Equity Pledge Debt Fund 826

Type: Debt

Target: $3,000,000

Annual Return: 7.25% - 7. 50%

Min-invest Amount: $10,000

Duration: 3 - 12 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $3,000,000 U.S. Dollars |

| Estimated Return | 7.25% - 7.50% Annualized Return*1 |

| Investment Type | Equity Pledged Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | September 2022 |

| Investment Horizon | 3 - 12 Months*2 |

| Dividend Schedule | Prepaid per 3 Months*3 |

*1 7.25% Annualized Return For Investment of 1-19 Units;

7.50% Annualized Return for investment above 20 Units.

*2 Investors will receive a minimum of 3 months of dividends. After 3 months, dividends will be calculated in terms of days till the developer repays the loan.

*3 Investors will receive prepaid dividends every 3 months if the developer chooses to extend the term.

- Property is in the core area of Lower East Side, Manhattan, and close to Manhattan Bridge and Williamsburg Bridge. Developer expects to receive Temporary Certificate of Occupancy (TCO) from Department of Building in October 2022.

- Property is a 12-floor, 85 units luxury condominium building, and building area is 73,831 SQFT. Property also features 4 parking spaces and 50 personal storage units for sale. Building offers 24-hour doorman service and amenities including gym, outdoor terrace, and entertainment center.

| Property Address | 208 Delancey Street, New York, NY 10002 |

| Site Area | Lower East Side, Manhattan, NY |

| Building Size | 73,831 SQFT |

| Living Area | 54,810 SQFT |

| Total Units | 85 Units |

| TCO Date | October 2022 |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 10/4/2022 | 9/20/2022 | 12/19/2022 | 3 Months | Prepaid Dividend | |

| Second | No Later than 1/3/2023 | 12/20/2022 | 3/19/2023 | 3 Months | Extension Option Owned by Developer *2 | |

| Third | No Later than 4/3/2023 | 3/20/2023 | 6/19/2023 | 3 Months | Extension Option Owned by Developer *3 | |

| Forth | No Later than 7/4/2023 | 6/20/2023 | 9/19/2023 | 3 Months | Extension Option Owned by Developer *3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 3 months worth of dividend. After 3 months, dividend will be calculated based on days until developer repays the principal.

*3 After first dividend period, developer owns 3 extension options. If developer exercises the options, investors will receive additional dividend accordingly.

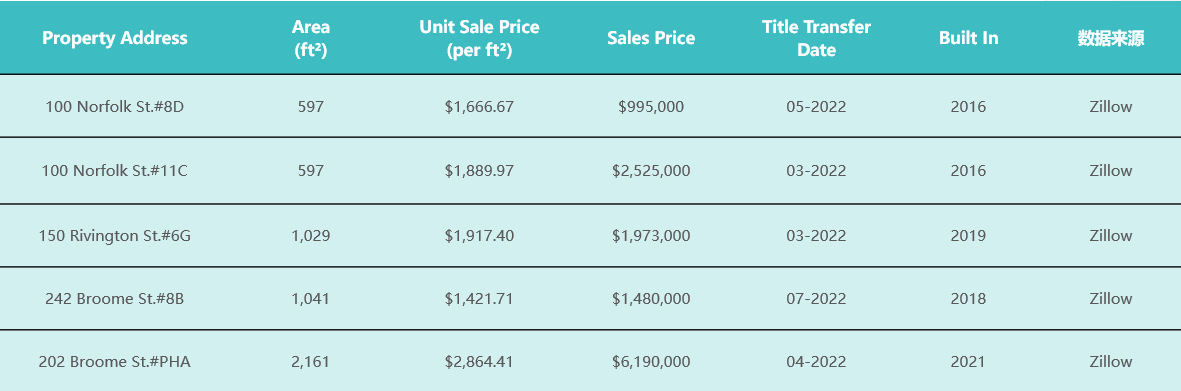

- According to the Appraisal Report provided by Property Valuation Inc. in April 2022, the property could have a market value of $103,000,000 after completion. As of August 2022, condo units worth of $49,000,000 had entered contract.

