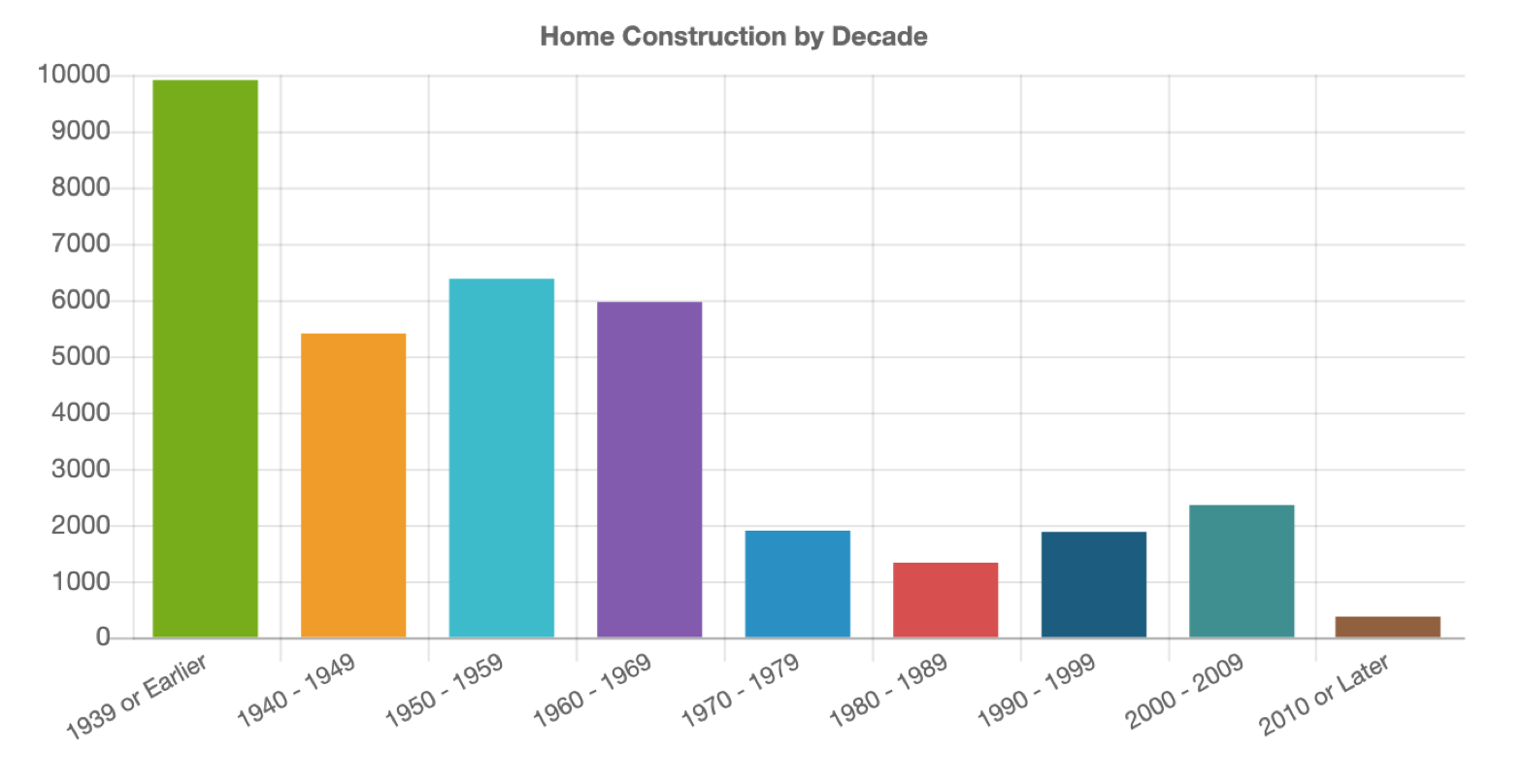

Demographics in Jamaica:

| 11435 Zip Code | |

|---|---|

| Total Population | 147,527 |

| Median Age | 36.2 |

| High School or Higher Education | 71.19% |

| Races | Asian、Hispanic、White、African |

| Median Family Income | $57,389 |

| Unemployment Rate | 7.8% |

| Family with Children | 11.04% |

| Average Family Member | 3.1 |

| Self-occupation Rate | 43.7% |

* Source:Point 2 Homes & NICHE

Condo Market Price Comparison:

After researching sales of condo apartments, sales of 23 unites in 6 separate buildings within the subject’s neighborhood were uncovered. All the sales closed after January 2017 during a stable to slightly improving market. However, there was no discernible difference noted between the sales and a time adjustment was not warranted. Adjustments were necessary for location, condition, parking, appeal and other factors.

