Equity Pledge Debt Fund 813

Type: Debt

Target: $1,500,000

Annual Return: 8% - 8.25%

Min-invest Amount: $10,000

Duration: 3 - 6 Months

Offering Amount: $1,500,000

Estimated Return: 8.00% - 8.25% Annualized Return1

Investment Type: Equity Pledge Loan

Unit Price: $10,000 per Subscription Unit

Offering Date: October 2020

Investment Horizon: 3 - 6 Months (3+1+1+1 Months)

Dividend Schedule: Prepaid before per Period

1 8% Annualized Return For Investment of 1-19 Units;8.25% Annualized Return for investment above 20 Units.

Address: 148-44/46 Hillside Avenue

Area: Jamaica, Queens, New York

Lot Size: 4,275 Square Ft. (22 Ft. x 95 Ft)

Zoning:R7A,C2-3 (FAR is 4 times)

Building Size: 21,888 Square Ft.

Address: 148-31/43 88th Avenue

Area: Jamaica, Queens, New York

Lot Size: 24,322 Square Ft. (140 Ft. x 140 Ft.)

Zoning:R7A,C2-3 (FAR is 4 times)

Building Size: 84,397 Square Ft.

Closing Date: May 2014 (Both Properties)

Closing Pric: $5,420,000 (Two combined)

