Equity Pledge Debt Fund 843

Type: Debt

Target: $1,500,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 6 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,500,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | January 2024 |

| Investment Timeline | 6 – 18 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

- Property is in prime area of Fresh Meadows, one of the most historical neighborhoods in Queens, and is adjacent to Grand Central Parkway. In recent years, the area has attracted more Asian businesses and homebuyers for its convenience, low crime rate, and high school ratings.

- The mixed-use property has 5 floors and total building area of 37,650 square feet. The building includes 29 condominium units, 3 community centers, 15 parking spots, and 17 storage units. There are 16 1-Bedroom units and 13 2-Bedroom units, all designed for young families. Bedrooms and living rooms are more spacious than other comparable units in Flushing, Queens.

| Address | 163-11 72nd Avenue, Fresh Meadows, NY 11165 |

| Area | Fresh Meadows, Queens, New York |

| Lot Area | 9,000 Sqft |

| Building Area | 37,650 Sqft |

| Intended Use | 29 Condo Units, 3 Communities Centers, 15 Parking Spots, 17 Storage Units |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 2/1/2024 | 1/18/2024 | 7/17/2024 | 182 days | Prepaid Dividend *2 | |

| Second | No Later than 8/1/2024 | 7/18/2024 | 1/17/2025 | 184 days | Extension Option Owned by Developer *3< | |

| Third | No Later than 2/1/2025 | 1/18/2025 | 7/17/2025 | 181 days | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

- According to the Appraisal Report provided by CBRE, the Property is valued currently at $17,993,000. On November 3rd, 2023, the Condominium Offering Plan for the sale of the Property obtained the acceptance for filing at the Office of the New York State Attorney General. It is expecting to receive temporary Certificate of Occupancy.