- Number of Unites: 23

- Median Price: $526/sf

- Parking Price: $20,000/Spot

- Contract Price Range: $540/sf~$645/sf

SALES COMPARISON

| 143-41 84th Dr | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unit | Price | Transaction Date | Rooms | Bedrooms | Bathrooms | Room Size/SF | Room Price/SF | Loc. | Cond. | Park. | Elev. | Appl. | Total Adj. | Adj. $/SF |

| 1B | $506,000 | 05/18/2018 | 4 | 2 | 2 | 1,018 | $497 | -10% | 5% | 0% | 0% | 0% | -5% | $472 |

| 3A | $620,000 | 12/05/2017 | 4 | 2 | 2 | 1,021 | $607 | -10% | 5% | -5% | 0% | 0% | -10% | $547 |

| 4B | $585,000 | 10/30/2017 | 4 | 2 | 2 | 1,018 | $575 | -10% | 5% | 0% | 0% | 0% | -5% | $546 |

| 3B | $555,000 | 05/15/2017 | 4 | 2 | 2 | 1,018 | $545 | -10% | 5% | 0% | 0% | 0% | -5% | $518 |

| 8E | $420,000 | 03/31/2017 | 3 | 1 | 1 | 650 | $646 | -10% | 5% | 0% | 0% | -5% | -10% | $582 |

| 8820 parsons blvd | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unit | Price | Transaction Date | Rooms | Bedrooms | Bathrooms | Room Size/SF | Room Price/SF | Loc. | Cond. | Park. | Elev. | Appl. | Total Adj. | Adj. $/SF |

| 4B | $346,000 | 04/25/2018 | 3 | 1 | 1 | 680 | $509 | 0% | 5% | 0% | 0% | 0% | 5% | $534 |

| 2D | $375,000 | 04/12/2018 | 4 | 2 | 1.5 | 810 | $463 | 0% | 5% | 0% | 0% | 0% | 5% | $486 |

| 3B | $310,000 | 11/28/2017 | 3 | 1 | 1 | 680 | $456 | 0% | 5% | 0% | 0% | 0% | 5% | $479 |

| 6D | $422,000 | 07/21/2017 | 4 | 2 | 1.5 | 810 | $521 | 0% | 5% | -5% | 0% | 0% | 0% | $521 |

| 5D | $378,000 | 06/13/2017 | 4 | 2 | 1.5 | 799 | $473 | 0% | 5% | 0% | 0% | 0% | 5% | $497 |

| 4D | $358,000 | 06/29/2017 | 4 | 2 | 1.5 | 810 | $442 | 0% | 5% | 0% | 0% | 0% | 5% | $464 |

| PHA | $615,000 | 04/21/2017 | 5 | 2 | 1.5 | 1,150 | $535 | 0% | 5% | -20% | 0% | -5% | -20% | $428 |

| 17836 wexford terrace | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unit | Price | Transaction Date | Rooms | Bedrooms | Bathrooms | Room Size/SF | Room Price/SF | Loc. | Cond. | Park. | Elev. | Appl. | Total Adj. | Adj. $/SF |

| 4C | $426,000 | 08/21/2017 | 4 | 2 | 2 | 787 | $541 | 0% | 5% | 0% | 0% | 0% | 5% | $568 |

| 5A | $300,000 | 03/17/2017 | 4.5 | 2 | 2 | 712 | $421 | 0% | 5% | 0% | 0% | 0% | 5% | $442 |

| 5C | $409,000 | 07/29/2017 | 4 | 2 | 2 | 783 | $522 | 0% | 5% | 0% | 0% | 0% | 5% | $548 |

| 17227 Highland Ave | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unit | Price | Transaction Date | Room Size/SF | Room Price/SF | Loc. | Cond. | Park. | Elev. | Appl. | Total Adj. | Adj. $/SF | |||

| 2E | $549,000 | 04/20/2018 | 981 | $560 | 0% | 10% | -5% | 10% | 0% | 15% | $644 | |||

| 3H | $490,000 | 12/29/2017 | 964 | $508 | 0% | 10% | 0% | 10% | 0% | 15% | $585 | |||

| 1C | $340,000 | 09/27/2017 | 925 | $368 | 0% | 10% | -5% | 10% | 0% | 20% | $441 | |||

| 2C | $415,000 | 07/05/2017 | 908 | $457 | 0% | 10% | -5% | 10% | 0% | 15% | $526 | |||

| 4B | $410,000 | 02/02/2017 | 992 | $413 | 0% | 10% | 0% | 10% | 0% | 20% | $496 | |||

Rental Market Price Comparison:

The analysis about is 3 buildings and the leases are after Jan 2018. In rent comparison analysis, Based on the market we noticed several new construction rental building raised up in past 6-12 months, especially high-end rentals appeared on Jamaica market. Local community is upgrading steadily.