- CrowdFunz 826 Fund will provide developer short-term liquidity. As of August 2022, developer had nearly $40,000,000 worth equity, which is more than 13 times of the lending amount from CrowdFunz Fund 826. Developer has provided Unlimited Personal Guarantee for further security.

- Underlying property is in Lower East Side, Manhattan, and is 3-min walk from the closest subway station. The area is populated and well developed, and it is one of tourist’s favorite locations close to Williamsburg bridge.

- The area has become one of the fastest growing communities in Manhattan; it has bars, restaurants, coffee shops, art galleries, and parks around, and it has become young professionals 'desired living community.

- The construction is completed; developer expects to receive TCO from Department of Building in October 2022.

- Loan provided by CrowdFunz Fund 826 will be used for project’s carrying cost, including loan interests and land tax. After obtained TCO, developer would repay the loan from CrowdFunz Fund 826 by inventory loan from commercial banks and the sales proceeds of condos.

- Developer has great reputation in Manhattan and Brooklyn developer network, and developer had established its unique development strategies and matured project cashflow management. Developer had cooperated with CrowdFunz for multiple times, including CrowdFunz Fund 604 (ended), Fund 805 (ended), and Fund 819 (on-going).

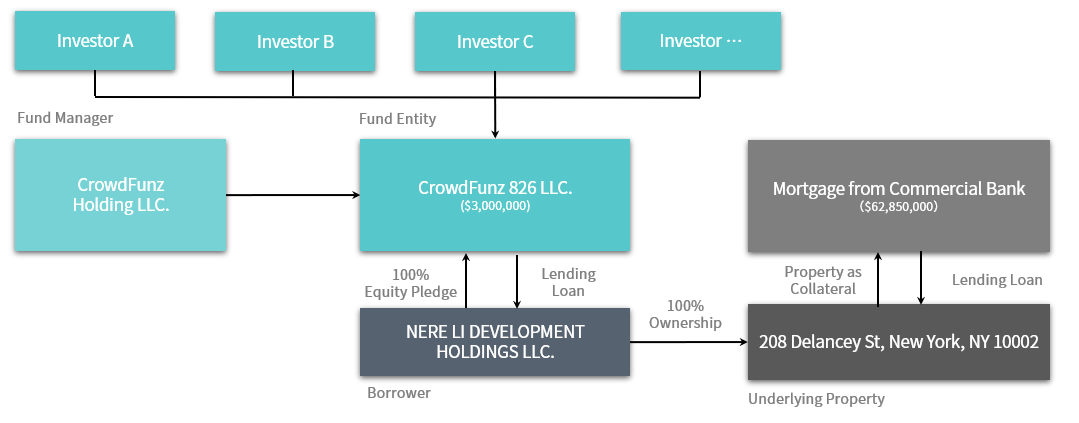

Investment Structure of CrowdFunz 826 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Construction Loan from Commercial Banks | $62,850,000 | 68.43% |

| Loan Issued by CrowdFunz Fund 826 | $3,000,000 | 3.27% |

| Equity Contribution by Developer | $26,000,000 | 28.30% |

| Total | $91,850,000 | 100.00% |

- Developer had contributed $26,000,000 of equity, which is accounted for 28.3% of total funding amount in the project.

- Based on the appraisal, the equity held by the developer could be conservatively valued at $40,000,000.

- The $3,000,000 loan provided by CrowdFunz Fund 826 will help developer’s short-term liquidity, and it is accounted for 3.27% of total funding amount.

- Developer had pledged 100% equity of the project entity as collateral and offered Unlimited Personal Guarantee.

