Equity Pledge Debt Fund 828

Type: Debt

Target: $2,000,000

Annual Return: 8.00 - 8.25%

Min-invest Amount: $10,000

Duration: 12 – 24 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $2,000,000 |

| Estimated Return | 8.00 – 8.25% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | December 2022 |

| Investment Timeline | 12 + 6 + 6 Months |

| Dividend Schedule | Prepaid per 6 Months*2 |

*1 8.00% Annualized Return for Investment of 1-19 Units; 8.25% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividends. After 12 months, dividends will be calculated in terms of days till principal is repaid; Investors will receive prepaid dividend before every period.

- Property is located in Woodside, a booming area of Queens and a key transportation hub connecting Manhattan and Long Island in New York. Two major roads, Highway I-278 and Queens Blvd., go cross the area.

- Developer purchased the Lot for $16,200,000 in June 2022 and is preparing for the demolition of existing building. Developer expects to complete the project in 3 years and 3 months. The proposed property will offer 120 residential units, 60 parking spots, and 60 storage units.

| Property Address | 58-01 Queens Blvd., Queens, NY 11377 |

| Site Area | Woodside, Queens, New York |

| Lot Area | 18,924 Sqft |

| Sellable Area | 96,602 Sqft |

| Total Units | 120 Residential Units |

| Construction Duration | 3 Years and 3 Months |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 12/21/2022 | 12/7/2022 | 6/6/2023 | 6 Months | Prepaid Dividend | |

| Second | No Later than 6/21/2023 | 6/7/2023 | 12/6/2023 | 6 Months | Prepaid Dividend *2 | |

| Third | No Later than 12/21/2023 | 12/7/2023 | 6/6/2024 | 6 Months | Extension Option Owned by Developer *3 | |

| Forth | No Later than 6/21/2024 | 6/7/2024 | 12/6/2024 | 6 Months | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After 12 months, dividends will be calculated in terms of days till principal is repaid.

*3 After 2 dividend periods, Developer owns two extension options, and investors will receive dividend accordingly.

- According to the Appraisal Report provided by CBRE, as of May 2022, the property could have a market value of $16,300,000.

- The short-term loan provided by CrowdFunz Fund 828 is secured by equity of the entity owning the project. As of November 2022, Developer had contributed $9,100,000 of equity, which is more than 4 times the loan offered by Fund 828. Developer would also provide unlimited personal guarantee.

- Project is located in Woodside, Queens, an emerging neighborhood with strong transportation network. The location also has 5-minute walking distance to LIRR, metro, and bus routes, making it convenient to access Manhattan, Queens, and Brooklyn.

- Among the emerging neighborhoods of Queens, Woodside takes advantages of its convenient transportation and has developed a diversify and comprehensive business environment. In the recent years, the residents has shown an incremental income increase which also benefits the gentrification of local real estate market.

- Developer plans to use the loan provided by CrowdFunz Fund 828 on demolition and other soft costs, including but not limited to property tax, filing fee, and interest payments.

- Once initial development is finished, Developer would apply for construction loan from a commercial bank or use other sources of funding to repay the loan provided by CrowdFunz Fund 828.

