Equity Pledge Debt Fund 831

Type: Debt

Target: $1,600,000

Annual Return: 8.00 - 8.25%

Min-invest Amount: $10,000

Duration: 6 – 24 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,600,000 |

| Estimated Return | 8.00 – 8.25% Annualized Return*1 |

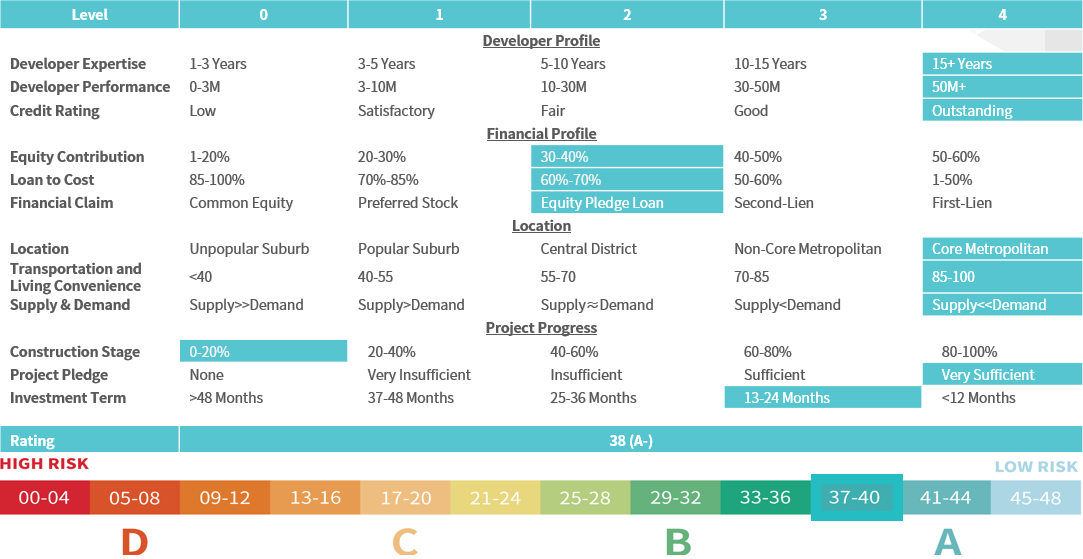

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | February 2023 |

| Investment Timeline | 6 – 24 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.00% Annualized Return for Investment of 1-19 Units% 8.25% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 5 or 6 months of dividend. After 6 months, dividends will be calculated in terms of days, till principal is repaid.

*3 Investors will receive prepaid dividend before every period of 6 months.

- Property is located in Long Island City, one of the fastest growing areas in New York. In the past decade, home price in Long Island City shown its growth. With convenient public transportation, Long Island City has became an ideal living area for young professionals.

- Developer purchased the lot for $13,000,000 in January 2020 and completed the demolition of existing warehouse in 2022. The excavation is currently in progress, and the construction is expected to be completed in second quarter of 2024 as a 7-floor mixed-use building with 64 condominiums and 1 commercial unit.

| Property Address | 23-17 41st Avenue, Long Island City, NY, 11101 |

| Site Area | Long Island City, Queens, NY |

| Lot Area | 10,000 Square Feet |

| Building Area | 40,080 Square Feet |

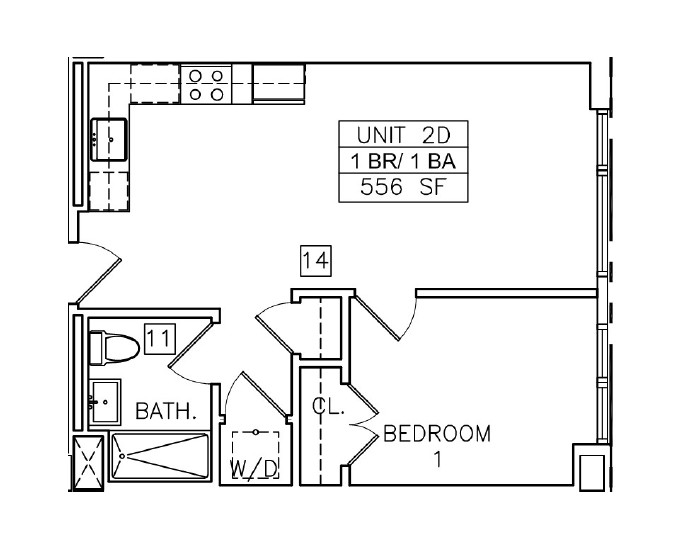

| Intended Use | 42 Condos Units, 2 Commercial Units and 21 Parking Spots |

| Construction Duration | 24 Months |

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Phase | Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | Phase I | $1,000,000 | No Later Than 3/21/2023 | 3/7/2023 | 9/6/2023 | 6 Months | Prepaid Dividend |

