First Lien Mortgage Fund 614

Type: Debt

Target: $1,400,000

Annual Return: 7% - 7.25%

Min-invest Amount: $10,000

Duration: 6 - 24 Months

Offering Amount: $1,400,000 U.S. Dollars

Estimated Return: 7.00% - 7.25% Annualized Return*1

Investment Type: First Lien Mortgage*1

Unit Price: $10,000 per Subscription Unit

Offering Date: June 2021

Investment Horizon: 6 - 24 Months

Dividend Schedule: Prepaid before per Period(6 Months in advance first then 3 Months per Prepaid)

*1 7% Annualized Return for Investment of 1-19 Units;7.25% Annualized Return for investment above 20 Units

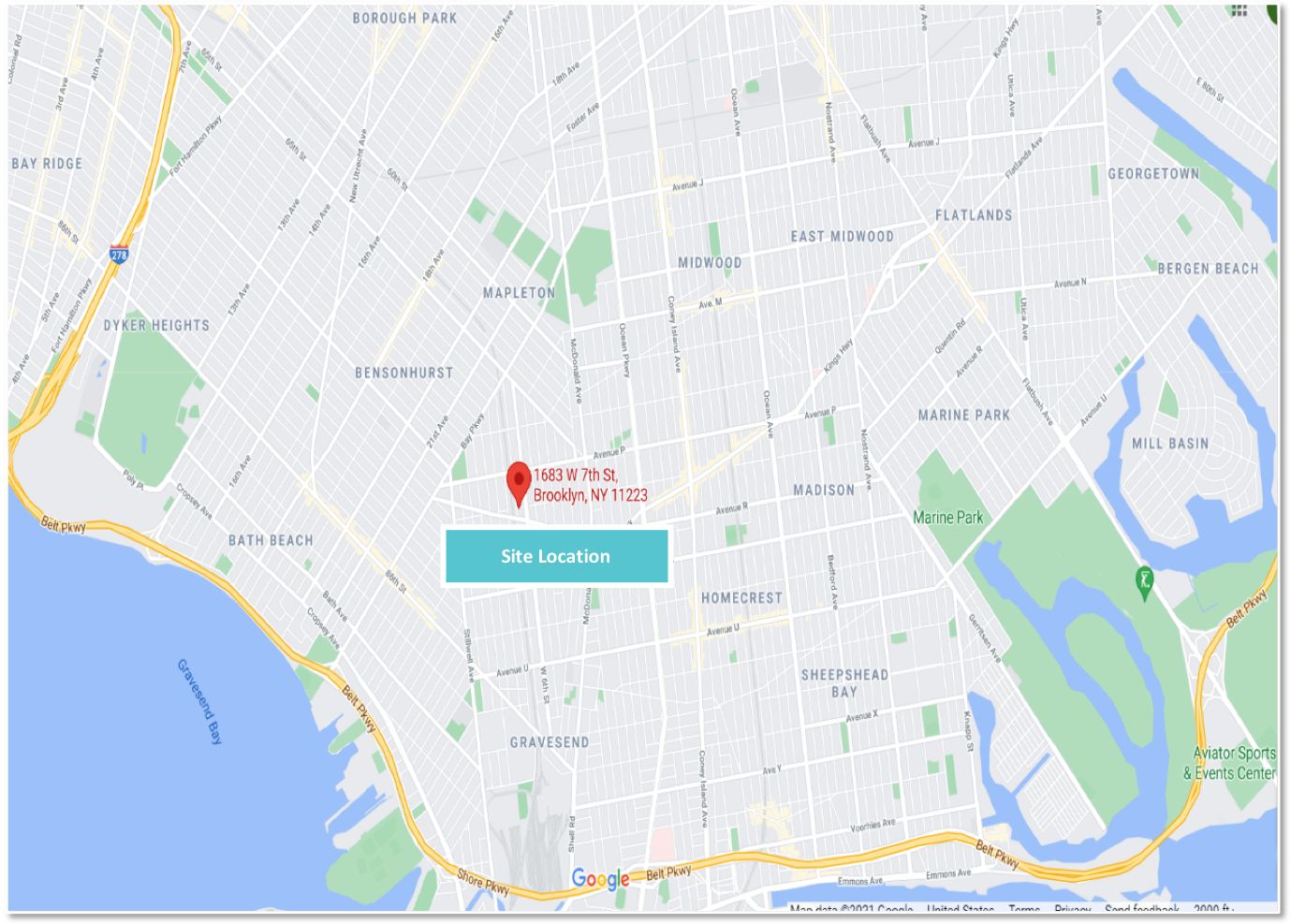

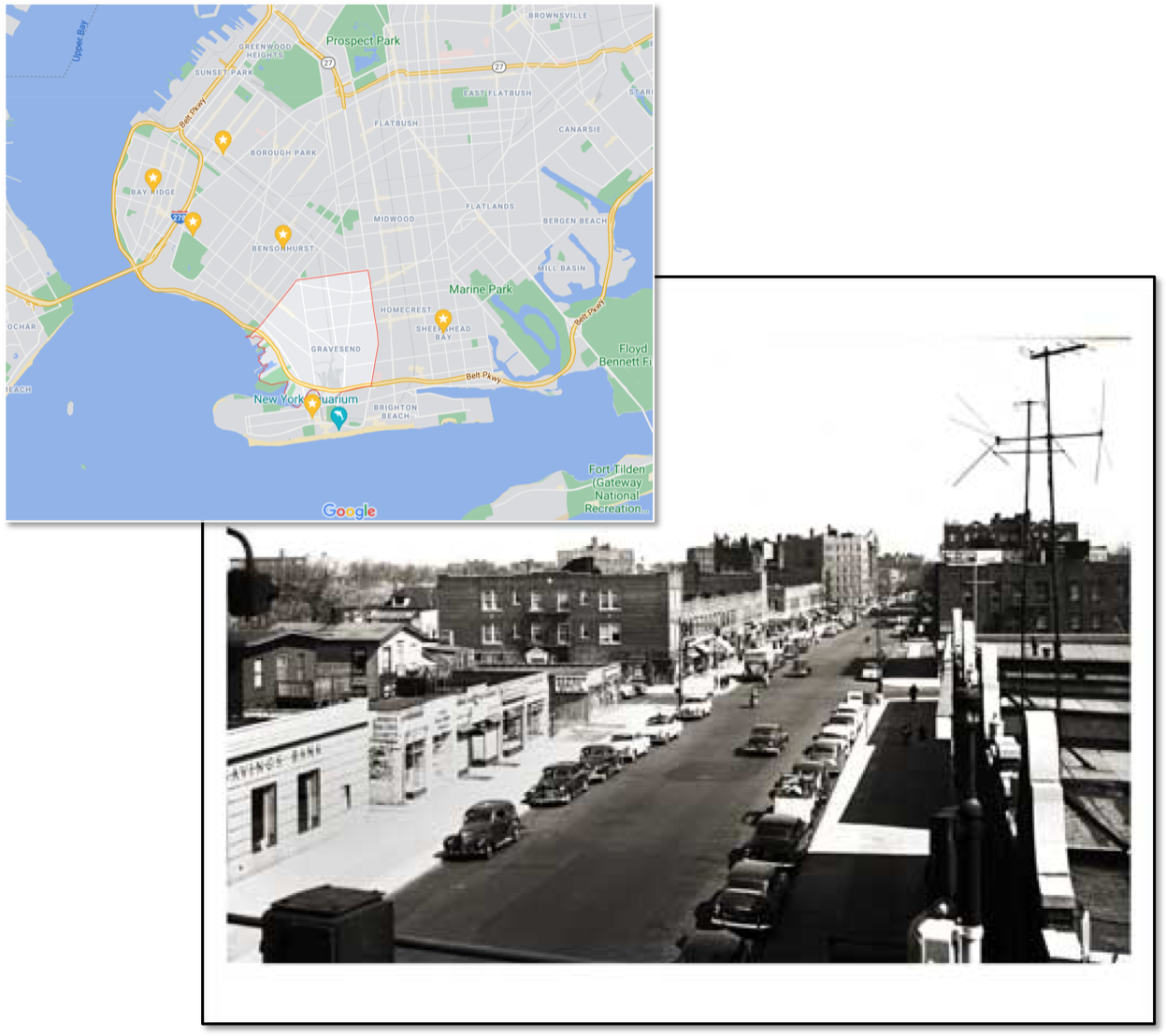

Address: 1683 W 7th St. Brooklyn, NY, 11223

Area: Sheepshead Bay, Brooklyn, New York

Lot Size: 2,050 Square Feet(20.5 Ft. x 100 Ft.)

Zoning: R7A(FAR=4)