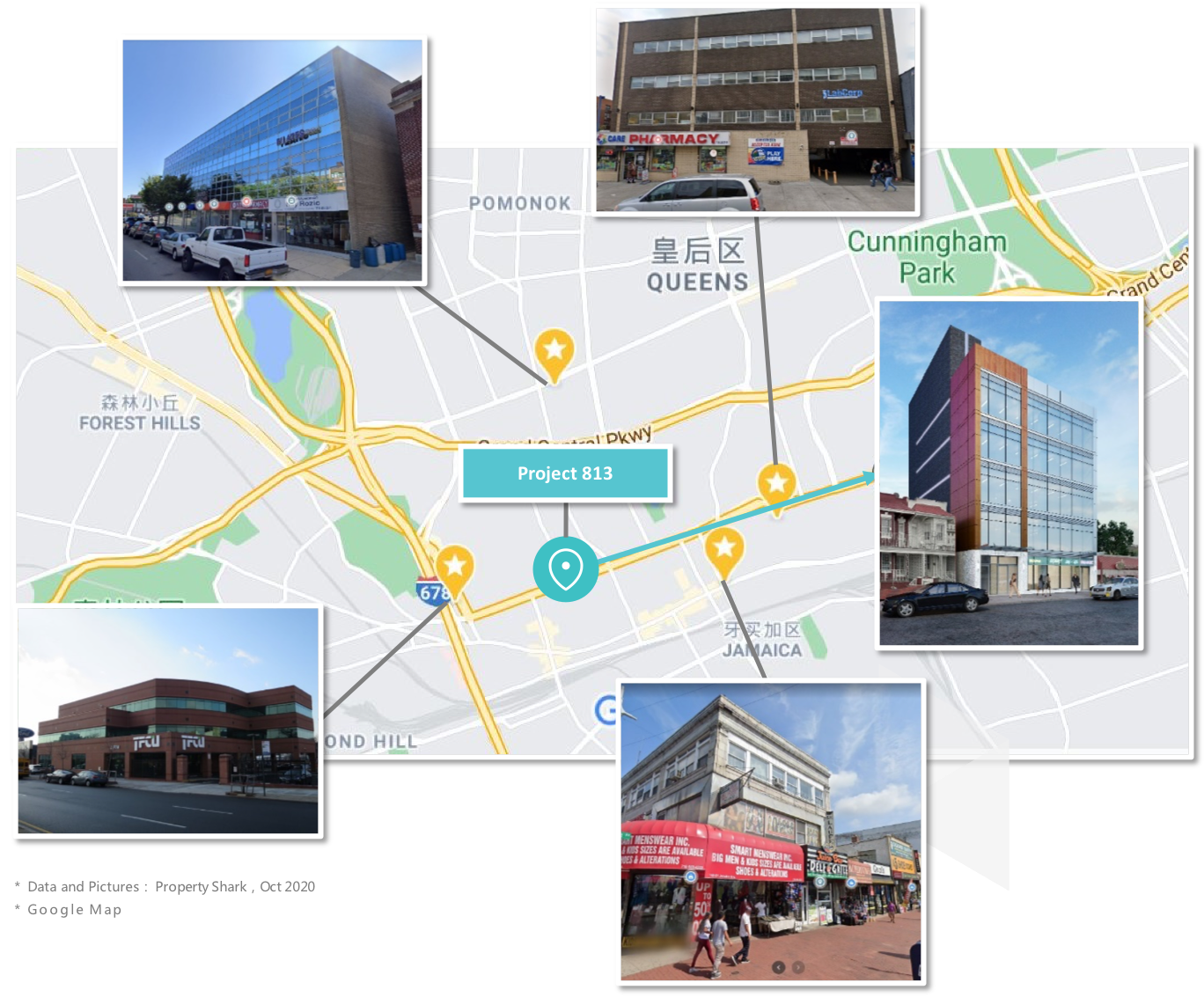

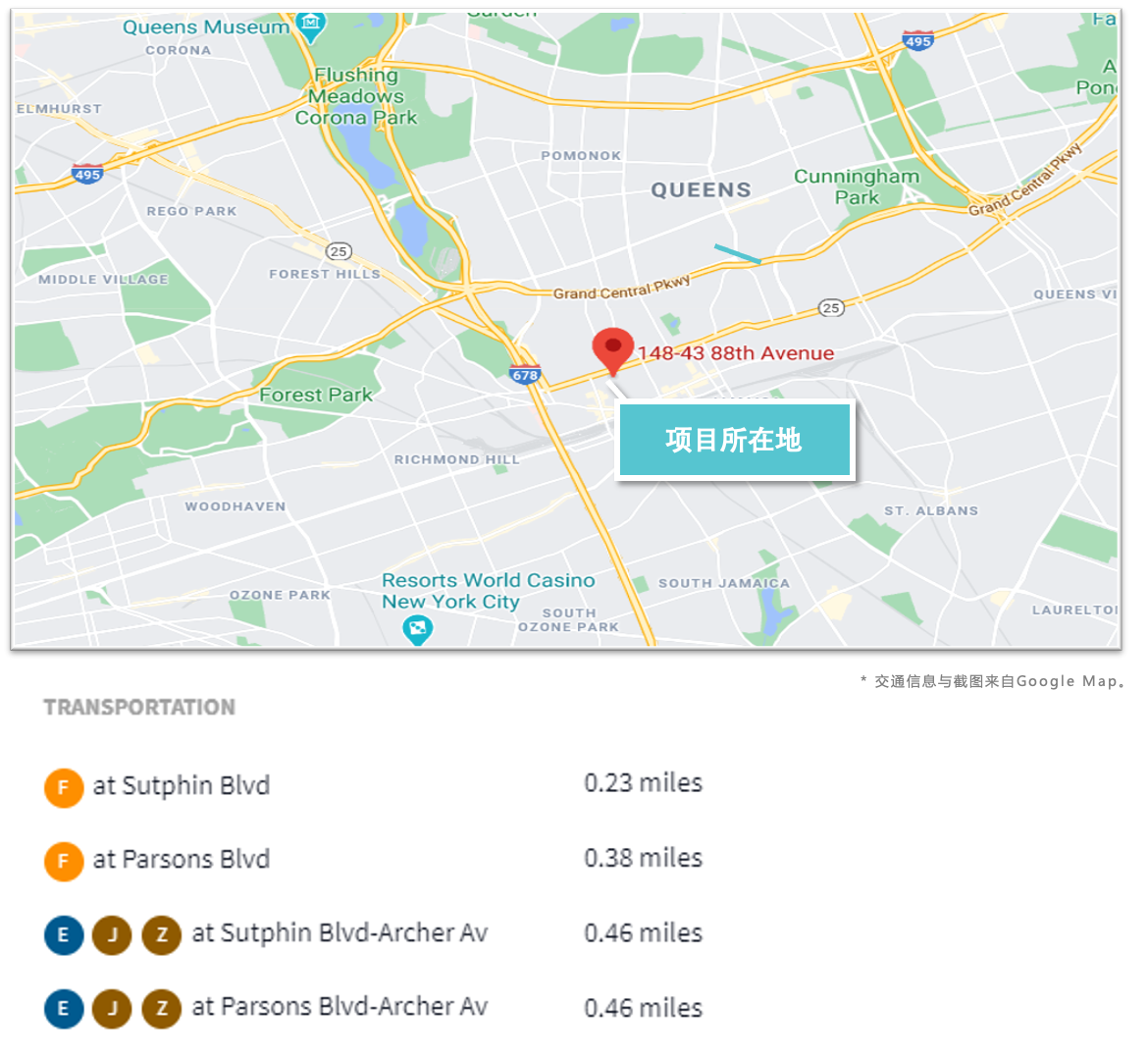

- The project is located in a prime location in Jamaica, Queens. The developer purchased two adjacent lots of land for development in May 2014. The land at 148-31/43 88th Ave will be used for the development of multi-family residential properties and the land at 148-44/46 Hillside Ave will be used for the development of commercial properties.

- The project site is adjacent to the Queens District Court and Social Security Center, and the surrounding living facilities are complete. At present, the main structure of exterior of the residential project is nearly completed, and the riskiest stage of construction has been passed. The current construction contractor is carrying out the construction of interior decoration, HVAC, water and electricity systems. The current construction progress of the commercial property building is about 15%. and the foundation construction has been completed.

- The transportation around the project is convenient and accessible. Five minutes’ walk to the subway station (E/F/J/Z), 40 minutes to Midtown Manhattan. And only 5 minutes’ walk from Long Island Railroad Station. It only takes 15 minutes to take Air Train to JFK Airport from the site.

The project developer purchased two adjacent lots of land at a total price of $5.42 million in May 2014 and began construction in 2016.

Residential Properties: Located at 148-31 to 43 88th Avenue, it is expected to build an 8-floor multi-family rental apartment with a total of 109 residential units, including 5 studios, 64 1B1Bs, 39 2B2Bs, and 1 large 3B2Bs.

Commercial Properties: Located at 148-44 & 148-46 Hillside Avenue, it is planned to build a mixed-use property. The building is expected to contain 6 floors, 1 story for retail space, 2nd to 6th floors for the community center, and 3 units of office space in the basement.

