First Lien Mortgage Debt Fund 613

Type: First Lien Mortgage

Target: $1,400,000

Annual Return: 7.5 - 7.75%

Min-invest Amount: $10,000

Duration: 12 - 30 months

Offering Amount: $1,400,000

Estimated Return: 7.50% - 7.75% Annualized Return1

Investment Type: First Lien Mortgage (Land & Construction)

Unit Price: $10,000 per Subscription Unit

Offering Date: October 2020

Investment Horizon: 12 - 30 Months (3+1+1+1 Months)

Dividend Schedule: Prepaid before per Period

1 7.50% Annualized Return for Investment of 1-19 Units; 7.75% Annualized Return for Investment above 20 Units.

Site Location: 45-45 211th St., Bayside, NY 11361

Region: Bayside, Queens, New York

Land Area: 9,000 SF( 65 Ft. x 125 Ft.)

Zoning: R3-A(FAR 0.5)

Land Closing Price: $1,500,000 U.S. Dollar

Land Closing Date: November 4th,2020

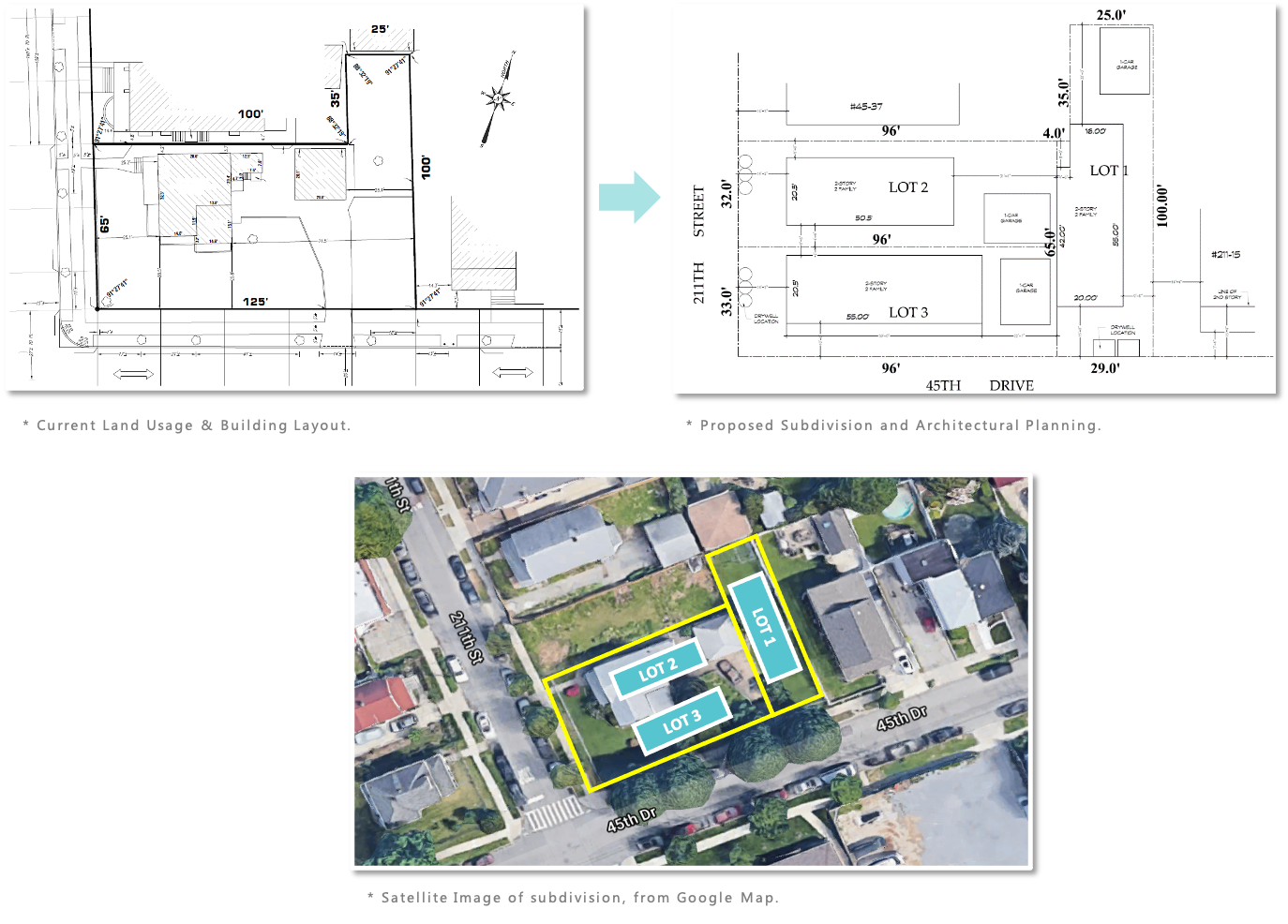

- The project is located in a matured residential area in Bayside, Queens. The land area of the project is 9,000 square feet. By now, it is a single-family residential building. The developer will subdivide the land to develop 3 independent two-family houses.

- As in the core area of Bayside, with abundant living facilities nearby, including Asian supermarkets, convenience stores, restaurants and cafes, the site is appropriate for residential purpose. In addition, the New York 26th school district where the area is located offers excellent quality of education and good public security, making the neighborhood one of the hottest communities to settle in New York City in recent years.

- The transportation around the neighborhood is convenient and accessible in all directions in New York City. It is 0.4 miles from the Long Island Railway Station with only 7-minute walkway; 25-minute by train to Midtown Manhattan, and 20-minute by bus Q12 to Flushing; 20-minute by car to JFK International Airport.