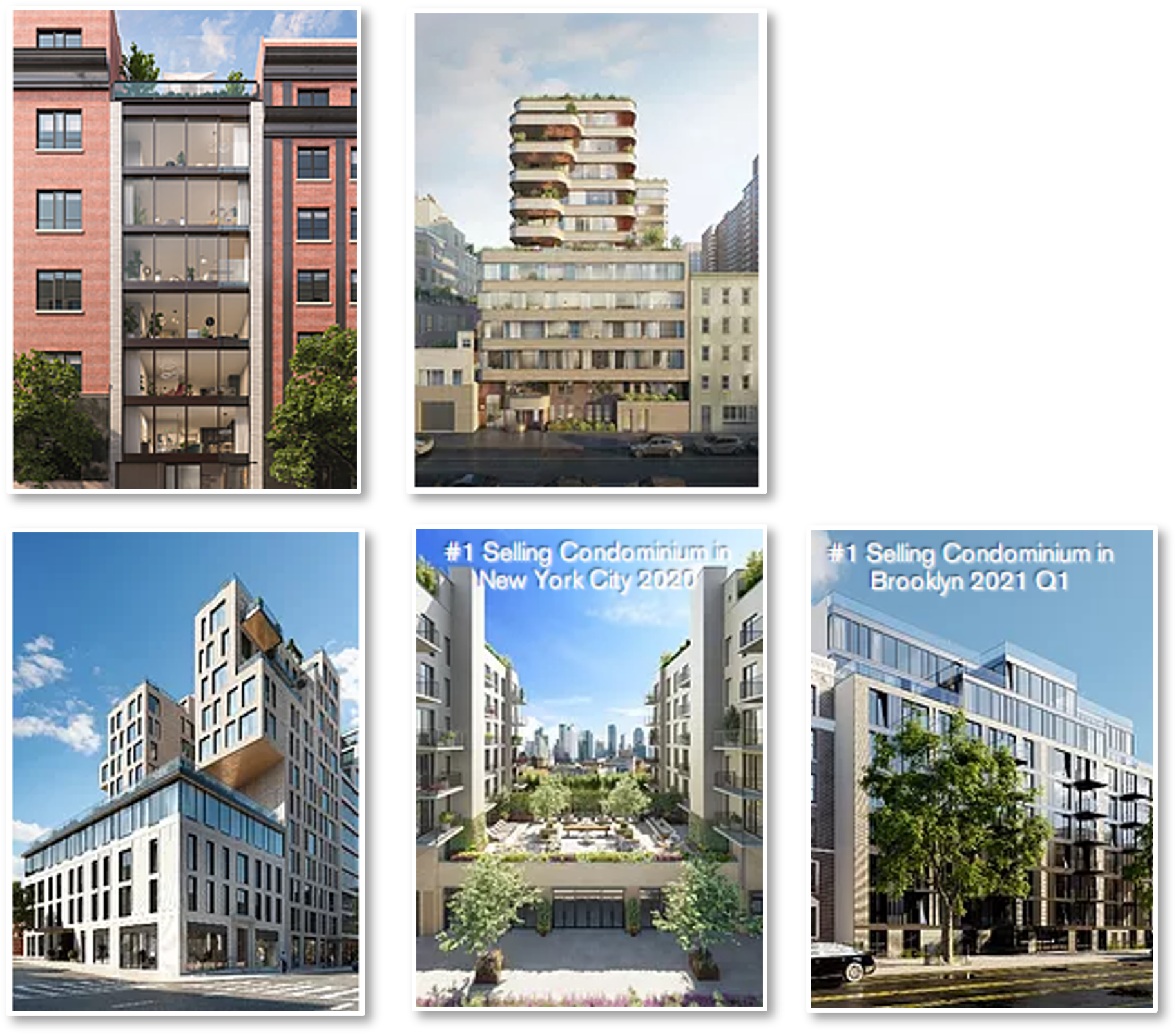

- Developer has great reputation within Manhattan and Brooklyn developer network for its unique development strategies and project cashflow management.

- Developer had collaborated with CrowdFunz for multiple times, including CrowdFunz Fund 604 (Fund Ended), Fund 805 (Fund Ended), Fund 819 (Fund Closed), and Fund 826 (Fund Closed). The developer has shown its development strength and good reputation to CrowdFunz investors.

