First Lien Mortgage Fund 615

Type: Debt

Target: $1,450,000

Annual Return: 7.25% - 7.50%

Min-invest Amount: $10,000

Duration: 12 - 18 Months

Offering Amount: $1,450,000 U.S. Dollars

Estimated Return: 7.25% - 7.50% Annualized Return*1

Investment Type: First Lien Mortgage

Unit Price: $10,000 per Subscription Unit

Offering Date: October 2021

Investment Horizon: 12 - 18 Months

Dividend Schedule: Prepaid before per Period(6 Months in advance first then 3 Months per Prepaid)

*1 7.25% Annualized Return for Investment of 1-19 Units;7.50% Annualized Return for investment above 20 Units

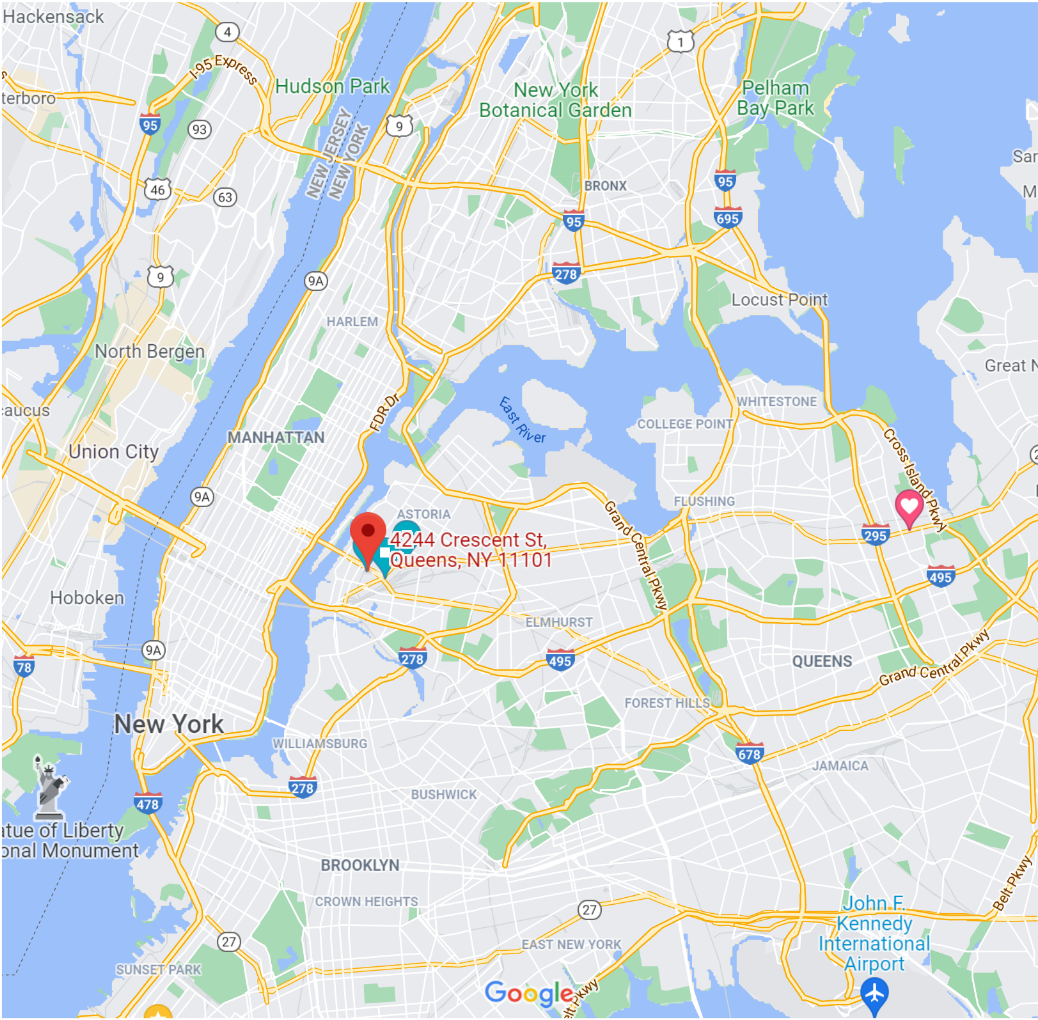

Address: 42-44 Crescent St, 1st FL, Long Island City, NY 11101(Commercial Units)

