Equity Pledge Debt Fund 820

Type: Debt

Target: $1,000,000

Annual Return: 7.75% - 8%

Min-invest Amount: $10,000

Duration: 6 - 18 Months

| Fund Type | Equity Pledge Debt Fund |

| Offering Amount | $1,000,000 U.S. Dollars |

| Estimated Return | 7.75% - 8.00% Annualized Return *1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | February 2022 |

| Investment Horizon | 6 – 18 Months |

| Dividend Schedule | Prepay Before Per Period (6+6+6 Months) |

* 7.75% Annualized Return For Investment of 1-19 Units;

* 8.00% Annualized Return for investment above 20 Units.

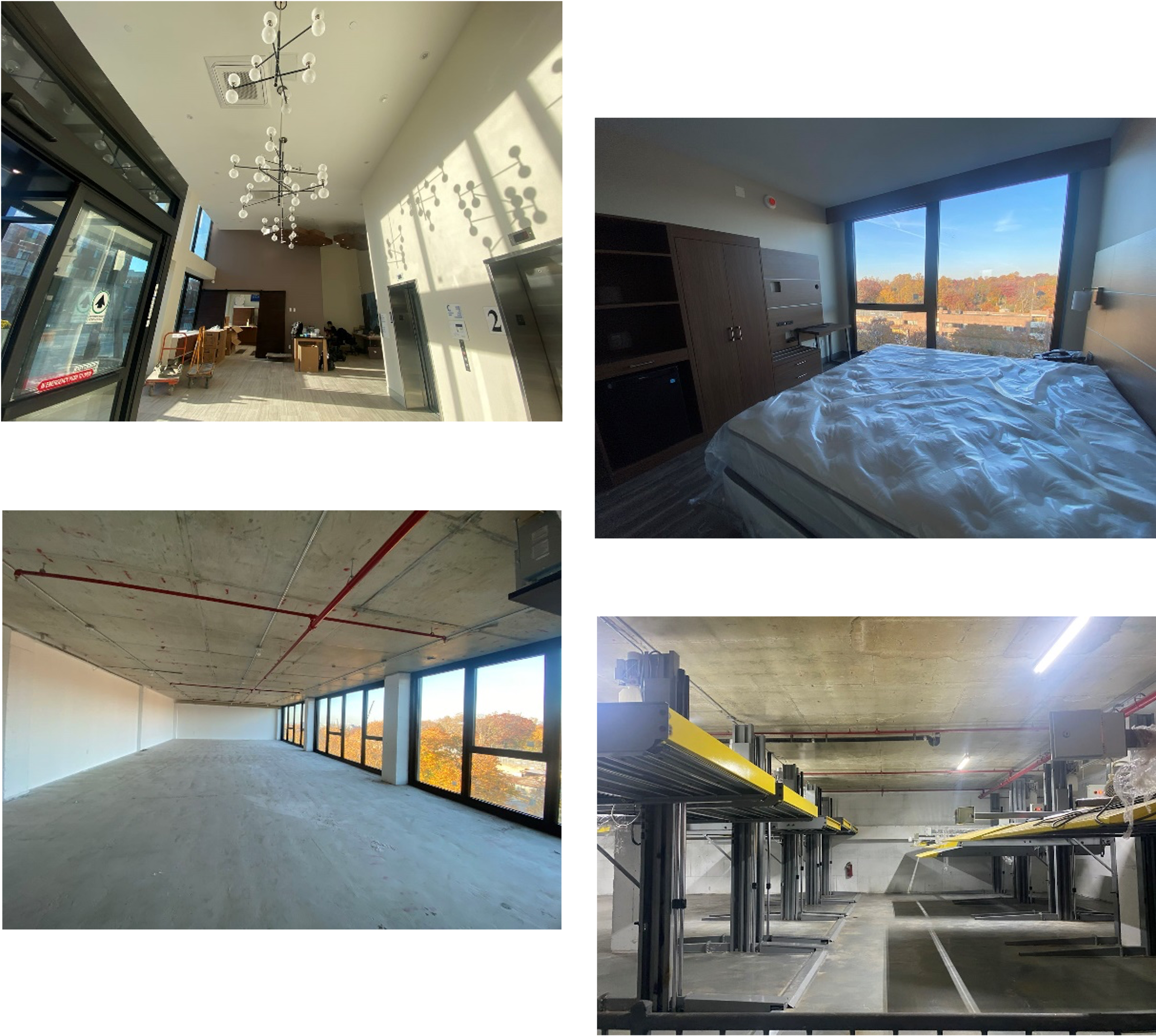

- Developer purchased the project land in 2021. After adjusting the construction plan multiple times, developer decided to build two separate buildings for different uses. One of the buildings will be a hotel, and the other one will be a community center with parking structure.

