Mortgage Debt Fund 618

Type: Debt

Target: $1,200,000

Annual Return: 8.00%

Min-invest Amount: $10,000

Duration:

| Fund Type | Private Equity Fund |

| Offering Amount | $1,200,000 |

| Estimated Return | 7.75% - 8.00% Annualized Return |

| Investment Type | First Lien Mortgage |

| Unit Price | $10,000 / Subscription Unit |

| Offering Date | November 2022 |

| Investment Timeline | 12 -24 Months |

| Dividend Schedule | Prepaid per 6 Months |

*1 7.75% Annualized Return For Investment of 1-19 Units;

8.00% Annualized Return for investment above 20 Units;

*2 Investors will receive at least 12 months of dividend. After 12 months, dividend will be accrued based on number of days till the principle is repaid;

*3 Investors will receive prepaid dividend every 6 months.

- Property is in Little Neck, Queens, a historic area populated by high-net-worth families that reside in luxury single family houses. The area provides ample education resources with competitive property tax rate.

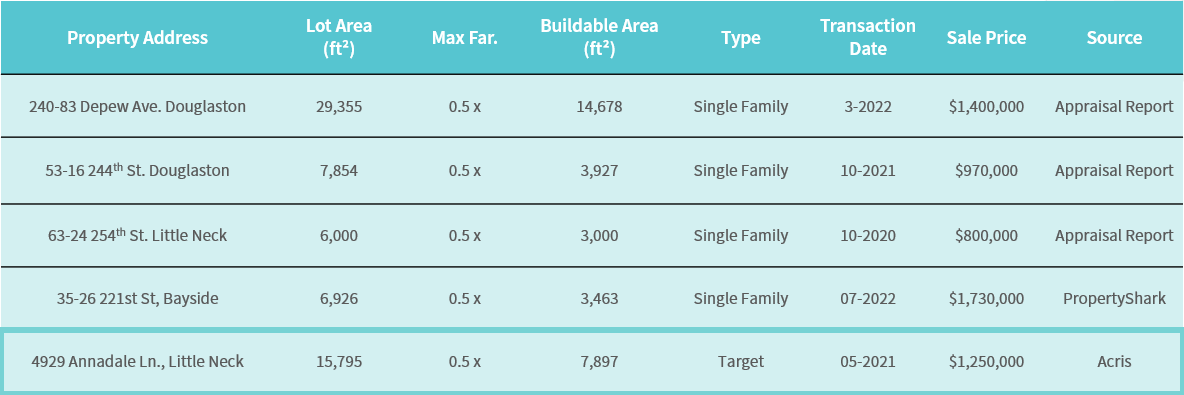

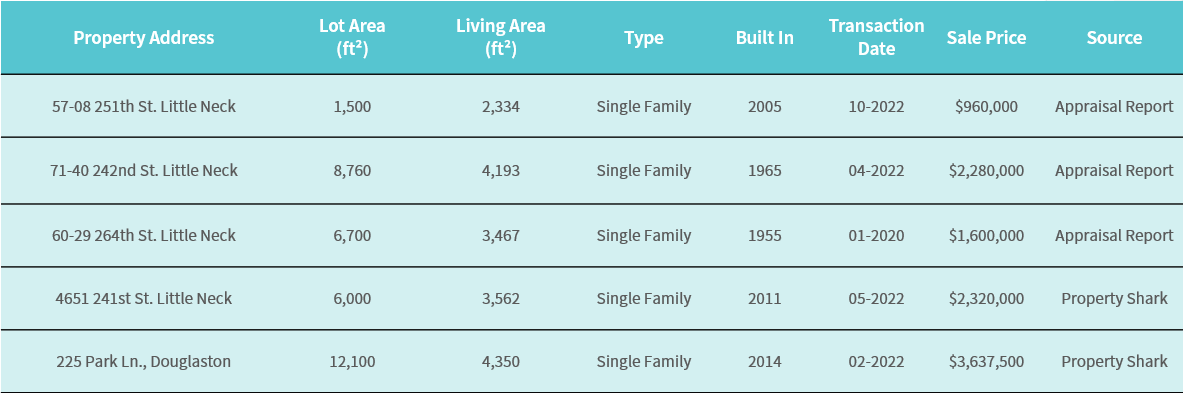

- Developer plans to build a 15,795 square feet single family luxury house, with 5,000 square feet of living area. Building plan was approved in January 2022. As of October, foundation and exterior wall had been finished, and construction is proceeding as planned.