Area: Long Island City, Queens, New York

Size: 3,452 Square Feet(Including 1,702 square feet of basement)

Closing Price: $2,000,000

Estimate Closing Date: 10/26/2021

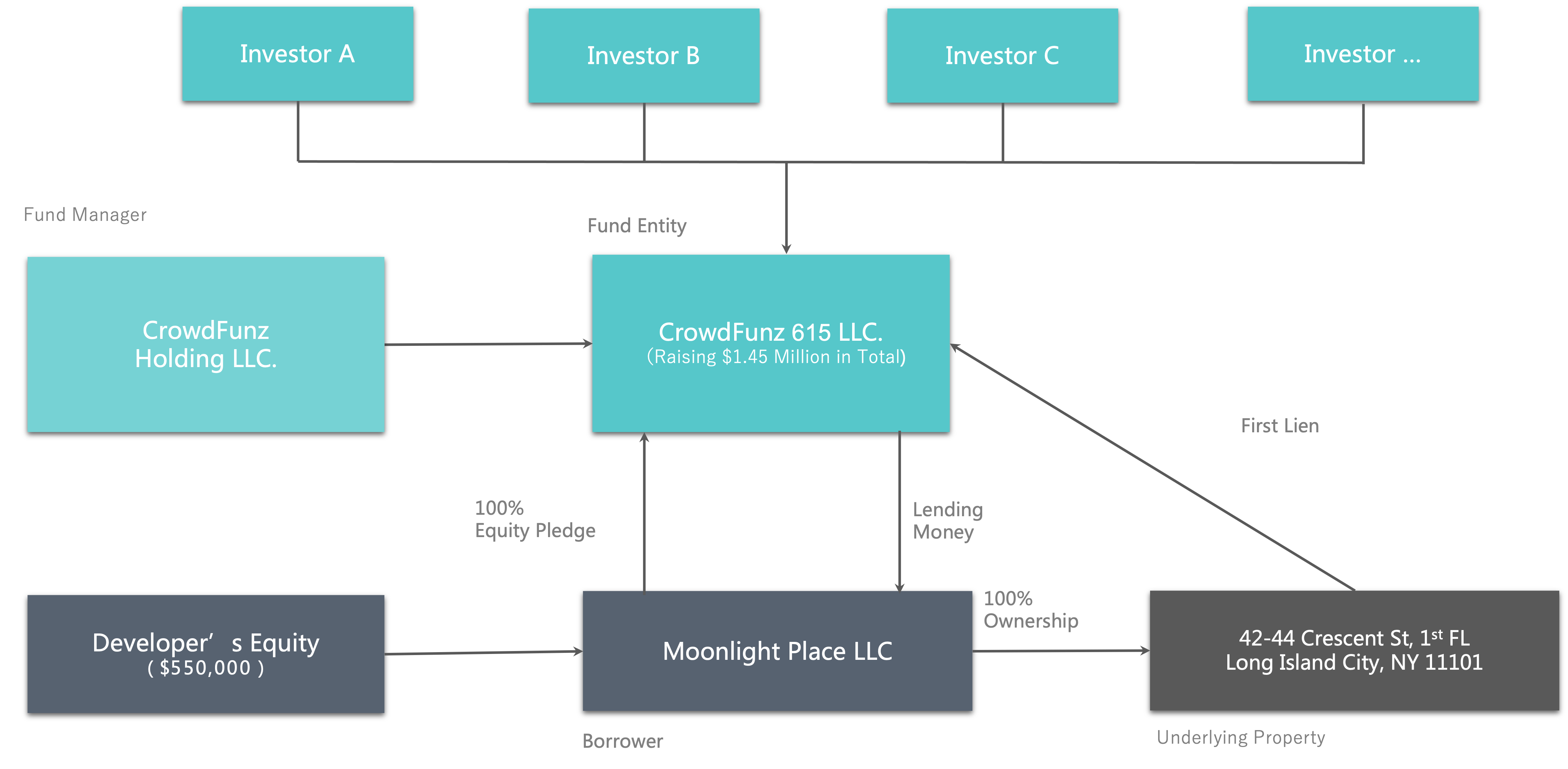

The underlying asset is a brand-new mixed-use building’s first floor in the prime area of LIC. Most of the buildings in the surrounding area are dense residential rental buildings. The loan of $1,450,000 provided by CrowdFunz Fund 615 will be the first lien acquisition mortgage for the borrower.