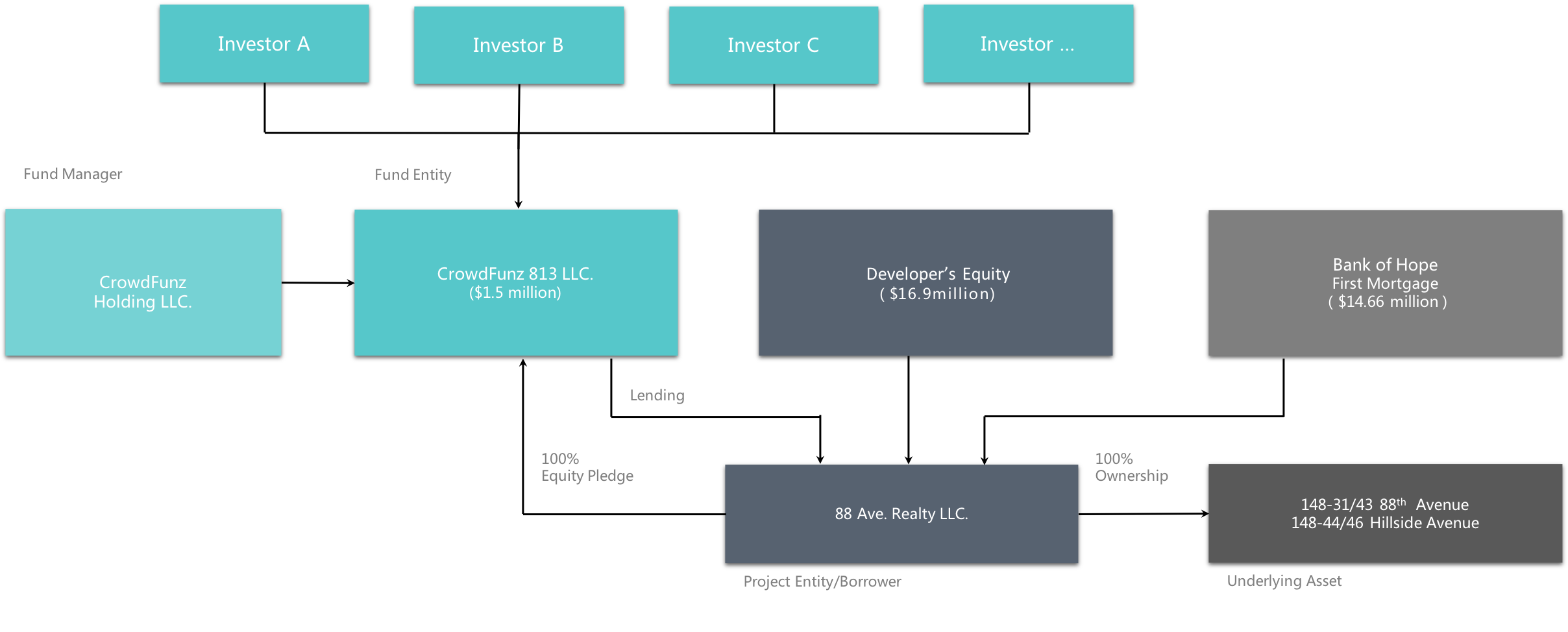

The developer borrowed a loan from CrowdFunz Fund 813 by pledging all the shares of 88 Ave. Realty LLC. It is expected that all funds from the loan will be used for the final phase of construction of residential properties.

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round | Batches Of Investment | Funding Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | First Batch | $1,000,000 | No Later Than 11/05/2020 | 10/22/2020 | 1/21/2021 *2 | 3 Months | Pre-Paid Dividend |

| Second Batch | $500,000 | No Later Than 11/19/2020 | 11/06/2020 | 1/21/2021 *2 | 2.5 Months | Pre-Paid Dividend | |

| Second | No Later Than 2/05/2021 | 1/22/2021 | 2/21/2021 | 1 Month | Extension Options By Developer | ||

| Third | No Later Than 3/08/2021 | 2/22/2021 | 3/21/2021 | 1 Month | Extension Options By Developer | ||

| Fourth | No Later Than 4/05/2021 | 3/22/2021 | 4/21/2021 | 1 Month | Extension Options By Developer | ||

*1 In case of holidays and non-working days, the payment date will be automatically postponed to the next working day.

*2 After the expiration of the first Dividend Period, the developer has a 1+1+1 month extension repayment option, during which the investor will receive the same dividend rate.

Sufficient Value of Pledged Property

According to the valuation report provided by the third-party appraisal agency CAPITAL APPRAISAL SERVICES, INC. in August 2019, after the completion of the project, the value of the residential property is approximately $34.5 million, the value of the commercial property is approximately $7 million. The total value is up to $41.5 million.

At present, the mortgage loan for the construction of the development project is $14,669,791, and the developer’s own equity investment is $16,902,443. After the $1,500,000 loan provided by CrowdFunz Fund 813 enters the project, the total debt is $16,169,791. The loan-to-cost ratio (LTC) of the project is only 48.89%, and the loan-to-value ratio (LTV) is only 38.96%.

The short-term loan provided by CrowdFunz Fund 813 is pledged by the borrowing entity’s 100% shares. And the developer’s own equity to the CrowdFunz Fund 813 loan amount ratio as high as 11.27. At the same time, the developer’s key shareholders will provide personal unlimited guarantee to further protect the interests of fund investors.

