Equity Pledge Debt Fund 830

Type: Debt

Target: $1,500,000

Annual Return: 8.00 - 8.25%

Min-invest Amount: $10,000

Duration: 6 – 24 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,500,000 |

| Estimated Return | 8.00 – 8.25% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | January 2023 |

| Investment Timeline | 6 – 24 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.00% Annualized Return for Investment of 1-19 Units; 8.25% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend. After 12 months, dividends will be calculated in terms of days, till principal is repaid.

*3 Investors will receive prepaid dividend before every period of 6 months.

- Property is located in Long Island City, one of the fastest growing areas in New York. In the past decade, home price in Long Island City shown its growth. With convenient public transportation, Long Island City has became an ideal living area for young professionals.

- Developer purchased the lot for $13,000,000 in January 2020 and completed the demolition of existing warehouse in 2022. The excavation is currently in progress, and the construction is expected to be completed in second quarter of 2024 as a 7-floor mixed-use building with 64 condominiums and 1 commercial unit.

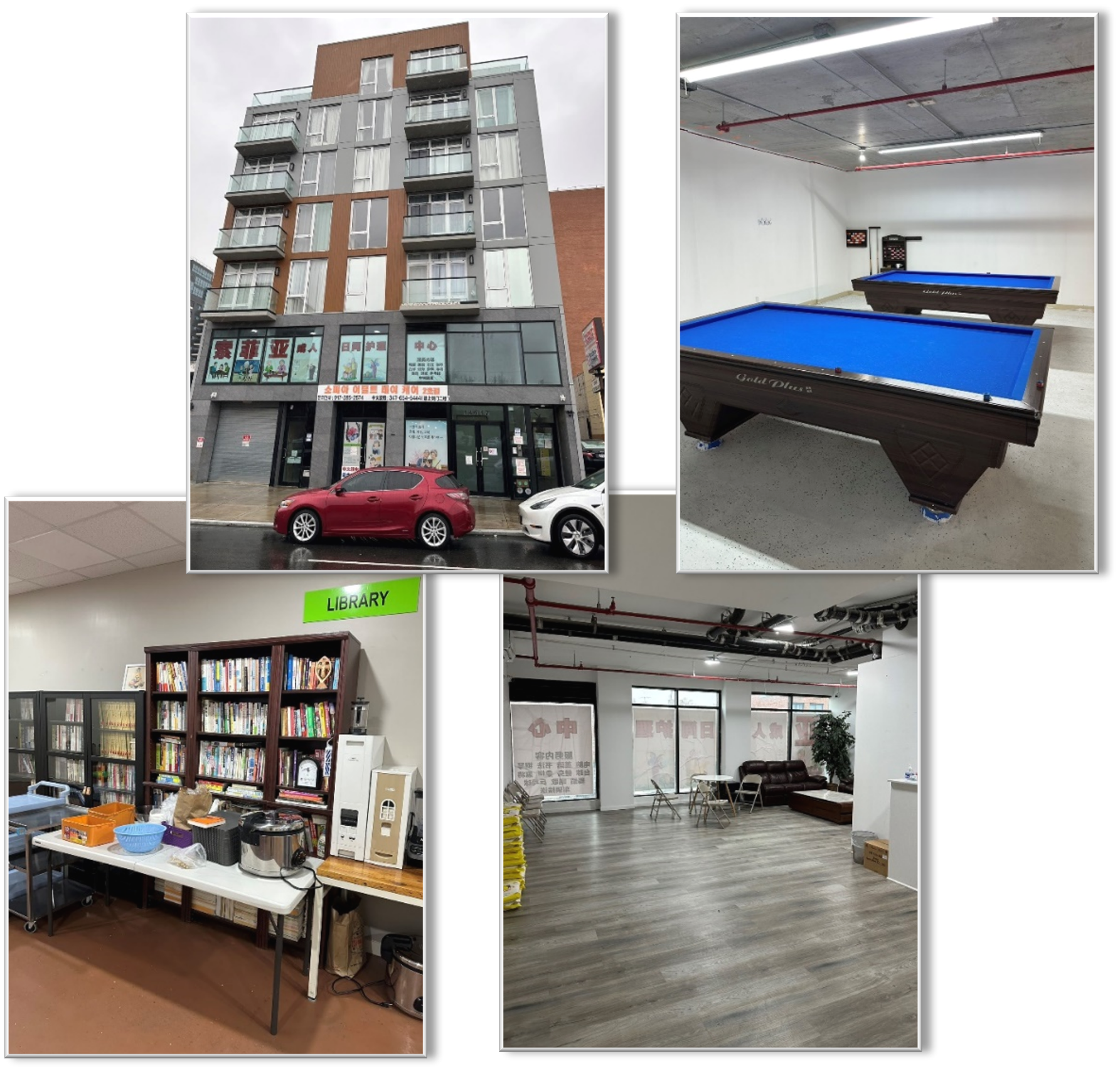

| Property Address | 146-17 Northern Blvd., Queens, NY 11354 |

| Site Area | Flushing, Queens, New York |

| Lot Area | 8,602 Sqft |

| Building Area | 41,854 Sqft |

| Intended Use | 34 Condo Units and 6 Commercial Units |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 2/21/2023 | 2/7/2023 | 8/6/2023 | 6 Months | Prepaid Dividend *2 | |

| Second | No Later than 8/21/2023 | 8/7/2023 | 2/6/2024 | 6 Months | Extension Option Owned by Developer *3 | |

| Third | No Later than 2/21/2024 | 2/7/2024 | 8/6/2024 | 6 Months | Extension Option Owned by Developer *3 | |