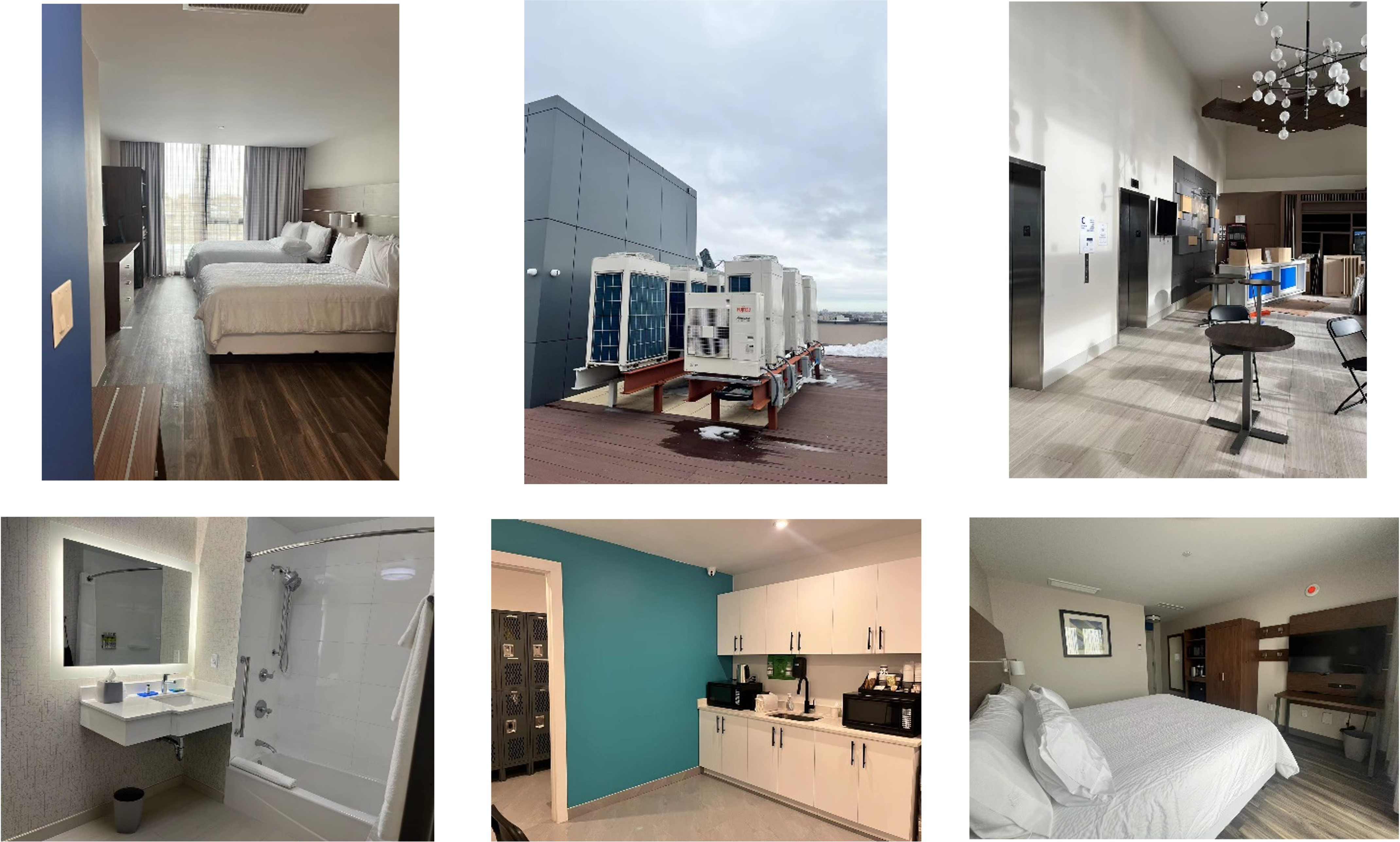

- The project broke ground in 2016, and the hotel had received TCO from NYC Housing Department in January 2022. The Community Facility received Offering Plan in 2021 and is expected to receive TCO in February 2023.

