Equity Pledge Debt Fund 841

Type: Debt

Target: $1,300,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 6 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,300,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

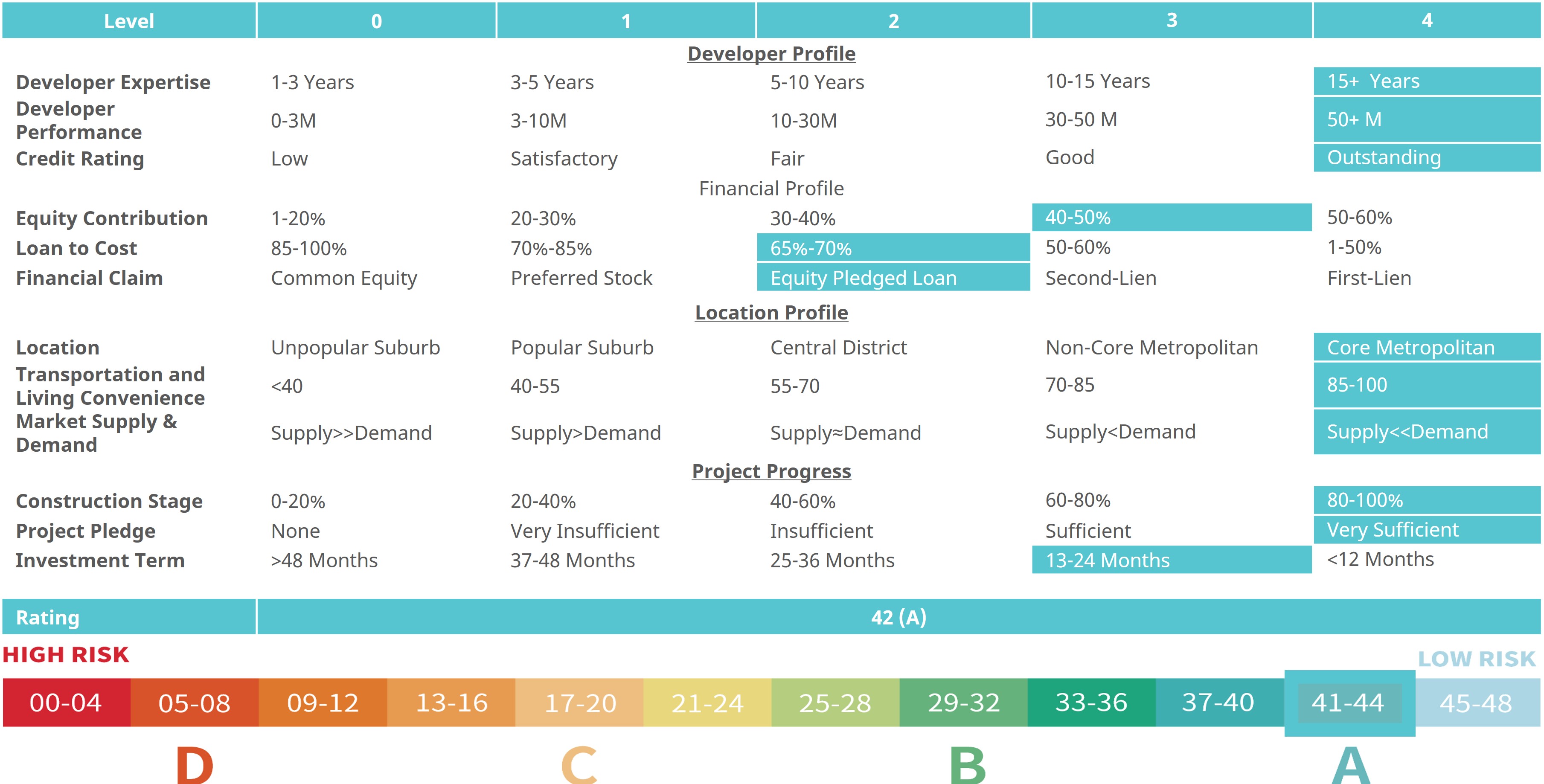

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | October 2023 |

| Investment Timeline | 6 – 18 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 6 months of dividend. After 6 months. Borrower has 2 extension option, and investors will receive dividend accordingly.

