Equity Pledge Debt Fund 819

Type: Debt

Target: $2,500,000

Annual Return: 8% - 8.25%

Min-invest Amount: $10,000

Duration: 12 - 24 Months

Offering Amount: $2,500,000 U.S. Dollars

Estimated Return: 8.00% - 8.25% Annualized Return*1

Investment Type: Equity Pledge Loan*1

Unit Price: $10,000 per Subscription Unit

Offering Date: June 2021

Investment Horizon: 12 - 24 Months

Dividend Schedule: Prepaid per 6 Months

*1 8.00% Annualized Return for Investment of 1-19 Units;8.25% Annualized Return for investment above 20 Units

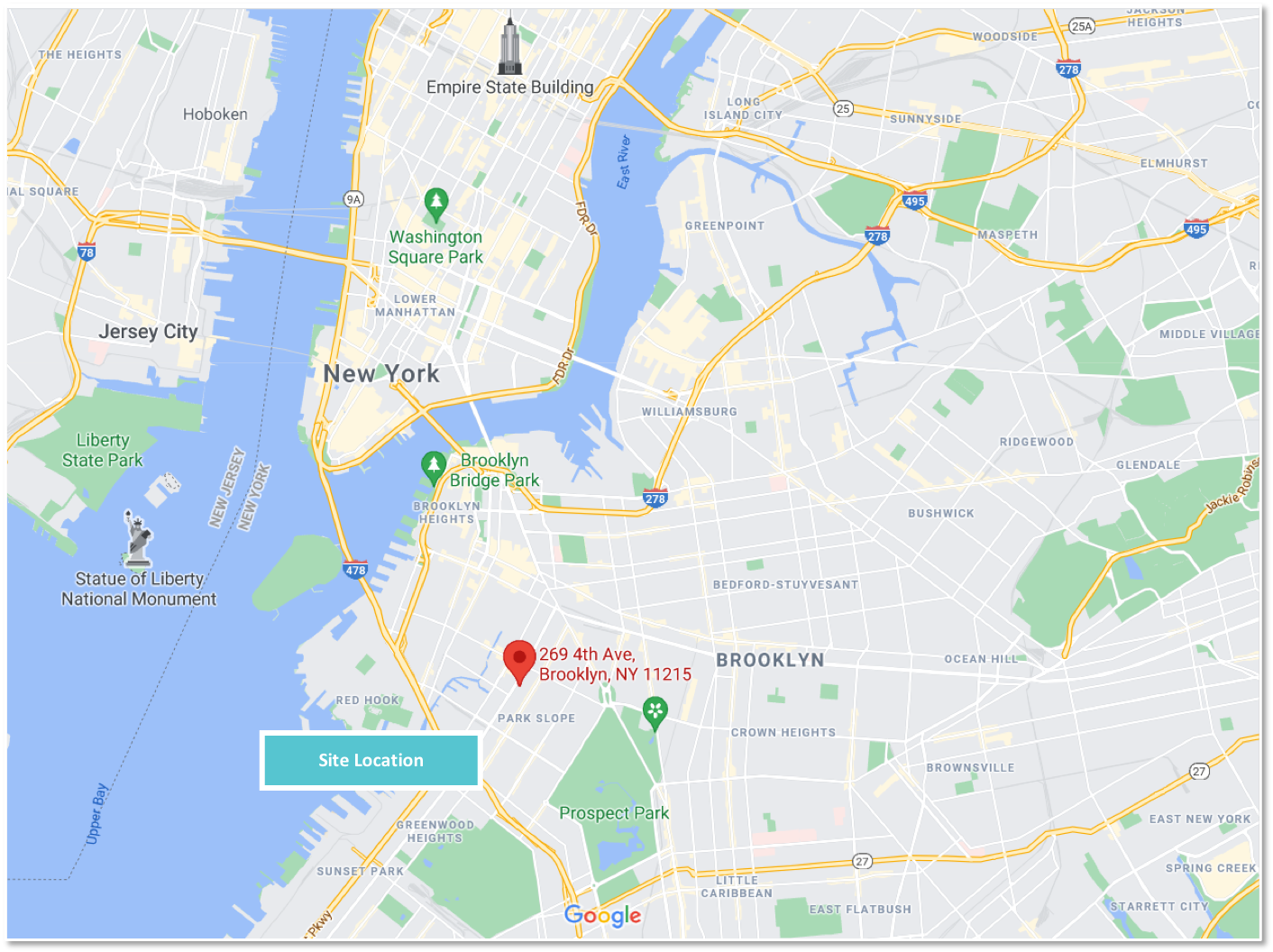

Site Address: 269 4th Avenue, Brooklyn, 11215

Site Location: Park Slope, Brooklyn, New York

Land Size: 4,840 Square Feet

Zoning: R8A(Max FAR = 6.02)