- The project is in Sunset Park, Brooklyn. Two buildings both have 7 floors, totaling 107,617 square feet of building area. The hotel will consist of 88 rooms, totaling 30,047 square feet. The community center with consist of 12 clinic units, and a designated parking structure with 94 spots, totaling 29,903 square feet of building area.

| Site Address | 825 & 833 39th St, Brooklyn, NY, 11232 |

| Site Area | Sunset Park, Brooklyn, New York |

| Lot Size | Near 15,000 SF |

| Zoning | M1-2 |

| Building Size | 107,617 SF |

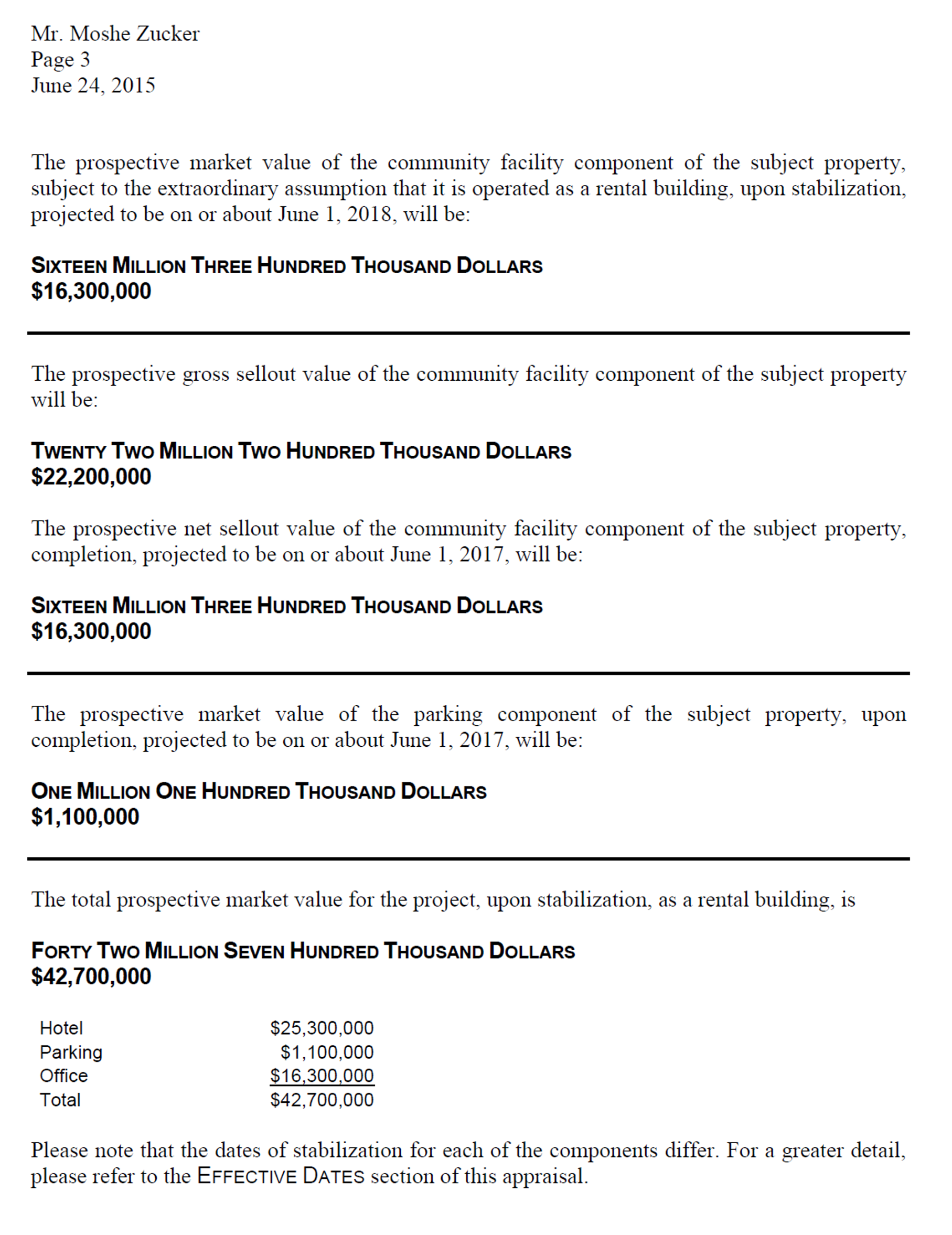

| Market Value Post-Completion | $42,700,000 (Based on BBG appraisal report in 2015) |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Funding Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | $1,000,000 | No Later than 3/1/2022 | 2/15/2022 | 8/15/2022 | 6 Months | Pre-paid Dividend |

| Second | No Later than 9/1/2022 | 8/16/2022 | 2/14/2023 *2 | 6 Months | Extension Option Owned by Developer | |

| Third | No Later than 3/1/2023 | 2/15/2023 | 8/15/2023 | 6 Months | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After the expiration of the second Dividend Period, the developer has one options to extend the borrowing 6 months. If the developer chooses to extend, the investors will receive dividends at the same rate of return during the extension.

- According to the Appraisal Report provided by independent firm BBG in 2015, underlying property will be worth $42.7 Million post-completion. As of January 2022, the project developer had contributed $22.6 Million cash, and received $15.15 Million construction loan from The Berkshire Bank.

- The hotel has obtained TCO in January 2022, and the partnered brand Holiday Express Inn is expected to start operation in mid February 2022. At the current construction pace, the community center is expected to receive TCO in February or March 2022.