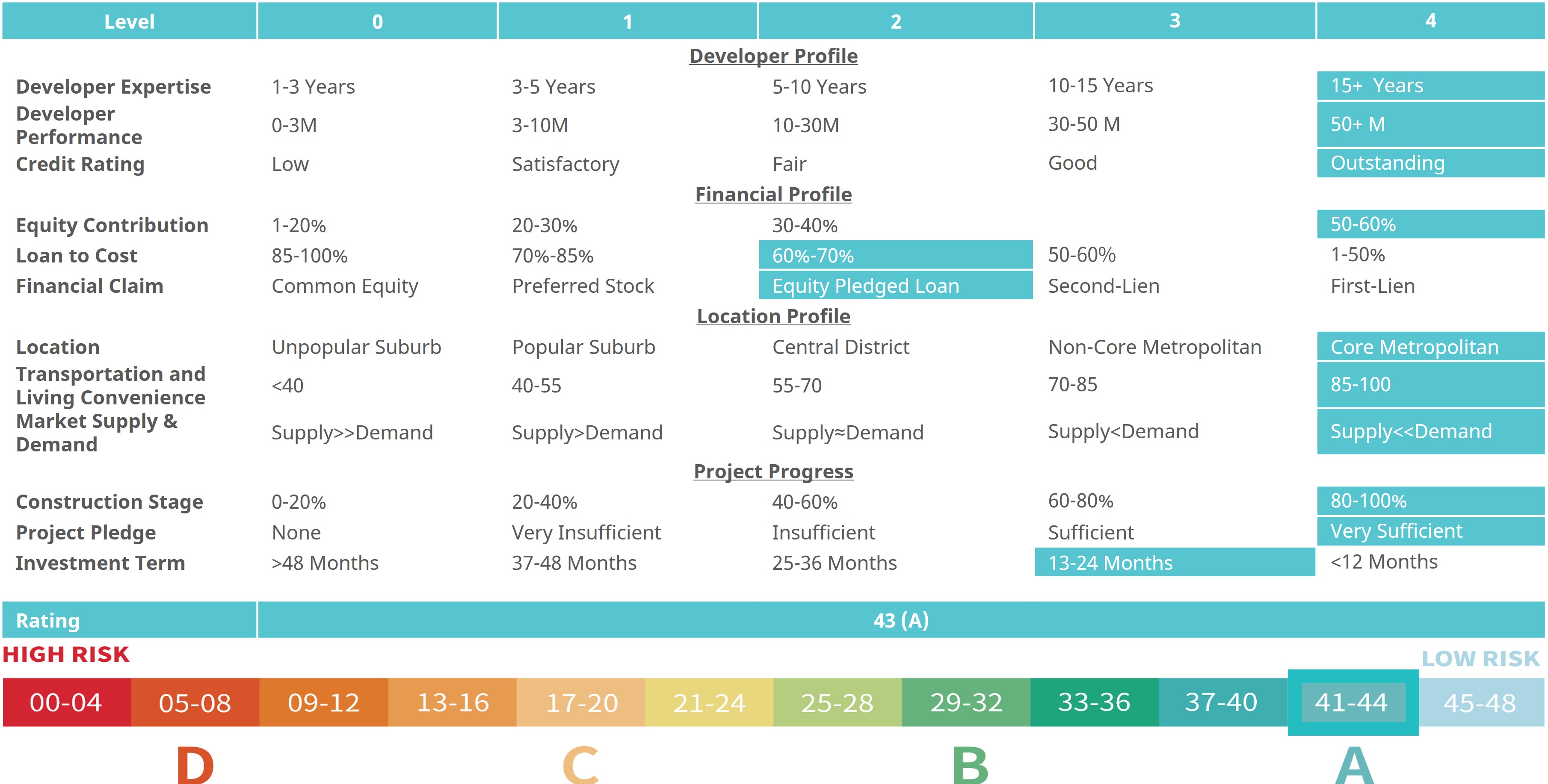

- The short-term loan provided by CrowdFunz Fund 843 is pledged by 100% ownership of project entity, which is valued at $10,573,000. Developer Key persons will also provide unlimited personal guarantee.

- The Property is in Fresh Meadows, a well-known Jewish neighborhood in the last century. Over the last 3 decades, the area had attracted many Asian residents for its proximity to Flushing, great school district, and convenient living facilities.

- Area has convenient transportation and developed businesses. Sales and rental price of local homes are cost-effective. Many young child-bearing families moved into local condo homes over the past years.

- The borrower expects to use the loans provided by CrowdFunz Fund 843 for the carrying costs of the final sales stage of the project development. Explained in detail, $300,000 shall be used to pay the interest reserve of the existing construction loan; $1,000,000 shall be used to repay a proportion of the principal of the existing loans; $200,000 shall be used to pay property taxes and other soft costs of the project development.

- The Developer expects to use the sales proceed, or cashflow from other projects to repay the loan originated by Fund 843.

- The family-owned Developer started its business from building small residential properties and had built over 200,000 Sqft of commercial and residential properties to date. In recent years, the Developer had started multiple projects in emerging markets in New York city.

- As of now, the Developer had successfully cooperated with CrowdFunz in CrowdFunz Fund 807, Fund 809, Fund 812, Fund 818, Fund 822, Fund 823, Fund 617, Fund 827, and Fund 841.