- Number of Rentals: 423 leases

- Lease Median Price: $33/sf/year

- Lease price Range: $1,720 /room/month ~$2,781/room/month

RENTAL COMPARISON

| 152-11 89th Avenue | 152-09 88th Avenue | 153-30 89th Avenue | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Address | Unit # | Rent/Month | Under Contract Date | Room Size/SF | $/SF/Year | |||||||||

| 153-30 89th Ave | 217 | $2,400 | 11/8/2019 | 694 | $41 | |||||||||

| 153-30 89th Ave | 926 | $2,150 | 10/26/2019 | 694 | $37 | |||||||||

| 152-11 89th Avenue | 417 | $4,200 | 10/22/2019 | 1450 | $34 | |||||||||

| 152-09 88th Avenue | 405 | $2,250 | 10/25/2019 | 720 | $37 | |||||||||

| 152-09 88th Avenue | 5060 | $2,200 | 9/30/2019 | 690 | $38 | |||||||||

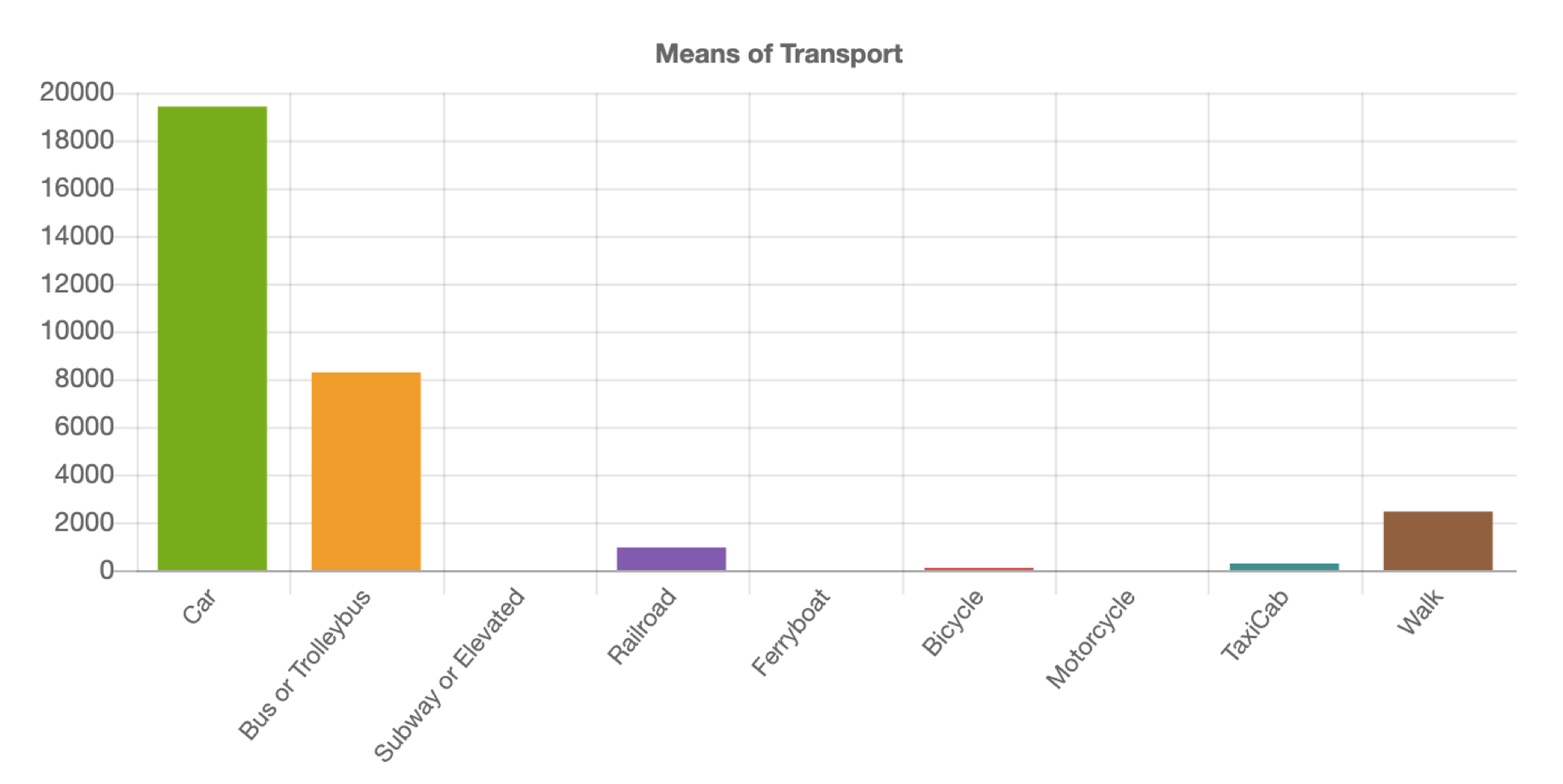

Geographic Location:

The project is located at the core area of Jamaica. It’s 5 mins walking distance to E/F line subway station and 5 mins walking distance to LIRR station. It’s about 20 mins training ride to Manhattan. The project is close to I678 and Queens Blvd and 8 mins drive to JFK airport.

It’s right next to the core politics and business area in Queens and there are surrounding hospitals, police stations, banks, school and senior centers.

Transportation:

Subway: E/F

Train: LIRR

JFK: 5 miles (about 12 mins drive)

LGA: 7 miles (about 20 mins drive)

Developer: Century Development Group

Founded Time: 1990

Project Area: Flushing, Elmhurst, Rego Park, LIC, Brooklyn

Project Type: Multi-families, Condo, Mix-use, Hotel, Office Building

Project Display:

Founded and headed by George Xu, Century Development Group is an integrated Real Estate Development Company. Since the late 1990’s, Mr. Xu has been involved in the developments of residential, commercial, mixed-use and hospitality projects primarily in the borough of Queens, New York. To date, George Xu has worked on over a million square feet of real estate developments; mixed-use developments including residential, hospitality, office, and retail. The total value of his completed projects is calculated to be over $237,000,000. The net worth of his current and developing projects is anticipated to be over $421,000,000. The total assets of his projects is over $658,000,000.

1. Since the second quarter of 2018, the U.S. real estate market has been in adjusting period. The price growth rate fell from the pick at the end of 2017, and the sales prices moderately declined. Looking forward to the trends in the next 2 years, the real estate industry will face higher costs of borrowing due to incremental interest rates, and the overall market might turn back to a more rational position which is based on affordability and supply and demand. In such market trends, CrowdFunz will mainly focus on debt investment opportunities as the core of strategy, adopting conservative loan agreements to build partnerships with real estate developers, and reduce uncertainty from fluctuant market adjustment which may lower the profitability of CrowdFunz’s investors.