Saleable Size: 38,332 Square Feet

Buildable Size: 54,244 Square Feet

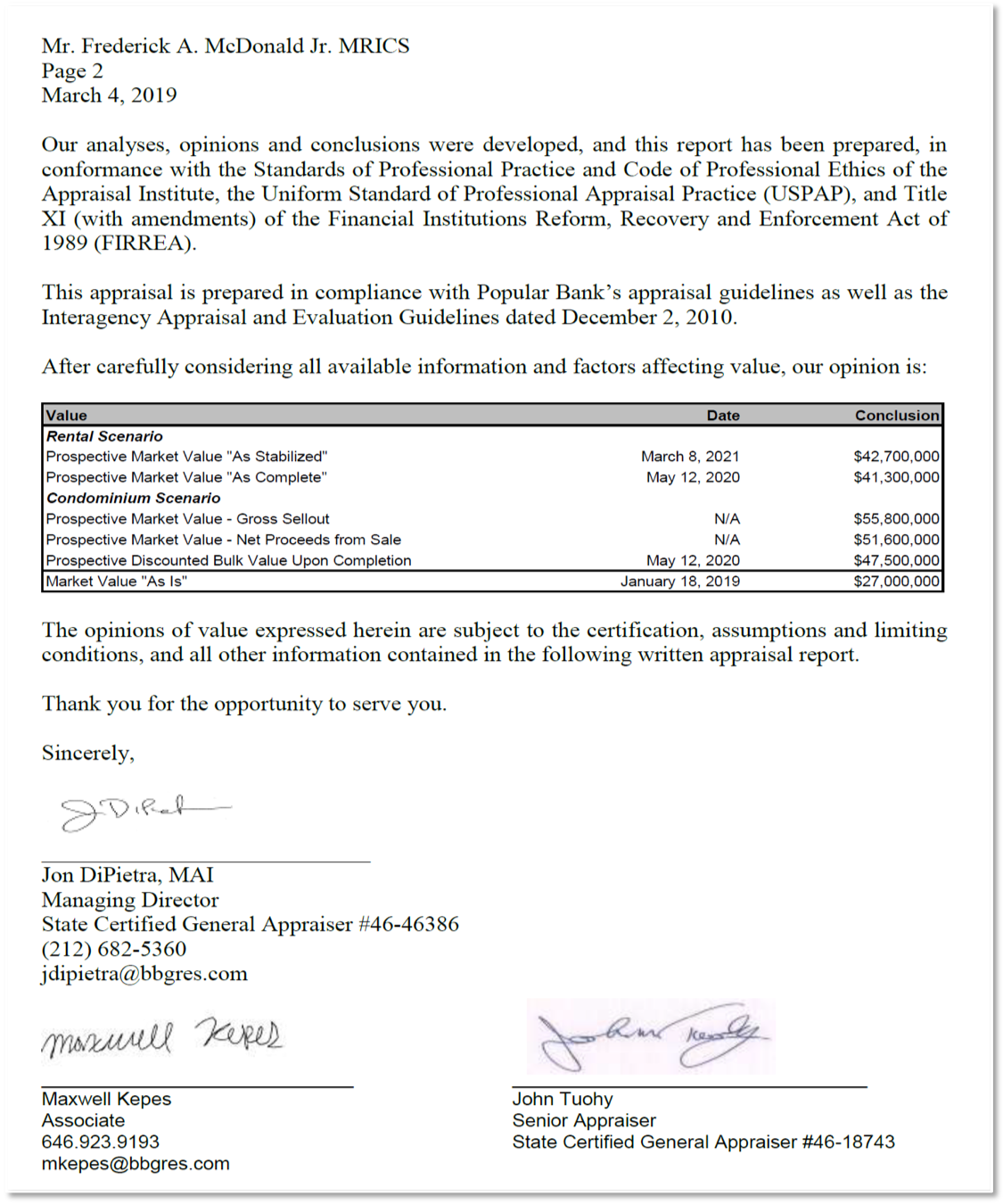

Market Value: $55,800,000 U.S.D(Based on the Appraisal provided by BBG, March 2019)

The developer purchased the land at the project site in 2013. After several years of negotiations, the adjacent land and air rights (Air Rights) were also purchased by the developer and integrated ready for larger-scale design and development.

The project’s ground-breaking was in January 2020, and its Condominium Offering Plan was filed and approved by the New York State Office of the Attorney General in April 2020. The project’s Certificate of Occupancy is expected to be obtained from the Department of Building of New York City in April 2022.