Land Closing Cost: $1,150,000 U.S. Dollars

Land Closing Date: June 24th, 2014

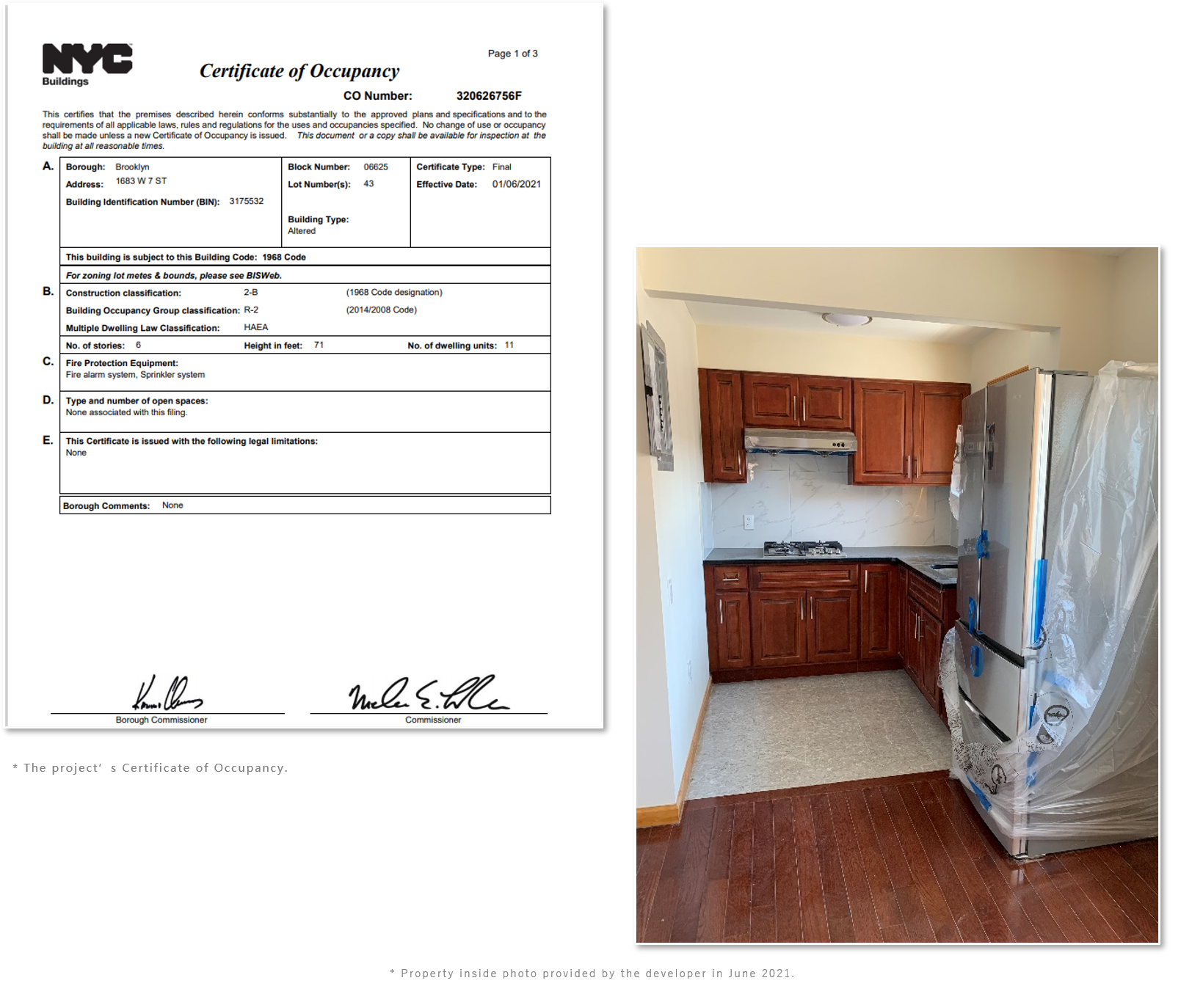

The developer bought the land and started the project construction in 2013. In July 2018, the completed property obtained the Certificate of Occupancy and started its operations.

The project is in the traditional prime neighborhood. As a corner lot, its size is 2,050 square feet with a 6-floor residential building in total of 9,579 square feet buildable size. There are 11 condominiums (1 of 1B1B; 10of 2B1Bs) in the property, and it has obtained the Certificate of Occupancy from Dept. of Building, New York. Currently, the project has completed all construction works and been waiting for the approval of Condo Book. After the approval, unit sales shall be started immediately, and the proceeds of sales will be used to pay back the mortgage issued by CrowdFunz Fund 614.

The architectural design and units planning of the project fit local buyers’ needs. The major unit is small economical two-bedroom condo that provides 600 more square feet. The average salable price of unit is $470,000, which is suitable for self-living or rent-generating investment.

The surrounding community has demographics mainly from white and Asian races; various living facilities are well-developed in the area. Supermarkets, Delis, restaurants, and cafes also surround the property. For transportation, subway station of line N & Q is just one block away. The property is close to King Hwy., one of Brooklyn’s major streets, and it only takes 10-min walking to Ave U, which is covered by Asian stores that have great attraction for Chinese buyers.

| Expected Dividend Calendar | |||||

|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | No Later than 7/14/2021 | 6/30/2021 | 12/29/2021 *2 | 6 Months | Pre-paid Dividend |

| Second | No Later than 1/14/2022 | 12/30/2021 | 3/29/2022 | 3 Months | Extension Option Owned by Developer |

| Third | No Later than 4/14/2022 | 3/30/2021 | 6/29/2022 | 3 Months | Extension Option Owned by Developer |

| Fourth | No Later than 7/14/2022 | 6/30/2022 | 9/29/2022 | 3 Months | Extension Option Owned by Developer |

| Fifth | No Later than 10/14/2022 | 9/30/2022 | 12/29/2022 | 3 Months | Extension Option Owned by Developer |

| Sixth | No Later than 1/14/2023 | 12/30/2022 | 3/29/2023 | 3 Months | Extension Option Owned by Developer |

| Seventh | No Later than 4/14/2023 | 3/30/2023 | 6/29/2023 | 3 Months | Extension Option Owned by Developer |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After the expiration of the first Dividend Period, the developer has 6 options to extend the borrowing 3 months. If the developer chooses to extend, the investors will receive dividends at the same rate of return during the extension.