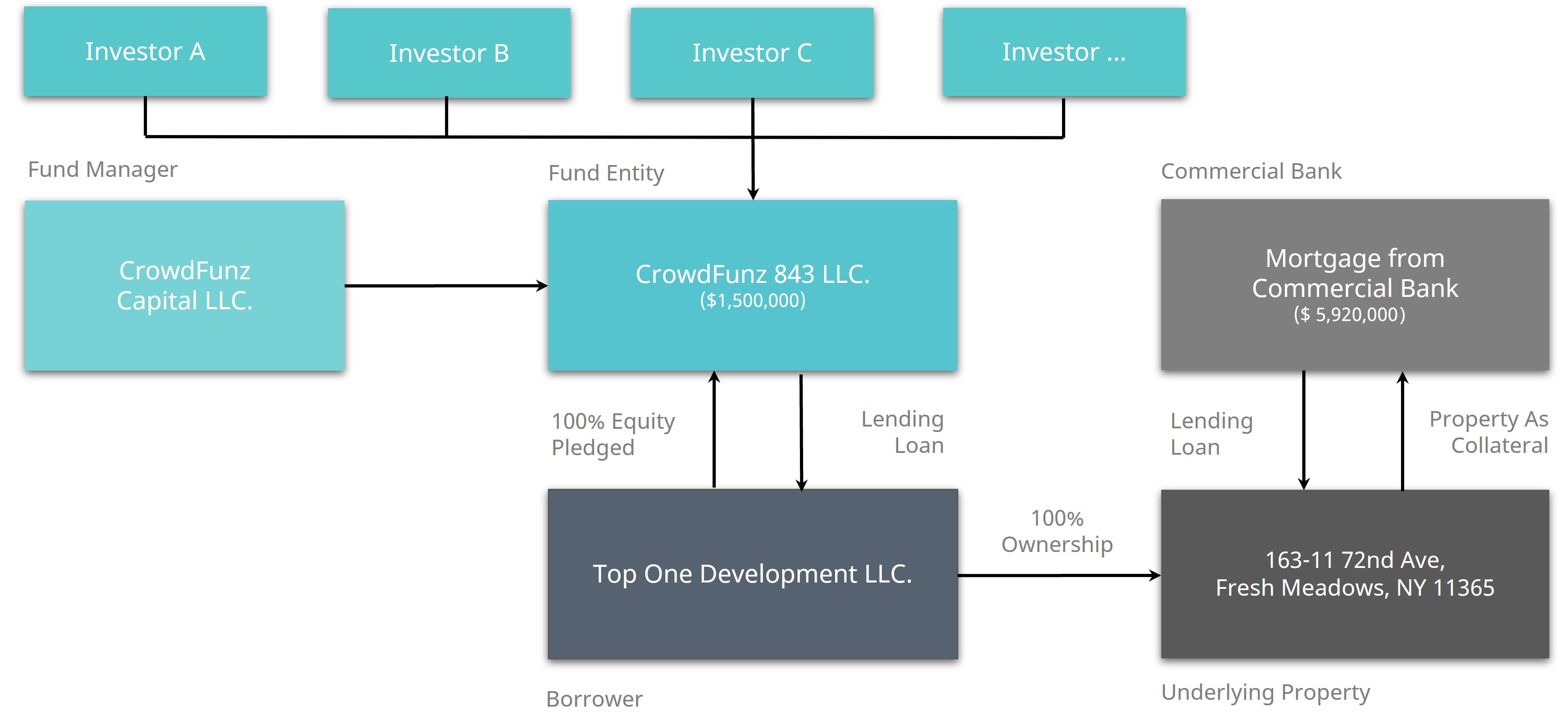

Investment Structure of CrowdFunz 843 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Loan from Commercial Bank (Building and Lot) | $5,920,000 | 32.90% |

| CrowdFunz Fund 843 Equity Pledge Loan | $1,500,000 | 8.3% |

| Developer Equity | $10,573,000 | 58.76% |

| Total | $17,993,000 | 100.00% |

- According to the Appraisal Report provided by CBRE, the underlying project is valued at $17,993,000.

- The loan from Commercial Bank of $5,920,000 is accounted for 32.90% in the capital stack; the $1,500,000 equity pledge loan provided by CrowdFunz Fund 843 is accounted for 8.3; Developer equity is valued at $10,573,000, which is 7 times the loan amount provided by Fund 843.

- Borrower had pledged 100% ownership of the project entity to Fund 843, and developer’s key persons will provide unlimited personal guarantee to the borrowing.