*3 Investors will receive prepaid dividend before every period of 6 months.

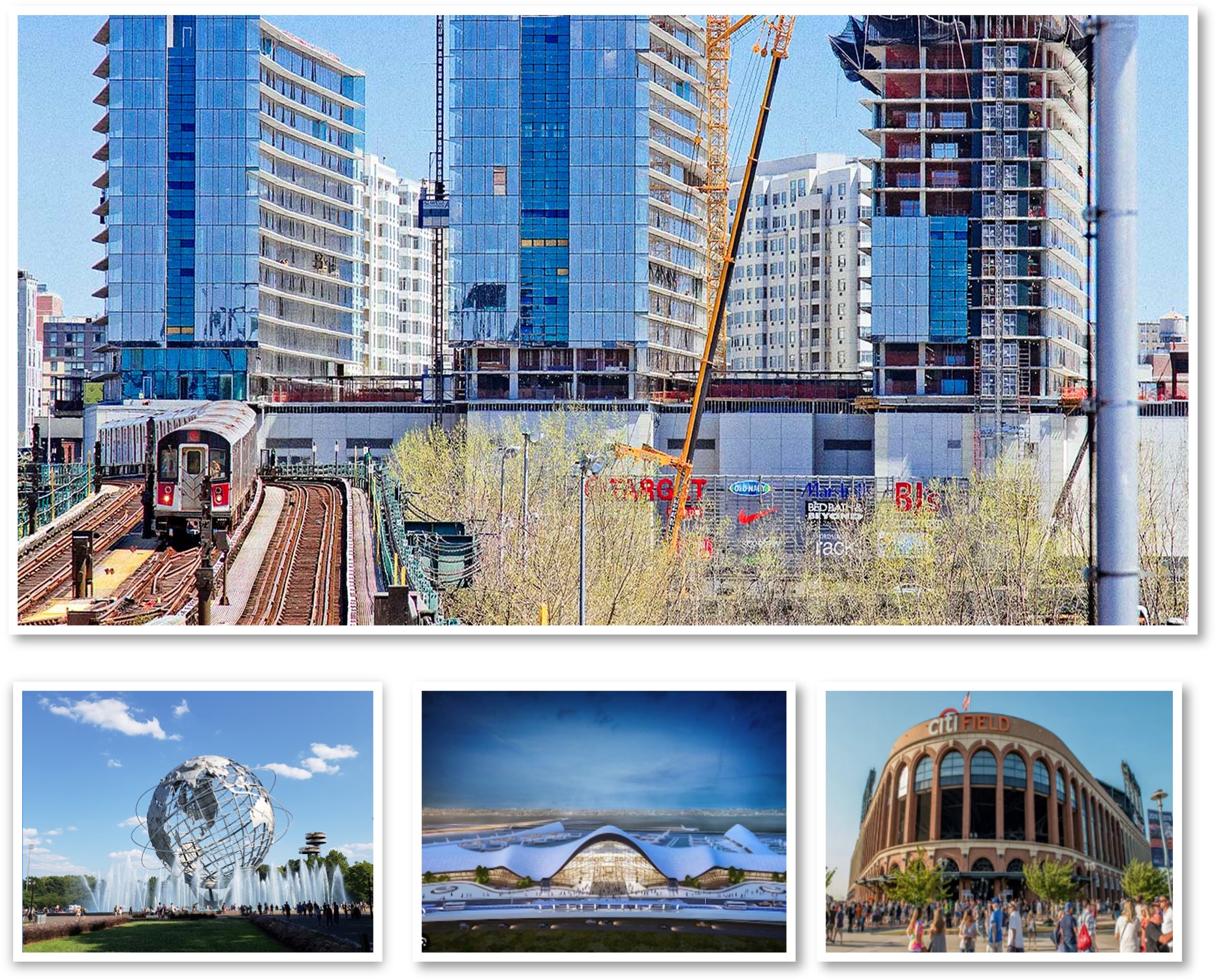

- Project is on Main Street in Flushing, one of the booming areas for business and living in Queens, New York. Over the past 20 years, Flushing had been quickly developed and now has mature communities and convenient transportations. Flushing is the biggest hub for Chinese in the East Coast. Huge population demands clinic and medical services particularly in Mandarin-speaking.

- The underlying property features 12 individual commercial condos used as clinic offices. Developer purchased the lot in 2017 and demolished the existing 2-floor building. The construction was finished in 2021, and all units for sale had received Condo Book.

| Address | 133-20 41st Road, Flushing, NY 11135 |

| Area | Flushing, Queens, NY |

| Lot Area | 5,000 Sqft |

| Building Area | 29,563 Sqft |

| Intended Use | 12 Individual Clinics Units |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 11/15/2023 | 11/1/2023 | 4/30/2024 | 182 days | Prepaid Dividend *2 | |

| Second | No Later than 5/15/2024 | 5/1/2024 | 10/31/2024 | 184 days | Extension Option Owned by Developer *3< | |

| Third | No Later than 11/15/2024 | 11/1/2024 | 4/30/2025 | 181 days | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 182 days of dividends. After 6 months, dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