- CrowdFunz 820 Fund will provide the developer with $1,000,000 short term mezzanine loan, which will be used to cover soft costs, including part of the construction cost and property taxes. Developer had pledged 100% of the project’s equity, along with Unlimited Personal Guarantee, for the protection of the fund investors.

- Project is in Sunset Park, Brooklyn, known as the second biggest Chinatown. Area has a huge Chinese population, mainly immigrants from Chaoshan, Guangdong. Residents have good amount of savings and spending power, but the area lacks hotels and community centers, which the project will help supplement.

- In recent years, Sunset Park has garnered more market attention, and has become a prime emerging market. For its prime location, safety, living convenience, and abundance of promising businesses, the area has attracted many Chinese residents and new immigrants.

- According to data by Property Shark, medium home price in the area is around $850,700;According to StreetEasy, medium monthly rent is $1,900, The market is prospering for both For-Sale and For-Rent properties.

- As the developer is close to using up the construction loan, a short-term bridge loan is needed to pay for the uptick in material prices, and for the hotel to successfully start operation. The developer expects to refinance the construction loan with a Commercial Bank, after 6 months of operation and cash flow, which will retire the mezzanine loan provided by CrowdFunz 820 Fund.

- The seasoned developer has over a decade of commercial real estate development experience, with a unique perspective for hotels and mixed-use commercial properties. The project marks the first collaboration between CrowdFunz and the developer, and we look forward to establishing a long-lasting business relationship that will benefit both parties, and more importantly, our investors.