| Forth | No Later than 8/21/2024 | 8/7/2024 | 2/6/2025 | 6 Months | Extension Option Owned by Developer *3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 6 months of dividends. After 6 months, dividends will be calculated in terms of days, till principal is repaid.

*3 After 1 dividend period, Developer owns 3 extension options, and investors will receive dividend accordingly.

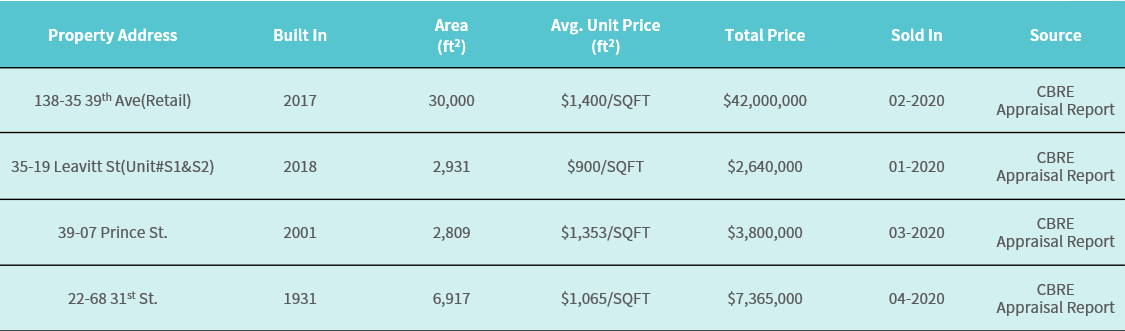

- According to Appraisal Reports provided by CBRE and BBG, the 3 commercial units in cellar, the ground floor, and the second floor could be valued at $16,100,000.

- The short-term loan provided by CrowdFunz Fund 830 is secured by Developer’s equity in the cellar, the ground floor, and the second floor, which is worth $5,725,000. In addition, Developer will provide Unlimited Personal Guarantee for additional security, which is worth 10 times the loan amount issued.

- Property is in the core area of Flushing and has nearby bus station. LIRR train station is 8-min walk away. Area is populated by Asian and Korean communities and became a prime investment area for Chinese investors.

- Local economy and household spending are strong, and it still shows great growth potential.

- Developer will use the loan provided by CrowdFunz Fund 830 on superstructure and other constructions costs of its Kew Gardens project. We chose one Developer’s completed property as collateral to control the investment risks.

- Developer expects to refinance debt through a commercial bank, or to use other sources of cash flow to repay the loan provided by CrowdFunz Fund 830.

- Developer has over 15 years of experience in real estate investment in New York and has approved experience in development in China. Developer had completed 5 major projects and has 3 on-going projects.

- CrowdFunz Fund 830 marks the first collaboration between Developer and CrowdFunz. We wish to bring value to both parties, and most importantly, our investors through this project.