The project site location is in the Park Slope, Brooklyn, New York. The proposed property is a 12-storey complex with total 54,244 square feet buildable size, and the property contains 33 residential units and 1 commercial unit. As of June 2021, 9 of residential units had been sold, and another 5 residential units have received inquiries from home buyers. The projected sales performance is positive.

According to the appraisal report provided by BBG in March 2019, after the completion of holistic sales, the market value of the underlying property is approximately $55,800,000.00 U.S.D. As of June 2021, the developer’s cumulative paid-in capital is in total of $17,648,000.00, and the received construction loan from commercial bank is in total of $26,500,000.

According to the current construction progress, the developer expects that the completeness of the project’s construction and sales will be achieved with quality assurance and on time and has the confidence to repay the loan issued by Fund 819 Fund under projected schedule.

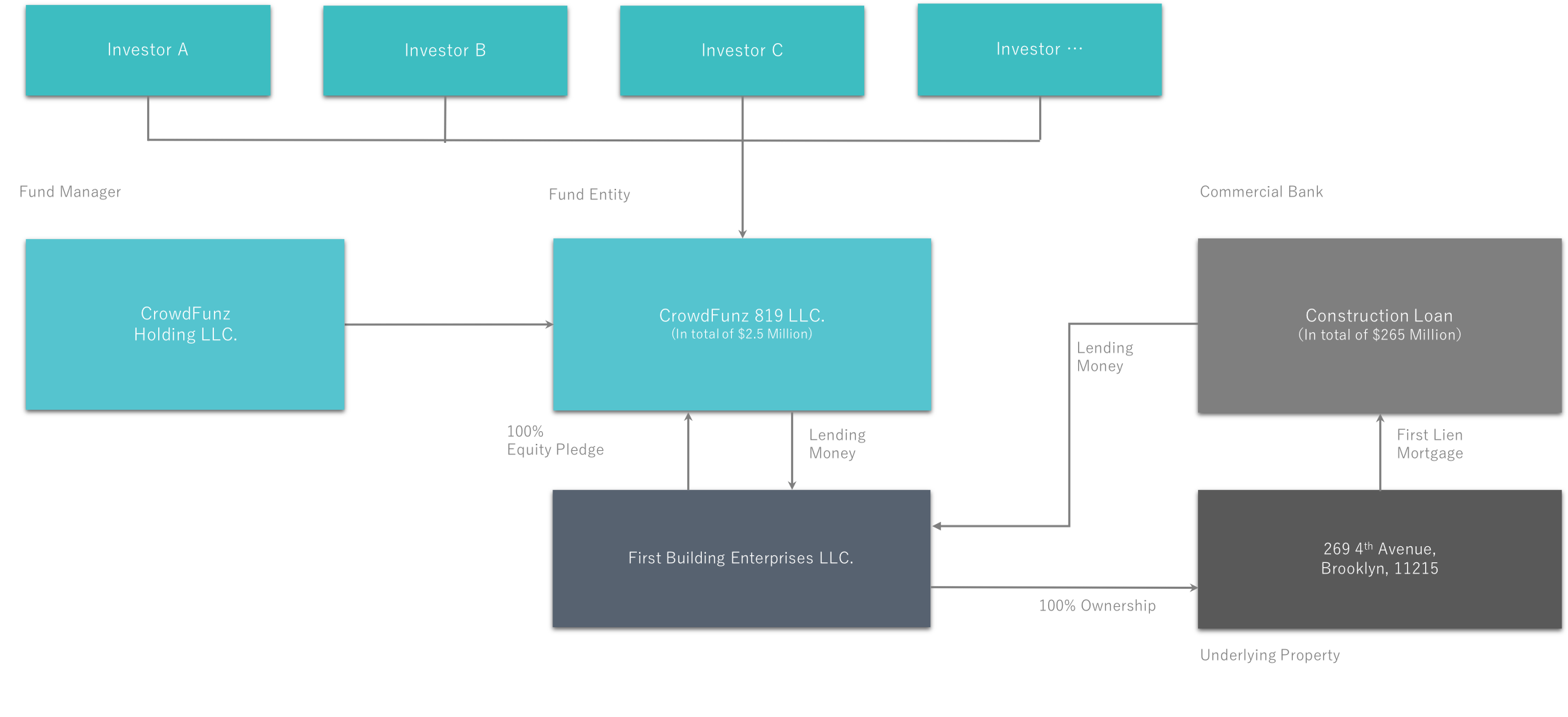

CrowdFunz Fund 819 will provide the developer a total of $2,500,000 mezzanine loan with 100% of project entity’s ownership interests pledged and unlimited personal guarantee offered by key persons of the developer.

| Expected Dividend Calendar | |||||

|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | No Later than 7/21/2021 | 7/7/2021 | 1/6/2022 *2 | 6 Months | Pre-paid Dividend |

| Second | No Later than 1/21/2022 | 1/7/2022 | 7/6/2022 | 6 Months | Pre-paid Dividend |

| Third | No Later than 7/21/2022 | 7/7/2022 | 1/6/2023 | 6 Months | Extension Option Owned by Developer |

| Fourth | No Later than 1/21/2023 | 1/7/2023 | 7/7/2023 | 6 Months | Extension Option Owned by Developer |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day;

*2 After the expiration of the second Dividend Period, the developer has 2 options to extend the borrowing 6 months. If the developer chooses to extend, the investors will receive dividends at the same rate of return during the extension.