Prime Location, Potential Market

The project is located close to Queens Sutphin Blvd station. The surrounding public transportation is well developed, subway lines include E, F, J, Z lines, buses include Q1, Q2, Q3, Q28 and other lines, which can reach various communities in Queens. The train line, Babylon, Long Beach, Ronkonkoma, Port Washington, etc., and directly to Manhattan or Long Island .The airport express Air Train takes 10 minutes to JFK International Airport.

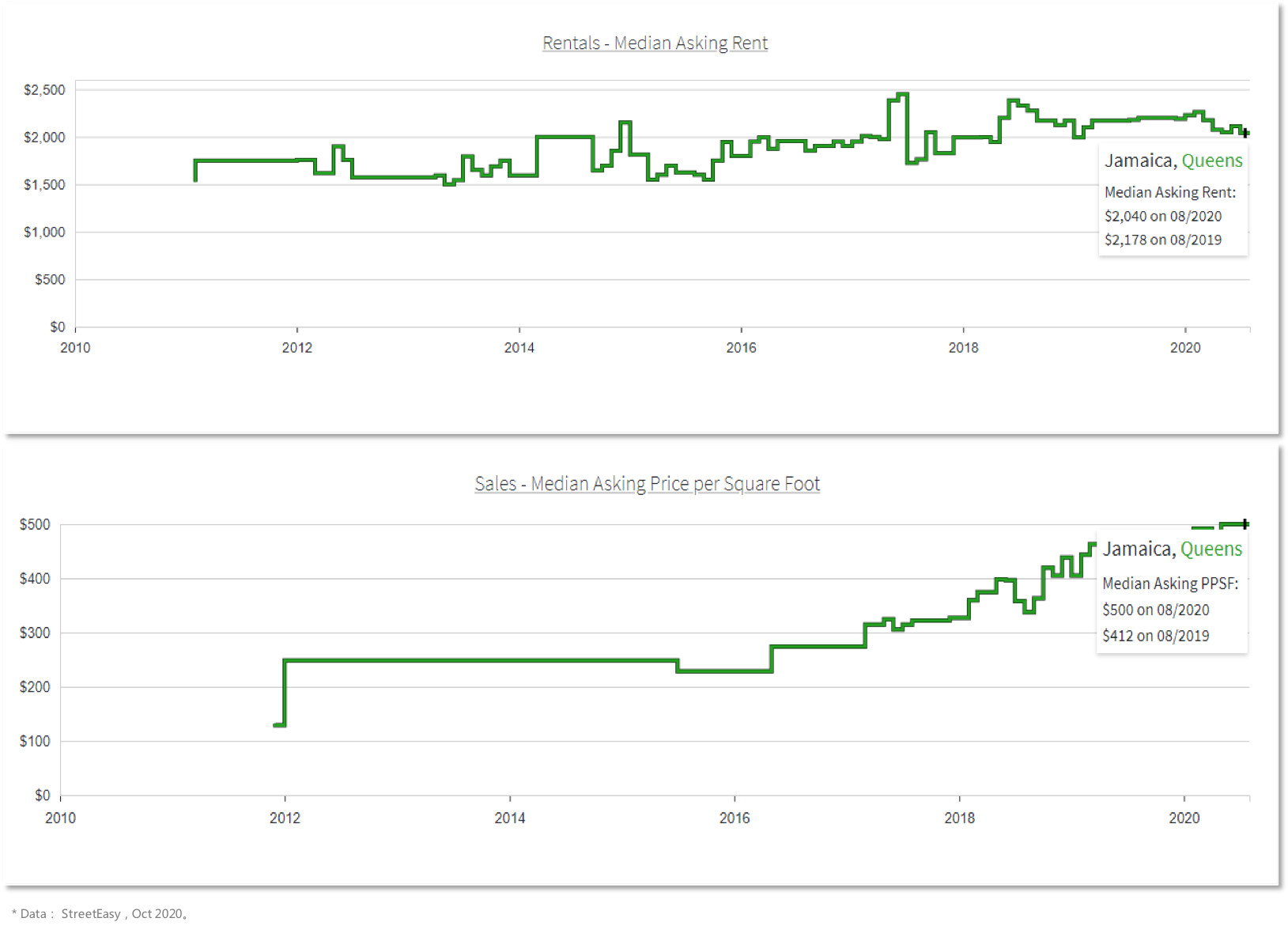

- In recent years, the area where the project is located has begun to build many comprehensive property development projects. Compared with other relatively mature areas in New York, Jamaica is currently cost-effective and has great growth potential. According to statistics from online platforms such as Trulia and Zillow, the median house sale price in Jamaica is currently $536,000; the median monthly rent is $2,040, which has been rising steadily in the past 5 years.

Transparent Fund Usage, Explicit Exit Strategy

Affected by the epidemic, the cost of real estate development projects in the United States has generally increased this year. The short-term loans issued by CrowdFunz Fund 813 will all be used for the construction expenses of the projects that developers urgently need to ensure that the total project period is reached as soon as possible after the epidemic. Upon the completion, the developer will immediately apply for refinancing from the bank, and the proceeds amount will be sufficient to repay the loan issued by CrowdFunz Fund 813.