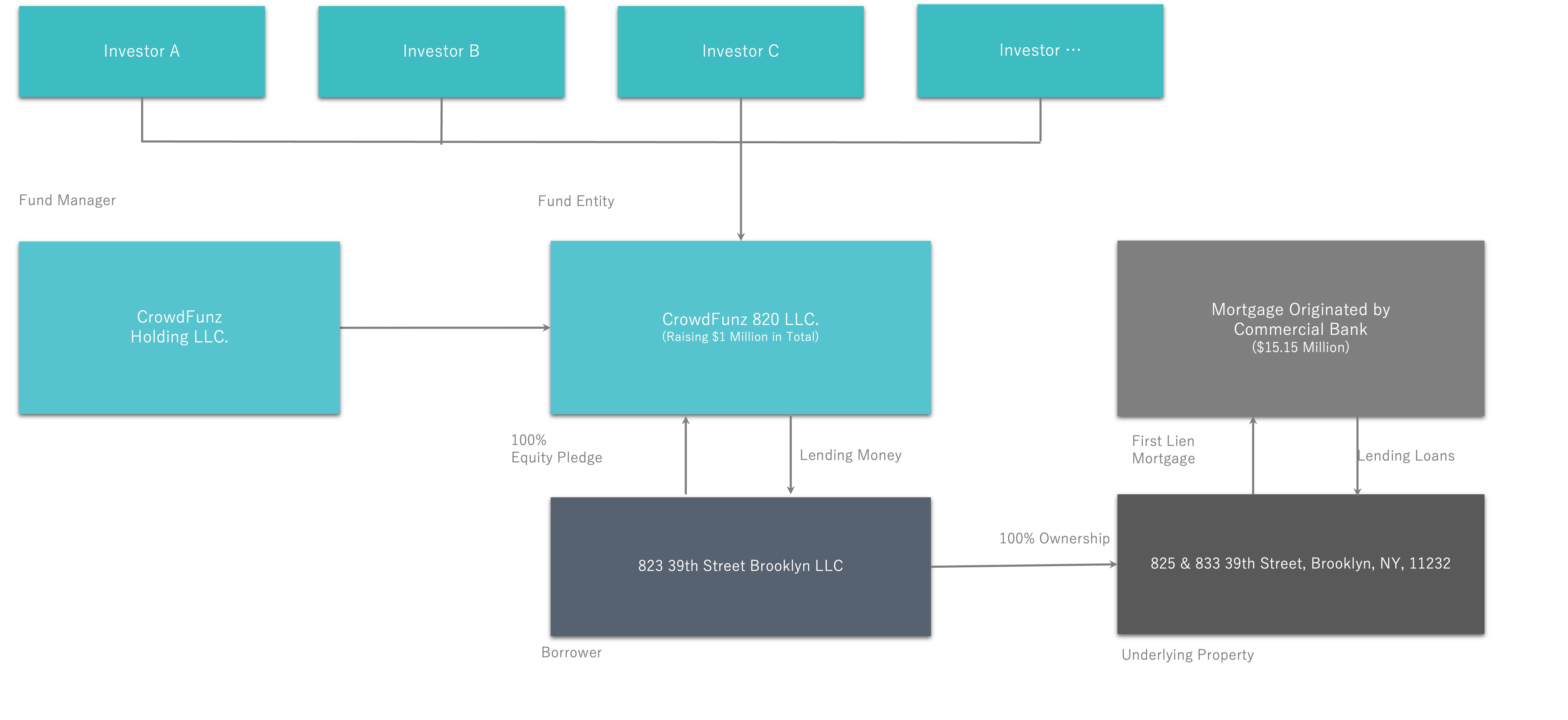

Investment Structure of CrowdFunz 820 Fund

CAPITAL STACK

| Capital Stack | Percentage | |

|---|---|---|

| Mortgage Originated by Commercial Bank | $15,150,000 | 39.10% |

| Loan Issued by CrowdFunz 820 Fund | 1,000,000 | 2.58% |

| Equity Investment by Developer | 22,600,000 | 58.32% |

| Total Amount | $38,750,000 | 100.00% |

After CrowdFunz 820 Mezzanine Loan enters the capital stack

- Commercial Bank has originated $15,150,000 of construction loan and holds First Lien position. The construction loan is only accounted for 39.1% of total capital deployed.

- CrowdFunz 820 Fund has originated a total of $1,000,000 of mezzanine loan and holds second lien position. The loan is accounted for 2.58% of total capital and is secured by project entity’s equity and Developer’s unlimited personal guarantee.

- Developer has contributed $22,600,000 of equity investment and is accounted for 58.32% of total capital.

- The project has a Loan-to-Cost of 41.68%, and the financial exposure is below industry average.

FUND USAGE

The $1,000,000 provided by CrowdFunz 820 Fund will be used to cover the cost in final construction phase, and other soft costs.