Sufficient Value in the Collateral

According to the appraisal report provided by BBG in March 2019, after the completion of holistic sales, the market value of the underlying property is approximately $55,800,000.00 U.S.D. As of June 2021, the developer’s cumulative paid-in capital is in total of $17,648,000.00, and the received construction loan from commercial bank is in total of $26,500,000.

According to the current construction progress, the developer expects that the completeness of the project’s construction and sales will be achieved with quality assurance and on time and has the confidence to repay the loan issued by Fund 819 Fund under projected schedule.

CrowdFunz Fund 819 will provide the developer a total of $2,500,000 mezzanine loan with 100% of project entity’s ownership interests pledged and unlimited personal guarantee offered by key persons of the developer.

Prime Location, In Demand Market

The project site location is in Park Slope, a wealthy and historic community in Brooklyn. It only takes 10-minute driving from Manhattan’s Financial District to the site. The site is also close to Prospect Park which offers a beautiful surrounding environment.

The public transportation around is well-developed with dozens of subways (F, G, D, etc.) and bus lines; residents can easily reach all areas of New York. It takes 20-minute driving from the site to LaGuardia Airport and 30-minute driving to JFK Airport.

In recent years, the community has received market attention and has became one of the prime communities close to Manhattan. Due to its convenient commute, low crime rate, and developed business environment, Park Slope has attracted a large number of high-income professionals living here.

Transparent Fund Usage, Explicit Exit Strategy

Due to the increase of raw material prices and labor costs, the developer needs short-term capital liquidity to cover the extra expenses. After the holistic sales is completed, the developer will use the proceeds from the property sales to repay the loan originated by CrowdFunz Fund 819.