Seasoned Developer With Extensive Experience

The developer has been deeply involved in the New York City real estate market for 30 years. They are well-known and have a good reputation in the local market. Successful projects in the past are mainly concentrated in Queens. In recent years, they have hit the market with medium-sized mixed-use and residential projects. At present, the developer has successfully cooperated with CrowdFunz Fund 810. The fund is currently operating well, and the property construction progress is stable. Judging from current cooperation and past developer records, its development strength and business reputation are trustworthy. This project will bring a deeper cooperative relationship between CrowdFunz and the developer.

| Fund Source | Percentage | |

|---|---|---|

| Bank of Hope Mortgage | $14,669,791 | 44.36 % |

| CrowdFunz Fund 813 | $1,500,000 | 4.54 % |

| Developer Equity | $16,902,443 | 51.10% |

| Total | $33,072,234 | 100.00% |

After the CrowdFunds Fund 813 enters the project, in the capital stack, Bank of Hope loaned $14,669,791 in mortgage, accounted for 44.36%, with the first position. CrowdFunz Fund 813, the $1,500,000 equity pledge loan, accounting for 4.54%, ranked the second position. In the case of loan default, CrowdFunz Fund 813 has the right to directly take over the project company ‘s 100% equity to liquidize for repayment.

| Fund Usage | Percentage | |

|---|---|---|

| Land Cost | $5,420,000 | 16.39 % |

| Construction Cost | $20,957,695 | 63.37% |

| Soft Cost | $1,543,166 | 4.67% |

| Financing Cost | $5,151,372 | 15.58% |

| Total | $33,072,234 | 100.00% |

At present, the construction mortgage of the development project is $14,669,791, and the developer’s own equity investment is $16,902,443. After the $1,500,000 loan provided by the CrowdFunz Fund 813 enters the project, the total debt is $16,169,791. The loan-to-cost ratio (LTC) of the project is only 48.89%, and the loan-to-value ratio (LTV) is only 38.96%. For this project, the developer’s own capital investment has exceeded 50% of the total capital investment, and the residential property is close to completion. If CrowdFunz Fund 813 invests with a small mezzanine loan, the risk is controllable and the risk of default is extremely low.

| 813 Fund Usage | Proportion | |

|---|---|---|

| Electrical | $60,000 | 4.00% |

| Plumbing | $100,000 | 6.67% |

| Window and Panel | $300,000 | 20.00% |

| Mechanical HVAC | $150,000 | 10.00% |

| Interior | $360,000 | 24.00% |

| Floor Installation | $80,000 | 5.33% |

| Construction Material | $50,000 | 3.33% |

| Superstructure | $40,000 | 2.67% |

| Hoist and Scaffold | $260,000 | 17.33% |

| Working Capital | $100,000 | 6.67% |

| Equity Pledge Debt Fund | $1,500,000 | 100.00% |

* Provided By Developer

The $1,500,000 lent by the CrowdFunds Fund 813 is a small mezzanine loan, which is expected to be used for the final stage of the important construction expenditure of the residential project. (see details through the figure on the right)

Affected by the epidemic and the trade war, the cost of real estate development in the United States has generally risen this year, and the efficiency of banks and lending institutions has not been able to match the developers' requirements to achieve construction progress in a timely manner.

The entry of this loan will ensure that the developer completes the construction of the project within the expected time, so that the entire multi-unit rental apartment can be leased and operated as soon as possible after the epidemic delays. And it will also facilitate the developer to finish the construction as soon as possible to obtain lower interest rate loans from banks and reduce financing costs.