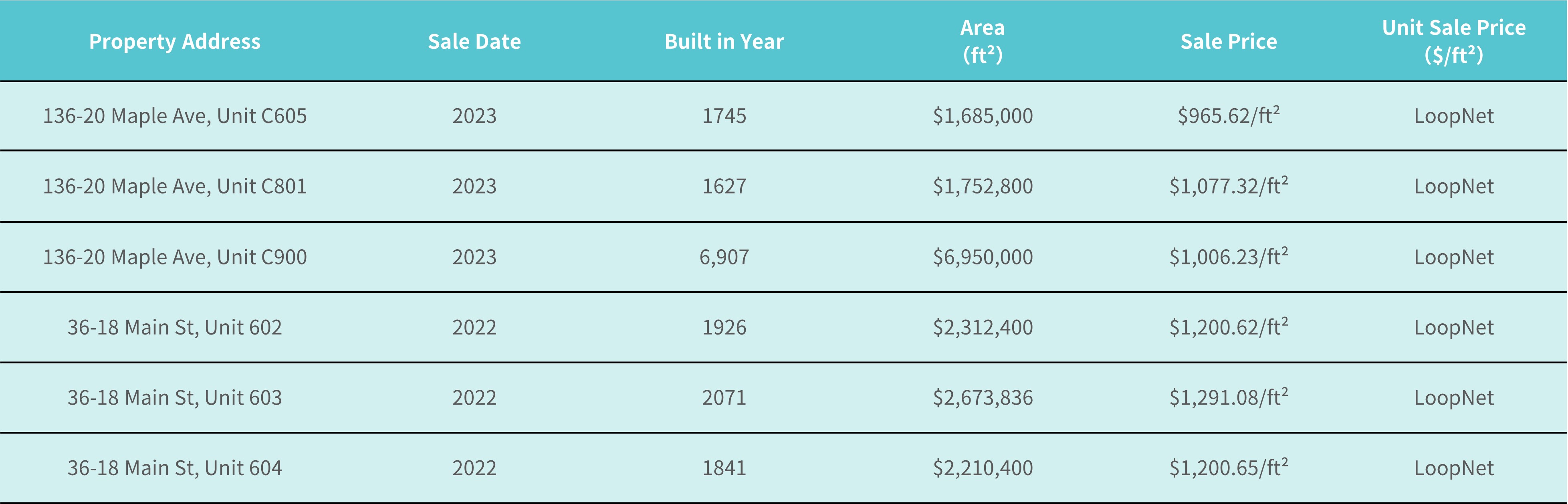

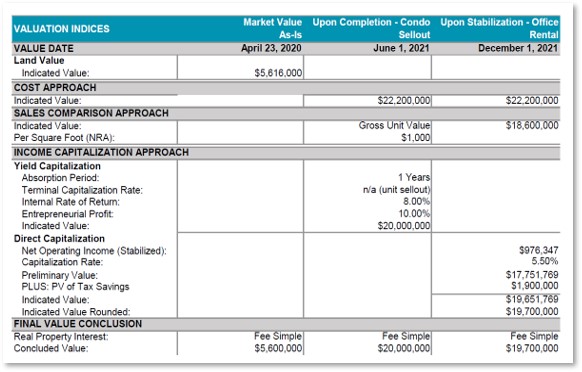

- According to the Appraisal Report provided by Cushman & Wakefield, the current market value of the property is at $20,000,000.

- The short-term loan provided by CrowdFunz Fund 841 is pledged by 100% ownership of the project entity, which is valued at $9,500,000. Developer’s Key persons will also provide unlimited personal guarantee.

- Project is in prime area of Flushing, Queens. Q58 bus station is next to the building, and driving to LGA Airport takes 10 minutes. For potential clinic offices , the underlying property possesses location advantages in the local community.

- Flushing had become the biggest Chinese community in the East Coast. The needs for Mandarin-speaking medical service are strong. Most clinics are running near capacity, giving new facilities great growth potential.

- Developer plans to use the loan provided by CrowdFunz Fund 841 to cover the carrying costs of the final stage of sales .

- In the total loan proceeds, $500,000 will be used for interest reserve, $400,000 will be used for repayments of existing construction loan; the remaining $400,000 will cover property tax and other expenses.

- The completed construction reduces the investment risk of the loan originated by Fund 841. Developer plans to repay the loan by using the sales proceeds or other sources of fund.