The developer expects to purchase the land, with a total land area of 9,000 square feet, at a price of $1.5 million in November 2020. The current buildings on the land are only a house and a utility room, left plenty of usable space. According to the architectural planning, the purchased land will be subdivided into 3 lots, and each lot will be developed to a two-family residential property with the area as following:

Lot 1: 3,075 SF (Gross Buildable Area: 2,143 SF);

Lot 2: 3,168 SF (Gross Buildable Area: 2,200 SF);

Lot 3: 2,760 SF (Gross Buildable Area: 1,956 SF).

The zoning of the land is R3A. It is expected that a two-story, two-family residential building and a separate single-car garage will be built in each lot. Each residential unit will have 3 bedrooms, 2 full-bathrooms, an open kitchen, and a mixed space of living and dining room. The unit on the first floor will have a full-basement that can store accessories, with a laundry area, utility room, and a full-bathroom.

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| First | Phase I | $750,000 | 11/18/2020 | 11/4/2020 | 5/3/2021 | 6 Months | Prepaid Dividend |

| Phase II | $250,000 | 3/18/2021 | 3/3/2021 | 5/3/2021 | 2 Months | Prepaid Dividend | |

| Phase III | $400,000 | 4/18/2021 | 4/3/2021 | 5/3/2021 | 1 Month | Prepaid Dividend | |

| Second | 5/18/2021 | 5/4/2021 | 11/3/2021 *2 | 6 Months | Prepaid Dividend | ||

| Third | 11/18/2021 | 11/4/2021 | 5/3/2022 | 6 Months | The develop has the option on extension | ||

| Fourth | 5/18/2022 | 5/4/2022 | 11/3/2022 | 6 Months | The develop has the option on extension | ||

| Fifth | 11/18/2022 | 11/4/2022 | 5/3/2023 | 6 Months | The develop has the option on extension | ||

*1 In case of holidays and non-working days, the payment date will be automatically postponed to the next working day.

*2 After the expiration of the second Dividend Period, the developer has the option to extend the borrowing 3 times. If the developer chooses to extend, the investor will receive dividends at the same rate of return during the postponement.

Sufficient Collaterals

- According to the appraisal provided by the third-party agency, RCI Appraisal Corp., in October 2020, the current value of the land is approximately $1.42 million; after the completion of the project, the valuations of the three two-family residential properties are US$1.44 million, $143.5 Million, and $1.4 million, respectively, in a total of $4.275 million.

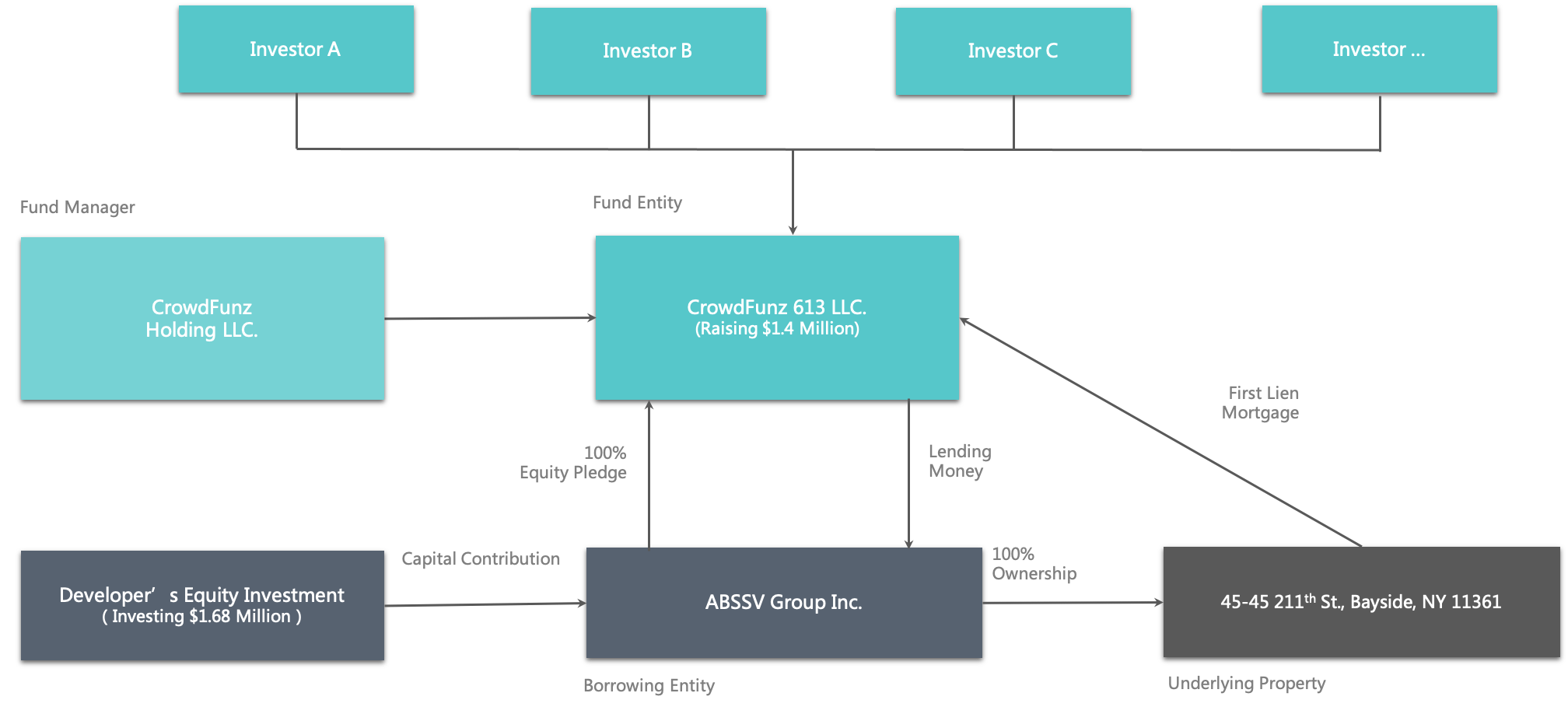

- The estimated total equity investment by the developer is about $1,685,000. Counting the total $1.4 million mortgage originated by CrowdFunz Fund 613, the expected Loan-to-Cost(LTC) ratio of the project is about 45.38%.