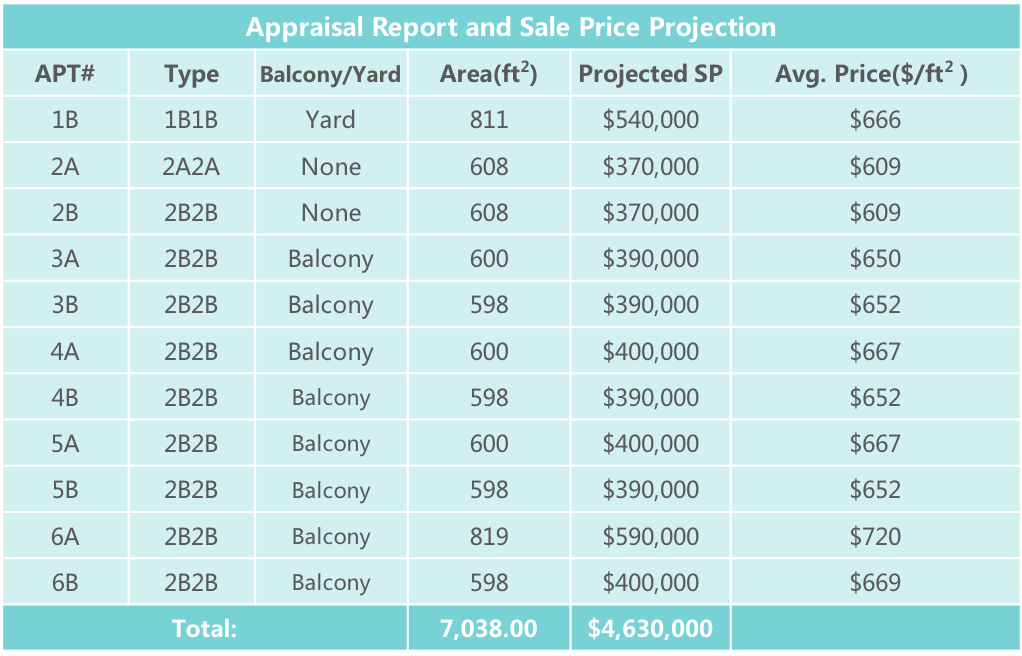

Sufficient Value in the Collateral

According to the third-party appraisal provided by RCI Appraisal Corp. in June 2021, the total value of the property is, $4,630,000 as is condominium building, or $3,220,000 as is rental apartment building.

The developer has invested over $2,400,000 for land acquisition and holistic construction expenses. After obtaining the $1,400,000 mortgage issued by CrowdFunz Fund 614, the project’s LTC will be 36.85%, and LTV will be 30.23%.

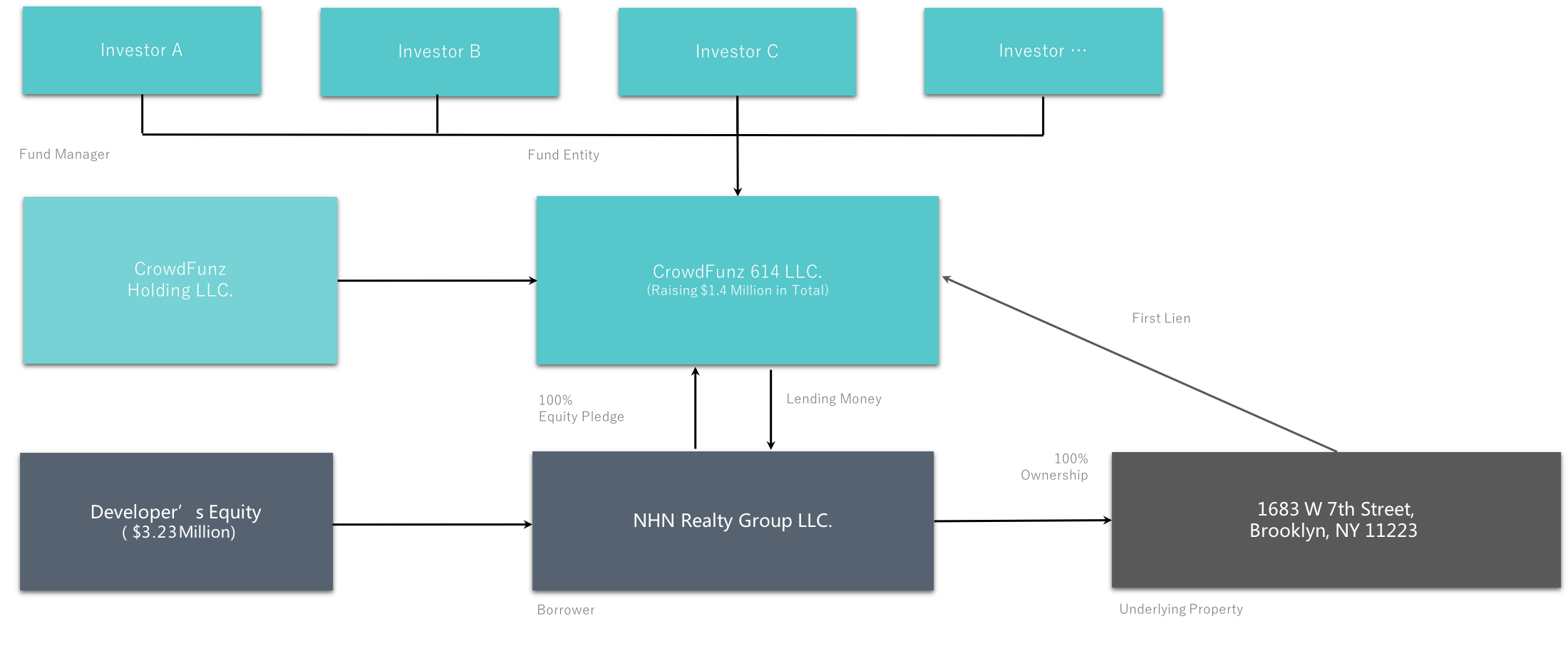

CrowdFunz Fund 614 has triple protections:1. the mortgaged property itself with first lien title; 2. 100% ownership interests of the project entity pledged by developer; 3. unlimited personal guarantee provided by key person of the developer.

Prime Location, In Demand Market

The project is located close to King Hwy. with only 1-min walking distance to the subway station. Multiple subway lines like N, Q, and W are accessible to directly reach Queens, Staten Island, and Manhattan. Subway lines D and F are also available for reaching other transport nexuses. Nearby bus lines include B82, B4, and B6. It takes 30-min driving to JFK airport.

In recent years, there are growing demands of condo and rental units in Sheepshead Bays area. Even during the pandemic, local pricing was still stable. According to the data from Property Shark, the median price of residential units in the zip code area is currently $631,000; According to the data from StreetEasy, the median price of rental units is $1,775 per month.

Transparent Fund Usage, Explicit Exit Strategy

The mortgage provided by CrowdFunz Fund 614 will be paid off based on the sale progress.

The total $1,400,000 loan will be distributed to the developer at once to help pay off the current construction loan.

