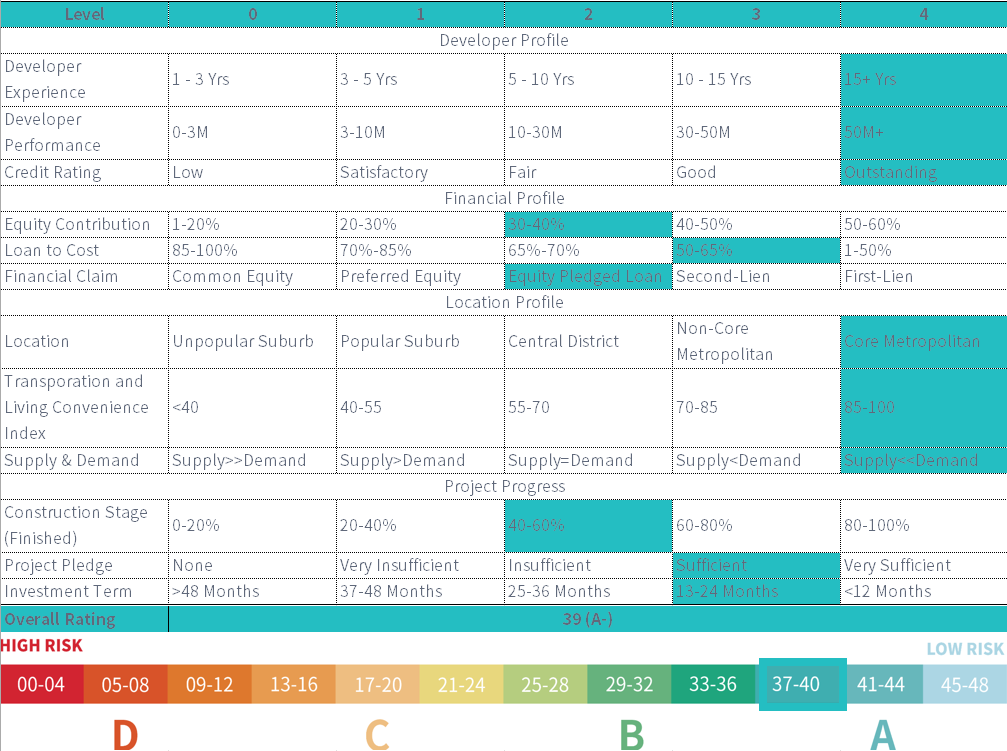

Equity Pledge Debt Fund 823

Type: Debt

Target: $500,000

Annual Return: 7.75% - 8%

Min-invest Amount: $10,000

Duration: 6 - 24 Months

| Fund Type | Equity Pledge Debt Fund |

| Offering Amount | $500,000 U.S. Dollars |

| Estimated Return | 7.75% - 8.00% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | April 2022 |

| Investment Horizon | 6 - 24 Months |

| Dividend Schedule | Prepay Before Per Period(Every 6 Months) |

*1 7.75% Annualized Return For Investment of 1-19 Units; 8.00% Annualized Return for investment above 20 Units.

- Developer purchased the 5 lots for $5.5 million in 2018, and the construction plan was approved at the end of 2020. As of April 2022, building superstructure has been finished, and the interior construction is progressing according to plan.