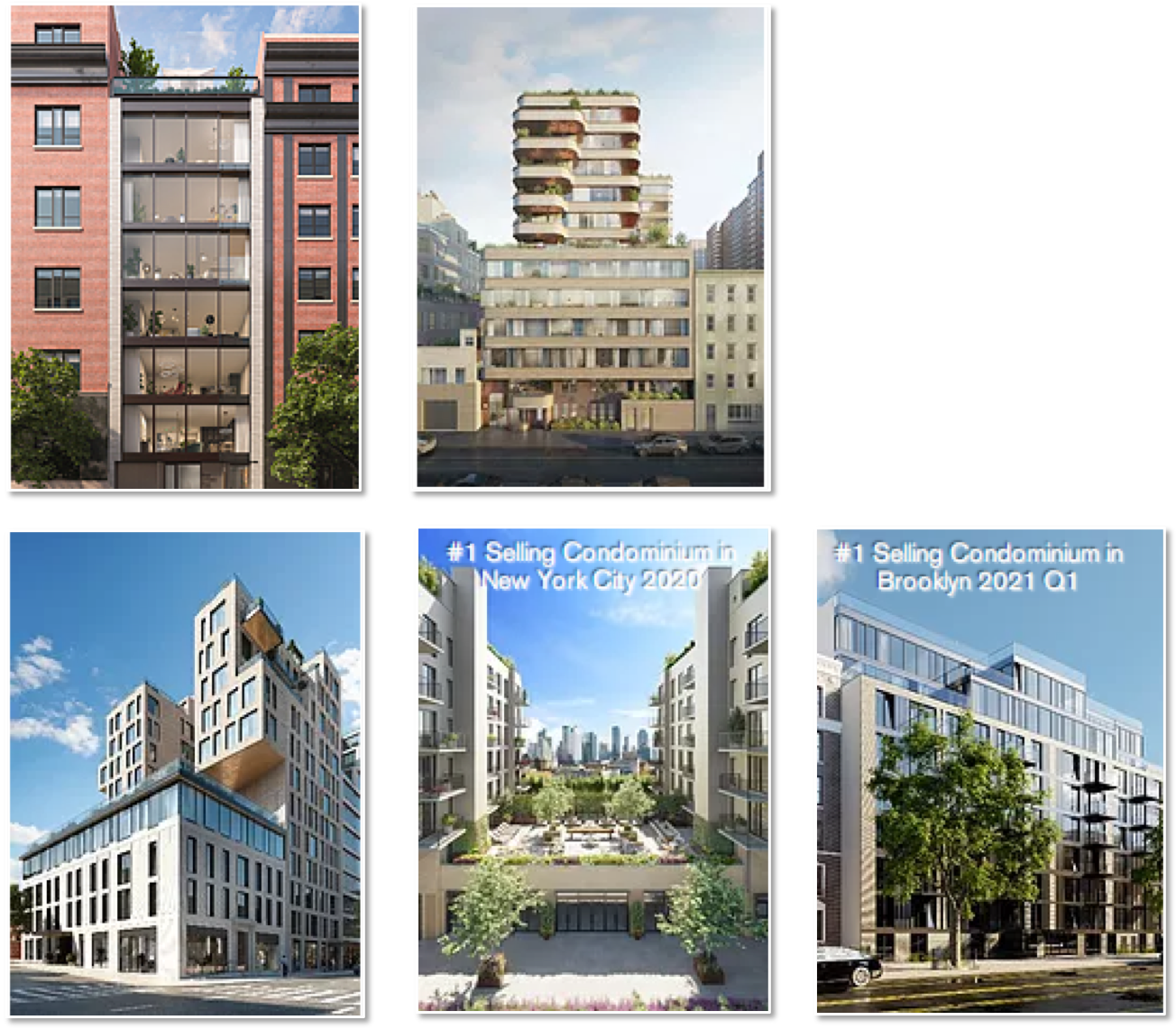

Seasoned Developer with Approved Experience

The developer is well-known among local real estate professionals in New York City. Its unique development strategy, aesthetic architectural design, and efficient project management have helped the developer establish reputation and prestige in the industry. In addition, the developer has also cooperated with CrowdFunz prior in Fund 604 and Fund 805, which had proved its credibility on financing promises.

| Capital Stack after Fund 819 Entering | Percentage | |

|---|---|---|

| Construction Loan Originated by Commercial Bank | $26,500,000.00 | 56.81% |

| CrowdFunz Fund 819 | 2,500,000.00 | 5.36% |

| Paid-in Capital by Developer | 17,648,000.00 | 37.83% |

| Total Capital: | $46,648,000.00 | 100.00% |

After CrowdFunz Fund 819 entering the project, the capital stack of the project consists of:

$26,500,000 construction loan, with first lien, originated by commercial bank, counted 56.81% in total capital;

$2,500,000 short-term mezzanine loan issued by CrowdFunz Fund 819, counted 5.36% in total capital;

$17,648,000 paid-in capital from the developer, counted 37.83% in total capital;

The loan-to-cost ratio of the entire project is expected to be 62.17%, and the risk level from the project’s financial structure is considered lower than the industry average.

The mezzanine loan issued by Fund 819 will be used for material costs of the last construction stage in the project:

| CrowdFunz Fund 819 – Projection of Fund Usage | ||

|---|---|---|

| Expenses Items | Amount($) | Percentage |

| Cabinets | $110,000 | 4.40% |

| Floors | 110,000 | 4.40% |

| Utility Facilities | 470,000 | 18.80% |

| Doors and Windows | 380,000 | 15.20% |

| Fences | 300,000 | 12.00% |

| Grey boards | 100,000 | 4.00% |

| Roofs | 250,000 | 10.00% |

| Scaffolds | 80,000 | 3.20% |

| Air Conditions | 350,000 | 14.00% |

| Kitchen Countertops | 200,000 | 8.00% |

| Bathroom Materials | 150,000 | 6.00% |

| Total: | $2,500,000 | 100% |

* Expenses Items provided by the Developer, June 2021

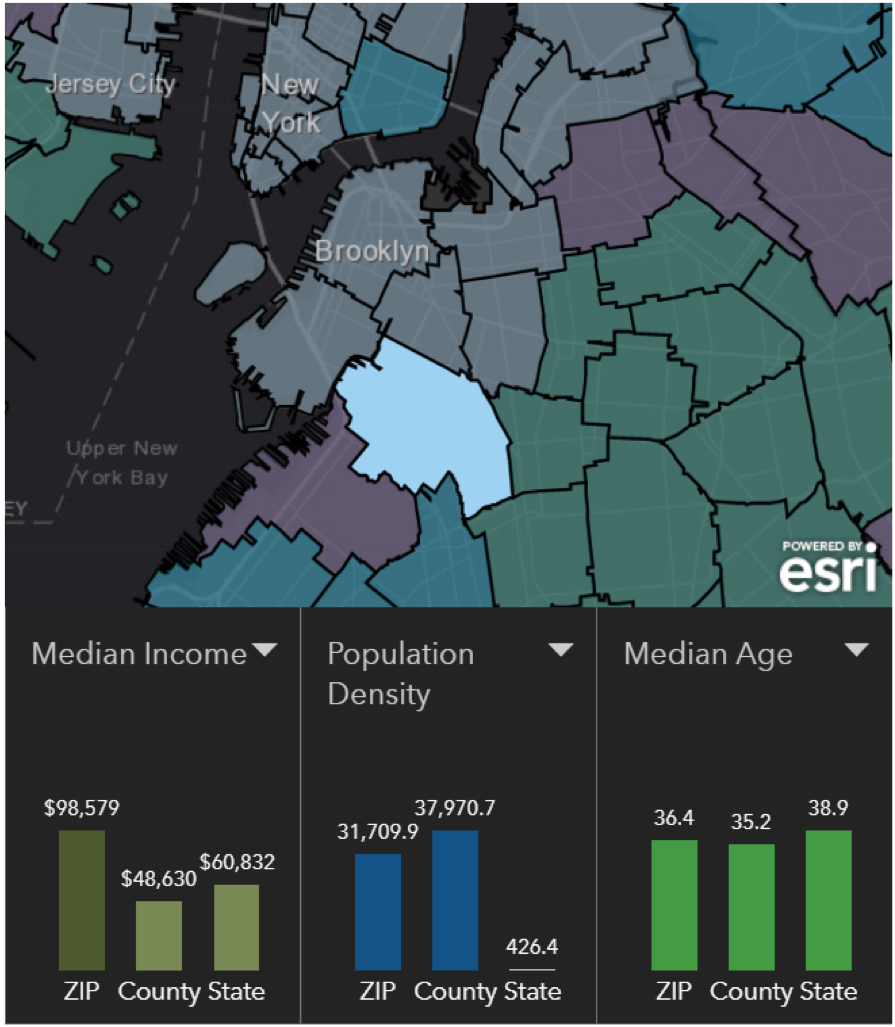

Demographics:

| Zip Code 11223 | |

|---|---|

| Regional Population | 31,709 |

| Median Age | 36.5 |

| High School Education or Above | 73% |

| Ethnics | White and Asian based |

| Family Median Income | $98,579 |

| Child-Bearing Family | 25% |

| Average Family Size | 2 |

| Primary residence | 61% |

The population in this area is dominated by whites and Asians; Asians are mainly Chinese and Indians. The major population is middle-class. Compared with other areas in Brooklyn, Park Slope has population with extremely high incomes; According to the data from the U.S. Census Bureau in 2021, the median household income is $132,091; according to ESRI, the median household income is $98,579.

According to data from the U.S. Census Bureau, residents have an average age of 36.5 years; the family structure is dominated by singles, counted for 51%, and 75% of households have no children with family size of 2.

61% of residential units are rental, and 33% are condominiums. The house vacancy rate is only 7%.

Overall, the demographics in this area are stable. Due to residents’ high income, the community is considered prime in Brooklyn.

* Data Source: United States Zip Codes. Org. , Esri Zip Code Lookup, and American Community Survey, June 2021.