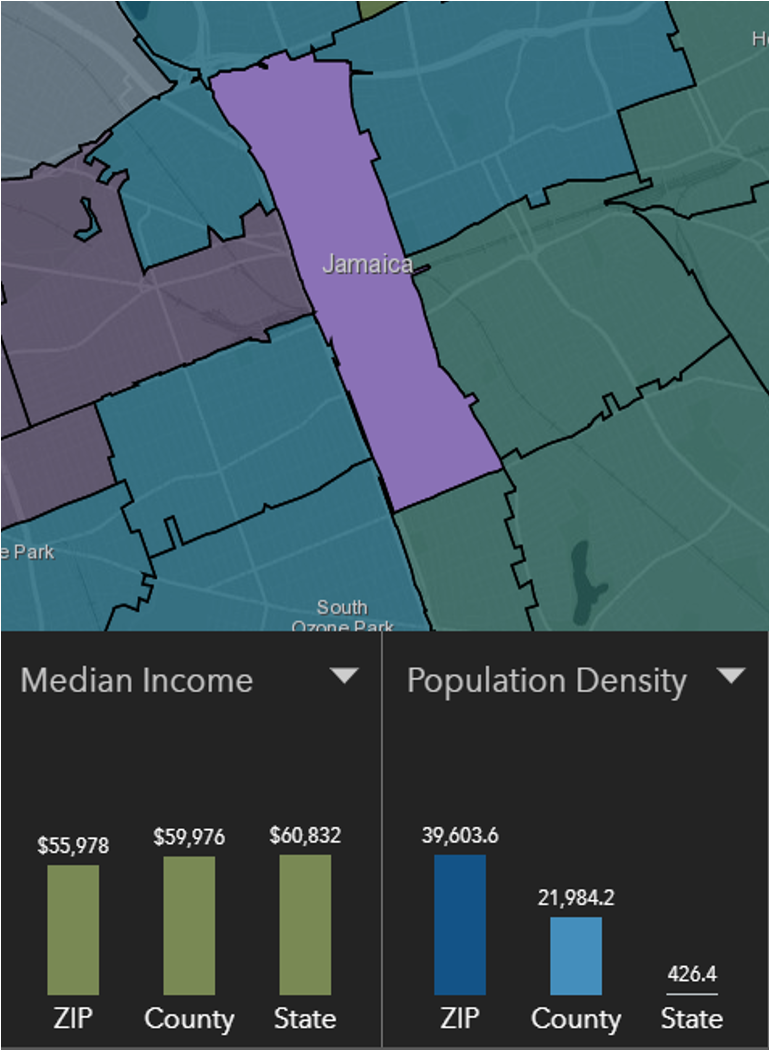

Demographics:

| Zip Code 11435 | |

|---|---|

| Regional Population | 59,296 |

| Median Age | 35.8 |

| High School Edu or Above | 76.9% |

| Ethnics | Latino(32.5%),AA(25.6%),Asian(19.4%),White(14.2%) |

| Family Median Income | $55,978 |

| Occupancy Rate | 96% |

| Child-Bearing Family | 37% |

| Average Family Size | 3.1 |

| Primary Residence | 36% |

The population in this area is obviously racially diverse, with a large minority population. Hispanics accounted for about 1/3, Africans accounted for 1/4, Asians accounted for 1/5, and traditional whites accounted for less than 1/6.

Residents in the area are generally young, with an average age of about 35.8 years. Most families have a relatively high proportion of children soon after marriage, close to 37%. And the community is vibrant.

The owner-occupied ratio in the region is only 36%, and there is strong demand for residential rental market. Compared with other parts of Queens, rents in this area are lower and more affordable.

There are many bars, restaurants, cafes and parks in the area. The community has a strong atmosphere and a long history and rich culture.

In recent years, many new immigrants have poured into the region, making the rental market more active and at the same time further promoting the development of surrounding commercial circles.