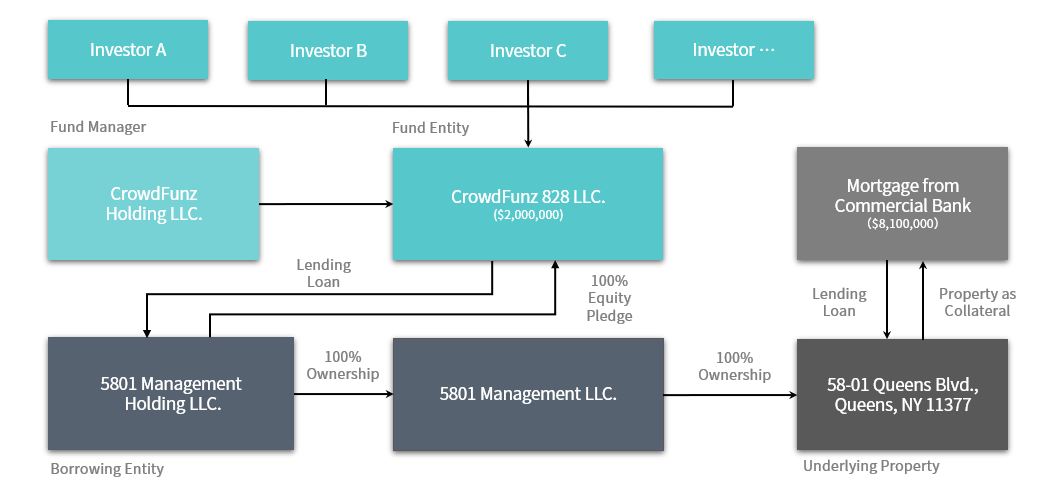

Investment Structure of CrowdFunz 828 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Mortgage from Commercial Bank | $8,100,000 | 42.18% |

| CrowdFunz Fund 828 Equity Pledge Loan | $2,000,000 | 10.42% |

| Developer Equity Contribution | $9,100,000 | 47.40% |

| Total | $$19,200,000 | 100.00% |

- Developer had contributed $9,100,000 of equity, which is accounted for 47.4% in the capital stack.

- CrowdFunz Fund 828 will lend $2,000,000 of Equity Pledge Loan, which is accounted for 10.42% in the capital stack.

- Developer had pledged 100% equity of the entity owning the project and would provide Unlimited Personal Guarantee.