- CrowdFunz Fund 613 will possess three types of lending security: a) First Lien Mortgage secured by the underlying properties; b) 100% Ownership Pledge of the borrowing entity; c) Unlimited Personal Guarantee co-signed by the key shareholders of the developer. Three types of lending security together can further reduce the possibility of default.

Prime Location, Potential Appreciation

- The site location is close to Bayside Station, a key transportation hub in Queens, and the surrounding public transportation is convenient. The buses include Q13, Q28, Q31 etc. can reach communities in Queens, Little Neck, and Great Neck; the LIRR train lines such as Penn Station and Port Washington can commute directly to Manhattan or Long Island. There is only 20-minute driving distance to JFK International Airport as a plus.

- In recent years, there has been a boom of school district housing in the site located area, which leads the sales and rental markets being active. Due to the pandemic this year, suburban areas in New York have also shown potential appreciation. According to data from Property Shark, the median house sales price in the Bayside area is $775,000; based on data provided by StreetEasy, the median monthly rent is $2,000 in Bayside, Queens.

Seasoned Developer, Local Familiarity

- The project developer has more than 20 years of development experience in the New York real estate market. The main developments are in Queens and Brooklyn. The developer has deep understanding of the needs in local regions and has good project supervision and management capabilities. The developer also establishes cooperative relationship on the supply side of building materials, controlling substantial adjustment to match the project processes on time.

- CrowdFunz Fund 613 will be the first business cooperation between the developer and CrowdFunz. Based on the excellent development experience of the developer, CrowdFunz believes that financing and investing in this project will be a sound and mutually-beneficial start.

Clear Debt Spending, Straight Exit Strategy

The mortgage originated by CrowdFunz Fund 613 will be divided into three phases, aligning with the processes of the project:

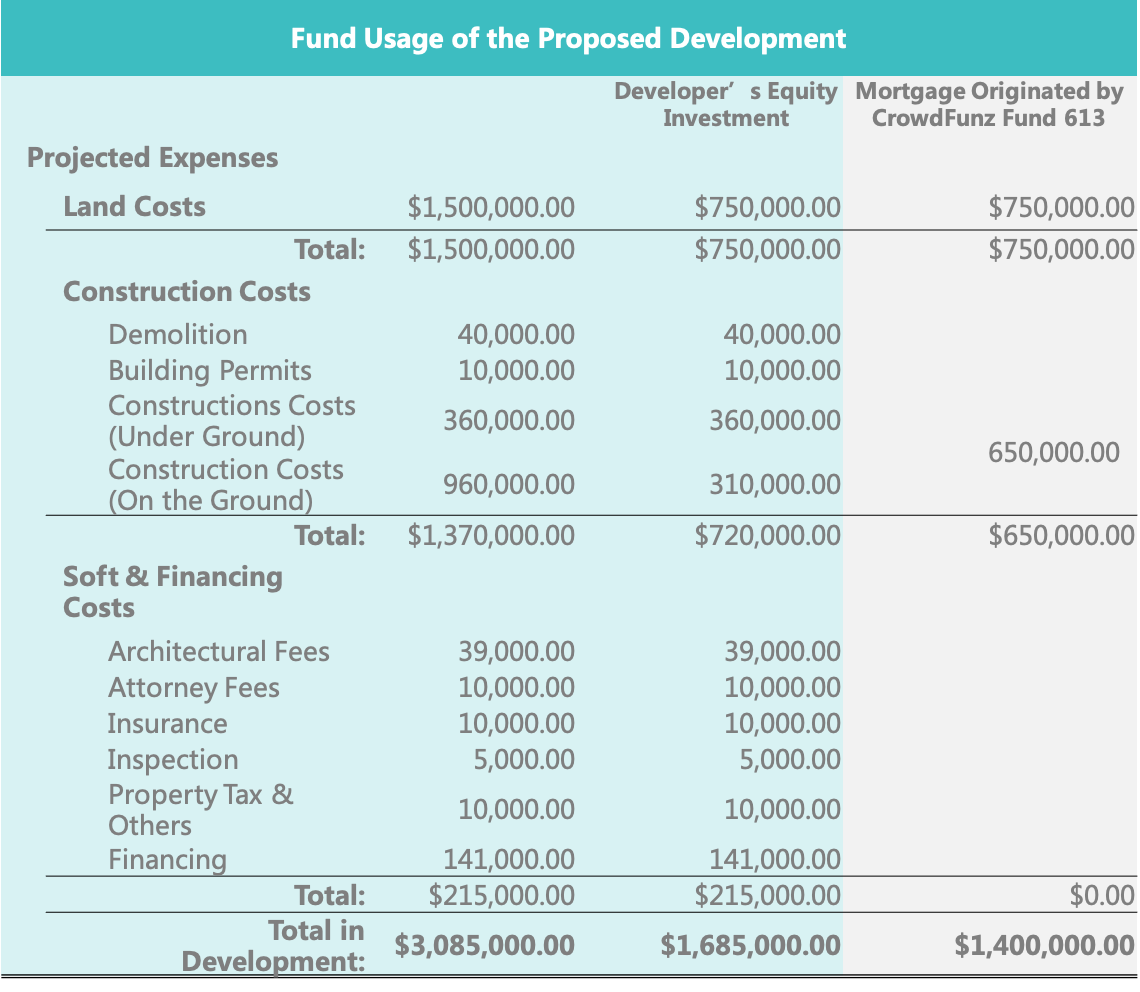

- Phase I: Land Loan in total of $750,000, exclusively for acquiring the land. It is expected to be originated in early November 2020. After acquiring the land, the developer will start the demolition of existing buildings and the construction of proposed properties;