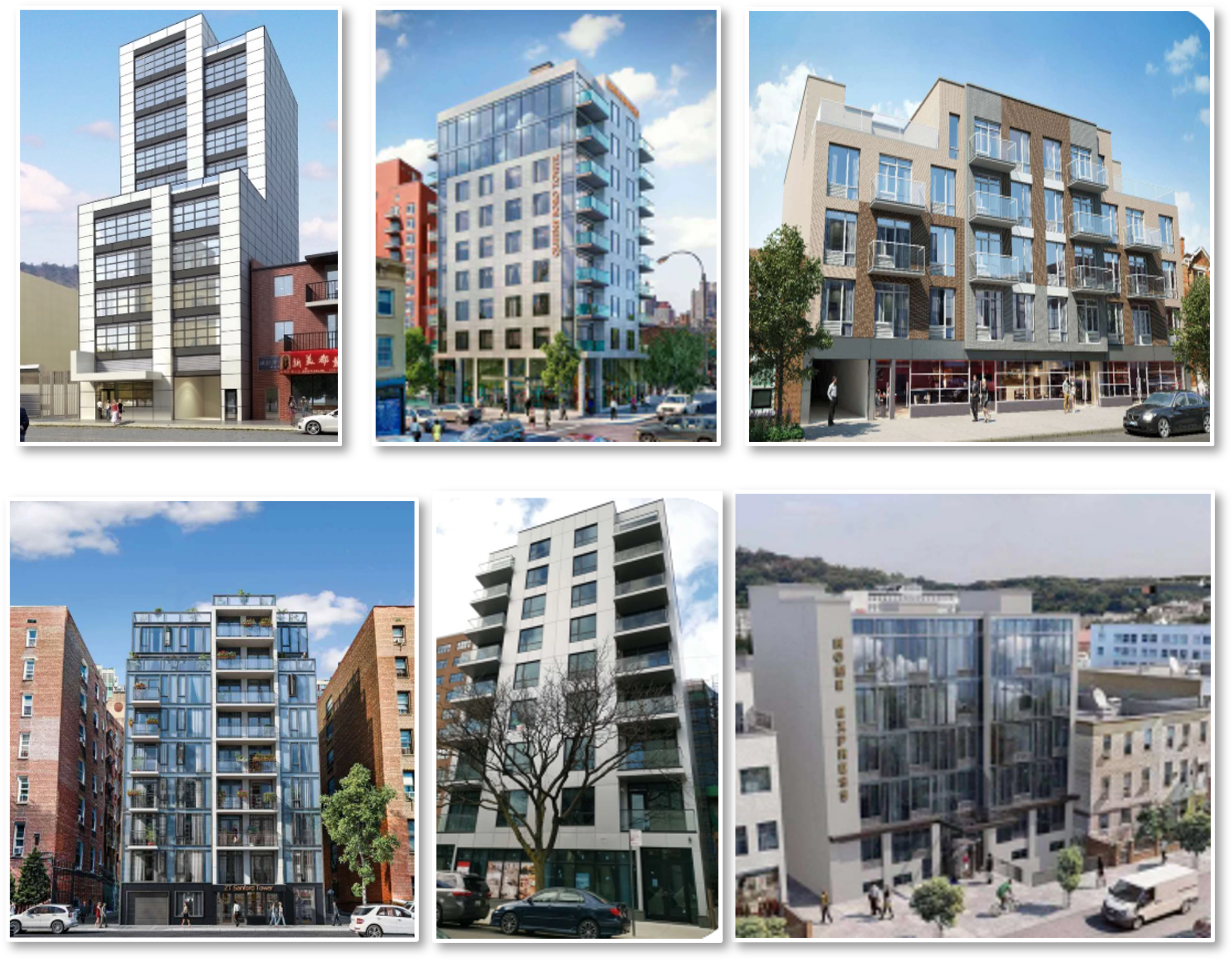

- As a family-operated business, Developer started its business from small-scale residential developments and has completed over 200,000 Square feet of commercial and residential properties. In recent years, Developer has targeted multiple emerging markets in Queens, New York city, and has accumulated good understanding of local residential and commercial needs.

- Developer has successfully cooperated with CrowdFunz Fund 804, 807, 809, 812, 818, and 822. Each fund has fulfilled its financial obligations, establishing trustworthy goodwill.