| Use of CrowdFunz 820 Fund | ||

|---|---|---|

| Cost Item | Amount | Percentage |

| Construction Cost | $450,000 | 45.00% |

| Property Taxes and Fees | 300,000 | 30.00% |

| Independent Advisors’ Fees | 50,000 | 5.00% |

| Operation Cost | 200,000 | 20.00% |

| Total | $1,000,000 | 100% |

* Data provided by Developer

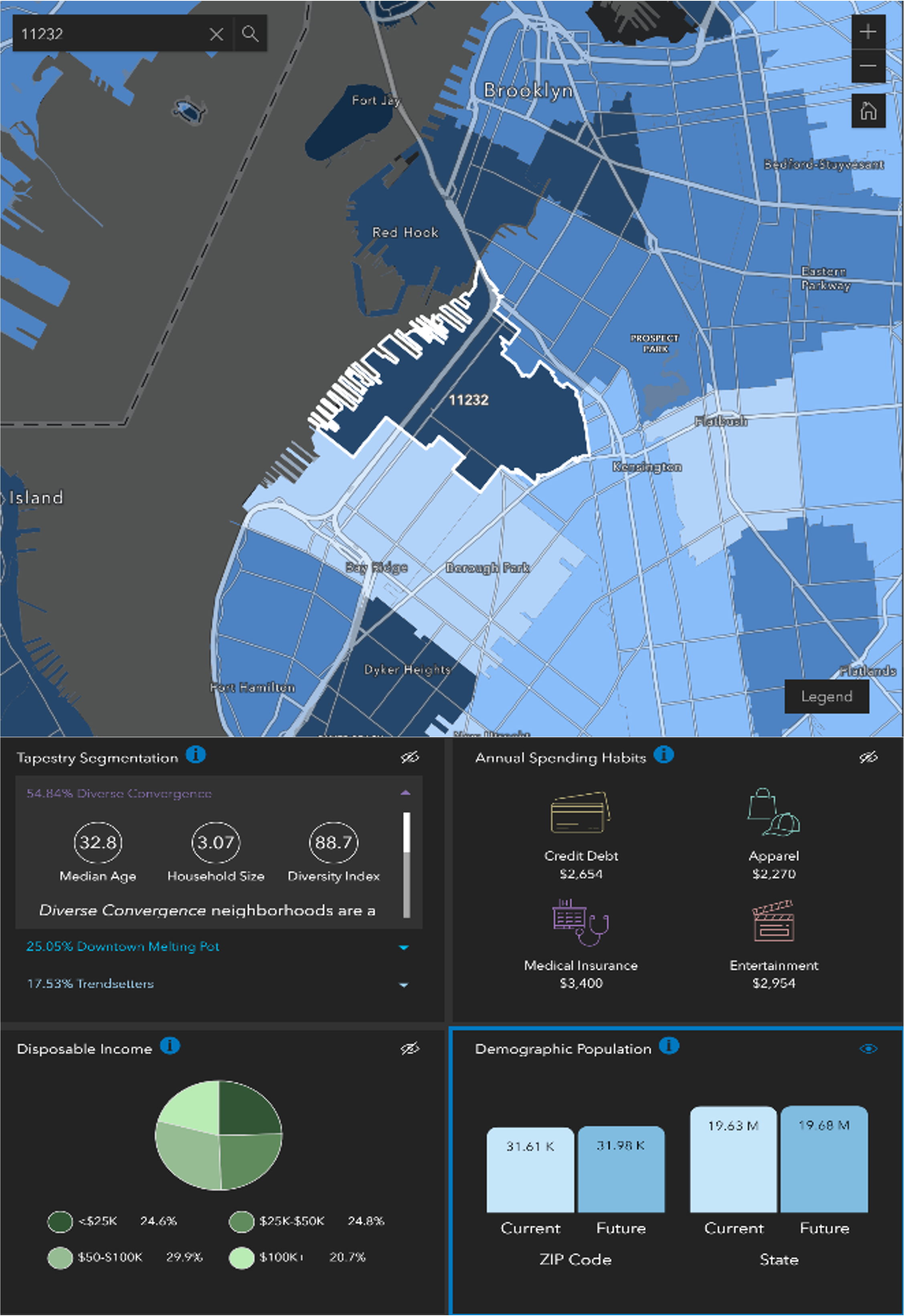

Demographics in the Zip Code

| Zip Code 11232 | |

|---|---|

| Regional Population | 26,430 |

| Median Age | 34.2 |

| High School Education or above | 50% |

| Races | Asian |

| Family Median Income | $84,732 |

| Child-Bearing Family | 33% |

| Average Family Size | 2.79 |

| Average Family Size | 50% |

Most of the residents are of Asian backgrounds, mainly Chinese and Indian. Most families living in Sunset Park are middle class, with living standard above other areas in Brooklyn and a Family Medium Income of $84,732.