* DATA: United States Zip Codes. Org. & Esri Zip Code Lookup,Oct 2020

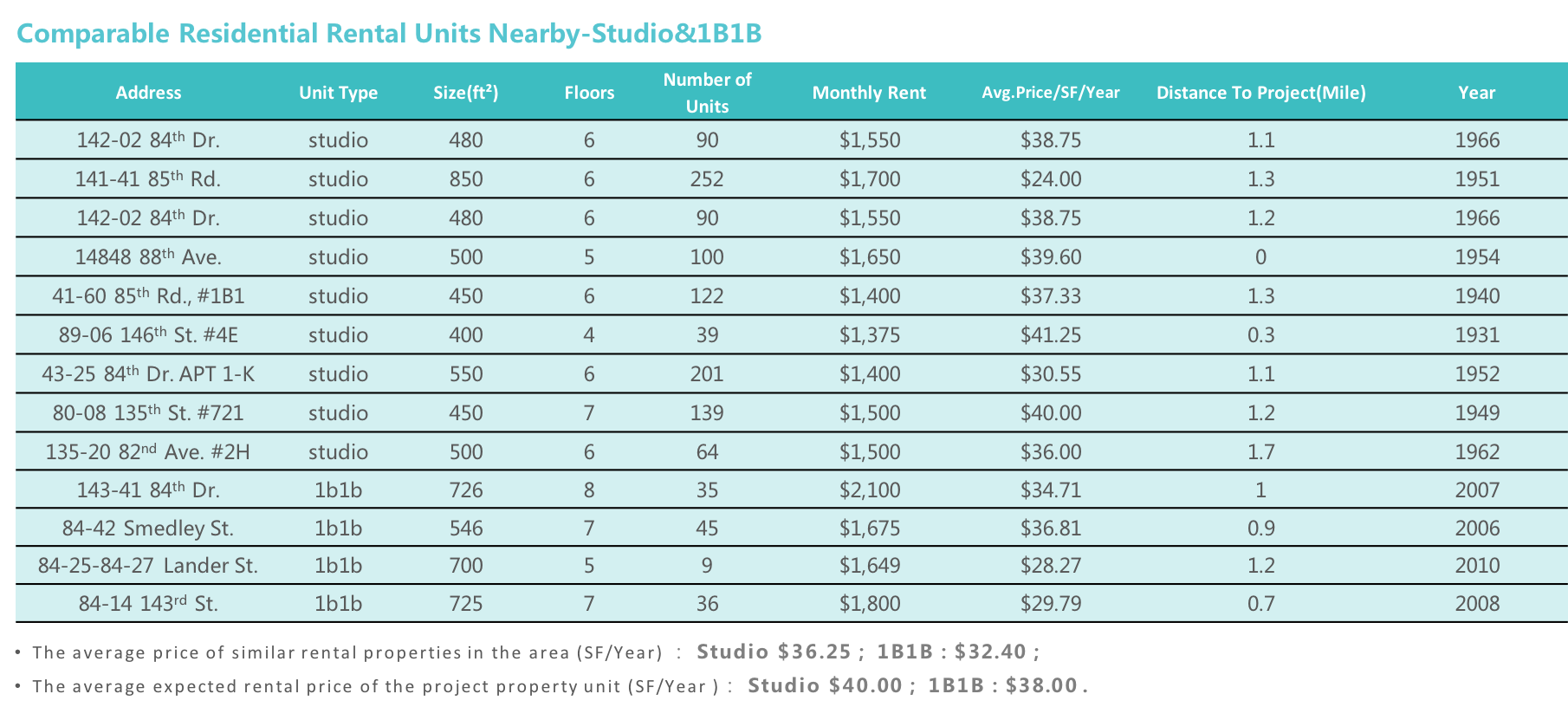

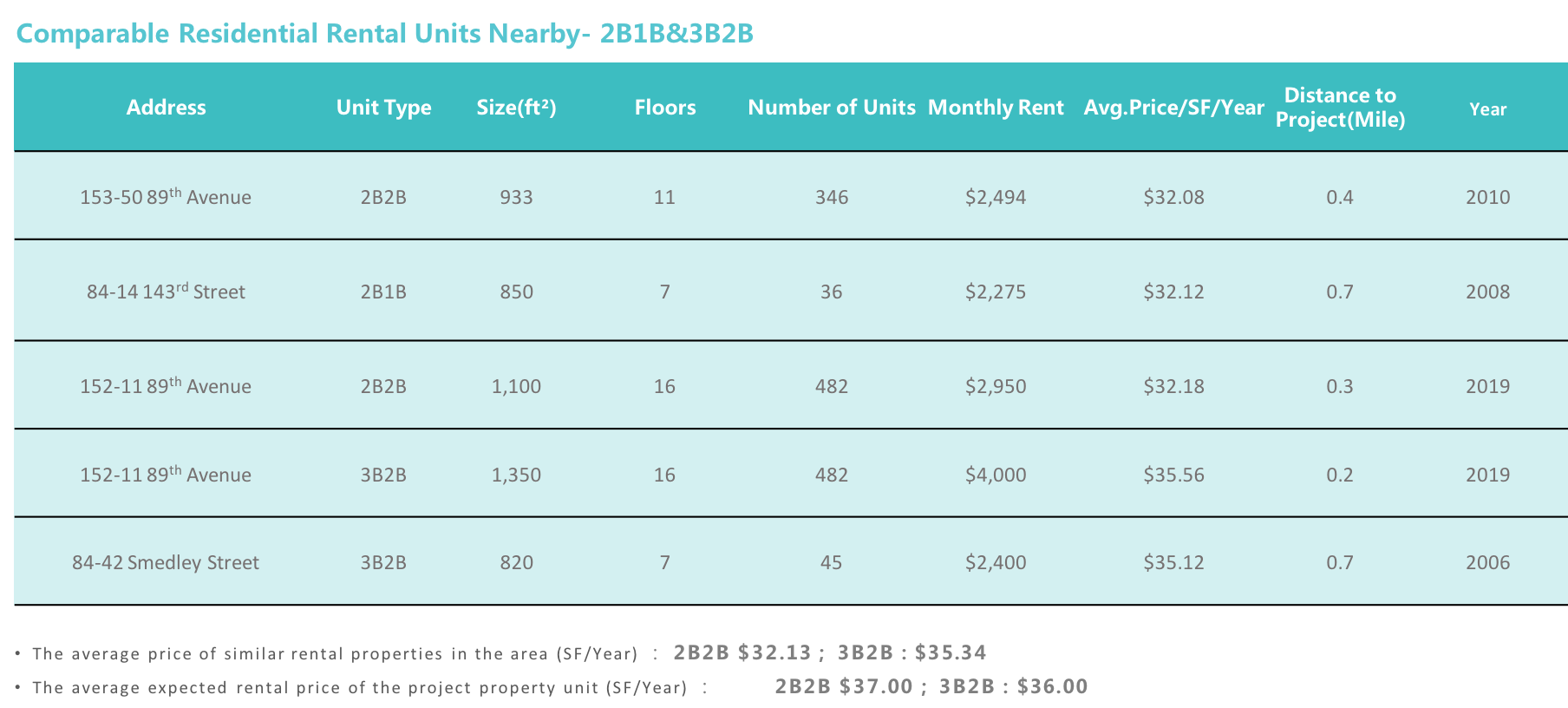

Residential Properties Nearby

From the perspective of the residential rental market, in the past 5 years in Jamaica, the housing rental and sales market in the community has been relatively stable. As the community’s self-occupation rate is only 36%, rental properties rate is 64% of the total. Therefore, the market is great for the development of rental apartments.

In the past 10 years, many new immigrants have settled in this area, mainly Latin American, African American and Asian, adding vitality to the community. Non-native U.S. residents account for more than 35% of the region. Although the family income of newcomers in the United States is lower than the average level in New York City, the rental demand promoted by the new population has been growing steadily

Jamaica in 2020 has been affected by the epidemic, monthly rents in the residential rental market will drop slightly, but the overall rent is stable. Since most of the current rental apartments in the area are old and new high-quality properties under construction are particularly scarce, the project has obvious comparability advantages in the area and has huge potential.

* Data: StreetEasy,Oct 2020.

Similar Properties With Commercial Leasing:

According to the current commercial property leasing information provided by the market surrounding the project, the commercial properties currently being leased around are mainly retail/service industries. Small and medium-sized leasing spaces that can be used for commercial retail. However, their businesses can’t scale up due to the small and old buildings.