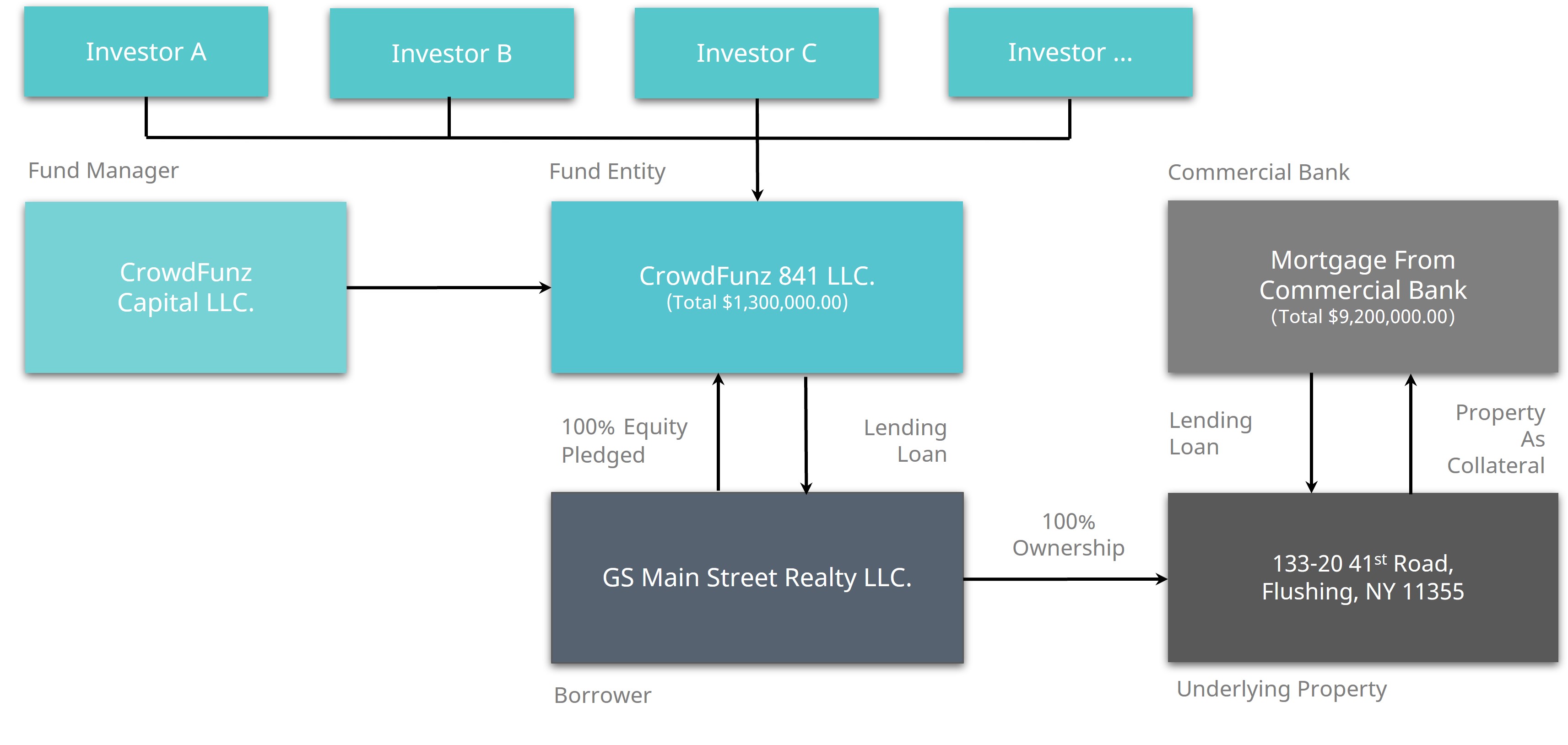

Investment Structure of CrowdFunz 841 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Loan From Commercial Bank | $9,200,000 | 46.00% |

| CrowdFunz Fund 841 Equity Pledge Loan | $1,300,000 | 6.50% |

| Developer Equity | $9,500,000 | 47.50% |

| Total | $20,000,000 | 100.00% |

- The construction of the project was completed. The property obtained Condo Book, and all units are available for sale.

- According to the third-party Appraisal Report, the underlying property is valued at $20,000,000. After deducting the $9,200,000 remaining loan balance from Commercial Bank, and the $1,300,000 loan amount from CrowdFunz Fund 841, the equity value of the project is around $9,500,000, which is 7 times value of Fund 841.