| Address | 4929 Annadale Lane, Little Neck, NY, 11362 |

| Area | Little Neck, Queens, NY |

| Lot Area | 15,795 Square feet |

| Building Area | 5,000 Square feet |

| Estimated TCO | Forth Quarter of 2023 |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 12/1/2022 | 11/15/2022 | 5/14/2023 | 6 Months | Prepaid Dividend*1 | |

| Second | No Later than 6/1/2023 | 5/15/2023 | 11/14/2023 | 6 Months | Prepaid Dividend*2 | |

| Third | No Later than 12/1/2023 | 11/15/2023 | 5/14/2024 | 6 Months | Extension Option Owned by Developer *3 | |

| Forth | No Later than 6/1/2024 | 5/15/2024 | 11/14/2024 | 6 Months | Extension Option Owned by Developer *3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day;

*2 Investors will receive at least 6 months of dividend. After 6 months, dividend will accrue in terms of days until Developer repays the loan;

*3 Developer has 2 extension rights. If Developer chooses to exercise the first extension option, investors will receive 6 months worth of prepaid dividend.

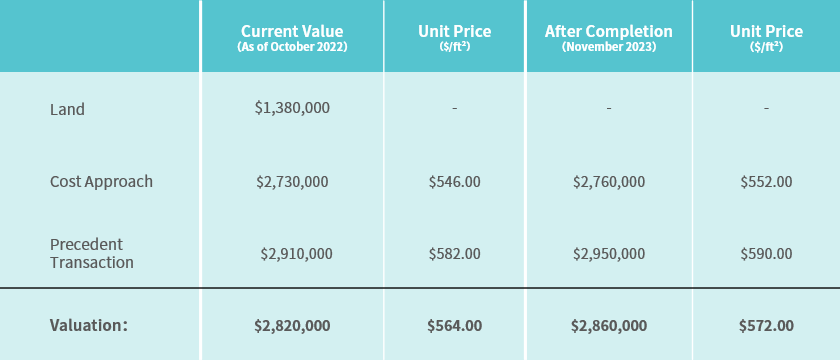

- According to Appraisal Report provided by Marshall Stevens in October, property has market value of $2,820,000 as-is, and could be sold for at least $2,860,000 when completed.

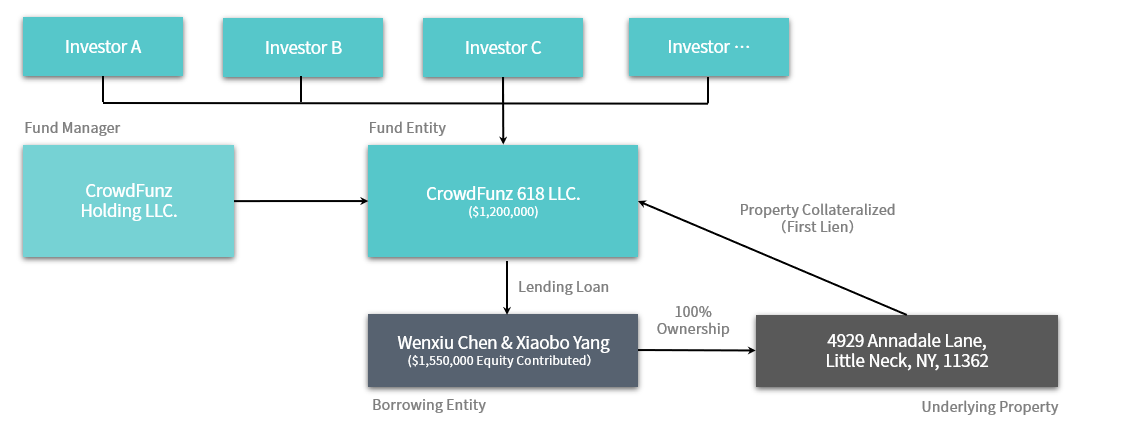

- CrowdFunz Fund 618 will provide short-term liquidity to cover the construction cost, with land as the collateral. Project equity is $1,550,000 and is 3 times the loan amount. Developer had also provided Unlimited Personal Guarantee.

- Property is in Little Neck, Queens and is 3-min driveway from LIRR. It takes 30 minutes to arrive Midtown Manhattan by taking train. A comprehensive Highway network also supports for convenient traveling. Area has strong education resources, relatively low cost of living and property tax, with living convenience. Over the years, area has got more attention and interests from Chinese investors and homebuyers.

- Property’s superstructure is completed. Developer expects to receive Certificate of Occupancy from Department of Building in forth quarter of 2023. Loan provided by CrowdFunz Fund 618 will cover construction cost. Once construction is complete, Developer will either sell the property or apply for Inventory Loan to repay the loan.