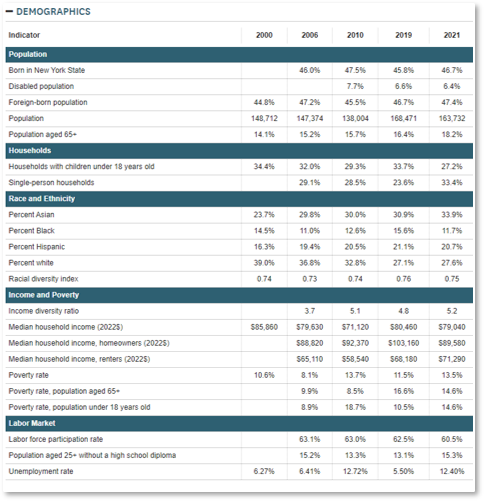

Demographics in the Zip Code

| Hillcrest/Fresh Meadows | |

|---|---|

| Population | 163,732 |

| Born in place | New York(46.70%)/ Out of State(5.90%)/ Out of the U.S.(47.40%) |

| Race | Asian(33.90%)/White(27.60%)/Latino(20.70%)/African American(11.70%) |

| Child-bearing (Under 18) | 27.20% |

| Unemployment Rate | 12.40% |

According to the latest data provided by American Community Survey, Fresh Meadows has very diverse population. Over the past 10 years, Asians have become the majority and are accounted for 33.9%, followed by Caucasians and Latinos.

47.4% of residents were born out of the U.S. Residents have an average age of 41.4 years, and most people are white-collar professionals in New York state.

Families that bear children under 18 years old are accounted for 27.2%. Most families prioritize living standard and education quality.