- Phase II: The First Construction Loan in total of $250,000, for the construction costs after the completion of foundation works of three proposed properties. It is expected to be originated in the first quarter of 2021;

- Phase III: The Second Construction Loan in total of $400,000, for the construction costs after the full installation of the doors and windows of three proposed properties. It is expected to be originated in the second quarter of 2021.

The mortgage originated by CrowdFunz Fund 613 will possess the first lien on the underlying properties. In addition, the project company, ABSSV Group Inc., will pledge its 100% equity interests to Fund 613, increasing creditworthiness and reducing investment risk. After the development being completed, the developer will repay the loans through the proceeds from the sale of the proposed properties.

| Source of Capital | Percentage | |

|---|---|---|

| Mortgage Originated by CrowdFunz Fund 613 | $1,400,000 | 45.38% |

| Developer’s Equity Investment | $1,685,000 | 54.62% |

| Total | $3,085,000 | 100.00% |

After receiving all loan disbursements from CrowdFunz Fund 613, the project will have $1,400,000 mortgage, accounting for 45.38% of the total source of capital and possessing first lien of underlying properties and a pledge of 100% ownership interests of the project entity. In the case of default, CrowdFunz Fund 613 has the rights to claim the ownership of underlying properties as well as the project entity.

In addition, the key shareholders of the project entity signed personal guarantees to further secure the mortgage borrowing from CrowdFunz Fund 613, which grants Fund 613 the financial claim on the co-signers’ personal properties in a case of default, strengthening the capability of debt repayment.

| Use of Capital | Percentage | |

|---|---|---|

| Land Cost | $1,500,000 | 48.62% |

| Construction Cost | $1,370,000 | 44.40% |

| Soft & Financing Costs | $215,000 | 6.98% |

| Total | $3,085,000 | 100.00% |

Initially, CrowdFunz Fund 613 will provide the developer a first lien mortgage equal to 50% of the land transaction price, and following soft costs will be paid by the developer’s equity investment. After the proposed development starts, the estimated construction costs is about $1,370,000, in which CrowdFunz Fund 613 offers two construction loan disbursements in a total of $650,000, accounting for 47.45% of the costs. It is expected that the Loan-to-Cost (LTC) ratio of the entire development will be controlled at 45.38%.

In the capital structure of the project, the equity investment from the developer's own cash will exceed 50% of the total source of capital. CrowdFunz Fund 613 is the sole lender holding the collateralized first lien and equity pledge to control the lending and investing risks.

* Provided By Developer

The $1,400,000 mortgage originated by CrowdFunz Fund 613 is a combination loan for land acquisition and construction costs. The loan will be divided into three phases of disbursement, and each will be used for exclusive purposes in accordance with the development processes.

The first phase of disbursement will ensure that the developer completes the land acquisition of the project within the expected time.

The second phase of disbursement will be originated after the completion of foundation works of the proposed three 2-family properties.

The Third phase of disbursement will be originated after full installation of the doors, windows, and superstructures of the proposed three 2-family properties.

The combination loan is to assist the developer finish the proposed development and sales of constructed properties as soon as possible to ensure the success of project as well as the repayment of loan.

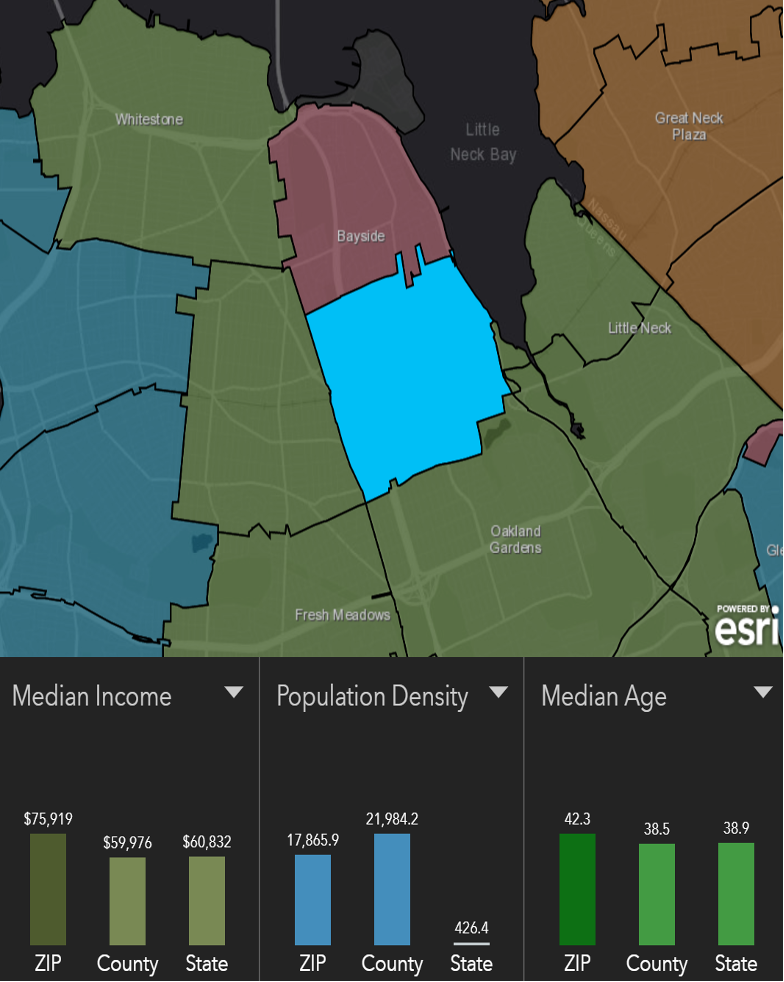

Demographics:

| Zip Code 11361 | |

|---|---|

| Regional Population | 27,246 |

| Median Age | 43.3 |

| High School Edu or Above | 88.0% |

| Ethnics | Asian & White |

| Family Median Income | $75,919 |

| Occupancy Rate | 90% |

| Child-Bearing Family | 31% |

| Average Family Size | 2.67 |

| Primary Residence | 57.4% |

The population in this area is dominated by Asian and white, and Chinese and Korean have high proportion among Asian population. The major residents are white-collar workers who constitute middle-class families with a median household income of $75,919.

The residents in the zip code are mainly middle-aged population, with an average age of 43.3-year-old; most families are married and have a child, with an average family size of 2.67.

The primary residence rate in the area is relatively high at a rate of 57.4%. The residential sale and rental markets has been very active due to its school district.

The communities in the area have a century of history, and the local living atmosphere is harmonious.

In recent years, many Chinese immigrants have migrated into the region, causing the development of supporting living facilities being accelerated.

* DATA: United States Zip Codes. Org. & Esri Zip Code Lookup,Oct 2020

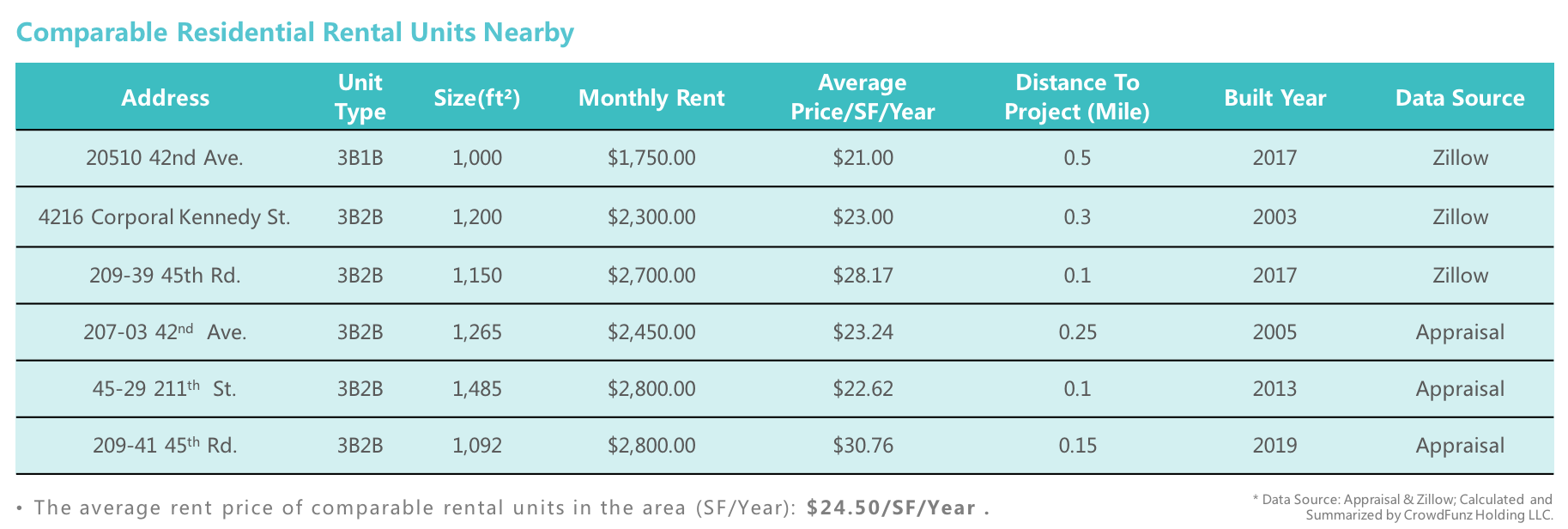

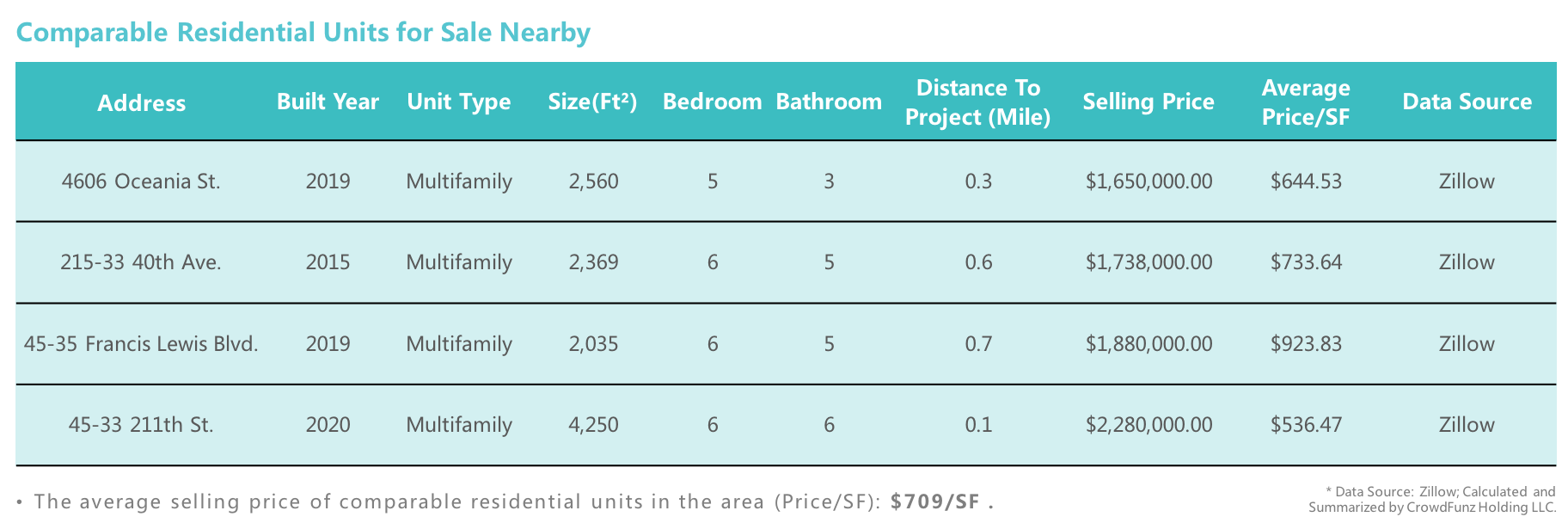

Residential Properties Nearby

The average selling price of residential properties in the Bayside area has fluctuated slightly in recent years due to the huge difference in transaction prices between newly built properties and the resale of old properties; compared to the sales market, the residential rental market has more stable performance. The excellent school district has attracted new middle-class families to settle down in the communities.

In the past decade, new immigrants settled in this area are mainly Asian population, bringing vitality to the communities. The average household income in the area exceeds the average of New York City’s, leading the dry power of stronger local developments.

In 2020, the Bayside housing market was barely affected by the pandemic, the sales price of residential properties has been increased sharply. This may be attributed to the trend that New Yorkers are moving out of the urban area which triggers suburbanization effect. Backed by its good school district, Bayside neighborhoods have certain potential on residential property appreciation.

* Data: StreetEasy,Oct 2020.