| First | Phase II | $600,000 | No Later Than 4/21/2023 | 4/7/2023 | 9/6/2023 | 5 Months | Prepaid Dividend |

| Second | No Later Than 9/21/2023 | 9/7/2023 | 3/6/2024 | 6 Months | Extension Option Owned by Developer *2 | ||

| Third | No Later Than 3/21/2024 | 3/7/2024 | 9/6/2024 | 6 Months | Extension Option Owned by Developer *3 | ||

| Fourth | No Later Than 9/21/2024 | 9/7/2024 | 3/6/2025 | 6 Months | Extension Option Owned by Developer *3 | ||

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After the first dividend period for both Phase I and II investment, dividends will be calculated in terms of days till principal is repaid.

*3 After the first dividend period, Developer owns three extension options, and investors will receive dividends accordingly at the same dividend rate.

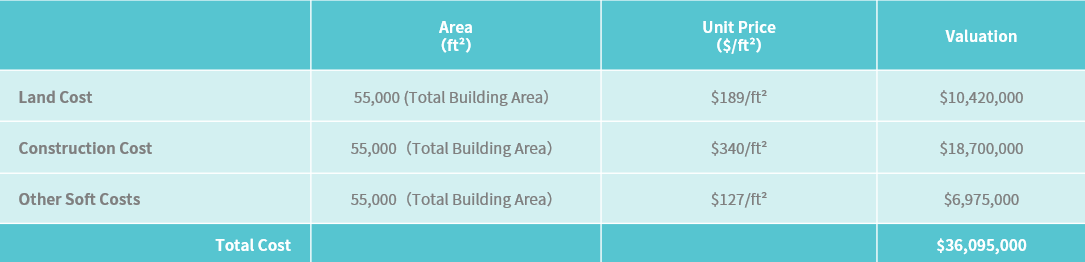

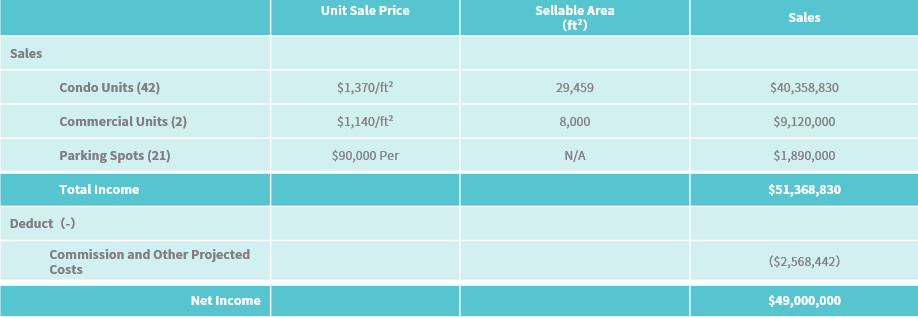

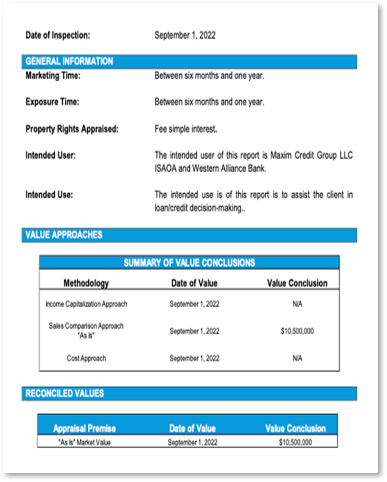

- According to Appraisal Report provided by Leitner Berman in September 2022, the land was valued at $10,500,000; once completed, the property could be valued at $49,000,000.

- The short-term loan provided by CrowdFunz Fund 831 is secured by Developer’s equity in the project entity. Developer had contributed $5,000,000 of equity and expects to contributed additional $7,633,250. Developer will also provide Unlimited Personal Guarantee for additional security.

- Long island City is an emerging area in New York, and it’s on the other side of East River, directly facing the United Nation headquarters. The surrounding public transportation is well-developed, and there are 7 subway lines and multiple bus lines covered, making residents conveniently go to Queens, Brooklyn, and Manhattan.