2. The mission of CrowdFunz is to offering fixed income products that have controllable value-at-risk, conforming to the demands of investors who would like to minimize their risk profiles. CrowdFunz also insists on selecting real estate projects with low loan-to-value ratio and high collateral as a part of core criteria of debt investment.

3. Compared to other regional real estate markets in the U.S., the market environment of New York city generally has relatively lower volatility and downward interval; the real estate market at New York city has strong local economic support and steady residential and commercial demands. By regional market familiarity and professional understanding of real estate development, CrowdFunz carefully selects those fundraising projects of which the underlying assets or development plans possess great business fundamentals and potentials.

4. As a result of our conservative strategy, CrowdFunz 810 was successfully passed our risk filtering processes and due diligence. CrowdFunz securitized the borrowing to private equity investment opportunities and introduces it to all CrowdFunz’s clients and potential investors. We believe that the strong market fundamentals in Jamaica real estate market, the developer’s reliable track of record, and dependable feasibility of the operational planning of the development may support the success of investment for investors who are looking for moderate risk-return trade-off.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-2 yrs | 3-5 yrs | 6-10 yrs | 10+ yrs | |

| Tracking Record | 0-3M | 3-10M | 10-50M | 50M+ | |

| Credit Score | Accept | Fair | Good | Excellent | |

| Financials | |||||

| Investor Equity% | <20% | 20%-30% | 30%-40% | 40%-50% | 50%-60% |

| Loan Senior Crowdfunz | 70%-79% | 60%-69% | 50%-59% | 1%-49% | 0% |

| Location | |||||

| Location | Rural | Suburban | Core Urban | ||

| Walk Score | 0-49 | 50-69 | 70-89 | 90-100 | |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Type | |||||

| Development Phase | Ground Up | Value-added | Stablized | ||

| Property as Collateral | No | Yes | |||

| Occupancy | Low | Moderate | High | Very High | |

| Investment Term | 60+ Mths | 25-60 Mths | 13-24 Mths | < 12 Mths | |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)