* Source: NYU Furman Center, U.S. Census Bureau, in January 2024

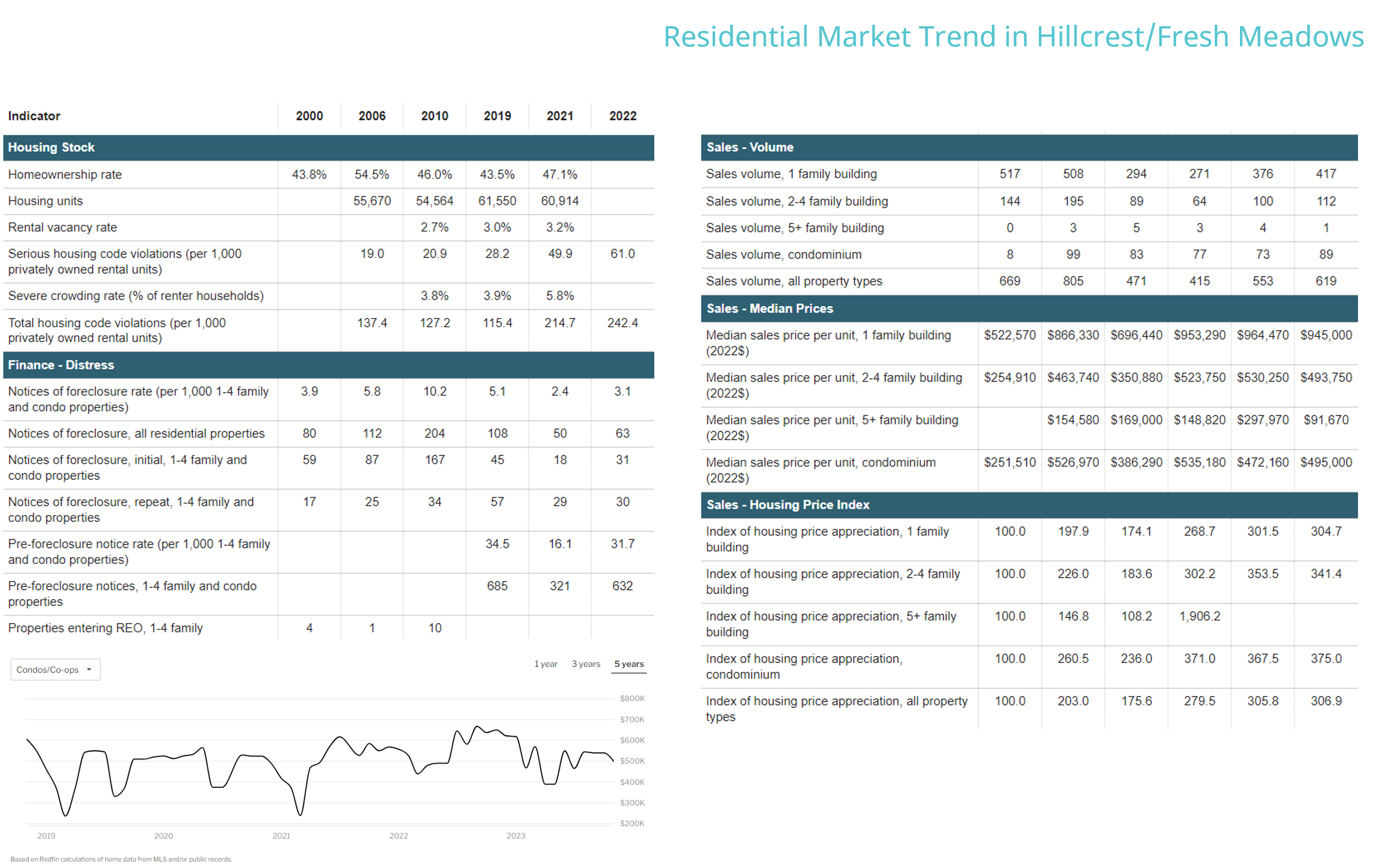

Residential Property Market in Long Island City

According to the data compiled by American Community Survey, as of the end of 2021, in Hillcrest/Fresh Meadows area, 47.1% of the residents purchased home to live in, well above the average in Queens. There are 60,814 units registered, while a vacancy rate of 3.2% is also below Queens’ average.

According to American Community Survey, as of the end of 2022, the notice of foreclosure rate in Hillcrest/Fresh Meadows was 3.1%, highlighting residents’ financial health.

Since 2020, single-family house has been the most popular residential property sold, while the sales of condominium had stabilized at 80 units sold per year.

As of the end of 2022, the median sale price of single-family house was $945,000, and median sale price of condominium was $495,000.

*Source: RedFin, January 2024.