- Currently, the population density in Long Island City has almost reached the same level of traditional prime areas in Manhattan. The population is young and has steady and growing income, which makes the local commercial and residential developments to be prosperous.

- Developer plans to use the loan provided by CrowdFunz Fund 831 on early stage demolition, excavation, and other soft costs.

- Once the development is finished, Developer would apply for construction loan from a commercial bank or use other sources of funding to repay the loan provided by CrowdFunz Fund 831.

- Developer has over 3-decade experience in local real estate development and had established its reputation in New York market. Prior successful projects are mainly in Queens, New York, and the project developed in recent years are mainly medium size mixed-use buildings.

- Developer had collaborated with CrowdFunz for multiple times, including CrowdFunz Fund 810 (Fund Ended) and Fund 813 (Fund Ended), etc. The developer has shown its development strength and good reputation to CrowdFunz investors.

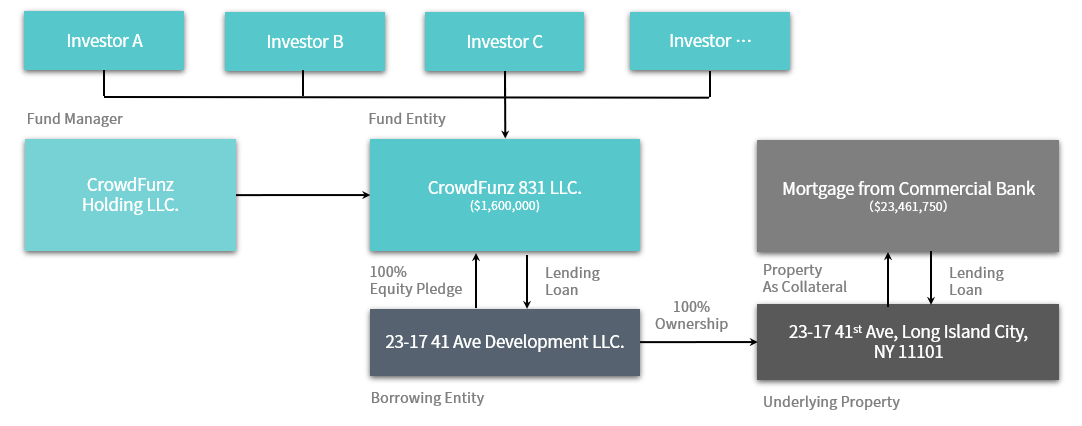

Investment Structure of CrowdFunz 831 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Mortgage from Commercial Bank | $23,461,750 | 62.24% |

| CrowdFunz Fund 831 Equity Pledge Loan | $1,600,000 | 4.24% |

| Developer Equity Contribution | $12,633,500 | 33.52% |

| Total | $37,695,000 | 100.00% |

- Developer had contributed $5,000,000 and plans to contribute another $7,633,250 into the project entity. The total equity is accounted for 33.52% in the capital stack.

- CrowdFunz Fund 831 will lend $1,600,000 short-term mezzanine loan, which is accounted for 4.24% in the capital stack.

- Developer had pledged 100% equity of the entity owning the project and would provide Unlimited Personal Guarantee.