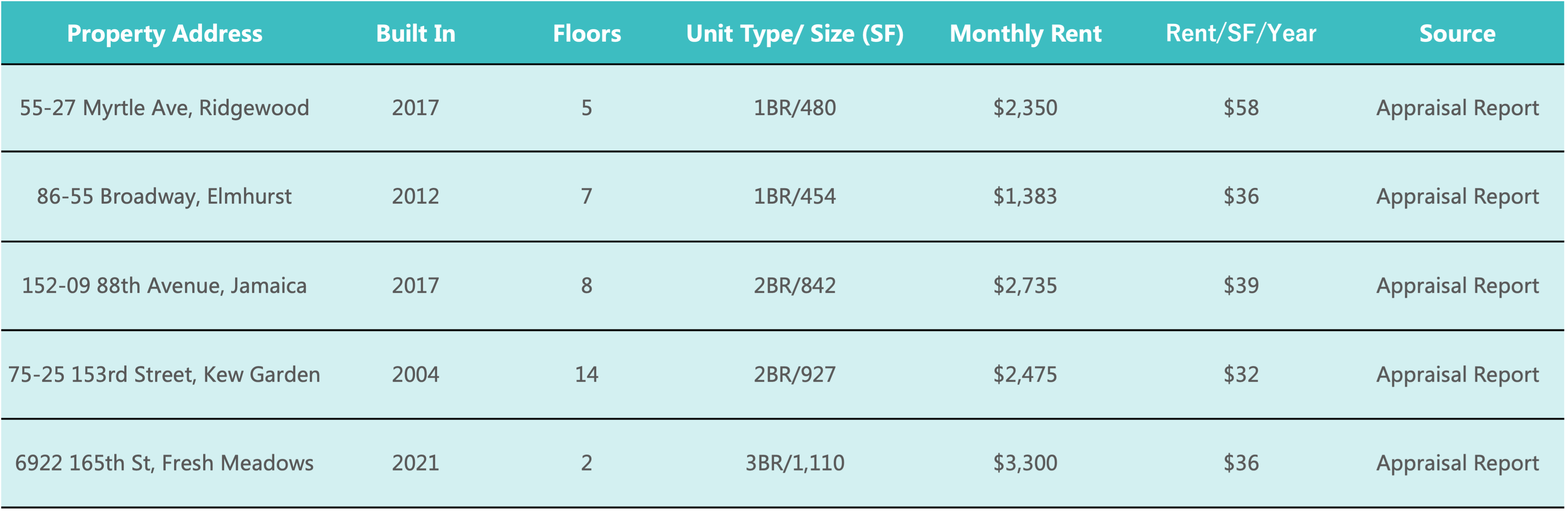

- The property is in Fresh Meadows in Queens. The building is 5-floor tall, mixed-use, with total area of 37,650 SF. The building has 29 residential units, 3 communities service centers, 15 parking spots, and 17 storage units. There are 16 One-Bedroom and 13 Two-Bedroom units, catered to young families. The residential units have relatively bigger living rooms, compared to other properties in Flushing.