Condo Book is expected to be obtained within 6-8 months. . After obtaining the approval, the developer will be able to pay off the loan by selling 3 to 4 condo units.

Seasoned Developer with Approved Experience

The developer has over 10 years of local market experience, and his projects are mainly located in Brooklyn, New York. The prior experience helps the developer accurately understand market demands.

CrowdFunz Fund 614 is the second fund that CrowdFunz cooperates with the developer. In the last cooperation, CrowdFunz already confirmed its project management skills. We believe that CrowdFunz Fund 614 will be the continuation of success for both parties.

| Capital Stack | Percentage | |

|---|---|---|

| Mortgage issued by CrowdFunz Fund 614 | $1,400,000 | 30.23% |

| Developer’s Equity | 3,230,000 | 69.76% |

| Total | $4,630,000 | 100.00% |

After the mortgage issued by CrowdFunz Fund 614 contributes to this project, the capital stack will consist of: $1,400,000 mortgage originated by CrowdFunz Fund 614, counted 30.23% of total value; developer’s equity worth $3,230,000, counted 69.76% of total value.

The mortgage issued by CrowdFunz Fund 614 will have the first lien, and in addition, 100% ownership interests pledged as well as unlimited personal guarantee from key person of the developer.

| Mortgage Usage | Percentage | |

|---|---|---|

| Pay-off Construction Loan | $1,050,000 | 75.00% |

| Property Tax | 150,000 | 10.71% |

| Financial & Operations | 200,000 | 14.29% |

| Total | $1,400,000 | 100% |

The $1,400,000 mortgage originated by CrowdFunz will be used for: 1. paying off construction loan by spending $1,050,000; 2. paying property tax by spending $150,000; 3. paying financial and operations expenses by spending $200,000.

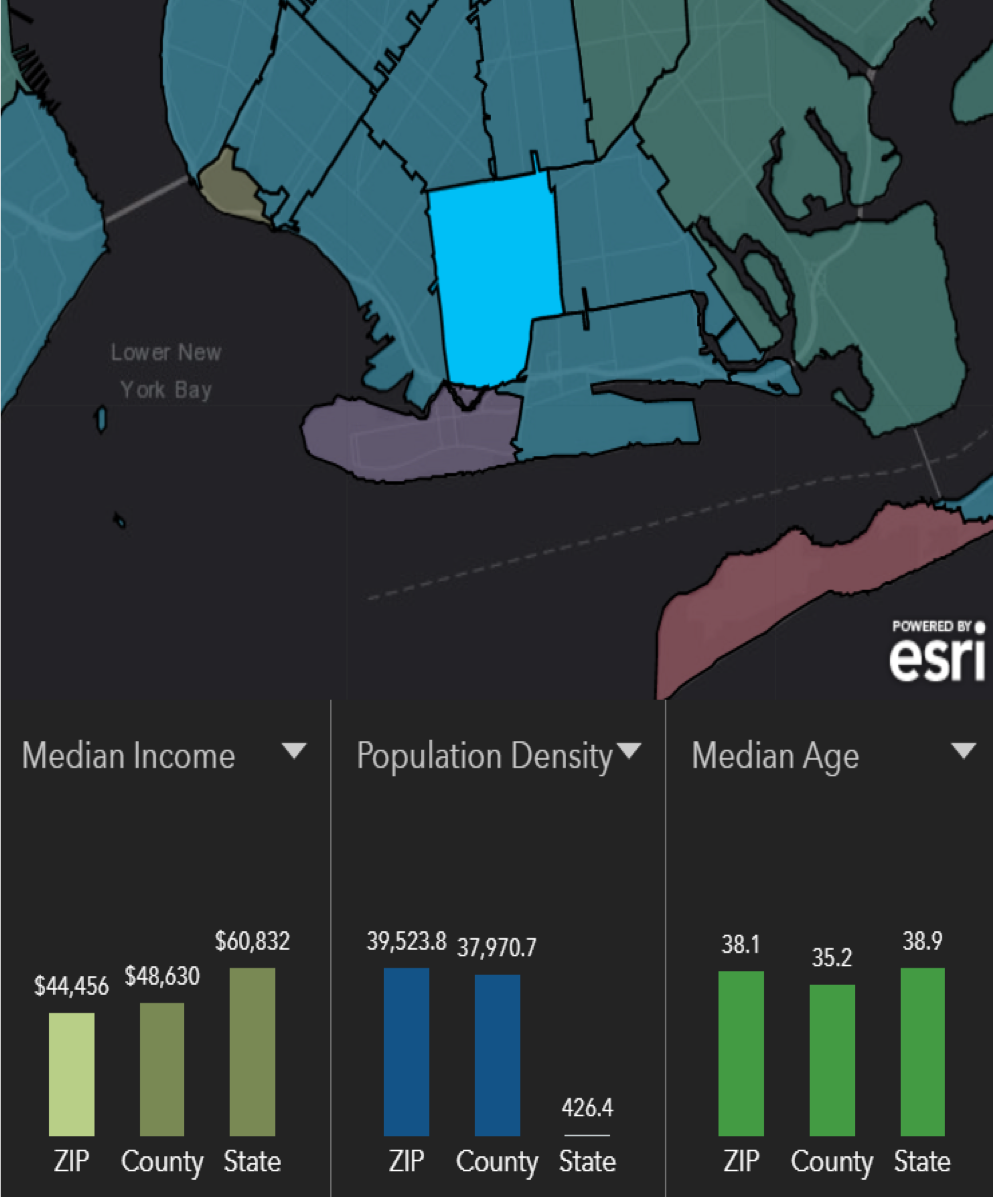

Demographics in the Zip code:

| Zip Code 11223 | |

|---|---|

| Regional Population | 39,523 |

| Median Age | 38.1 |

| High Diploma and Above | 46.4% |

| Racial Demographics | White and Asian based |

| Median Family Income | $44,456 |

| Family with Children | 32% |

| Average Household Size | 3 |

| Rental Housing Percentage | 58% |

Most in the population are White and Asian; middle- and lower-income families, working in service and education-based industries, are the primary residents; according to Esri, the area average median income is $44,456.