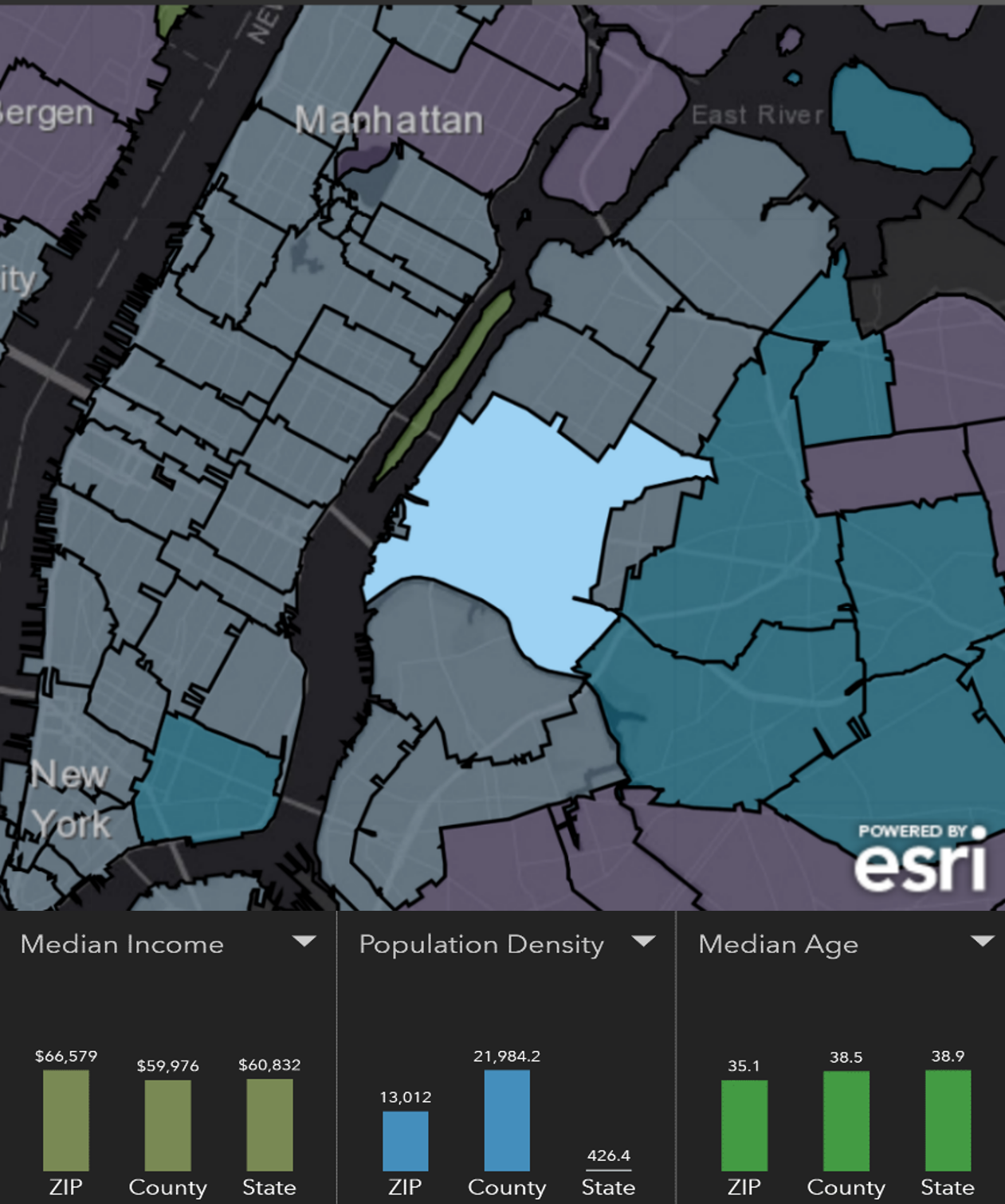

Demographics in the Zip code

| Zip Code 11101 | |

|---|---|

| Regional Population | 31,366 |

| Median Age | 35 |

| High School Education or above | 69.8% |

| Workplace | Metropolitan(99.8%) |

| Family Median Income | $66,579 |

| White Collar/Blue Collar | 90.5%/9.5% |

| Child-Bearing Family | 23.6% |

| Average Family Size | 2.21 |

| Average Housing Price | $975,000 |

Due to its premium geographic location, Long Island City has become one of the hottest areas absorbing new real estate developments in New York. Meanwhile, more companies and residents have chosen Long Island City as the destination for business and living.

Younger population dominants in the area, and most residents are middle class professionals with jobs and stable incomes. The ethnic backgrounds are also well-diversified.

The average age is 35; 23% of the families have children. Self-residence is the main demand for tenants. Due to the low housing inventory available for sale and high needs from buyers, the property prices are constantly going up.

* Data Source: United States Zip Codes. Org. & Esri Zip Code Lookup, American Community Survey, February 2023