| Site Address | 163-11 72nd Ave, Fresh Meadows, NY 11365 |

| Site Area | Fresh Meadows, Queens, New York |

| Lot Size | Near 9,000 SF |

| Zoning | R6(FAR 2.43x) |

| Buildable Area | 24,981 SF |

| Building Size | 37,650 SF |

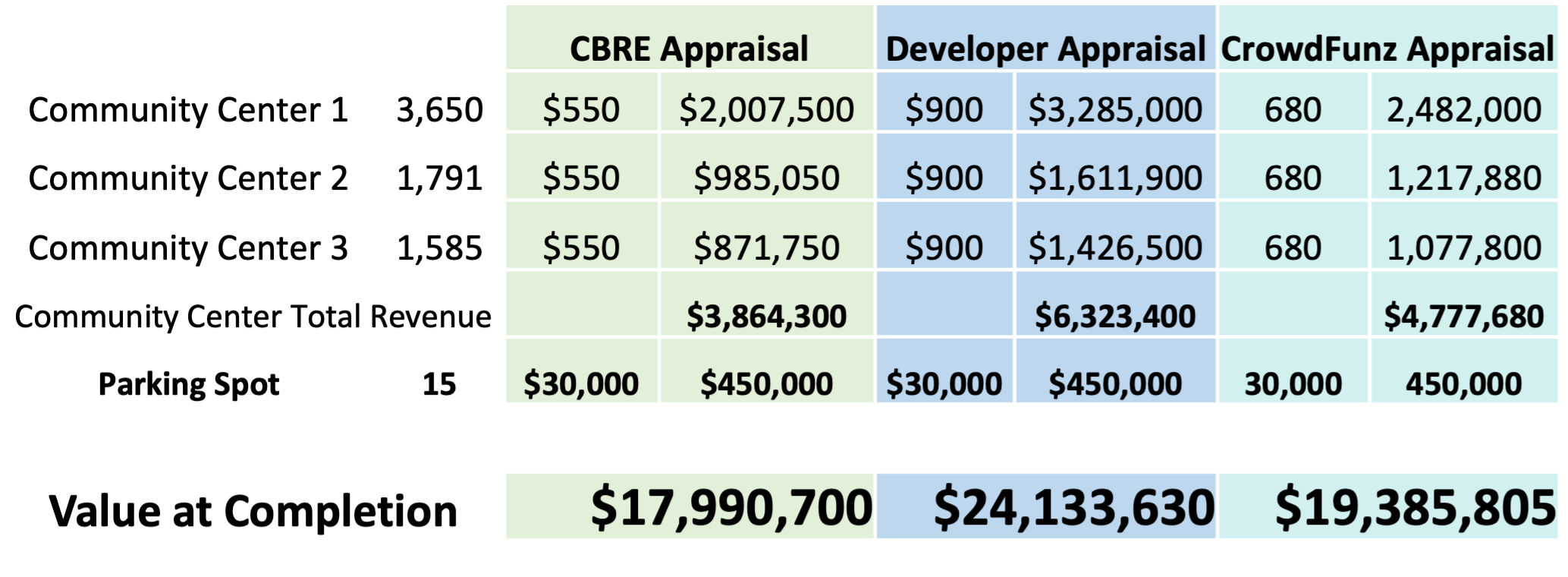

| Market Value Post-Construction | $17,993,000 (CBRE Appraisal Report in August 2020) |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Funding Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | $500,000 | No Later than 5/11/2022 | 4/27/2022 | 10/26/2022 | 6 Months | Pre-paid Dividend |

| Second | No Later than 11/11/2022 | 10/27/2022 | 4/26/2023 | 6 Months | Extension Option Owned by Developer | |

| Third | No Later than 5/11/2023 | 4/27/2023 | 10/26/2023 | 6 Months | Extension Option Owned by Developer | |

| Fourth | No Later than 11/11/2023 | 10/27/2023 | 4/27/2024 | 6 Months | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After the expiration of the first Dividend Period, the developer has 3 options to extend the borrowing by 6 months. If the developer chooses to extend, the investors will receive dividends at the same rate of return during the extension.

- The developer purchased the 5 properties in 2018. After discussing with architect, the developer decided to develop a mix-use property, instead of pure commercial, in order to maximize profit.

- As of April 2022, the bank has approved the $6.7 million construction loan and has distributed $4.53 million to the developer. The developer has contributed $4.25 million of equity to fund initial land acquisition and partial construction cost.

- The $500,000 of mezzanine loan provided by CrowdFunz 823 Debt Fund will provide the developer with short term liquidity. Due to inflation on labor and raw material, there is a delay in the funding of construction loan. The developer will use the proceeds to cover interior construction cost.

- The developer has pledged 100% equity of the project entity to CrowdFunz 823 Debt Fund and will provide unlimited personal guarantee to further secure the loan provided by CrowdFunz.

- The site is in one of the historically prime locations with high Chinese population. With proximity to Flushing and convenient access to public transportations, the area has attracted strong interest from homebuyers.

- The area has attracted substantial interests from Chinese investors, due to its strong transportation network, sufficient living facilities, premier education systems. Residential and mixed-use properties have competitive market price.

- Due to inflation and shortage in raw material and labor, the developer needed short-term bridge loan to fund the pre-order of raw material and interior construction. As of April 2022, the building has topped off, and interior is 30% completed, and the entire construction is 70% finished. When the project is completed, the developer will start the selling Condo units to repay the loan provided by CrowdFunz 823 Debt Fund.

- The developer has great reputation in real estate industry and has completed multiple successful projects in Brooklyn and Queens. Previously, the developer had multiple cooperation with CrowdFunz as listed. CrowdFunz 804 Debt Fund (Repaid); CrowdFunz 809 Debt Fund (Repaid); CrowdFunz 812 Debt Fund (Repaid); CrowdFunz 818 Debt Fund (In Progress), CrowdFunz 822 Debt Fund (In Progress).