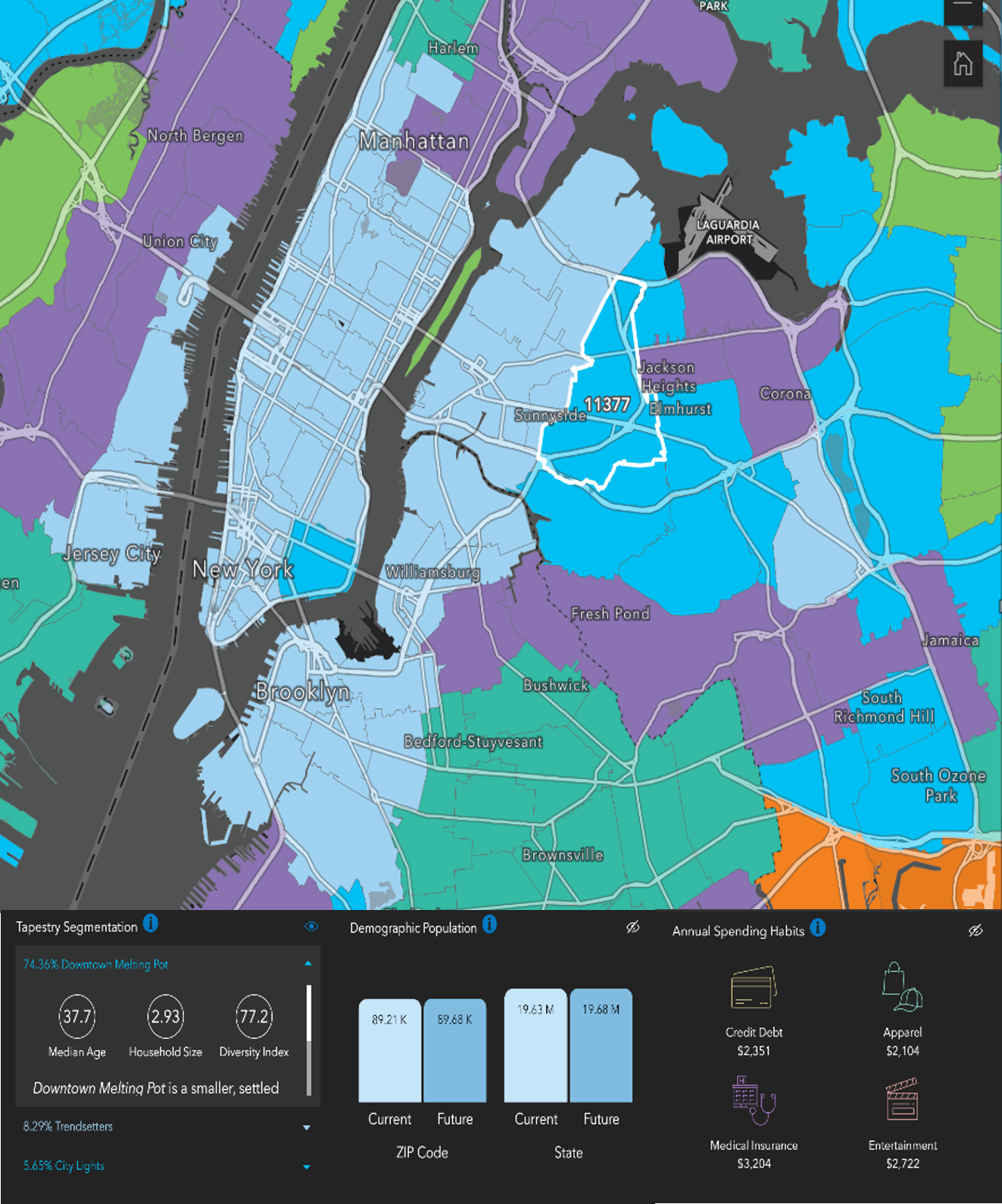

Demographics in the Zip Code

| Zip Code 11377 | |

|---|---|

| Population | 83,825 |

| Median Age | 40.5 |

| College Education or Above | 52.6% |

| Commute Area | Metropolitan(99.9%) |

| Average Household Income | $77,052 |

| White/Blue Collar | 75.7%/24.3% |

| Child-bearing Family | 25.5% |

| Average Family Size | 2.67 |

| Average Home Price | $569,000 |

Woodside is a key transportation hub, connecting Long island and New York City. Its strong network of transportation makes it being ideal living area for young New Yorkers。

Most residents live with a family lifestyle, therefore they spend mostly on daily necessities。

Residents have an average age of 40.5 years old. Child-bearing families are accounted for 25.5% of population. Most people purchase house to live in. However, local properties also had garnered huge investor interests, in turn pushing up the house price。