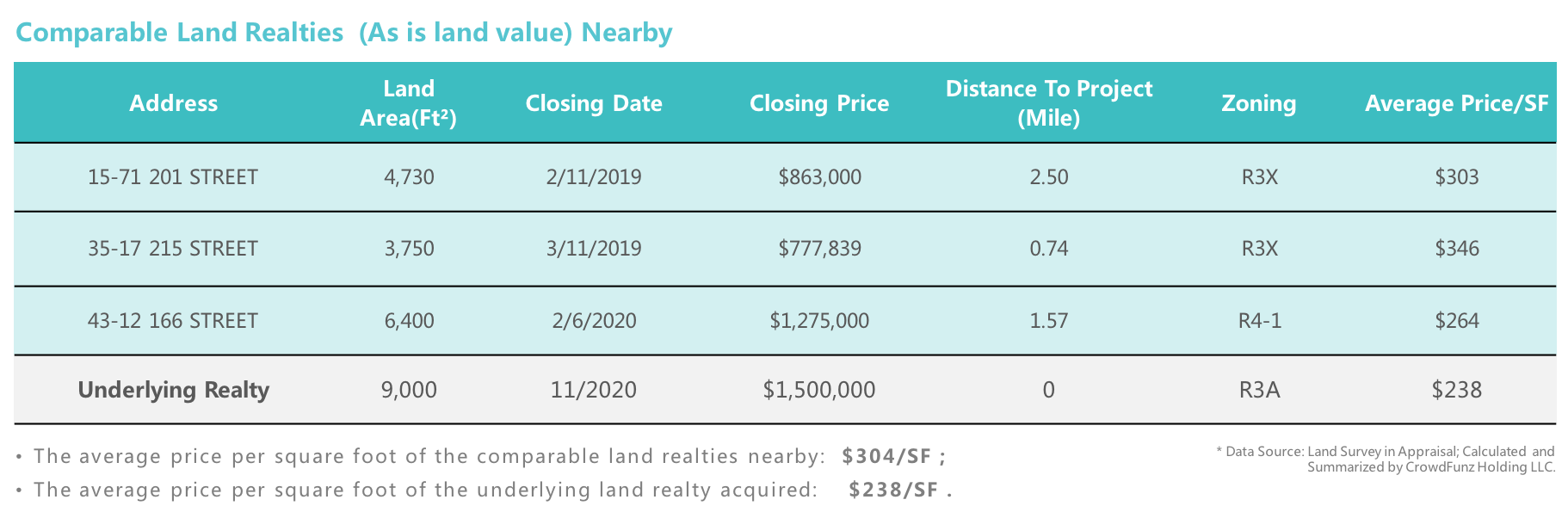

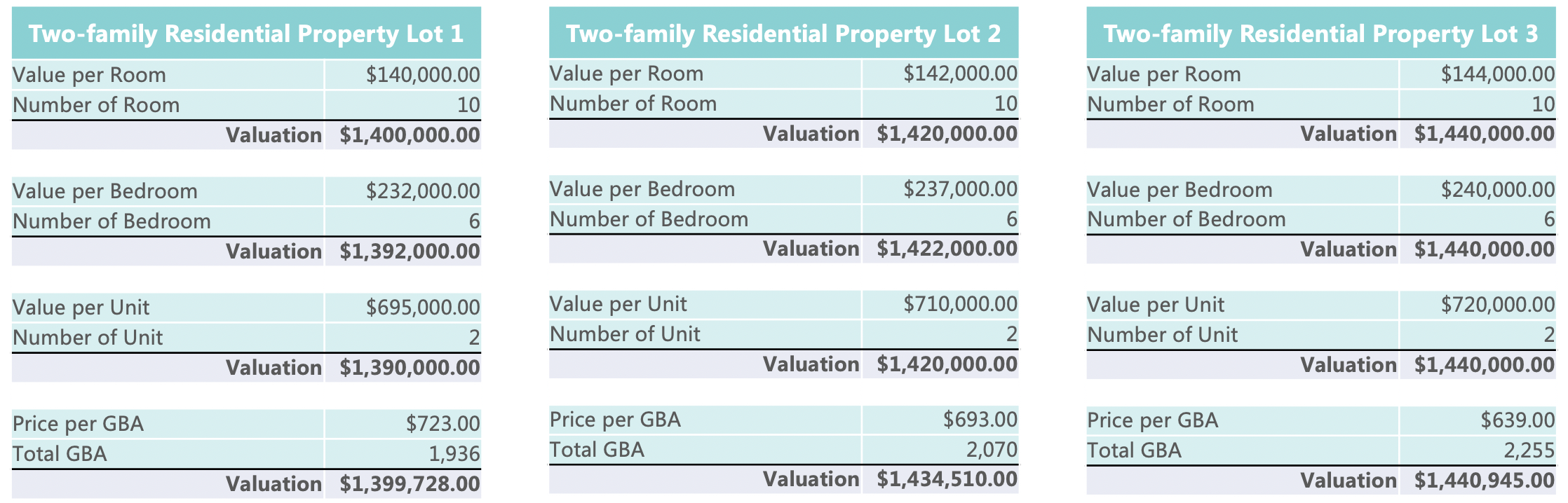

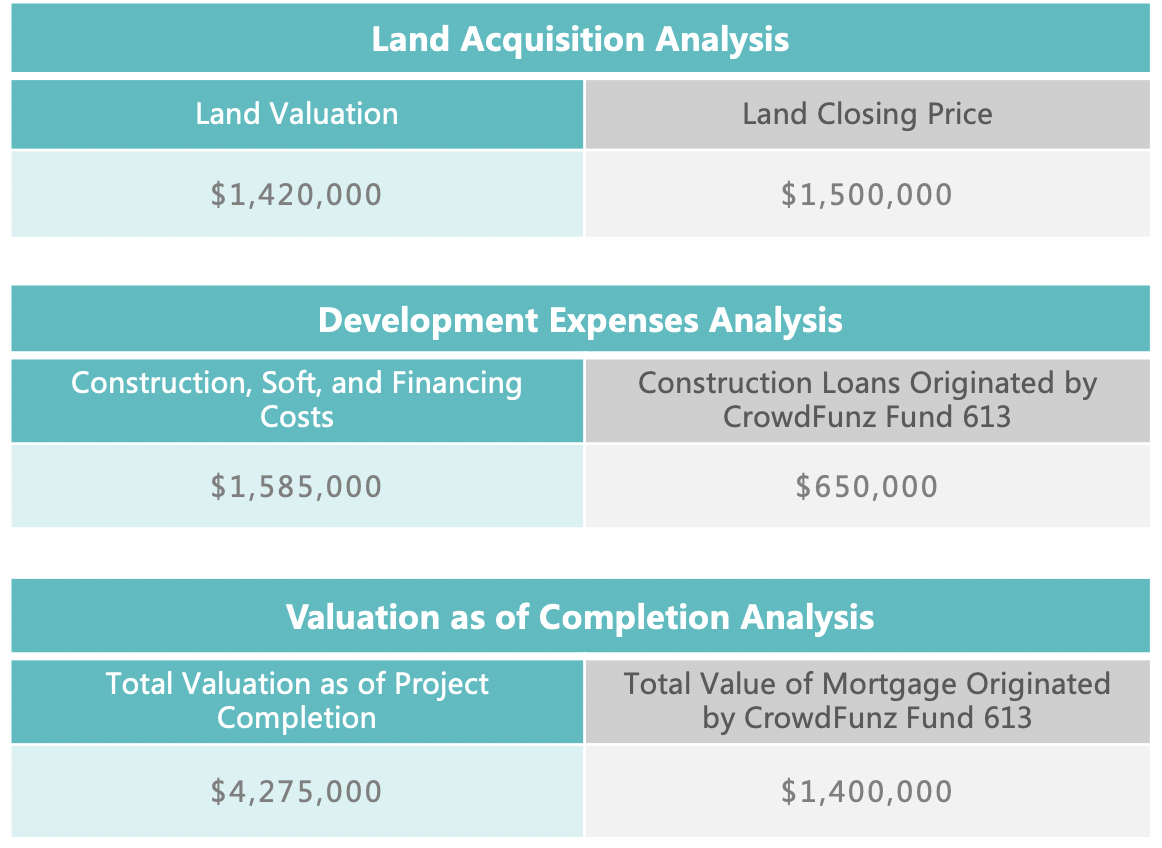

Valuation Analysis of 3 Proposed Two-family Residential Properties:

According to the appraisal, the valuation of the 3 lots in the underlying project is as follows:

- Valuation of Proposed Two-family Residential Property on Lot 1: $1,399,728.00; Price per GBA: $723/SF ;

- Valuation of Proposed Two-family Residential Property on Lot 2: $1,434,510.00; Price per GBA: $693/SF;

- Valuation of Proposed Two-family Residential Property on Lot 3: $1,440,945.00; Price per GBA: $639/SF .