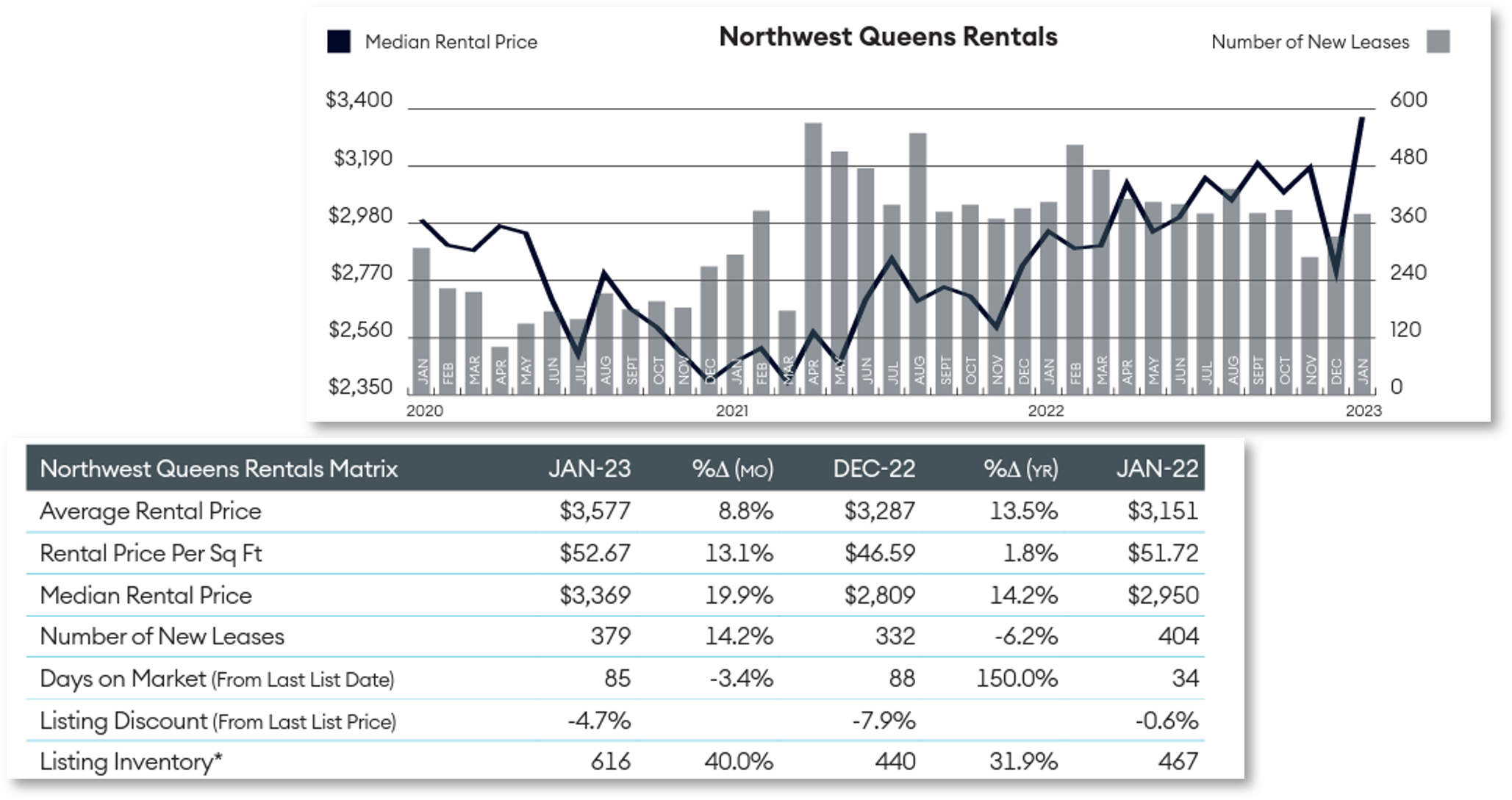

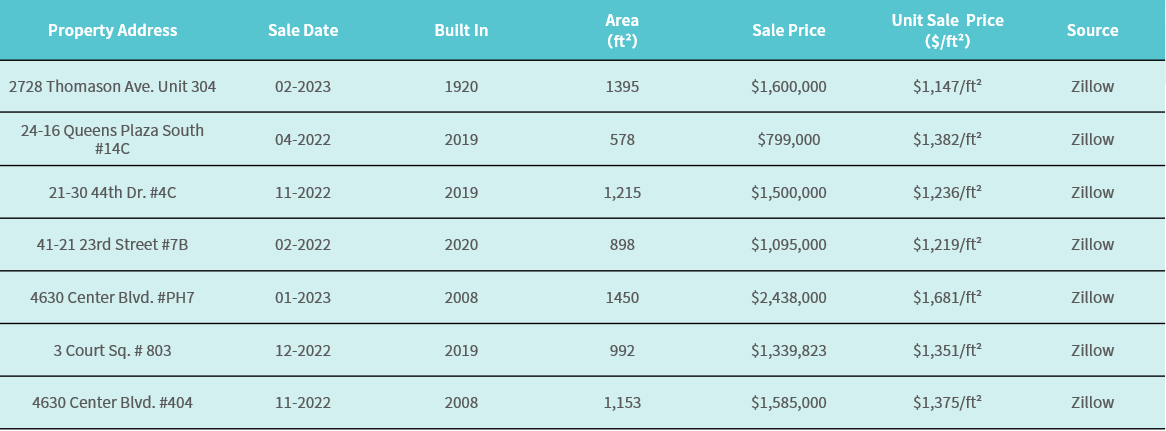

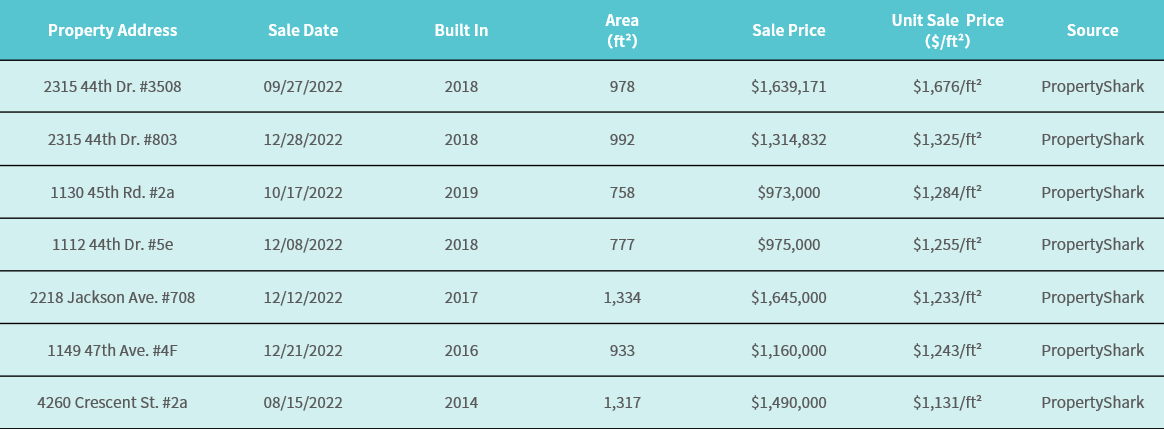

Current Market Overview

The median home sale price in Long Island City was $460,000 at the end of Q4, 2022, a 15% YoY decline. The median price per square foot of residential properties in the area was $1,003, up 3% YoY. Although the local real estate market had negatively affected by rising U.S. mortgage interest rates in 2022, the market has begun to recover after entering the Q1, 2023.

According to the New York Rental Report from Douglas Elliman, in Q1, 2023, apartment rental in Long Island City, Astoria, Sunnyside, and Woodside have begun to recover significantly, with an average Rents rose to $52.6/SF/Year, and the average condo rental price rose to $3,577 per unit.

* Source: Douglas Elliman.