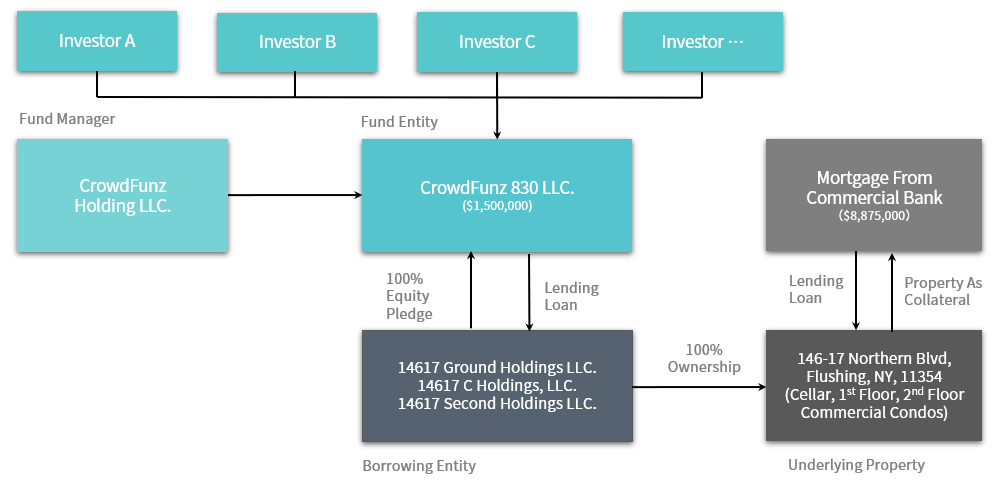

Investment Structure of CrowdFunz 830 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Mortgage from Commercial Bank | $8,875,000 | 55.12% |

| CrowdFunz Fund 830 Equity Pledge Loan | $1,500,000 | 9.32% |

| Developer Equity Contribution | $5,725,000 | 35.56% |

| Total | $16,100,000 | 100.00% |

- Developer will use 6 commercial units at 146-17 Northern Blvd as the collateral for loan provided by CrowdFunz Fund 830. The units have been fully leased to creditworthy tenants on a long-term basis.

- Property is valued at $16,100,000. Developer’s equity contribution is close to 4 times the loan amount provided by CrowdFunz Fund 830.

- Developer had signed Personal Guarantee to further secure the loan provided by CrowdFunz Fund 830.

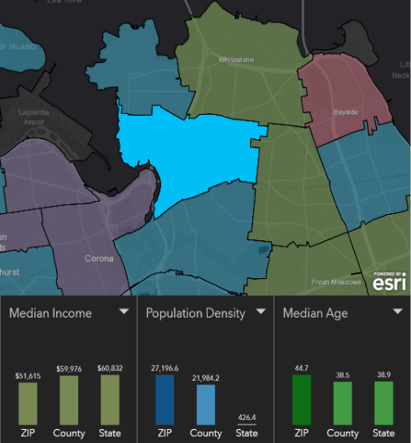

Demographics in the Zip Code

| Zip Code 11354 | |

|---|---|

| Regional Population | 55,200 |

| Median Age | 44.7 |

| High School Education or above | 73% |

| Race | Asian(63%) / Caucasian(16%) / Latino(16%) |

| Family Median Income | $51,615 |

| White Collar / Blue Collar | 84.9%/15.1% |

| Child-bearing Family | 25.2% |

| Average Family Size | 2.7 |

| Buy House to Own | 39% |

With strong network of business, transportation, and education, the area had become one of the most popular destinations for Chinese families and an attractive real estate market.

Residents are mainly Asian, which makes up over 60% of the regional population.

Local families have stable income and sound financial health. Real estate market is mainly focused on Rental properties. New immigrants in recent years had propelled the rental market further. With limited supplies and high buying demands, investing in local real estate is becoming more attractive.

* Source: United States Zip Codes. Org. & Esri Zip Code Lookup, January 2023.