* Source: United States Zip Codes. Org. & Esri Zip Code Lookup。

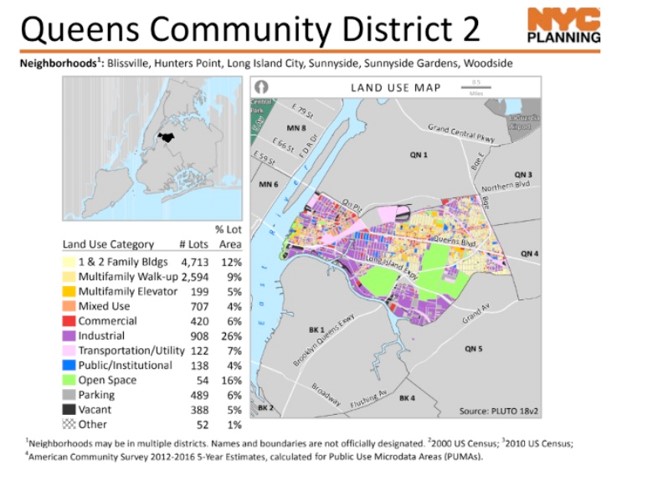

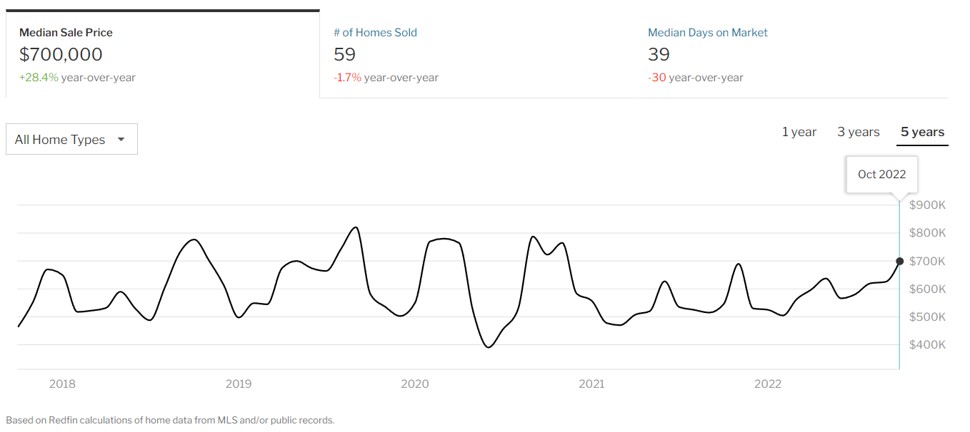

Market Trend of New Residential Development

Woodside is in Queens Community District 2, which has residential and industrial properties as major realties. About 12% is 1-2 family houses, 14% is multi-family buildings, and 4% mix-used properties. In multi-family properties, the majority is co-ops that were built in the last century, and the supply of condominiums is limited。

In recent years, Long Island City and Sunnyside had quickly developed, which stimulates the condominium average price to $1,400/Square foot in Woodside。

Several new multi-family properties have been established in Woodside, including buildings on 46-02 70th Street and 52-22 Roosevelt Avenue.