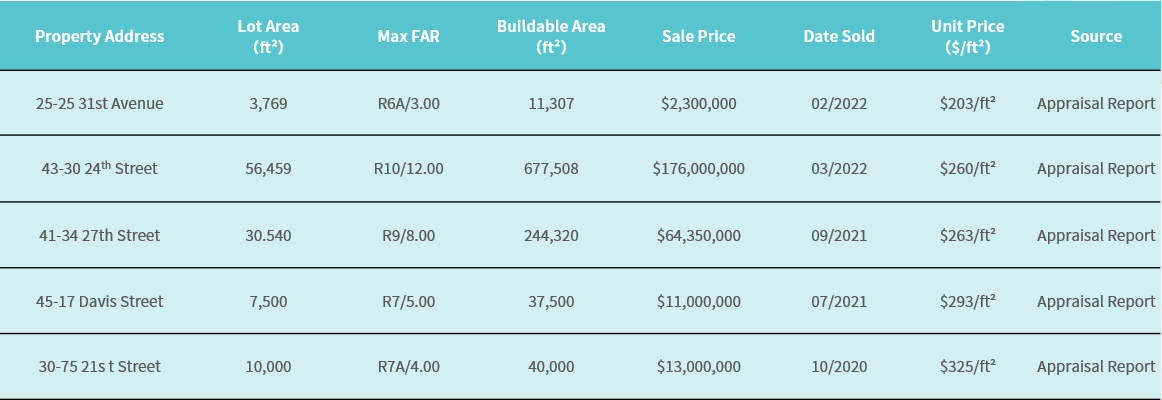

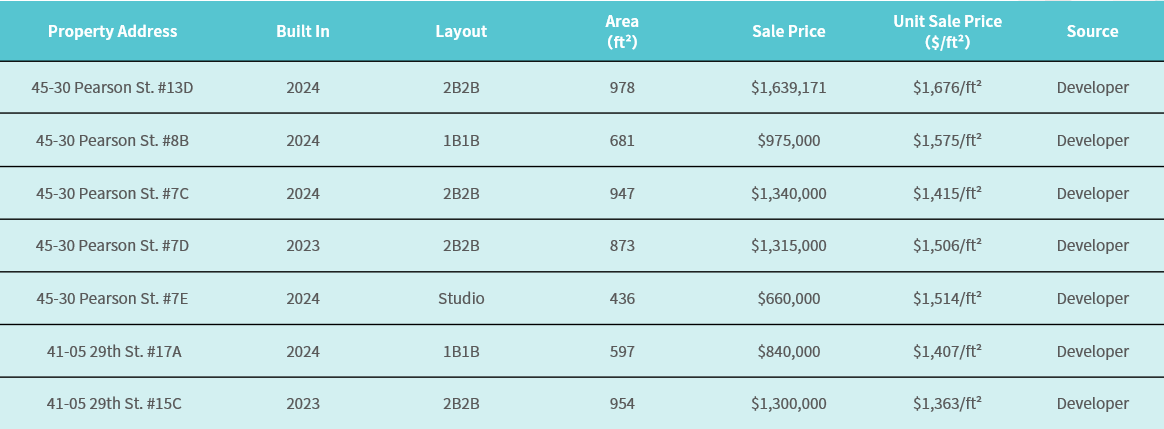

Valuation – Cost Approach

* Source: Appraisal Report provided by Leitner Berman, data compiled and calculated by CrowdFunz.