Valuation and Financing Analysis of the Proposed Development:

According to the appraisal and the data collected by CrowdFunz, the summary of valuation and financing analysis is as follows:

- The actual closing price of the land is close to the valuation in the land appraisal, which is in line with market expectations. The mortgage originated by CrowdFunz Fund 613 holds a position of 50% Loan-to-cost (LTC) ratio, and the market price of the collateral is two times of the loan.

- After starting the construction, the two construction loans disbursed by CrowdFunz Fund 613 will be weighted as 41% of the total development costs (including construction costs, soft costs, and financing costs), with effectively controlled investment risk.

- Based on the valuation provided by the third-party appraisal, after the completion of the development, whether in terms of rental income approach or sales comparison approach, the total value of the three two-family properties is estimated to be $4.27 million. As of project completion, the total amount of mortgage originated by CrowdFunz Fund 613 will only lead to a Loan-to-Value (LTV) ratio of 32.75%. The property value is supposed to be sufficient, and the repayment ability of the mortgage is optimistic.

Geographic Location:

The site is close to Queens Blvd. and located in the core area of Bayside, the northeast area of Queens, New York. The geographical location is convenient, with 5-minute walking distance to LIRR train station; 25-minute by train to reach Penn Station in Manhattan; 5-minute walking distance to the bus station, accessible to Main Street, Flushing, Little Neck, Great Neck, and other areas in Queens and Long Island. The crime rate in Bayside is low, and the community is friendly and safe.

Transportation:

Subway: 7(Flushing Main Street)

Bus: Q12, Q13, Q28, Q31, n20G, etc.

Train: Port Washington, Penn Station, etc.

To Manhattan Midtown: 13-16 Miles (About 45-min Driving)

To JFK Airport: 12.5 Miles(About 30-min Driving)

To LaGuardia Airport: 6.1 Miles(About 25-min Driving)

Schools:

Bayside area is the New York's 26th School District, which ranks among the top of the city’s. The schools like PS41, PS130, and PS205 in the district have high education quality and good studying atmosphere. The K-12 schools in Bayside area also have good reputation on teaching quality. The schools in Bayside have attracted many middle-class Asian families to settle down in the nearby communities.

Diet & Living:

The communities in Bayside are matured. The surrounding area covers many living facilities, which is extremely convenient to satisfy the residents’ needs of daily life. Chinese and Korean restaurants are scattered around the communities, and It only takes 15-minute driving to the core area of Flushing, offering more dining and shopping options for the residents.

Recreation:

Alley Pond Park, the New York’s largest wetland park, is close to Bayside. Two other large parks, Fort Totten Park and Crocheron Park, are also located in the area. There are two AMC movie theaters within 15-minute driving distance to the site, and there are many large gyms, golf courses, and basketball courts within 3 miles, offering wide options for recreation.

Developer Company: 3T Construction Inc.

Website: http://www.3t3t.com/

3T Construction Inc. was established over two decades, focusing on residential and mixed-used properties. The prior successful projects completed by the developer include 98 East Broadway, East West Tower, Rego Park Plaza, Union Turnpike Mansion, Parsons Twin Tower, LIC Manor Condo, and Shangri-La LIC Condo. Those projects are located in Queens, Manhattan Chinatown, and other areas in New York City.

At present, 3T Construction Inc. has developed and held tens of thousands of square feet in its properties, and the total value of the developed projects has exceeded 100 million US dollars. The company has extensive local experience in developing residential and mixed-used properties and understands the local real estate market in New York. It is also good at project management and has a good reputation in the industry.

Successful Projects By Developer:

CrowdFunz Fund 613 will replace the function of commercial bank in this project, providing a combination loan to fulfill the financing needs during the entire development. The fast loan processing availability and reasonable interest rate will help the developer accelerate the construction processes and achieve the completion of proposed properties in a short-to-medium term.

From acquiring land to construction stages, the amounts of loans originated by CrowdFunz Fund 613 are strictly controlled under 50% of Loan-to-Cost (LTC) ratio, aligning with the basic risk management standards of lending institutions. The disbursements of following construction loans will be revied and adjusted in accordance with the actual construction process and construction quality completed by the developer, ensuring the lending risk be controlled within a rational range.

In recent years, the developments of small two-family residential properties have been booming in Bayside not only due to the current condition of neighborhoods but the surging demands on investing in real properties in good school districts. More Asian buyers are driving the potential appreciation of residential properties backed by their investment purposes.

Based on the developer’s decent track records of development experience and financing credibility, CrowdFunz believes that the proposed properties in this project will meet market demands, and the developer has the ability to achieve the project completion, property sales, and the repayment of borrowed debt.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-3 Years | 3-5 Years | 5-10 Years | 10-15 Years | 15+ Years |

| Tracking Record | 0-3M | 3-10M | 10-30M | 30-50M | 50M+ |

| Credit Score | Low | Accept | Fair | Good | Excellent |

| Financials | |||||

| Investor Equity | 1-20% | 20-30% | 30-40% | 40-50% | 50-60% |

| Loan-to-cost ratio | 85-100% | 70%-85% | 65%-70% | 50-65% | 1-50% |

| Financial claims | Common Equity | Preferred Equity | Equity pledge debt | Secondary lien debt | First lien debt |

| Location | |||||

| Location | Sub Rural | Rural | Regional center | Suburban | Core Urban |

| Walk Score | <40 | 40-55 | 55-70 | 70-85 | 85-100 |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Status | |||||

| Development Phase | 0-20% | 20-40% | 40-60% | 60-80% | 80-100% |

| Property as Collateral | No | Extremely insufficient | Relatively insufficient | Relatively sufficient | Extremely sufficient |

| Investment Term | >48 Months | 37-48 Months | 25-36 Months | 13-24 Months | <12 Months |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)