The area population’s average age is 37; almost 50% of the population are married, and the average household size is 3; 32% of families have children living with them.

Rental is the primarily housing type, counted 58% of the market; the rest 29% belongs to self-occupied houses;

Compared with Brooklyn’s other regions, the community embeds more friendly and lively culture.

Due to increasing Asian population, the zip code area has booming local businesses. With momentum and market demands, the area shows its business opportunities.

* Data Source: United States Zip Codes. Org., Esri Zip Code Lookup & US Census Gov, June 2021.

Surrounding Area Analysis

The zip code area is called Gravesend. Compared to 2010’s level, its median asking price has almost doubled. One possible cause is that Gravesend has received NYC’s affordable housing budgets thus in turn eased many residents’ rental pressure; the other reasons might be attributed to Gravesend’s geographical location and its attractive housing rent. Recently, the area has attracted many working-class adults.

In addition, Whites and Asians have brought many business opportunities into the area. As a result, the surrounding infrastructures along with living facilities have sprung up.

During 2021, although impacted by the pandemic, Gravesend’s housing price and housing rent stayed stable. Also, due to construction delays, the area demand far exceeds housing supply which brings attractive investment opportunities.

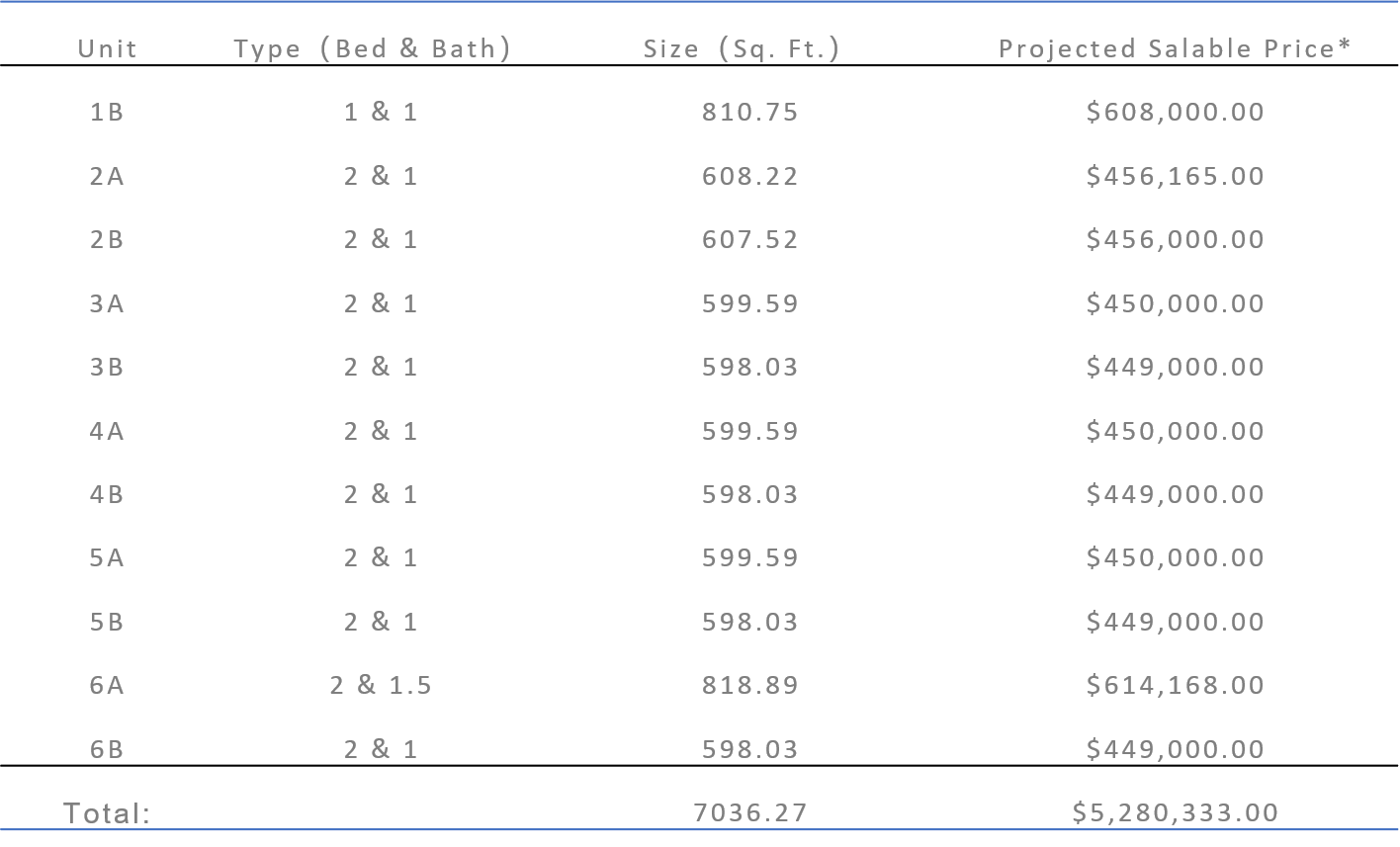

Property Valuation Analysis, Considering It as Condominium Building:

The chart below lists the details of projected unit selling prices:

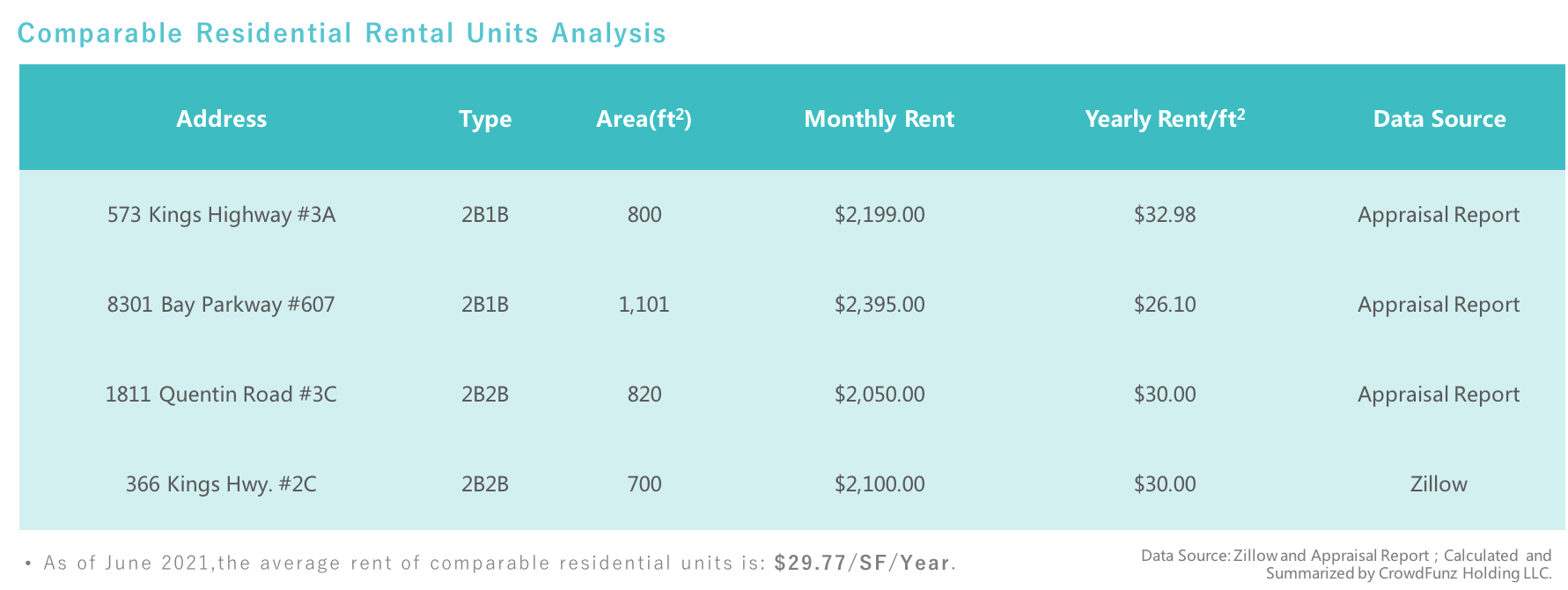

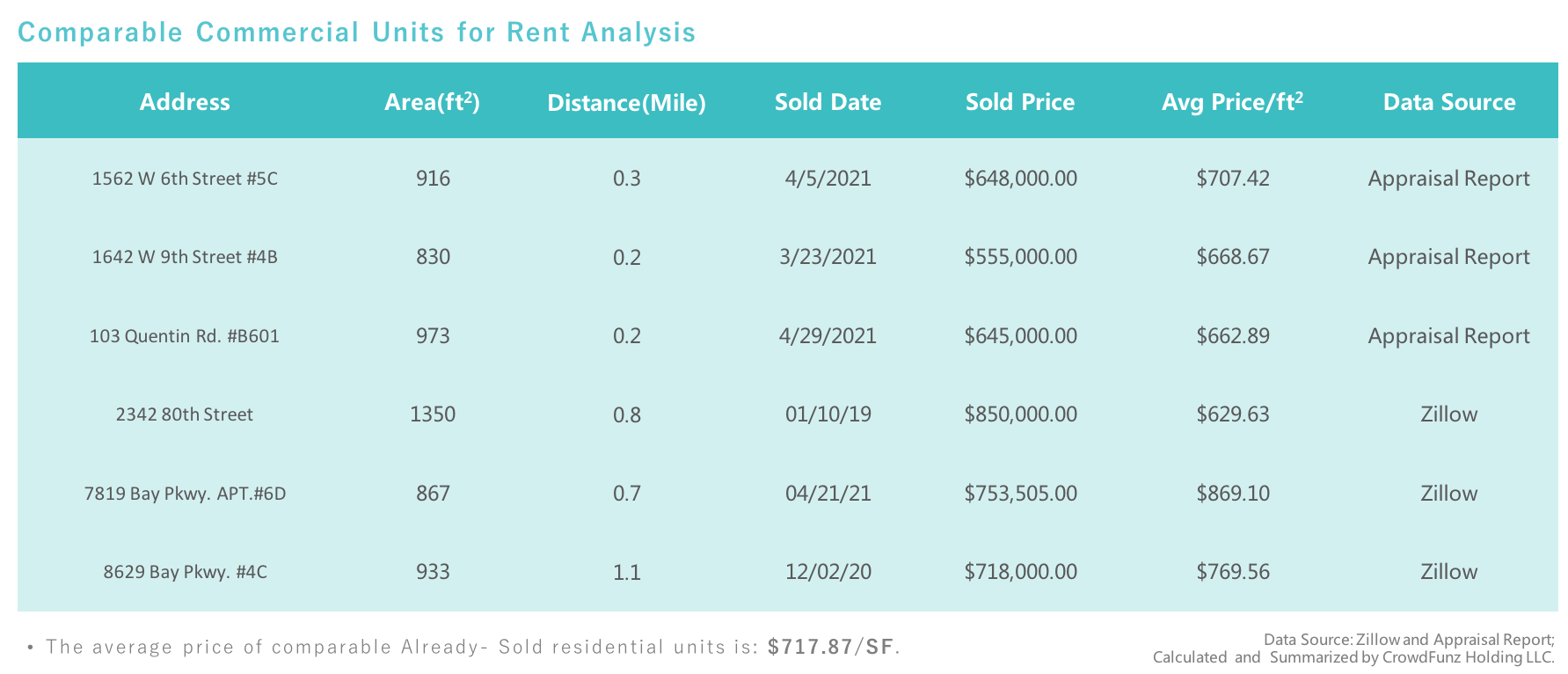

According to Appraisal Report and comparable housing market data, the nearby comparable residential units for-sale have an average price of $623/ft2;

According to CrowdFunz Independent analysis, after pandemic, the identical similar residential units for-sale have an average price of $710/ft2;

The current comparable residential units sold have an average selling price of $738/ft2;

Considering the above three sets of price, CrowdFunz believes that the property valuation presented by the appraisal report is rational.

Considering the collaterals in this lending, CrowdFunz believes that Fund 614 has relative low investment risks.

Location:

The project is in the Sheepshead Bay region, the southwest corner of Brooklyn, New York. The site has only 1-min walking distance to the Kings Highway subway station and 30–min subway transit to Manhattan downtown. East New York Train Station and Ocean Pkwy. are also close to the site.

Transportation:

Subway: N、Q、R (Kings Highway)

Bus: B82、B4、B6

Train: East New York to Jamaica

To Midtown Manhattan: 12 Miles (About 35-min Driving)

To JFK Airport: 13.6 Miles (About 25-min Driving)

To LGA Airport: 19.6 Miles (About 40-min Driving)

Nearby Schools:

The property is assigned to NY 21st School District. The 21st school district has moderately better educational quality and academic cultures. In addition, according to the information from Greatschools.org, nearby schools such as PS101, PS97, and Brooklyn School of Inquiry have an average rating of 9, which is much higher than the area average score.

Living Facilities:

The surrounding retail circumstance enables either convenient or healthy lifestyle. Daily living facilities include groceries stores (CTown Market), banks(Chase Bank), urgent care, and gyms(Planet Fitness). Also, restaurant choices are plentiful, covering from Chinese cuisines to modern American diners.

Recreation:

The site is near the famous Marine Park which features all kinds of sporting fields including multiple golf courses. Besides beautiful parks and free spaces, residents can reach Kent movie theater within 10 minutes of driving.

Develoment Company: NHN Realty Group LLC.

Architectural Designer: Li Architect Associate, PLLC.

Construction Contractor: Lulu LJ Enterprise LLC.