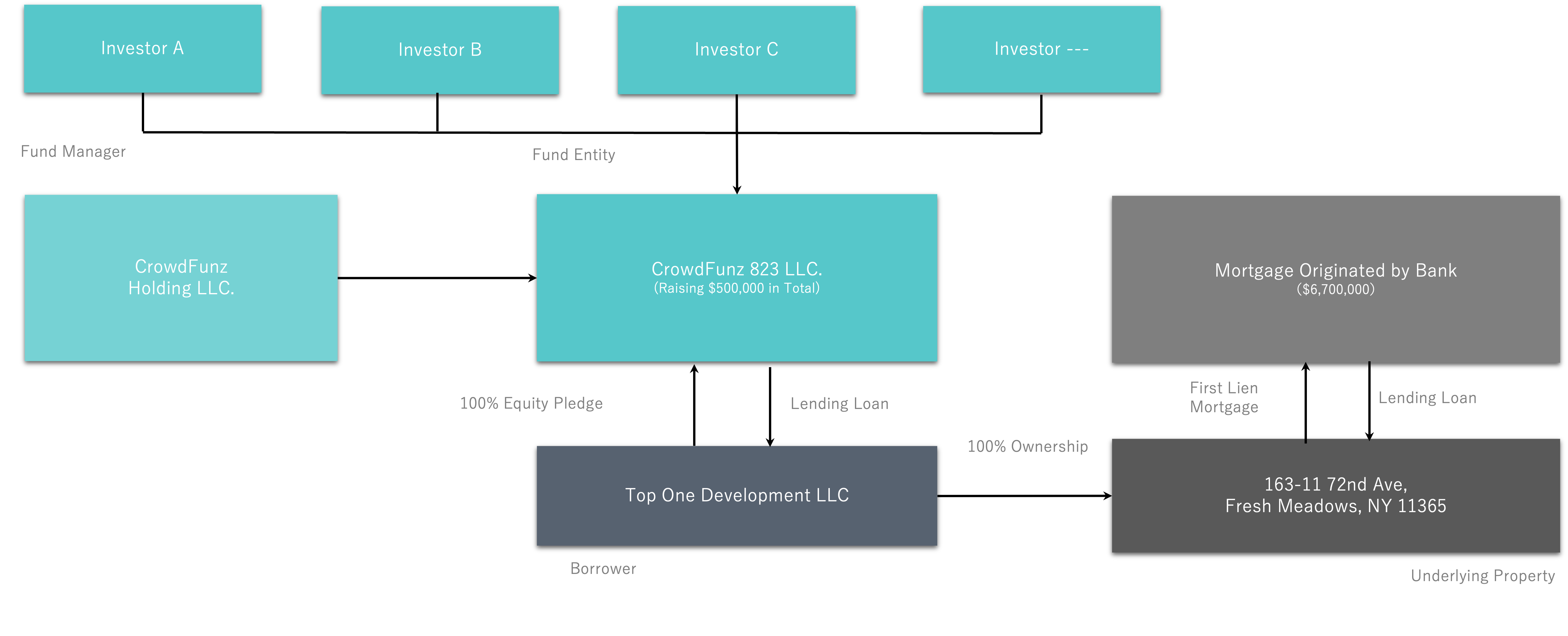

Investment Structure of CrowdFunz 823 Fund

CAPITAL STACK

| Capital Stack | Percentage | |

|---|---|---|

| Mortgage Originated by Commercial Bank | $6,700,000 | 58.52% |

| Loan Issued by CrowdFunz 823 Fund | 500,000 | 4.37% |

| Equity Investment by Developer | 4,250,000 | 37.11% |

| Total Amount | $11,450,000 | 100.00% |

After CrowdFunz 823 Mezzanine Loan enters the capital stack:

- Commercial bank has approved the $6.7 million construction loan in which $4.53 million has been distributed to cover construction cost. The first-lien mortgage is accounted for 58.52% of the total capital.