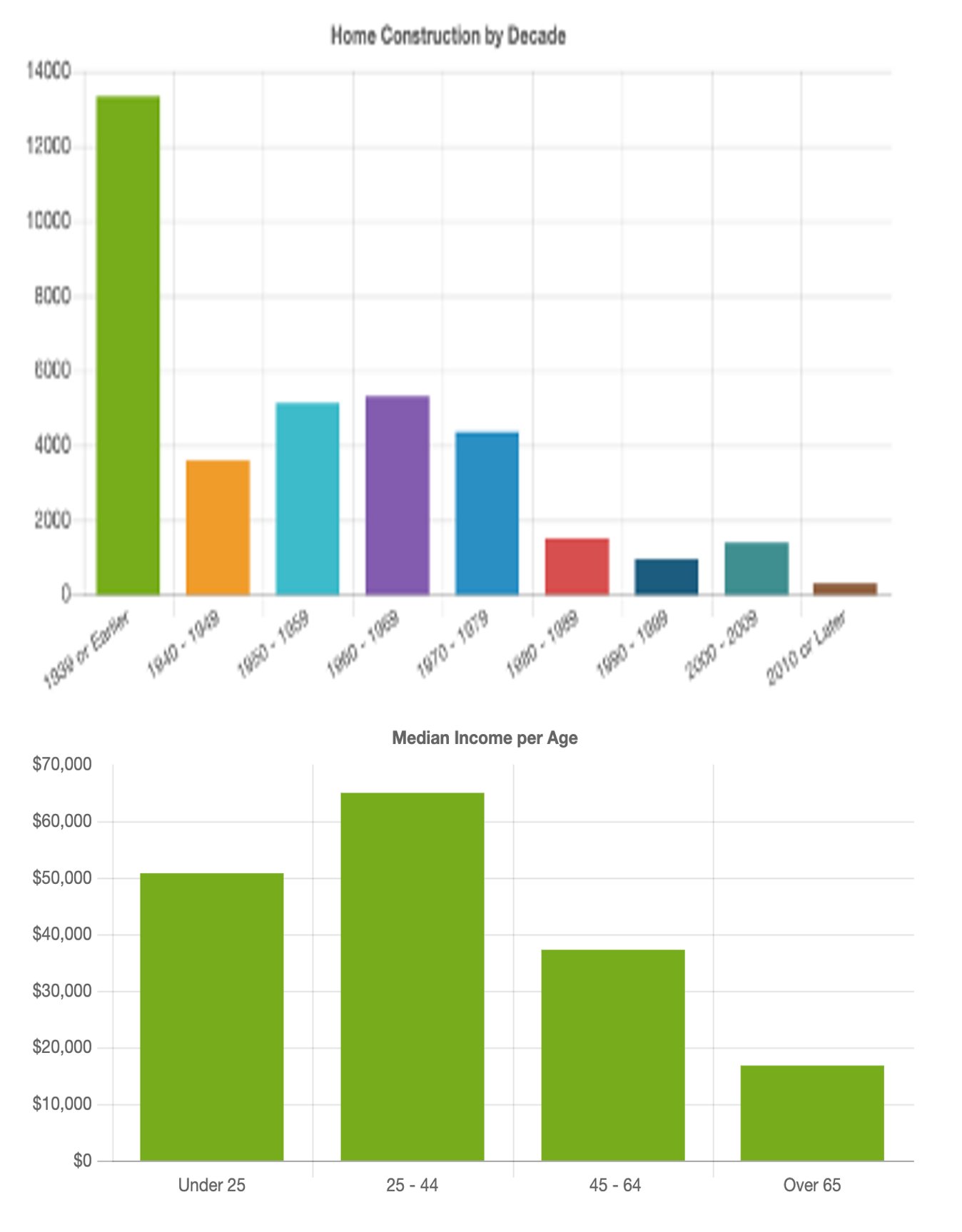

Demographics in the Zip Code

| Zip Code 10002 | |

|---|---|

| Regional Population | 77,925 |

| Median Age | 41.8 |

| High School Education or above | 81.51% |

| Race | Asian/Caucasian/Latino |

| Family Median Income | $65,718 |

| Child-bearing Family | 18.56% |

| Average Family Size | 2 |

| Buy House to Own | 49.88% |

Lower East Side is a great area for businesses and for residentials. It has become one of the most desired living areas by professionals and fashion enthusiasts, for its strong transportation and advanced living facilities.