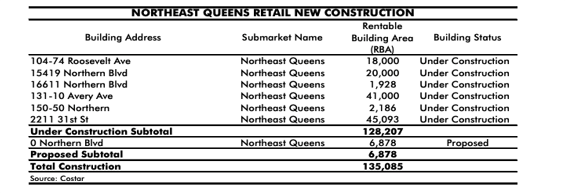

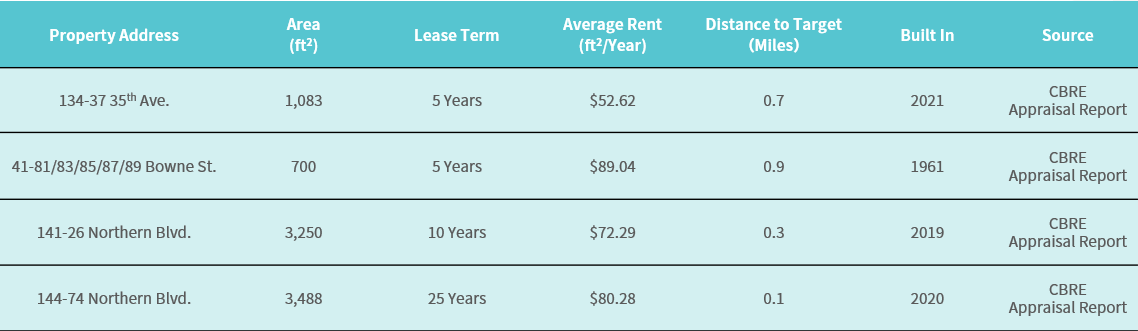

Local Market for Newly Built Commercial Real Estate

As of January 2023, there are 6 retail properties under construction in Northern Queens, totaling 128,207 Sqft of commercial space.

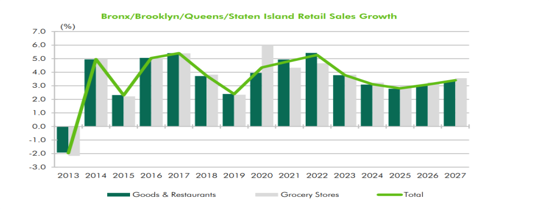

Local commercial real estate market has strong fundamentals due to the large population of middle-class residents. Retail businesses suffered during Covid-19, but outlooking for 2023 is broadly positive.

In the long term, local commercial real estate market is trending in the right direction. The current occupancy rate of commercial properties in Queens is about 96.3%; underlying units have been 100% leased.

* Source: CBRE Appraisal Report.

Valuation – Income Approach

Third Party Appraisal Report

* Data Source: Appraisal; Calculated and Summarized by CrowdFunz Holding LLC.

Location

Project is in the central area of Flushing with easy access to transportation, including LIRR, subway, and buses. Driving to JFK Airport and Midtown Manhattan takes 20 min and 30 min.

Transportation

- Subway:7 (10-min bus to station)

- LIRR: North and South

- To Midtown Manhattan: 20-min Train

- To JFK Airport:25-min Driving

- To LGA Airport:10-min Driving

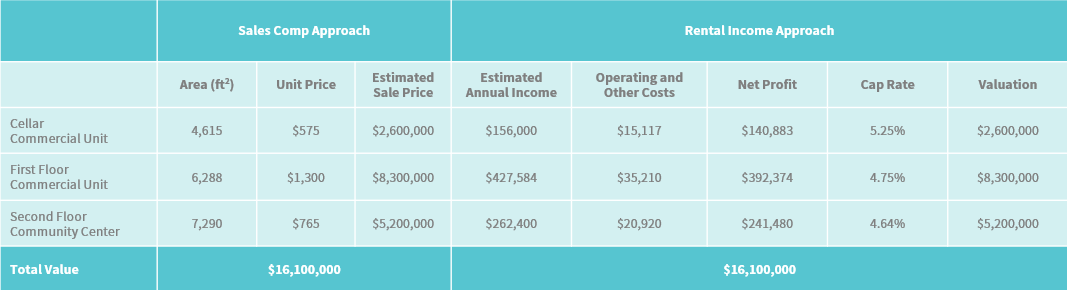

Nearby Schools

In the core area of Flushing, there is a wide selection of high-quality primary, middle, and high schools nearby to meet education needs, as shown on the map.

Living Facilities

Community is full of Chinese businesses to meet all needs, including Chinese and Korean supermarkets, restaurants, and shopping centers.

Recreations

There are museums, gyms, and recreation centers nearby, including science museums, tennis center, art center, and zoo.

Developer Company: FBL Development.

The project will be executed by two uprising Chinese developers. The team has over 15 years of experience in commercial real estate development and had completed 5 projects in Queens, New York.

In recent years, Developer is striving to establish itself in more emerging areas with outstanding projects.

- CrowdFunz Fund 830 will provide the borrower a short-term loan. We have selected Developer’s completed property as the collateral to control the risks. Once the project is completed, Developer will refinance with Inventory Loan, and/or use other sources of cash to repay the loan provided by CrowdFunz Fund 830.

- The loan provided by CrowdFunz Fund 830 has a low loan-to-value, and the underlying property has no additional risks related to construction. The project is in an emerging area of Flushing, where properties could be quickly liquated due to demands, further lowering risks.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)