- CrowdFunz 823 Fund has originated a mezzanine loan in total of $500,000, which is accounted for 4.37% of total capital.Developer has contributed $4,250,000 of equity investment, which is accounted for 37.11% of total capital.

- The developer has pledge 100% equity of project entity to CrowdFunz 823 Debt Fund and will provide unlimited personal guarantee. Equity is valued at around $4.25 million.

FUND USAGE

The $500,000 of mezzanine loan provided by CrowdFunz 823 Debt Fund will provide the developer with short term liquidity to cover interior cost.

The superstructure, facade, and waterproof had been finished, Window frames and glasses are expected to be finished in mid May.

Installation of plumbing and electricity systems, waterproof, and heat insulation are progressing according to plan.

| CrowdFunz 823 Fund – Proceed Usage | ||

|---|---|---|

| Construction Expenses | Amount | Percentage |

| Door and Window Frame | $80,000 | 16% |

| Plumbing and Electricity | 100,000 | 20% |

| HVAC | 120,000 | 24% |

| Elevator | 140,000 | 28% |

| Cabinets | 60,000 | 12% |

| Total | $500,000 | 100% |

* Data provided by Developer

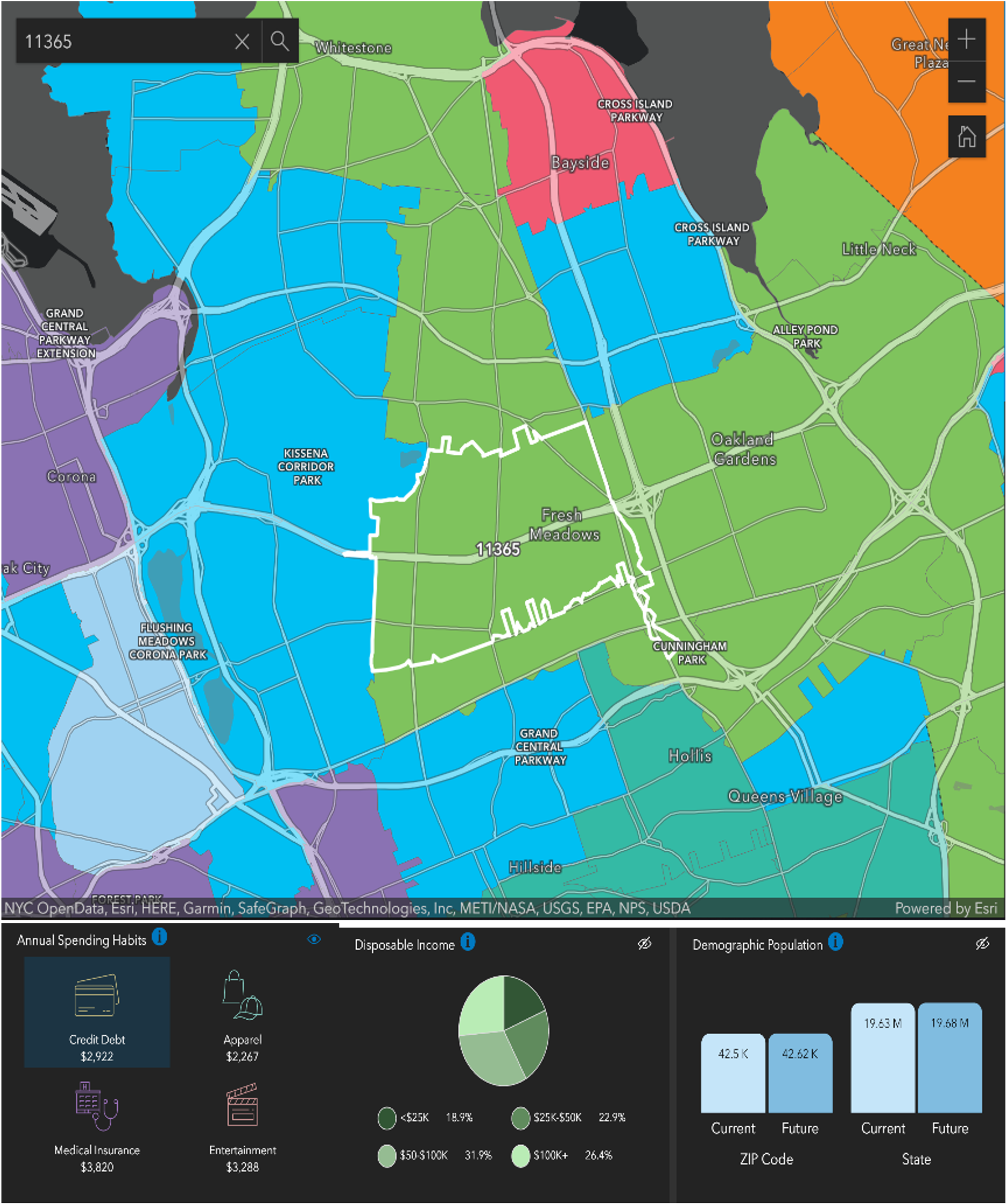

Demographics in the Zip Code

| Zip Code 11365 | |

|---|---|

| Regional Population | 43,730 |

| Median Age | 41 |

| High School Education or above | 69.8% |

| Commute Area | Metropolitan(99.9%) |

| Family Median Income | $87,247 |

| White Collar / Blue Collar | 79.7%/20.3% |

| Child-Bearing Family | 31.7% |

| Average Family Size | 2.78 |

| Average House Price | $857,000 |

Fresh Meadows neighborhood has competitive land price and higher sale price supported by strong demand from both homebuyers and investors, making the area suitable for mid-size developers.

Most residents in the area have families. Residents have stable income and spend mainly on daily family necessities.

Residents have an average age of 41 years. Children-bearing family is accounted for 31%. Housing inventory is low while the buying interest is strong, providing upward pressure on housing price. Some properties offer rental apartments to local students and parents.

* Data Source: United States Zip Codes. Org. & Esri Zip Code Lookup,American Community Survey in April 2022.

Location

Project site is in Fresh Meadows in Queens, a prime area with convenient access to bus stations and major airports. Driving to Midtown Manhattan takes approximately 40 minutes.