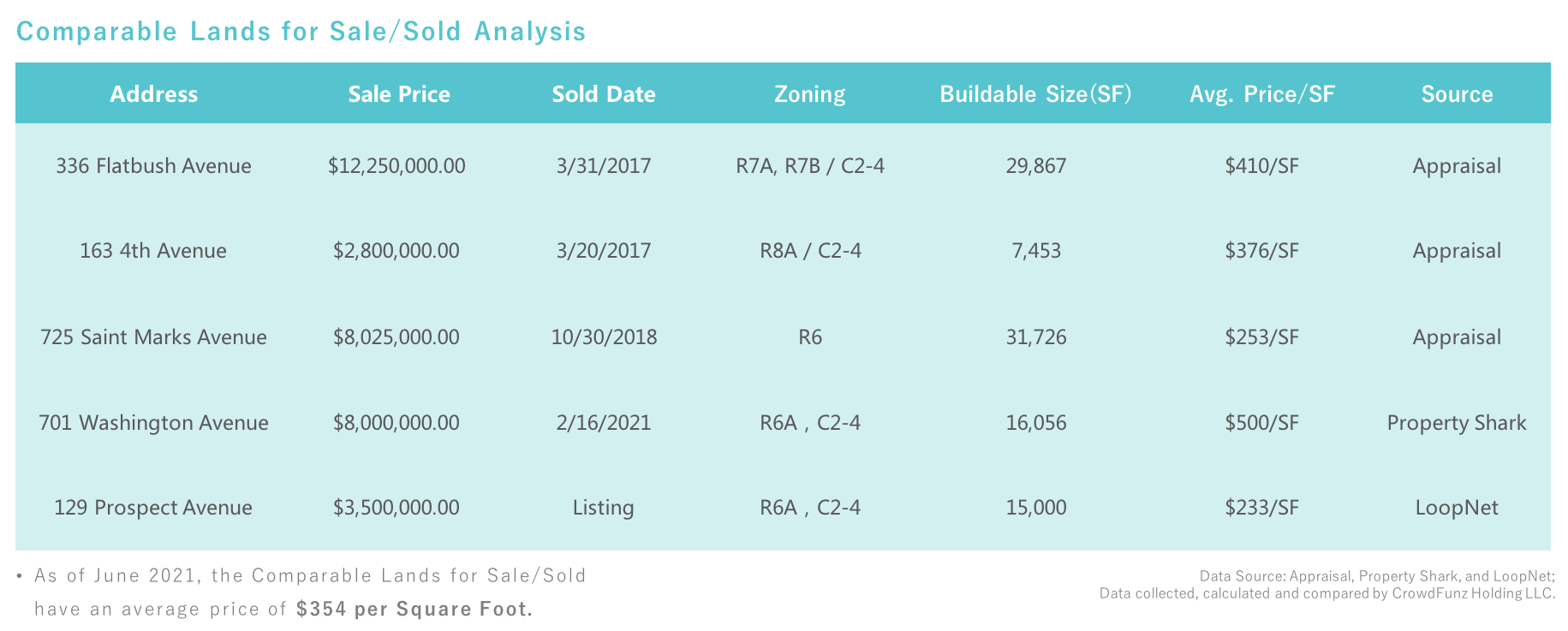

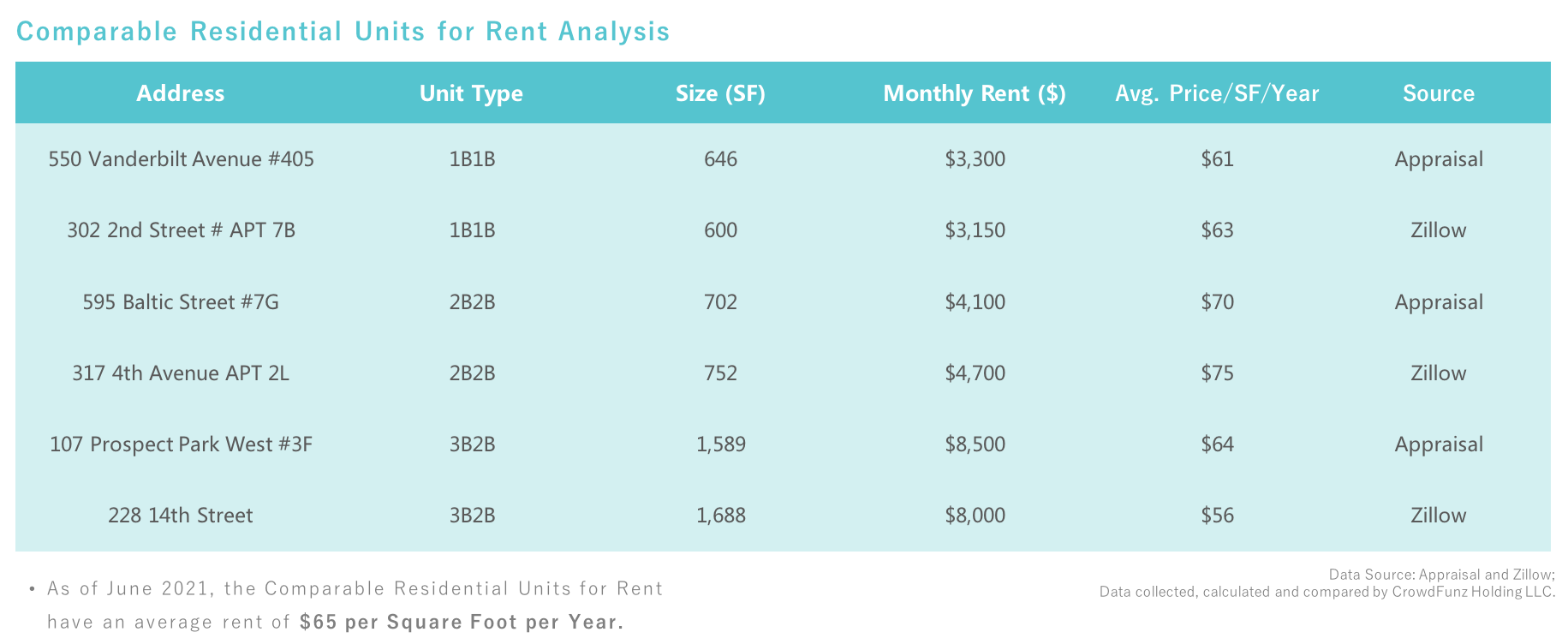

Compared with the valuation provided by BBG, the valuation suggestion from CrowdFunz is more conservative. The main method is to adjust the price of the properties for sale based on market conditions.