According to data, younger population dominates the area, with an average age of 34.2; 33% of the families have one or more children, and average family size is 2.79 people.

50% of the housing supply are owned by families, with the rest being single family rentals; overall vacancy rate is low.

Residents have strong savings and spending power, which encouraged the growth of local retail businesses.

* Data Source: United States Zip Codes. Org. & Esri Zip Code Lookup,American Community Survey in May 2021.

VALUATION ANALYSIS

According to Appraisal Report provided by independent firm BBG:

| Amount | Sale Price / Unit | Unit | |

| Revenues | |||

| Hotel | $25,300,000 | $287,500/Key | 88 Keys |

| Community Center | 16,300,000 | $546.92/SQFT | 29,803 SQFT |

| Parking Structure | 1,100,000 | $11,702/Spot | 94 Spots |

| Estimated Total Revenue | $42,700,000 |

美地众筹对项目物业进行的估值分析:

| Amount | Sale Price / Unit | Unit | |

| Revenues | |||

| Hotel | $22,000,000 | $250,000/Key | 88 Keys |

| Community Center | 17,800,000 | $597.25/SQFT | 29,803 SQFT |

| Parking Structure | 1,000,000 | $10,638/Spot | 94 Spots |

| Estimated Total Revenu | $40,800,000 |

- As the BBG Appraisal Report was conducted in 2015, it could only be used as a reference. CrowdFunz had prepared a more conservative and time-sensitive set of valuation.

- The property consists of 88 hotel rooms. As of January 2022, the hotel rooms have been offered an average purchase price of $250,000 per Key. And based on market comparable analysis, the community center can be sold at $580/SF to $630/SF.

- As the first lien mortgage has a principal of only $15.15 Million, it can be easily covered by over $20 Million of developer’s equity, and the $1 Million provided by CrowdFunz 820 Fund is comfortably secured.

Location

Project is in the Sunset Park neighborhood of Brooklyn, a prime area with convenient access to bus and subway stations. It takes 25 min to arrive at Financial District on a subway, 30 min to Manhattan on a bus, and 15 min to Brooklyn Bridge on a bus

Transportation

- Subway: D Train (9th Ave)

- Bus Line: B35, B70

- To Midtown Manhattan: 11 Miles(About 25-min Drive)

- To JFK Airport: 24 Miles(About 40-min Drive)

- To LGA Airport: 14 Miles(About 25-min Drive)

Nearby Schools

The basis education system in the area ranks average and does not possess significant competing leverage. According to Great Schools, the PS 169 schools are of average rating.

Living Facilities

The area is surrounded by Japanese, Chinese, and Italian restaurants, and adjacent to banks, supermarkets, clinics, gyms, and shopping malls. The site is close to one of the busiest street in Brooklyn, the 8th avenue.

Recreations

The neighborhood is close to Sunset Park, one of the most known community parks in Brooklyn, and the surrounding recreational businesses can meet all residents' need.

Developer Company: W&L Group

Developer Website: https://www.wandlgroup.com/

Prior Cooperation: None

The founder of W&L Group, Thomas Wang has over 15 years of experience in New York commercial real estate. The developer has completed numerous projects in Brooklyn, Queens, and Manhattan, with focus on hotels and large-scale residential buildings. Under the leadership of Thomas Wang, the development company is gradually becoming a comprehensive development, construction, and property management group.

- The loan originated by CrowdFunz 820 Fund is a short-to-mid term debt investment. In current capital stack, bank originated loan has been approved, and developer has contributed significant equity. Capital structure and leverage are clear.

- Proceeds provided by CrowdFunz 820 Fund will be used to cover construction and operation costs in the final phase. CrowdFunz will closely monitor the use of the capital after deployment.

- We believe that the risk-return balance in CrowdFunz 820 Fund is rational. Pledged entity’s paid-in equity is over $22 million, which is 20 times greater than the loan provided by CrowdFunz 820 Fund. Unlimited personal guarantee is also included.

- Based on clearly defined bilateral agreements, the loan originated by CrowdFunz 820 Fund can provide the developer with short-term liquidity to help the project proceed, and a great value-creation opportunity for the investors. The project has a financial risk lower than industry standard.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)