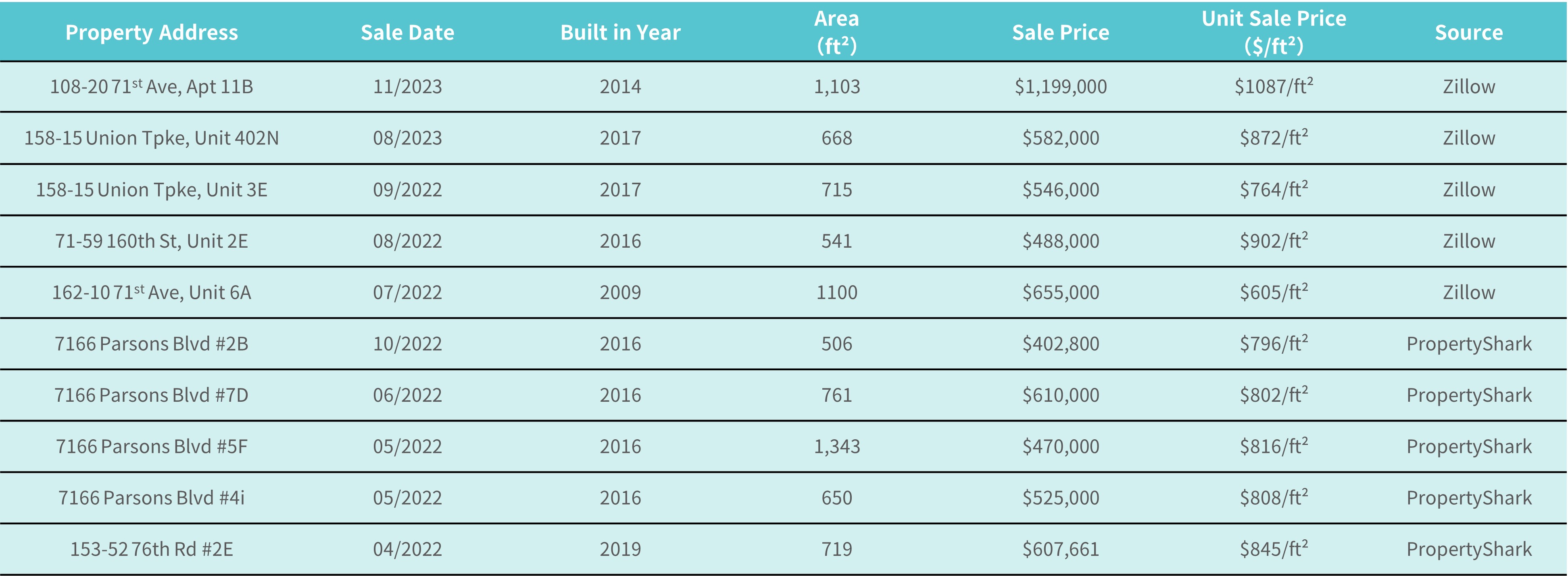

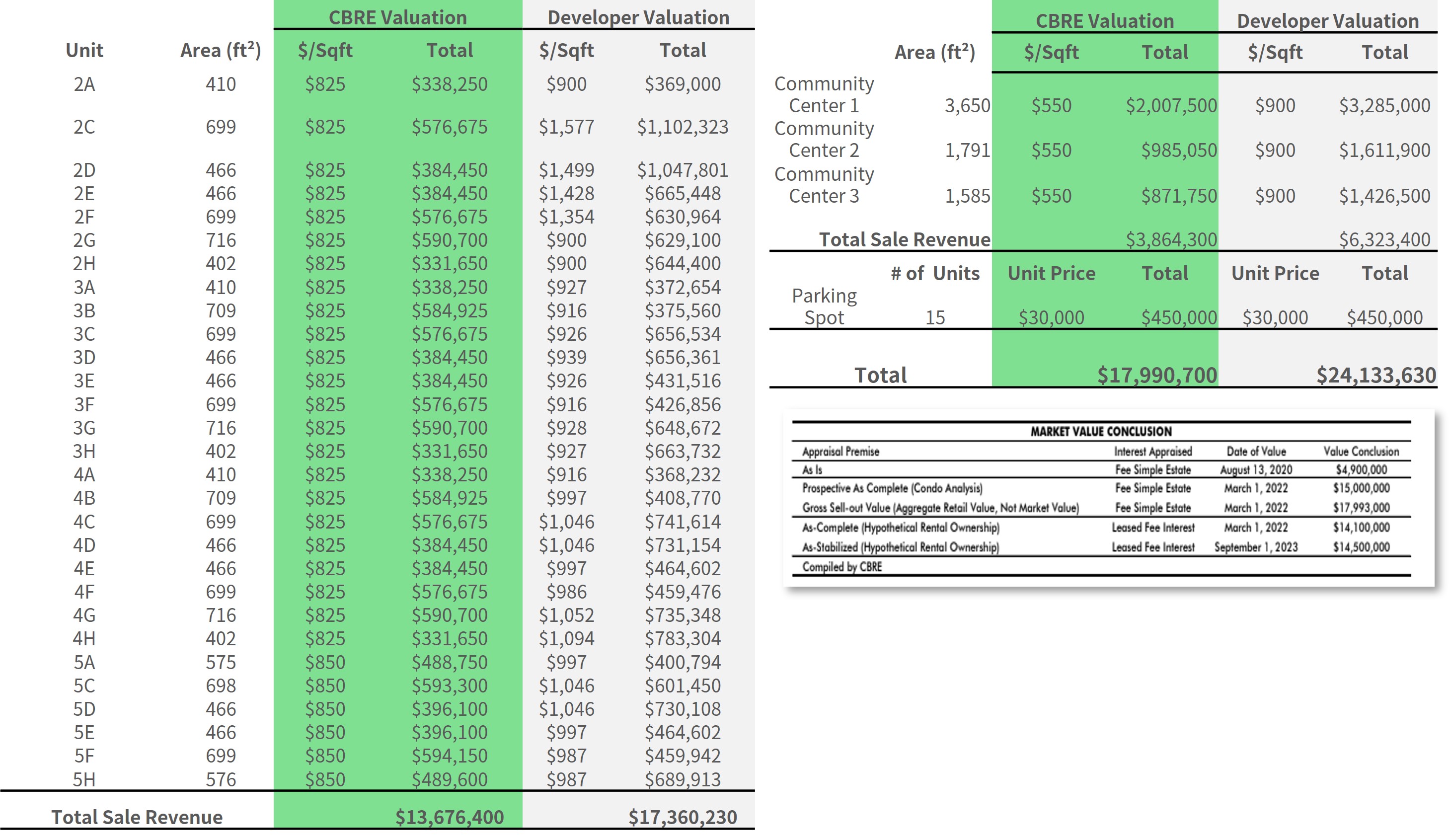

Valuation Analysis

* Source: CBRE Appraisal Report and Developer’s Forecast. Data compiled and calculated by CrowdFunz.

Location

The Property is surrounded by well-developed public transportation. Multiple bus lanes allow quick commute to Manhattan, Queens, and Brooklyn. Driving to JFK and LGA takes 10 and 20 minutes.

Transportation

- Bus:Q64,Q65,QM4,QM44

- To Midtown: 30-min

- To JFK Airport:20-min drive

- To LGA Airport:10-min drive

Schools

Area has a wide selection of high-quality primary, middle, and high schools to meet the education needs of children of all age. The schools that are rated 9/10 to 10/10 include Ps 173 Fresh Meadows, Ps 163 Flushing Heights, Jhs 216 George J Ryan, and Francis Lewis High School.

Living Facilities

Most residents have families and are over 40 years old. Area is safe, convenient, and family friendly. In recent years, local demographic and business became more diverse and could meet the taste of all residents.

Recreations

Property is near museums, sports stadiums, and other entertainment venues. Nearby highways allow families to travel conveniently.

Developer Company: CKZ Realty LLC.

Developer Website: https://www.greatstoneny.com/