On the other hand, Jamaica has its own business characteristics. Residents’ traditional habits of spending in small retail stores are deeply rooted. Due to the high population density, retail spaces such as supermarkets and convenience stores that meet residents’ daily needs are extremely profitable. Its future potential is also consistent with the development of the community. The retail space like the first floor of the project has huge market potential and high demand.

Similar Properties With Retail Space:

Number Of Investigated Space: 5

Median Price: $412.2/Square Feet

Range Of Price: $400 - $523 /Square Feet

Median Space: 2,350 Square Feet

Location:

The project is located in a densely populated area in Jamaica, a 5-minute walk to the subway and the Long Island Railroad station.,20 minutes’ drive to Manhattan Port Authority, and 15 minutes’ drive to Air Train to JFK Airport. The project is located close to the main traffic arteries of Queens like Queens Blvd, Van Wyck Expressway and Grand Central Pkwy.

Transportation:

Subway: E、F、J、Z(About 5 mins Walk)

Bus: Q1、Q2、Q3、Q36、Q43、Q77

LIRR Train: Port Jefferson, Babylon, Long Beach, Ronkonkoma, Port Washington

To Midtown Manhattan: 12-15 Miles (About 45 Mins’ Drive)

To JFK Airport: 4.2 Miles (About 15 mins’ Drive)

To LGA Airport: 13.5 Miles (About 25 Mins’ Drive)

Nearby Schools:

There is a complete basic education system near Jamaica, and there are many elementary schools, junior high schools, and high schools in the surrounding area to meet the basic needs of families in the region for children's education.

Living Facilities:

The community business district is mature, and life is convenient. The area covers various clothing and other lifestyle retail stores and many supermarkets to meet the basic needs of daily life. Cafes and bars are all available, and due to the ethnic diversity of residents, Chinese, American, and Mexican restaurants are all over the area.

Recreation:

There are museums and cinemas in the nearby community, and there are plenty of entertainment venues. The project is located one block away and is the largest park in the area, Rufus King Park. Sports venues are also scattered around the community, with multiple gyms, football and basketball courts within 3 miles nearby.

Developer Company: Century Development Group

Website: http://www.centurygroupdevelopment.com/

Prior Cooperation: CrowdFunz Fund 810

Century Development Group Established in 1990, it focuses on commercial and residential development projects. Successfully developed properties are spread across the Queens and Brooklyn in New York City. At present, the developer has worked on over a1 million square feet of real estate developments, and the total value of the developed projects exceeds $300 million.

The company has more than 30 years of local experience in the development of multi-family and condominiums. The projects currently under development are valued at more than $420 million. Relying on the expanding scale of development in mixed-use and residential properties, Century Development Group currently ranks among the leading Chinese developers in the New York area.

Successful Projects By Developer:

The loan provided by CrowdFunz Fund 813 to this project,is only expected 3-6 months and its liquidity greatly exceeds of traditional real estates debt investment. The design of this fund product is also tailored for investors who are suitable for short-term investments.

The overall investment risk of the CrowdFunz Fund 813 is much lower than the industry level. Although the fund is a short-term mezzanine loan,the collateral is extremely sufficient. On the other hand, the project company pledged by the developer has the ownership of the property that are under development,and has invested $17 Million in equity,which is 11.27 times greater than the loan provided by CrowdFunz Fund 813.

The developer has a low probability of default on loans and strong ability to repay on time. From the perspective of the capital stack of this project,LTC is 48.89%,LTV is only 38.96%,which is in line with obtaining low-interest long-term loans from traditional commercial banking institution refinancing requirements。At this moment, the construction period of multi-family rental property is close to completion, and the construction is expected to finish within one quarter. Also,the developer has an excellent credit and commercial loan record and has rich experience in capital operation of real estate projects. In the past ten years, handling various projects,its has established fine relationships with many lending institutions which boosts the repayment ability.

The developer has previously worked with CrowdFunz. The projects they bring are high-quality, and they have extensive development experiences. The past transactions between two parties are smooth,and it gained trust among our investors.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-3 Years | 3-5 Years | 5-10 Years | 10-15 Years | 15+ Years |

| Tracking Record | 0-3M | 3-10M | 10-30M | 30-50M | 50M+ |

| Credit Score | Low | Accept | Fair | Good | Excellent |

| Financials | |||||

| Investor Equity | 1-20% | 20-30% | 30-40% | 40-50% | 50-60% |

| Loan-to-cost ratio | 85-100% | 70%-85% | 65%-70% | 50-65% | 1-50% |

| Financial claims | Common Equity | Preferred Equity | Equity pledge debt | Secondary lien debt | First lien debt |

| Location | |||||

| Location | Sub Rural | Rural | Regional center | Suburban | Core Urban |

| Walk Score | <40 | 40-55 | 55-70 | 70-85 | 85-100 |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Status | |||||

| Development Phase | 0-20% | 20-40% | 40-60% | 60-80% | 80-100% |

| Property as Collateral | No | Extremely insufficient | Relatively insufficient | Relatively sufficient | Extremely sufficient |

| Investment Term | >48 Months | 37-48 Months | 25-36 Months | 13-24 Months | <12 Months |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)