The property is a mixed-use building. The first floor is a commercial unit and from the second to seventh floor are residential units( All sold out). The final Certificate of Occupancy was obtained in September 2021. The first-floor commercial unit has already been leased to a new tenant. The loan provided by CrowdFunz Fund 615 will help to close the acquisition of this commercial unit.

The site is in the prosperous and uprising community and it’s one of fastest growing communities in NYC. There’s a 5-min walk to reach 6 subway lines and it’s close to Queens Blvd, the major roadway of Queens. There are plenty of supermarkets, convenient stores, restaurants and cafes nearby. There’s huge demand for commercial because it’s surrounded by densely populated residential communities.

| Expected Dividend Calendar | |||||

|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | No Later than 11/10/2021 | 10/26/2021 | 4/25/2022 | 6 Months | Pre-paid Dividend |

| Second | No Later than 5/11/2022 | 4/26/2022 | 10/25/2022 *2 | 6 Months | Pre-paid Dividend |

| Third | No Later than 11/10/2022 | 10/26/2022 | 4/25/2023 | 6 Months | Extension Option Owned by Developer |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After the expiration of the second Dividend Period, the developer has one options to extend the borrowing 6 months. If the developer chooses to extend, the investors will receive dividends at the same rate of return during the extension.

Sufficient Value in the Collateral

According to the third-party appraisal provided by Marshall & Stevens, Inc. in October 2021, the total value of the property is $3,020,000.

CrowdFunz appraisal team gives the valuation for this property is $2,160,000 according to the research of this area, market experiences and the surrounding expectations.

CrowdFunz Fund 615 has triple protections:1. the mortgaged property itself with first lien title; 2. 100% ownership interests of the project entity pledged by developer; 3. unlimited personal guarantee provided by key person of the developer.

Prime Location, In Demand Market

The site is in the prime area in LIC, Queens. There is only a 2-min walking distance to the nearest subway station and 5-min walking distance to 6 subway lines. This area has one of the highest population density in Queens and is one of the most prime commercial real estate for investment.

The buyer has the long relationship with the developer. The developer has great faith and trust towards the buyer that they can improve the influences and value of the building by their smooth operations.

There are way more residential units than commercial ones in this area. With the growing population, the demand for commercial units is getting stronger.

Transparent Fund Usage, Explicit Exit Strategy

The mortgage provided by CrowdFunz Fund 615 will be used for acquisition of the target property:

The sale price of the commercial unit is $2,000,000 which is lower than the market value because of the long-term relationship between the seller and the buyer. Based on sales transaction record, with Certificate of Occupancy and locked-in tenants, the LTV is 72.5%. According to the third-party appraisal, the LTV is only 48%. The loan provided by CrowdFunz Fund 615 will be distributed to the buyer on 10/26/2021 and it will help close the acquisition of this property.

The tenant will be expected to operate within half year. After steady rental income kicks in the next half year, the borrower will seek to refinance from the bank to replace the bridge loan provided by CrowdFunz Fund 615.

Seasoned Developer with Approved Experience

The developer has over 10 years of local market experience, and his projects are mainly located in Queens and Brooklyn. The prior experience helps the developer accurately understand market demands.

CrowdFunz Fund 615 is the first fund that cooperates with the developer. We believe that CrowdFunz Fund 615 will be a win-win success for both parties by utilizing this new funding structure.

| Capital Stack | Percentage | |

|---|---|---|

| Mortgage issued by CrowdFunz Fund 615 | $1,450,000 | 72.50% |

| Developer’s Equity | 550,000 | 27.50% |

| Total | $2,000,000 | 100.00% |

After the mortgage issued by CrowdFunz Fund 615 contributes to this project, the capital stack will consist of: $1,450,000 mortgage originated by CrowdFunz Fund 615, counted 72.5% of total value. The mortgage issued by CrowdFunz Fund 615 will have the first lien position pledged of underlying property and 100% ownership interests.