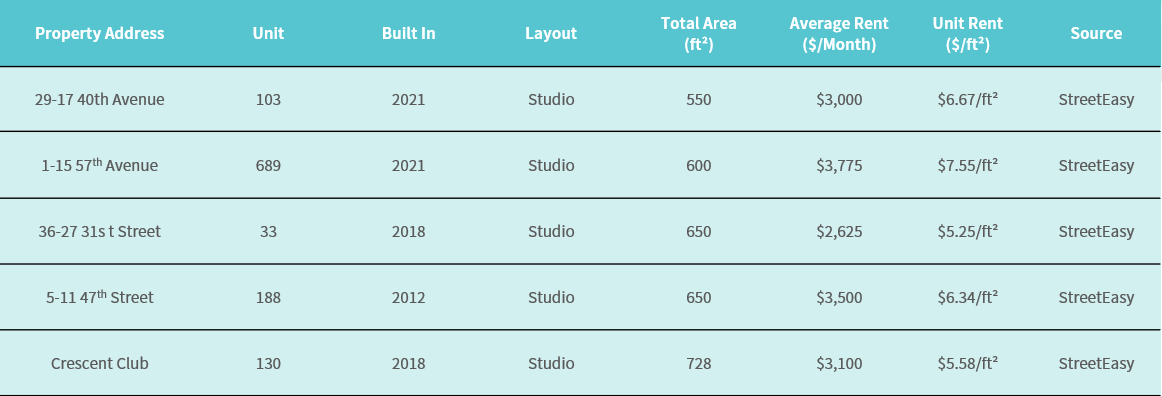

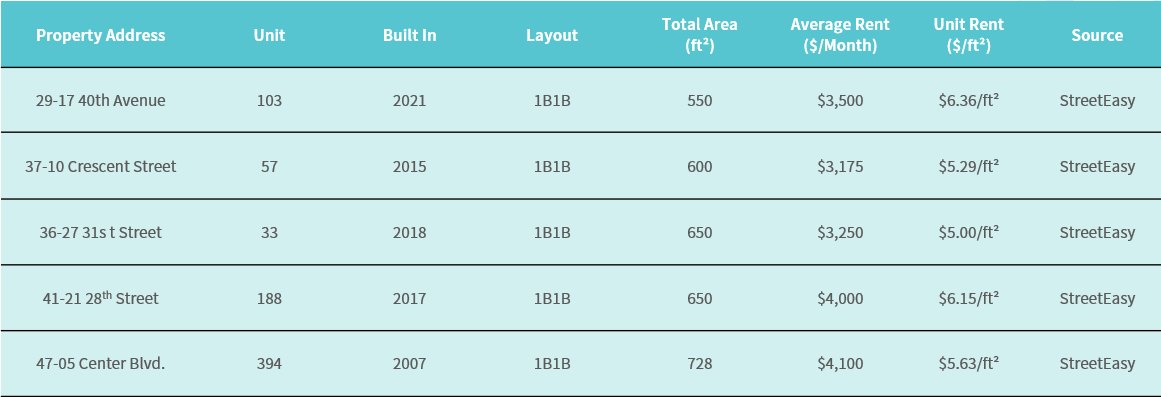

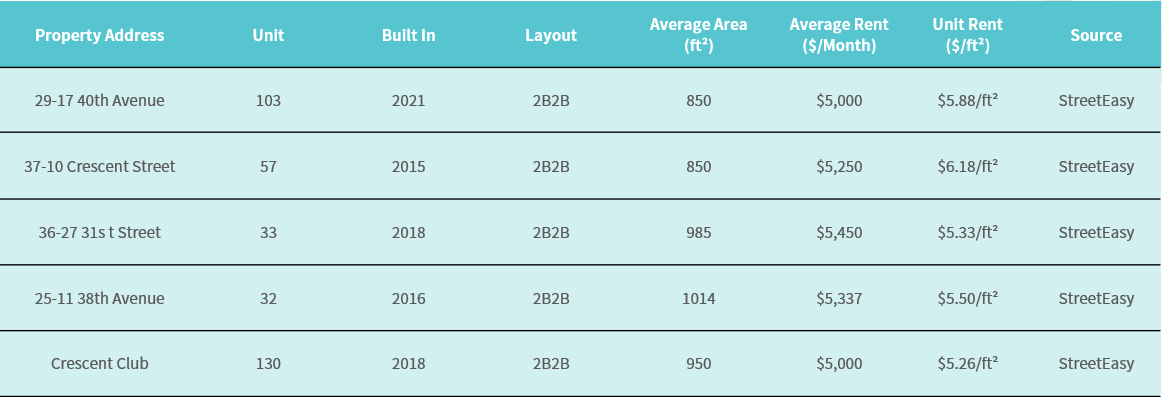

Valuation – Income Approach

* Source: Appraisal Report from BBG, data compiled and calculated by CrowdFunz.

Location

Project is in prime area of Long Island City. The surrounding public transportation is well-developed with 7 subway lines and multiple bus lines. The residents can conveniently reach various destinations in Queens, Brooklyn, and Manhattan. Driving from the project site takes 15 minutes to LaGuardia Airport and 25 minutes to JFK International Airport.

Transportation

- Subway:E/M/R/N/W <!-

- LIRR: North and South ->

- To Midtown Manhattan: 15-minute subway

- To JFK Airport:25-minute driving

- To LGA Airport:10-minute driving

Nearby Schools

The basic education system in the area covers many elementary schools, junior high schools, and high schools. There are also many technical schools to meet young professionals’ self-development goals.

Living Facilities

In addition to well-developed public transportation, the local business environment is vigorous. Companies and government agencies have been moved to the area, and brand-new restaurants and supermarkets have been settled.

Recreations

The surrounding recreation facilities are improving to fit residents’ need. Museums, gyms, and entertainment venues nearby are within walking distance.

Developer Company: 23-17 41 Ave Development LLC.

Prior Cooperation: CrowdFunz Fund 606 / Fund 806 / Fund 810 / Fund 813 / Fund 817

The development is led by a seasoned Chinese American development group and an emerging New York local developer. The whole team has commercial real estate development experience for over 3 decades.

The development team has completed numerous projects including retail complex, mega residential, and mixed-use buildings in various emerging areas in Queens and New York.

Besides local markets, the team has developed over 5 million square feet of projects in the metro areas of United State and China.

The team is actively engaged in not only development but acquisition, property management and sales in the past 20 years, generating constant profits for their partners and investors.

- Developer will use the loan provided by CrowdFunz Fund 831 to secure short-to-mid term liquidity, covering the costs of early stage demolition, excavation, foundation, and other soft costs.

- CrowdFunz Fund 831 will disburse loan in 2 phases and will continue to monitor the project construction processes and to follow up the updates of the project financial status, ensuring the loan repayments on time.

- Developer has established reputation and proven expertise, and the equity contribution in the underlying project is more than 8 times the loan offered by Fund 831.

- CrowdFunz believes that the loan provided by CrowdFunz Fund 831 has investment risk below industry average and is a great investment opportunity for suitable investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)