Prior Cooperation: CrowdFunz Fund 804 / CrowdFunz Fund 807 / CrowdFunz Fund 809 / CrowdFunz Fund 812 / CrowdFunz Fund 818 / CrowdFunz Fund 822 / CrowdFunz Fund 823 / CrowdFunz Fund 617 / CrowdFunz Fund 827 / CrowdFunz Fund 841

Starting off from brokerage, CKZ Realty has over 18 years of real estate development experience. Its first development in Elmhurst in 2002 was a huge commercial success.

Since then, Developer has been established its name and reputation among Chinese developers and accomplished multiple well-known projects.

- The loan provided by CrowdFunz Fund 843 is a short-to-medium term loan invested in a completed property. Developer plans to sell the condominium units and use the proceeds, or cashflows from other projects, to repay Fund 843.

- The loan provided by CrowdFunz Fund 843 has a low LTV that is below 45%, and the property bears no construction risk.

- The underlying Property is in the prime area of Fresh Meadows. Area has great school district and living facilities that could fulfill education and living needs. The prime location and the lack of newly developed houses make a great potential for the Property.

- CrowdFunz believes that under the loan agreement with clear legal rights and obligations, the short-term debt invested by Fund 843 has controllable risks and a low probability of default, making the fund a feasible real estate investment opportunity for retail investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)