- Borrower had pledged 100% ownership of the project entity to Fund 841, and developer’s key persons will provide unlimited personal guarantee to the borrowing.

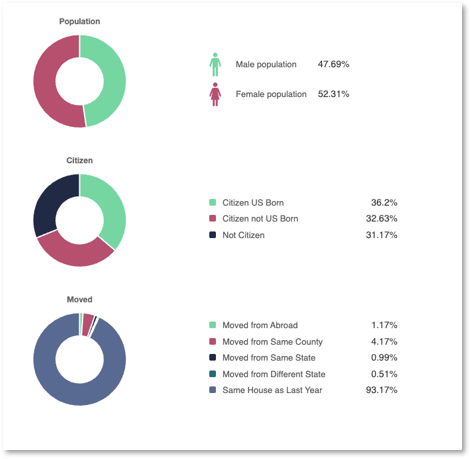

Demographics in the Zip code

| Zip Code 11355 | |

|---|---|

| Regional Population | 180,381 |

| Median Age | 44 |

| High School Education or above | 88.2% |

| Race | Asian (60%)/Caucasian (18%)/Latino (16%) |

| Family Median Income | $62.254 |

| Child-Bearing Family | 24.42% |

| Average Family Size | 3 |

Flushing has been one of the best booming areas in New York city. Due to its convenient transportation, more Asian immigrants rushed into the area in the past 20 years.