The property contains a total of 33 condominiums; 9 units have been sold so far, and of which, 3 were sold by the end of 2020, and the other 6 were sold in the first half of 2021.

Since the second quarter of 2021, sales of condominiums in New York have greatly accelerated, market demands have surged while housing prices have rebounded. CrowdFunz believes that the final market value of the underlying property will have a high probability to exceed current projection.

Location:

The project is located in the northwest corner of Brooklyn, New York City. The site has only 3-minute walking to Union St. subway station, taking 15-minute to Financial District, Manhattan, 3-minute walking to 3rd Ave. bus station, and 5-minute driving LIRR Atlantic Station and 10-minute driving to the Brooklyn Bridge.

Transportation:

Subway: B61, B37, B67, B69;

Train: From Atlantic Terminal to Jamaica Station;

To Midtown Manhattan: 8.5 Miles (20-min Driving);

To JFK Airport: 11 Miles (25-min Driving);

To LGA Airport: 11.1 Miles (25-min Driving).

Nearby Schools:

The property is assigned to NY 15th School District, which has outstanding education quality. According to the data from Greatschools.org, nearby K-5 schools such as PS321 and PS39 received 10/10 points. Middle schools, like MS51 and MS443, and Millennium Brooklyn High School also received scores near 10.

Living Facilities:

The community is good for living, surrounding restaurants including Japanese, Italian, Chinese and American cuisines. Adjacent to the prosperous area of Fifth Avenue in Brooklyn, the community is also convenient for daily shopping. Banks, supermarkets, clinics, gyms, and malls nearly offer residents a variety of choices.

Recreation:

The community is close to Brooklyn’s famous Prospect Park, which includes a zoo, camping grounds, lakes and gardens. The site has a 5-minute driving distance to Alamo Drafthouse Cinema. In addition, and surrounding entertainment facilities can meet residents’ needs.

Developer Company: New Empire Corp.

Developer Website: https://www.newempirecorp.com/

Prior Cooperation: CrowdFunz Fund 604, Fund 805

Founded in 1997, New Empire Corp. has more than 20 years of development experience in the New York real estate market. Its past projects are located in Brooklyn, Manhattan, and Queens.

With the purpose of creating a luxurious and comfortable living environment, its 34th Street project in Long Island City and the Ocean Avenue project in Brooklyn won the best sales awards in New York City and Brooklyn.

Under the leadership of Bentley Zhao, CEO, and Kevin Zhao, Vice President, the company has designed and built more than 100 residential and hotel projects, enabling New Empire Corp. to achieve impressive results.

The loan issued by CrowdFunz Fund 819 is a short-to-medium-term mezzanine loan. In the current capital stack, the paid-in capital from the developer is sufficient, and the construction loan is in place. The financial leverage is reasonable, and the structure is clear.

The loan issued by Fund 819 will be used for temporary material costs at the final stage of construction. After the loan disbursement, CrowdFunz will reasonably monitor the use of the proceeds.

CrowdFunz believes that the collateral value of Fund 819 is sufficient, which is 7 times of the lending amount. At the same time, the developer has seasoned experience, good track record and industry reputation.

We also believe that with explicit rights and obligations, Fund 819 may help developer solve short-term funding gaps while creating good investment opportunities for investors, in accompany with low default risks.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-3 Years | 3-5 Years | 5-10 Years | 10-15 Years | 15+ Years |

| Tracking Record | 0-3M | 3-10M | 10-30M | 30-50M | 50M+ |

| Credit Score | Low | Accept | Fair | Good | Excellent |

| Financials | |||||

| Investor Equity | 1-20% | 20-30% | 30-40% | 40-50% | 50-60% |

| Loan-to-value ratio | 85-100% | 70%-85% | 65%-70% | 50-65% | 1-50% |

| Financial claims | Common Equity | Preferred Equity | Equity pledge debt | Secondary lien debt | First lien debt |

| Location | |||||

| Location | Sub Rural | Rural | Regional center | Suburban | Core Urban |

| Walk Score | <40 | 40-55 | 55-70 | 70-85 | 85-100 |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Status | |||||

| Development Phase | 0-20% | 20-40% | 40-60% | 60-80% | 80-100% |

| Property as Collateral | No | Extremely insufficient | Relatively insufficient | Relatively sufficient | Extremely sufficient |

| Investment Term | >48 Months | 37-48 Months | 25-36 Months | 13-24 Months | <12 Months |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)