Residents are diverse, with 32% Asian. Other races include Caucasian, Latino, and African American.

Most residents are of middle-age and have stable family income. Average age is 41.8 year-old, and 20% of the families bear at least a child. As more professionals and residents move back into the city, local housing supply is becoming more insufficient, therefore making the area a great real estate investment target.

* Source: Point 2 Homes & NICHE public data.

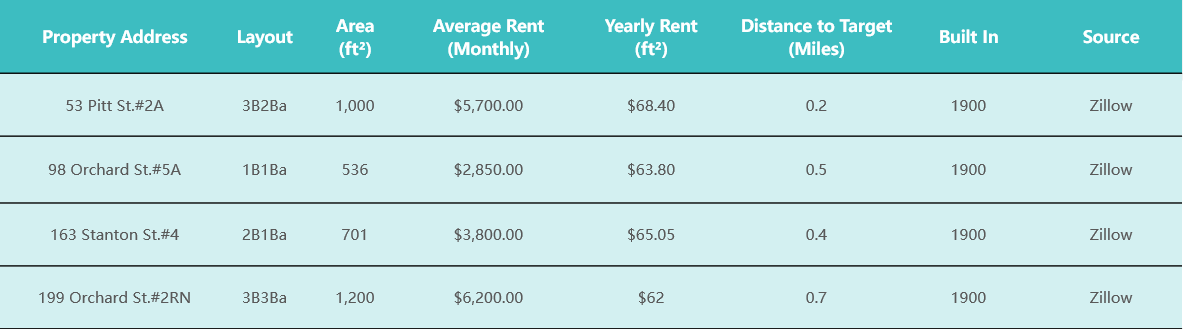

The valuation analysis by the appraisal company

* Appraisal Report; compiled and calculated by CrowdFunz

According to Appraisal Report provided by Property valuation Inc., the property could have $103,000,000 of total sales

Based on current market price, CrowdFunz estimates that the property could be valued at $107,000,000

Location

The area has strong network of transportation. Project site is 3-min walk from closest subway station and 15-min subway away from Midtown, Manhattan and Financial District. Driving to LGA or JFK Airport takes approximately 20 to 30 minutes.

Transportation

- Subway:A, C, F, M, J, Z (3-min walk to station)

- To Midtown Manhattan:3 miles(15-min drive)

- To JFK Airport:16 miles(30-min drive)

- To LGA Airport:9 miles(20-min drive)

Nearby Schools

The area has wide selection of high-quality primary, middle, and high schools, to meet education needs, as shown in the map.

Living Facilities

Project is in Manhattan’s prime area with abundant coffee shops, restaurants, art galleries, and living facilities. Proximity to Chinatown brings convenience to Chinese residents.

Recreations

Project is close to museums, gyms, and recreation centers. New Museum, Westwood Gallery, and Sperone Westwater Gallery are popular among tourists and residents.

Developer Company: New Empire Corp.

Developer Website: https://www.newempirecorp.com/

Prior Cooperation: CrowdFunz Fund 604 / CrowdFunz Fund 805 / CrowdFunz Fund 819

New Empire Corp. was founded in 1997 and has over 20 years of development expertise.

Its projects in Long Island City and in Brooklyn have won Best-selling Condominium Awards in New York City and Brooklyn.

Under the leadership of CEO Bentley Zhao and Vice President Kevin Zhao, the company has completed over 100 residential and hotel projects.

- The loan provided by CrowdFunz Fund 826 is a short-term bridge loan and will be utilized for developer’s carrying cost. By the time developer receives the proceeds, the construction of the property is completed. Developer expects to receive TCO in October 2022.

- After due diligence, CrowdFunz believes that the project is in prime location and has reasonable capital structure and strong developer background. Developer had equity valued more than 13 times of the loan amount provided by Fund 826, and Unlimited Personal Guarantee is added for risk control.

- CrowdFunz believes that the loan provided by CrowdFunz Fund 826 has investment risk below the industry average and is a great investment opportunities for suitable investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)