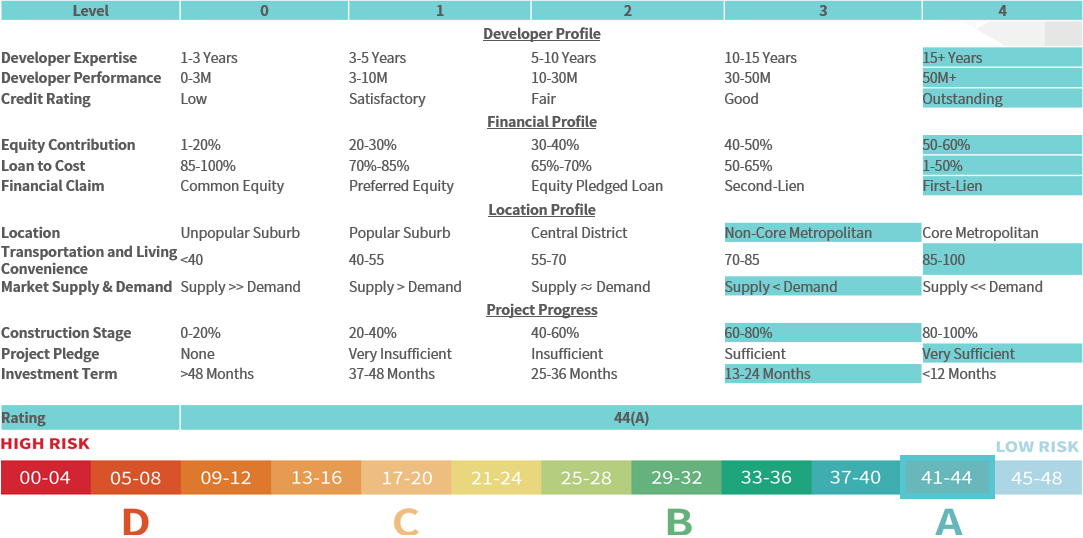

- Developer has 20-year experience in retailing and wholesaling of construction materials in New York and had successfully completed over 10 development projects.

- Developer has conservative strategy and completes projects step-by-step. Its strict standard for quality has garnered reputation regionally. This project will mark the first collaboration between CrowdFunz and Developer, and both parties hope for long-term mutual success.

Investment Structure of CrowdFunz 618 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| First Lien Mortgage Loan Originated from CrowdFunz Fund 618 | $1,200,000.00 | 43.64% |

| Developer Equity Contribution | $1,550,000.00 | 56.36% |

| Total | $2,750,000.00 | 100.00% |

- Project’s Capital Stack is clearly structured.

- According to Appraisal Report, property could be sold for at least $2,860,000 after completion, enough to cover $2,750,000 total investment in Capital Stack.

- Developer already contributed $1,550,000 of equity, which is accounted for 56.36% of the capital stack.

- CrowdFunz Fund 618 will provide $1,200,000 of First Lien Mortgage, which is accounted for 43.64% of capital stack, lover than the 55% lending benchmark of commercial banks.

- Loan provided by CrowdFunz Fund 618 has mortgaged as colleterial and Unlimited Personal Guarantee from Developer.