NHN Realty Group LLC. is a family style small real estate developer. The company started its business from 2-3 multi-family houses and incrementally seized the demands in such niche of New York real estate market while increasing its development experience. Through years of practices, the company formed its effective project management and obtained stable returns. The company also sharpens its advantages on economical building materials, designs and customer-based construction style.

The condominium building project at 1683 W 7th St. Brooklyn, is critical for the company. It’s a milestone that NHN Realty Group dedicated to successfully transform its development capability from small multi-family houses to condominium building.

The loan originated by CrowdFunz Fund 614 is a first lien mortgage, helping the developer pay off existing construction loan and successfully fill the operational costs before the completion of condominium sales. As of June 2021, the project is waiting for the approval of Condo Book, and the developer plans to use the proceeds of sales to repay the mortgage.

The capital stack after the mortgage origination has low financial leverage and explicit structure. The Loan-to-cost and Loan-to-value ratios are all below 40%. Compared to those real estate projects under construction, we believe that the underlying project has less uncertainty,

We also believe that the location of the property and the positioning of units could reasonably support the subsequent sales of condominiums. Recently, Chinese homebuyers have rushed into the area, targeting on small and economical units; some buyers purchase those properties for rent-generating investment. Thus, CrowdFunz also believes that the underlying project has high probability to successfully achieve its sales projection.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-3 Years | 3-5 Years | 5-10 Years | 10-15 Years | 15+ Years |

| Tracking Record | 0-3M | 3-10M | 10-30M | 30-50M | 50M+ |

| Credit Score | Low | Accept | Fair | Good | Excellent |

| Financials | |||||

| Investor Equity | 1-20% | 20-30% | 30-40% | 40-50% | 50-60% |

| Loan-to-value ratio | 85-100% | 70%-85% | 65%-70% | 50-65% | 1-50% |

| Financial claims | Common Equity | Preferred Equity | Equity pledge debt | Secondary lien debt | First lien debt |

| Location | |||||

| Location | Sub Rural | Rural | Regional center | Suburban | Core Urban |

| Walk Score | <40 | 40-55 | 55-70 | 70-85 | 85-100 |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Status | |||||

| Development Phase | 0-20% | 20-40% | 40-60% | 60-80% | 80-100% |

| Property as Collateral | No | Extremely insufficient | Relatively insufficient | Relatively sufficient | Extremely sufficient |

| Investment Term | >48 Months | 37-48 Months | 25-36 Months | 13-24 Months | <12 Months |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)