In addition, the unlimited personal guarantee will be signed from the key person of the borrower to ensure the safety of this loan even more.

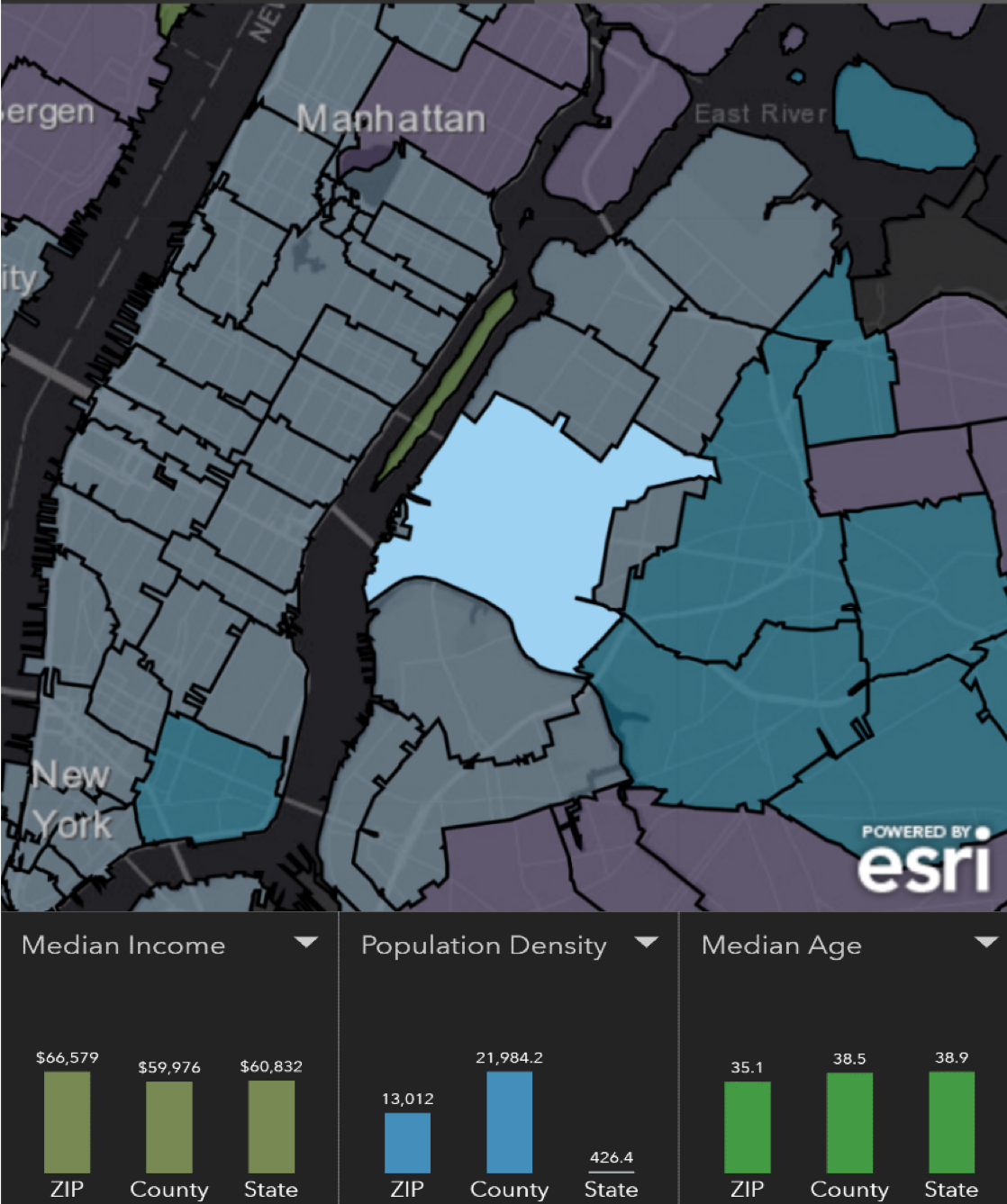

Demographics:

| Zip Code 11101 | |

|---|---|

| Regional Population | 31,366 |

| Median Age | 35 |

| High School Education or Above | 69.8% |

| Workplace | Metropolitan(99.8%) |

| Family Median Income | $66,579 |

| White Collar/Blue Collar | 90.5%/9.5% |

| Child-Bearing Family | 23.6% |

| Average Family Size | 2.21 |

| Average Housing Price | $975,000 |

Due to its premium geographic location, Long Island City has become one of the hottest areas absorbing new real estate developments in New York. Meanwhile, more companies and residents have chosen Long Island City as the destination for business and living.