Transportation

- Bus Line: Q64, Q65, QM4, QM44

- To Midtown Manhattan: About 40 Min

- To JFK Airport: 6 Miles(20-min drive)

- To LGA Airport: 5 Miles(10-min drive)

Nearby Schools

The project area offers impeccable education system, full of kindergarten, middle schools, and high schools. There are also higher education and professional study institutions for career advancement for young professionals.

Living Facilities

Most residents are around 40 years old with family. The area offers convenient access to grocery stores, local shops, living facilities, and transportations. Over the years, the area has become one of the best investment locations.

Recreations

The living facilities are catered to families, including recreation centers, parks, and museums.

Developer Company: Great Stone General Construction Corp.

Developer Website: https://www.greatstoneny.com/

Prior Cooperation: CrowdFunz 804 Debt Fund / CrowdFunz 807 Debt Fund / CrowdFunz 809 Debt Fund / CrowdFunz 812 Debt Fund / CrowdFunz 818 Debt Fund / CrowdFunz 822 Debt Fund

Great Stone General Construction Corp. has 20 years of real estate development experience. The team started as real estate brokers and became a seasoned developer. The firm had great commercial success in its first development in Elmhurst, Queens in 2002. Over the past two decades, the developer had completed multiple successful projects and earned outstanding reputation among New York real estate industry.

- The loan originated by CrowdFunz 823 Fund is a short- term debt investment. CrowdFunz will closely monitor the use of the capital after deployment and ensure timely repayments.

- Given the great expertise and credit history of the developer, sufficient equity value pledged, and healthy capital stack, we believe that the risk-return balance in CrowdFunz 823 Fund is rational. The pledged equity value is 8 times the loan amount provided by CrowdFunz 823 Debt Fund.

- Based on clearly defined bilateral agreements, the loan originated by CrowdFunz 823 Fund can provide the developer with short-term liquidity to help the project proceed, and a great value-creation opportunity for the investors. The project has a financial risk lower than industry standard.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)