Local residents are diverse and most are Asian. Other races include Latino, Indian, and Caucasian. Most residents are hardworking new immigrants; the average resident age is 44 years old.

As more Asian people migrated into Flushing, local housing demands are strong. Limited supply has also made all kinds of property prices keep increasing.

* Source: Point2homes.com, in October 2023.

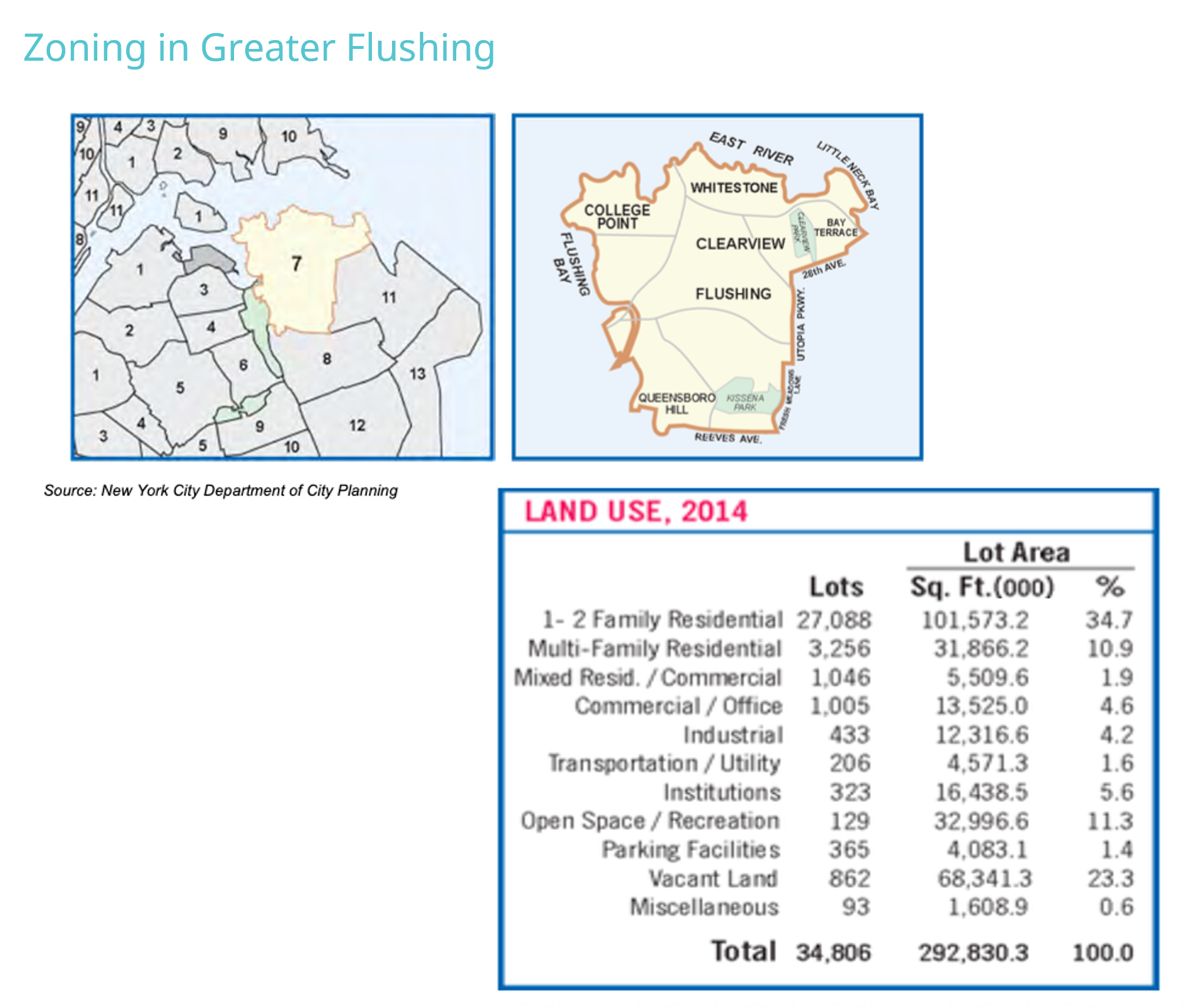

Commercial Property Market in Flushing

According to the Appraisal Report provided by Cushman & Wakefield, Flushing is the 4th biggest business hub in New York city, trailing Midtown Manhattan, Lower Manhattan, and Downtown Brooklyn. The Line 7 subway station at Main Street and Roosevelt Avenue has the biggest foot traffic in New York city, having over 50,000 commuters daily.

Under the current zoning regulation, 1-2 family residential units are accounted for 34.7% of land use, and multifamily residential units are accounted for 10.9%. The commercial units including clinic office are only accounted for 4.6%. With the growth of the high density Asian population, local commercial property prices continue rising.

The huge Asian population also makes Flushing a self-sufficient independent business environment that is very different from other areas in New York city. The local residential and commercial property prices are less influenced by the factors outside the community.

* Source: Appraisal Report provided by Cushman & Wakefield.

Cost Approach

* Source: Appraisal Report provided by Cushman & Wakefield.

Location

The property location is surrounded by well developed public transportations, as 7 train station is 5-min walk away and LIRR is 3-min walk away. It takes 20 minutes to arrive in Midtown Manhattan by taking LIRR and takes 8 minutes to LGA Airport by driving a vehicle.

Transportation

- Subway:Line 7 (5-minute walking distance)

- To Midtown: 20-minute train