Younger population dominants in the area, and most residents are middle class professionals with jobs and stable incomes. The ethnic backgrounds are also well-diversified.

The average age is 35; 23% of the families have children. Self-residence is the main demand for tenants. Due to the low housing inventory available for sale and high needs from buyers, the property prices are constantly going up.

* Data Source: United States Zip Codes. Org. & Esri Zip Code Lookup, American Community Survey, May 2021.

Location:

The site location is in the prime area of Long island City, Queens. The surrounding public transportation is well-developed with 6 subway lines and multiple bus lines. The residents can reach various communities in Queens, Brooklyn and Manhattan. It only takes about 1 minute walking to the subway station and takes about 10-minute subway ride to midtown Manhattan. There are several densely populated residential buildings in this area and there’s a very strong demand for commercial units driven by the ample shopping abilities by the locals. The commercial unit's shortage is still a norm here.

Transportation:

Subway: 7, N, W (Queensboro Plaza Station)E, M, R(Queens Plaza)

Bus: Q39, Q66, Q69, Q101, Q102

Train: LIRR(Long Island Railroad)

To Midtown Manhattan: 3 Miles (About 10 minutes subway ride)

To JFK Airport: 15 Miles (About 30-min Driving )

To LGA Airport: 6 Miles (About 15-min Driving)

Nearby Schools:

The basic education system in the area covers many elementary schools, junior high schools, and high schools, fitting the residents 'needs on children’s education. There are also many technical schools to meet young professionals’ self-development goals.

Living Facilities:

Despite convenient transportation, the business environment in Long Island City is booming, and living facilities are increasing like new stores and supermarkets. The area is safe and good to live in, attracting large amount of young generation around 30-year-old to relocate here.

Recreation:

The surrounding recreation facilities are also improving to fit residents 'needs. Museums, gyms, and entertainment venues nearby are within walking distance.

The loan originated by CrowdFunz Fund 615 is a first lien mortgage. The buyer has been looking for great value of commercial units during the pandemics. With the loan provided by CrowdFunz Fund 615, the buyer will be able to buy potential and low-risk commercial unit with strong demands.

The capital stack after the mortgage origination has low financial leverage and explicit structure. With the issued Certificate of Occupancy and the existing leasing tenant, the buyer is going to buy this commercial unit below the market value. After stable operations, the borrower will be able to pay off the loan issued by CrowdFunz Fund 615 by refinancing from the bank.

According to the development trend, small commercial units serving the residential keeps going up as well. Currently, the supply of residential units keeps up, however, the number of commercial falls behind by a lot which it will drive strong market demand.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-3 Years | 3-5 Years | 5-10 Years | 10-15 Years | 15+ Years |

| Tracking Record | 0-3M | 3-10M | 10-30M | 30-50M | 50M+ |

| Credit Score | Low | Accept | Fair | Good | Excellent |

| Financials | |||||

| Investor Equity | 1-20% | 20-30% | 30-40% | 40-50% | 50-60% |

| Loan-to-value ratio | 85-100% | 70%-85% | 65%-70% | 50-65% | 1-50% |

| Financial claims | Common Equity | Preferred Equity | Equity pledge debt | Secondary lien debt | First lien debt |

| Location | |||||

| Location | Sub Rural | Rural | Regional center | Suburban | Core Urban |

| Walk Score | <40 | 40-55 | 55-70 | 70-85 | 85-100 |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Status | |||||

| Development Phase | 0-20% | 20-40% | 40-60% | 60-80% | 80-100% |

| Property as Collateral | No | Extremely insufficient | Relatively insufficient | Relatively sufficient | Extremely sufficient |

| Investment Term | >48 Months | 37-48 Months | 25-36 Months | 13-24 Months | <12 Months |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)