* Source: Appraisal Report from CBRE。

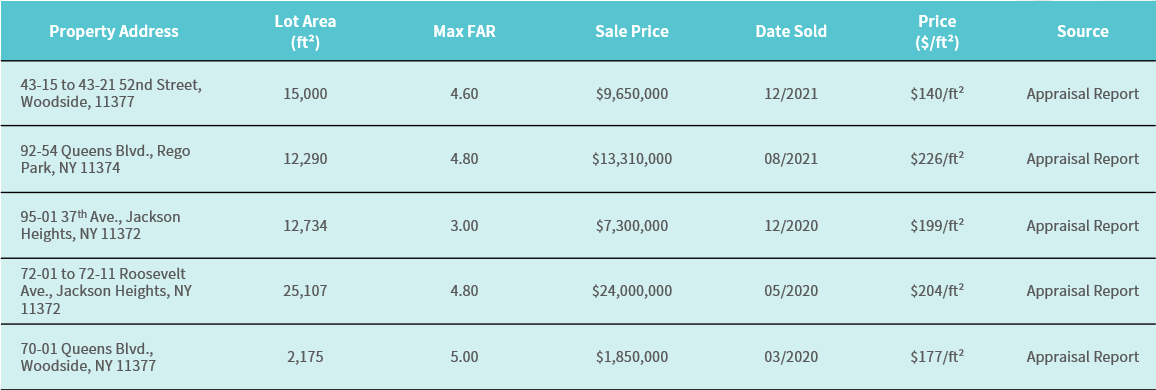

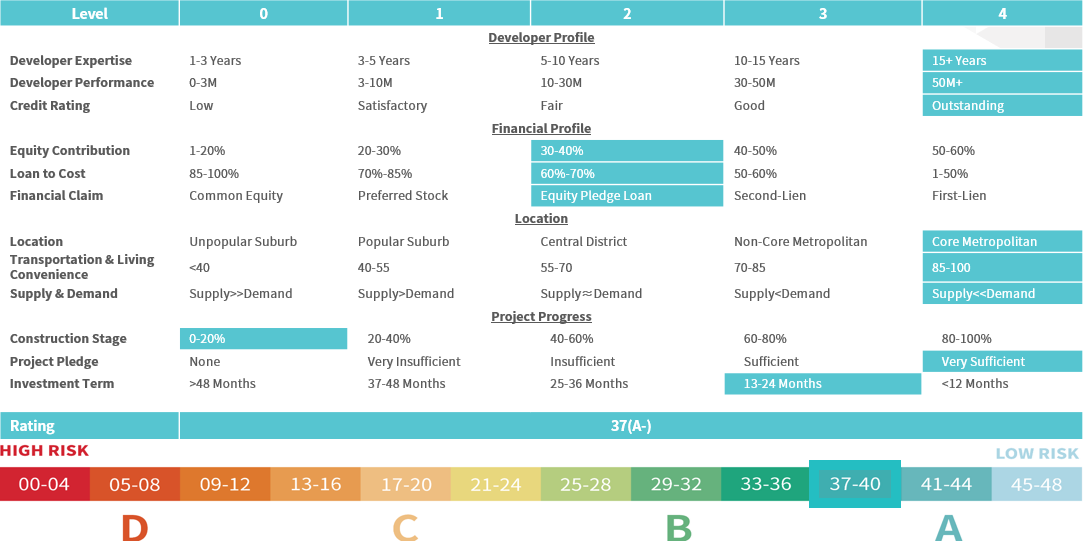

Land Valuation Analysis

Since the initial land preparation is undergoing, CrowdFunz prefers to considering the current project valuation based on the land market value.

After the comparable analysis, CrowdFunz believes that the underlying project’s land has an average price of $180/Square Foot.

The details of land valuation are listed below:

* Data Source: Appraisal; Calculated and Summarized by CrowdFunz Holding LLC.

Location

Project is in central area of Woodside, Queens, with easy access to public transportations, including LIRR, metro lines, and bus routes. Going to Midtown Manhattan takes approximately 15 minutes.

Transportation

- Subway:E/M/R/7 (5-10 minutes walking)

- LIRR:Northbound and Southbound

- To Midtown Manhattan: 15-minute subway

- To JFK Airport:25-minute driving

- To LGA Airport:10-minute driving

Nearby Schools

There are numerous primary schools, middle schools, and high schools to meet the education needs of local children. There are also professional schools for adults looking to advance their careers.

Living Facilities

The area has well-developed small business environment which is convenient for local families to satisfy their daily purchases; restaurants, supermarkets, and delis are diversified for residents of different races.

Recreations

The neighborhood has parks, childcare facilities, educational institutions, recreational centers, and museums.

Developer Company: New Empire Corp.

Developer Website: https://www.newempirecorp.com/

Prior Cooperation: CrowdFunz Fund 604 / CrowdFunz Fund 805 / CrowdFunz Fund 819 / CrowdFunz Fund 826

New Empire Corp. was founded in 1997 and has over 20 years of development expertise.

Its projects in Long Island City and in Brooklyn have won Best-selling Condominium Awards in New York City and Brooklyn.

Under the leadership of CEO Bentley Zhao and Vice President Kevin Zhao, the company has completed over 100 residential and hotel projects.

- The loan provided by CrowdFunz Fund 828 will give Developer short-to-mid term liquidity to cover demolition cost, property tax, excavation, government filing fee, and interest payments.

- After investment, CrowdFunz will continue to monitor the project’s construction processes and to follow up the updates of the projects financial status, ensuring the loan repayments on time.

- Developer has established reputation and proven expertise, and the equity contribution in the underlying project is more than 4 times the loan offered by CrowdFunz Fund 828.

- CrowdFunz believes that the loan provided by CrowdFunz Fund 828 has investment risk below industry average and is a great investment opportunity for suitable investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)