- To JFK Airport:20-minute driving

- To LGA Airport:8-minute driving

Schools

In the core area of Flushing, there is a wide selection of high-quality primary, middle, and high schools nearby to meet resident education needs.

Living Facilities

The community is full of Asian businesses to meet various living needs, including Chinese and Korean supermarkets, restaurants, and shopping centers.

Recreations

There are museums, gyms, and recreation centers nearby, including science museums, tennis center, art center, and zoo.

Developer Company: CKZ Realty LLC.

Developer Website: https://www.greatstoneny.com/

Prior Cooperation: CrowdFunz Fund 804 / CrowdFunz Fund 807 / CrowdFunz Fund 809 / CrowdFunz Fund 812 / CrowdFunz Fund 818 / CrowdFunz Fund 822 / CrowdFunz Fund 823 / CrowdFunz Fund 617 / CrowdFunz Fund 827

Starting off from realty brokerage business, CKZ Realty has over 18 years of real estate development experience. Its first development in Elmhurst in 2002 was a huge commercial success.

Since then, Developer has been established its name and reputation among Chinese developers and accomplished multiple well-known projects.

- CrowdFunz Fund 841 originates short-to-middle term loan for the borrower. CrowdFunz selects the project that Developer had completed the construction of underlying property to reduce associated investment risks.

- The loan originated by CrowdFunz Fund 941 has a low LTV that is below 53%. The underlying property is in the prime area of Flushing and fits the increasing medical office demands driven by growing population of all age groups in local communities.

- CrowdFunz believes that under the loan agreement with clear legal rights and obligations, the short-term debt invested by Fund 841 has controllable risks and a low probability of default, making the fund a feasible real estate investment opportunity for retail investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)