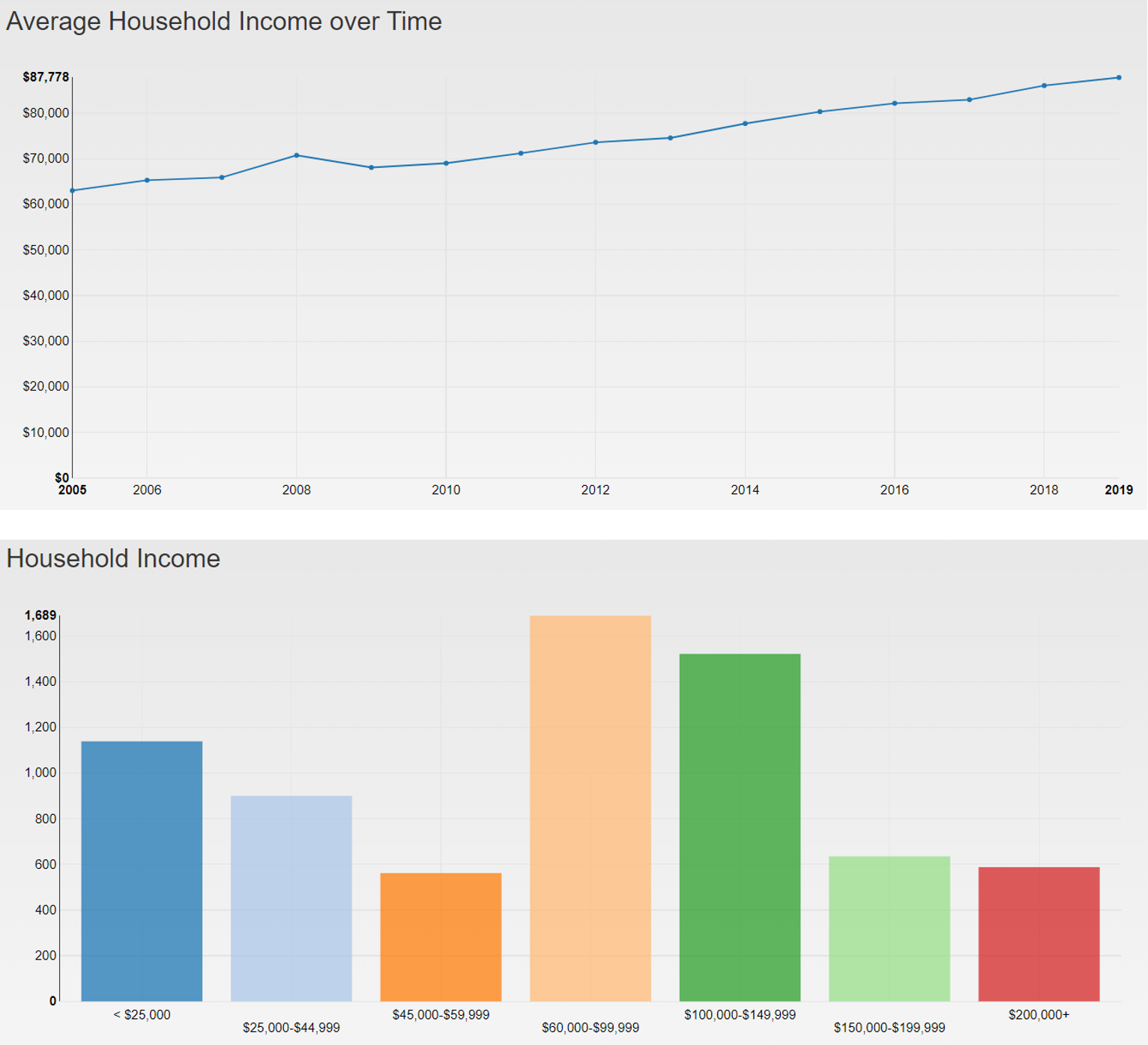

Demographics in the Zip Code

| Zip Code 11362 | |

|---|---|

| Regional Population | 18,694 |

| Median Age | 42.7 |

| College Education or Above | 91.3% |

| Race | Asian/Caucasian/Latino |

| Family Median Income | $92,212 |

| Child-bearing Family | 23% |

| Average Family Size | 3.17 |

| Buy House to Own | 79% |

Little Neck is located between Bayside and Long Island and offers convenient transportation to Long Island and Manhattan. In the past decade, area had developed retail stores and restaurants catered to Asian consumers.

Residents have average age of 42.7 years old and diverse residents, with 45.7% Caucasian, 42.14% Asian, and 2.35% African American. Families have stable middle-class income.

Neighborhood has stable and thriving economy, and the residents have high level of discretionary spending and high spending demands. The average family annual income is around $92,000.

* Source: Point 2 Homes,UnitedStatesZipCodes.com, and Esri.com.

Location

Project is in Little Neck’s prime neighborhood. Site is 5-min walk and 5-min drive way from M/R train and LIRR stations, respectively. Driving to Midtown, Manhattan, would take approximately 25 minutes. Project is also nearby 495 Highway and Northern Blvd. Driving to JFK or LGA Airports takes 20 minutes. Area provides inclusive living facilitates, including Shopping malls, hospitals, police stations, banks, and schools.

Transportation

- LIRR Station:0.8 Miles (3-min driving)

- To JFK Airport:12 miles (28-min driving)

- To LGA Airport:12 miles (25-min Driving)

Nearby Schools

Neighborhood has above-average and highly competitive education resources. According to Great Schools, the school district has PS94 and PS221 that are scored 10 and 9.

Living Facilities

Project’s neighborhood offers restaurants of different cuisines and shopping malls. In addition, area is nearby banks, hospitals, gyms, and other living facilities.

Recreations

Little Neck has library, science and art museums, and is close to U.S. Open Tennis stadiums located in Flushing. The area is suitable for families with children.

Developer Company: Great Stone General Construction Corp.

Developer Website: https://www.greatstoneny.com/

Starting off from brokerage, CKZ Realty has over 18 years of real estate development experience.

Its first development in Elmhurst in 2002 was a huge commercial success. Since then, Developer has been established its name and reputation among Chinese developers and has accomplished multiple well-known projects.

- CrowdFunz Fund 618 will provide Developer short-to-midterm liquidity to cover funding gap. Property’s superstructure is almost completed, making default risk relatively low.

- After due diligence, CrowdFunz believes that the property is in prime location, and the project has reasonable capital stack as Developer had contributed $1,550,000 of equity, which is 3 times the loan amount. Fund 618 will have first lien financial claim and additional unlimited personal guarantee.

- CrowdFunz believes that the loan provided by CrowdFunz Fund 618 has investment risk below the industry average and is a great investment opportunity for suitable investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)